Audit Report Reveals Digital Scotland’s Superfast Broadband Speed Targets

A new report from Audit Scotland, which works to ensure that public money in Scotland is used properly, has revealed more details about the actual coverage, funding and broadband speed expectations of the country’s £410 Million Digital Scotland roll-out programme with BT.

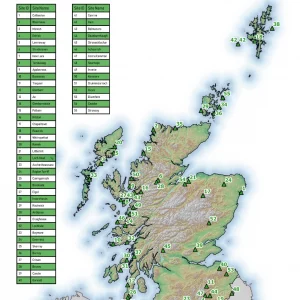

The Digital Scotland project aims to ensure that “fibre broadband” services are available to 85% of premises by the end of 2015 and 95% by the end of 2017/18, although the coverage target for the Highland and Islands (HIE) region alone is currently just 84% by 2016. The funding for this is via a mix of public and private investment, which is split into two regional projects.

Digital Scotland’s Phase 1 Funding

HIE – The Highlands and Islands (£145.8m):

• £126.4m from public bodies (Scottish Government, Broadband Delivery UK [£50.83m], Highland and Islands Enterprise and all seven local authorities in the project area)

• £19.4m from BT.RES – The Rest of Scotland (£264m):

• £157m from public sources (Scottish Government, ERDF, Broadband Delivery UK [£50m], and all 27 local authorities that form part of the Rest of Scotland Project area)

• £106.7m from BT.

So far the project has already helped to upgrade 220,000 additional homes and businesses (the current goal is to benefit a total of 746,000 premises), which would have otherwise been left neglected.

Meanwhile BT recently reported (here) that when you combine the 220,000 with their commercial roll-out of ‘up to’ 80Mbps capable FTTC technology (with a very tiny bit of ultrafast FTTP) then some 2 million premises in Scotland can now access their “fibre broadband” network (not including Virgin Media’s cable coverage etc.).

But the Digital Scotland project is also notorious for being distinctly less descriptive about their target(s) in respect to specific broadband download speeds, with the term “fibre broadband” typically being used to cover a multitude of sins (i.e. it could mean anything from 2Mbps to 80Mbps in Scotland). As today’s report repeatedly states, “the Scottish Government and HIE have not stated clearly what speeds will ultimately be delivered“.

The new Audit Scotland Report notes that, within the current intervention area, the extra “fibre broadband” coverage being delivered by Digital Scotland equates to around 55% receiving speeds of 30Mbps+ (Megabits per second), while 22% can expect between 24-30Mbps and finally 23% will get less than 24Mbps (note: the UK central Government defines “superfast” as 24Mbps+, although Ofcom and the EU separately prefer 30Mbps+).

The report also includes a useful chart of the projects regional impact on broadband speed coverage, although we’re not sure if their “superfast broadband” means 24Mbps+ or just “fibre broadband” (i.e. anything upwards of 2Mbps).

One other interesting aspect of today’s report is how it reveals, not unlike England’s recent National Audit Office study (here), that the HIE paid BT a total of £26.2m for work completed between September 2013 and September 2014 (£19.8m for backhaul infrastructure and £6.4m for work connecting premises).

But the HIE originally planned to pay £52.3m for the above period, of which £38.9m was to be for backhaul infrastructure and £13.4m for work connecting premises. Part of this is because BT has been running a bit behind schedule in some areas, such as in the HIE regions.

The report clarifies that BT has actually “exceeded its contractual targets by 57,000 premises“, although it is around 14,000 premises short of where it expected to be at this stage against its original plans. Never the less Audit Scotland calculates that 85% of premises “will have access to superfast broadband by March 2016“.

Caroline Gardner, Auditor General for Scotland, said:

“This investment by the public sector is intended to mainly benefit rural areas, where such access is currently either low or non-existent. Given the potential benefits, it’s important that the Scottish Government and HIE provide clear and regular updates on what coverage and speeds the broadband network will actually deliver, as the installation progresses.”

The Scottish Government has also welcomed today’s report and claimed that it shows they’re “on course to deliver our target“. Apparently the Public Audit Committee will now look at whether “the progress being made has delivered better coverage and faster speeds to rural Scotland, or if targets have been met by focusing on the easier-to-achieve parts of this ambitious infrastructure programme“.

During the earlier stages it’s quite normal for BT to adopt an inside-out approach by connecting up the easier sub-urban areas first (expanding the network out in a logical pattern), although this may slow later on when the programme is left with only the difficult to reach rural areas.

Meanwhile the Scottish Government is currently conducting another broadband Open Market Review (OMR) for future funding beyond Phase 1, which notes that after the current targets are met then about 231,876 premises will still need to be served via Next Generation Access (NGA) networks (plus 51,000 needing basic broadband of at least 2Mbps).

So far £41.98m of additional public money has already been allocated as part of a future Phase 2 Superfast Extension Programme to tackle the above areas, although the OMR isn’t due to finish until 20th March 2015 and a tender will then need to go out and be agreed (we fully expect BT to win that one too). Only then will we know how far Scotland will be able to push “fibre broadband“, although given the country’s rural nature we’d still expect quite a big gap to be left over even after Phase 2.

UPDATE 9:13am

The report also calculated the average total cost to the public purse of each premise provided with access to superfast broadband in Scotland. In the Rest of Scotland area it is £230, which rises to £475 per premise for the notoriously rural and thus more expensive the Highlands and Islands.

The figures are also affected by the level of investment that the public sector is making in each area, with more public money going into the highlands to meet a higher proportion of total capital costs etc. If the public sector was contributing the same proportion of total capital costs in each area, the average public subsidy for the highlands would reduce from £475 to £385 per premise. There’s also this..

We compared the modelled bid costs for the Highlands and islands contract, the rest of Scotland contract and the guideline costs included in BT’s submission for inclusion in the framework agreement. We looked at the average connection cost per premise for FTTC and for FTTP:

• In the rest of Scotland contract, the average cost per premise:

–– for FTTC links (which will be used for most of the network) is lower than BT’s guideline cost in the framework agreement

–– for FTTP links is almost double BT’s guideline cost in the framework agreement. BT aims to minimise the use of FTTP links, so these higher costs should have limited impact on total costs.• In the Highlands and islands contract, the average cost per premise:

–– for FTTC links is almost double BT’s guideline cost in the framework agreement

–– for FTTP links is almost three times BT’s guideline cost in the framework agreement. BT aims to minimise the use of FTTP links, so these higher costs should have limited impact on total costs.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook and Linkedin.

« WarwickNet Brings Superfast Broadband to Tanshire Park in Surrey UK

Latest UK ISP News

- FTTP (5523)

- BT (3517)

- Politics (2539)

- Openreach (2298)

- Business (2264)

- Building Digital UK (2245)

- FTTC (2044)

- Mobile Broadband (1974)

- Statistics (1788)

- 4G (1665)

- Virgin Media (1621)

- Ofcom Regulation (1462)

- Fibre Optic (1395)

- Wireless Internet (1389)

- FTTH (1381)

Comments are closed