Sky UK and BT Chiefs Spar Over Openreach’s Future and Broadband

Sky’s (Sky Broadband) CFO and COO, Andrew Griffith, has today warned that the UK is at “serious risk of falling behind” other countries in the broadband league table, unless Ofcom splits Openreach from BT. Meanwhile BT’s CEO, Gavin Patterson, once again accused rivals of making “inaccurate claims” and “gaming the regulator to secure commercial advantage.”

The bitter row is of course a continuation of the same one that we’ve been hearing for the best part of two years, which is centred on Ofcom’s on-going Strategic Review of the United Kingdom’s market for digital communication services (mobile, broadband, phone etc.).

The headline piece of that review is a proposal by the regulator to partly address the long-running competition and investment concerns by turning Openreach, BT’s UK network access division, into a “ring-fenced, ‘wholly-owned subsidiary’ of BT Group, with its own purpose and board members.” Failure to reach a deal on this could result in Openreach being forcibly split.

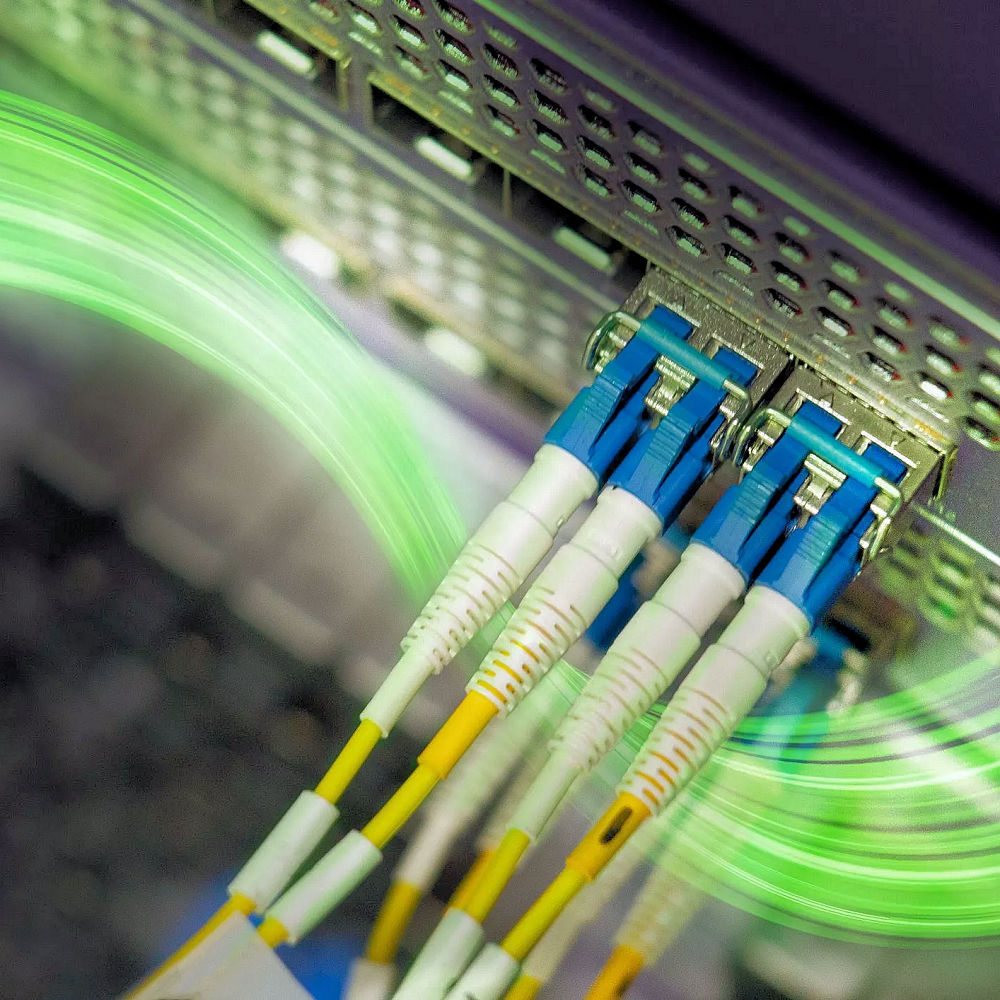

BT’s rivals, particularly Vodafone, Sky Broadband and TalkTalk, favour a split and claim that this is the only way to improve service quality and ensure the wider roll-out of pure ultrafast fibre optic (FTTP/B) broadband networks, as well as to deliver the investment that the United Kingdom needs.

On the other hand BT claims that the UK is already in a better state than its rivals say (e.g. 91% are within reach of a 24Mbps+ capable broadband connection) and they plan to invest £6bn into their broadband and mobile (EE) networks over the next three years, with 10 UK million premises gaining access to 300Mbps G.fast technology and 2 million more being covered via FTTP by 2020.

However BT’s rivals want a lot more fibre optic cable in the nation’s diet, as opposed to the cheaper hybrid-fibre approach of G.fast.

Andrew Griffith, Sky UK’s CFO and COO, said (Open Letter):

“If we look closer to home we can see that major EU countries that the UK may compare favourably with today, have plans to out-perform us tomorrow. Analysts predict that France will become the second largest European market for fibre to the home by 2019. Italy plans to roll out pure fibre to 250 Italian cities in the next three years, whilst Spain and Portugal already have more than 50 per cent fibre to the home coverage. It’s easy to see how Britain could be left in the slow lane.

And what is BT’s response as the monopoly owner of Britain’s national broadband infrastructure? To underinvest in fibre and continue to sweat its existing copper network. As a result, a mere 2% of UK households had access to fibre to the home last year, and plans to increase coverage are lacking in ambition.

There is a fundamental conflict of interest while Openreach – the BT division that owns and operates the national network – remains vertically integrated within BT Group. Because far from investing in the network, BT is actually a net recipient of cash from Openreach. It therefore has no incentive to invest more. Customers suffer and there is no motivation to improve its notoriously poor service.”

At the time of writing BT and Ofcom have yet to reach a deal over the future of Openreach, with reports at the weekend appearing to confirm that BT remains bitterly opposed to Openreach becoming a “legally separate company” (no CEO likes to lose full control over part of their business, even if the BT board would still have a say).

BT is also said to be worried about the related risks and costs of moving staff and pension liabilities to the “new” company. But if no voluntary deal can be done then Ofcom could push for the even more complicated (legally and financially) option of a full split. Sky’s Andrew Griffith believes that BT’s arguments against such a separation amount to “desperate claims.”

Andrew Griffith added:

“In response to this logical conclusion reached by so many, BT has made a number of desperate claims as it attempts to retain Openreach and its profits within BT Group – from the cost of separation to its pension scheme.

Whilst Ofcom can be forgiven for wishing they could duck the migraine-inducing topic of BT’s pension deficit, the reality is there are a multitude of City advisers experienced in providing tried and tested solutions to just such challenges. And perhaps shares in Openreach as a pure play fibre provider might be the long term investment asset that the BT pension trustees are looking for to plug their liabilities.

We need to see BT’s tired arguments for the stalling tactics that they are, and call time on this debate. The truth is that a motivated company finds solutions. A company that is not finds roadblocks.”

Meanwhile BT’s CEO, Gavin Patterson, hasn’t stayed silent and last week told the Broadband World Forum 2016 that it was wrong to accuse them of “investing in obsolete technology“, before pointing to the £3bn they’ve spent on deploying hybrid-fibre FTTC and a little FTTP connectivity to reach 26 million UK premises.

Patterson also highlighted the operator’s future FTTP and G.fast plans (as above), as well as their support for the Government’s proposed 10Mbps Universal Service Obligation (USO), as proof of their commitment.

Gavin Patterson, BT’s CEO, said:

“Breaking up BT would undermine network investment. It takes the whole of BT Group to make the case for massive network investments. Openreach cannot do it on its own.

Those arguing that splitting BT will boost investment fail to appreciate the huge risks. It would cost billions to split BT. This would be better spent on investment in networks. Openreach is best placed to invest as part of BT Group, as it benefits from lower funding costs, access to massive R&D capabilities and the ability to spread risk across a bigger business. And because it serves more than 500 communications providers on equal terms, these benefits flow to the whole industry.

In July, we made a proposal to Ofcom for reforms of Openreach to further strengthen its independence, which would preserve these benefits while minimising disruption and cost. We believe this is the best way to deliver the UK’s digital future.”

Ofcom has the power to make either model work if it really wants, yet it’s worth remembering that neither approach appears to offer a magic bullet for delivering both excellent service quality and connectivity to all.

Certainly none of BT’s rivals have offered a concrete plan for making such improvements, beyond the occasional generalised sound-bite. This is frustrating because they could club together and pledge a detailed strategy, combined with a proposed level of investment, if they really wanted.

In keeping with that it’s important to note that neither Sky, nor TalkTalk or even BT has pledged to deliver truly universal FTTP/H. Instead the arguments tend to centre on improving connectivity in urban areas (the low hanging fruit), except it’s the rural and some sub-urban areas in the final 5-10% that really need an upgrade and those are where the most vocal gripes can be heard.

Not to mention that everything in the commercial world has a cost and, one way or another, any improvements or upgrades will eventually affect the price you pay, such as via higher service charges or optional upgrades. This is true no matter what the outcome.

For now leaving BT in charge, albeit significantly reduced in power and influence, is currently Ofcom’s preferred path of least resistance. The regulator has of course to consider a much wider market than the big ISPs, such as the impact of their decisions on alternative network (AltNet) ISPs and backhaul suppliers etc.

Ofcom hopes to produce an answer to all of this by the end of 2016. Much may depend upon which side blinks first.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook and Linkedin.

« Cityfibre Expand Fibre Optic Network Deals with Onecom and euNetworks

Latest UK ISP News

- FTTP (5513)

- BT (3514)

- Politics (2535)

- Openreach (2297)

- Business (2261)

- Building Digital UK (2243)

- FTTC (2043)

- Mobile Broadband (1972)

- Statistics (1788)

- 4G (1663)

- Virgin Media (1619)

- Ofcom Regulation (1460)

- Fibre Optic (1394)

- Wireless Internet (1389)

- FTTH (1381)

Comments are closed