Ofcom and BT Reportedly Prep Contingency Plans for AltNet Flops UPDATE

A new newspaper report claims that “runaway inflation” is threatening to cause a “wave of bankruptcies” among the new generation of alternative full fibre (FTTP) broadband ISP networks, which is said to have triggered Ofcom into drawing up contingency plans with BT for how to handle the fallout, should smaller players start to fail.

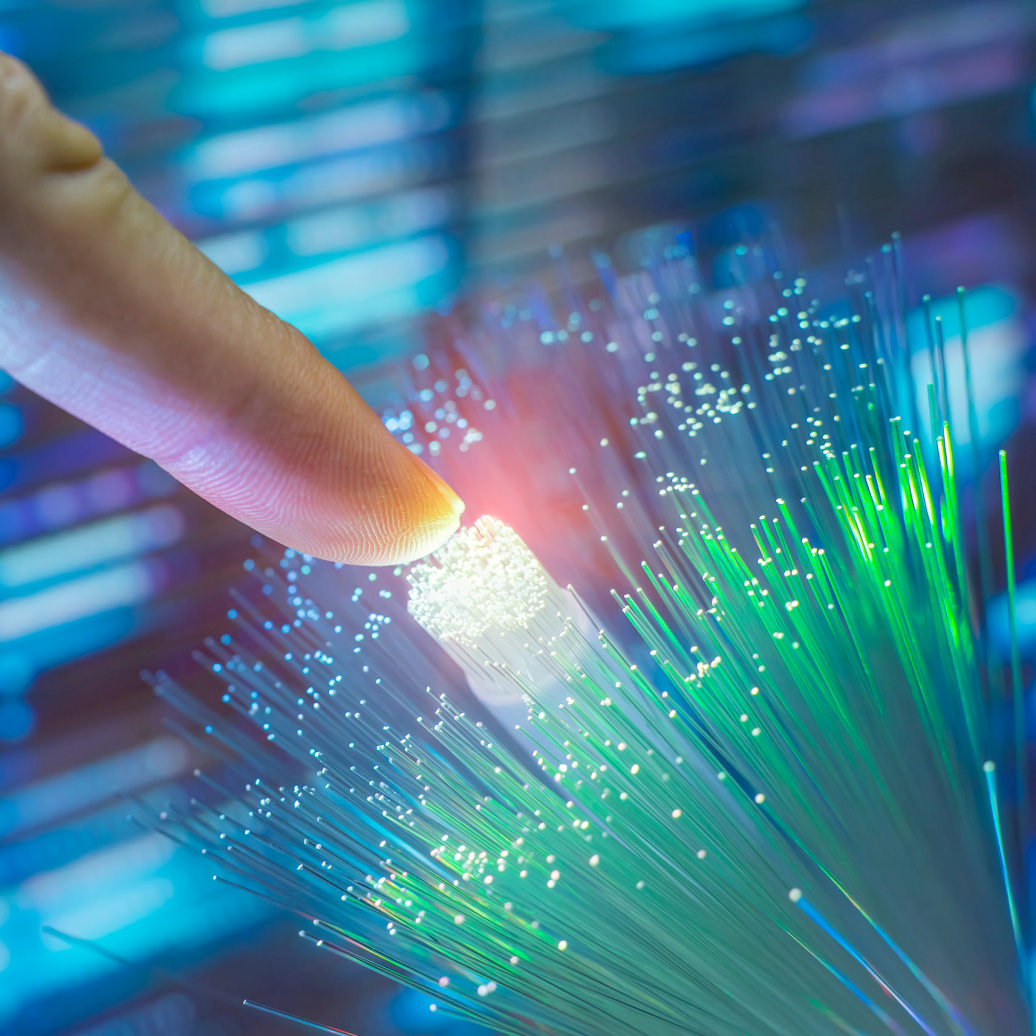

Over the past few years’ we’ve seen the UK become home to a mass of new alternative network (AltNet) providers (100+), many of which are backed by many millions – and in some cases even billions – of pounds in private investment. Quite a few of these also hold major plans to expand gigabit-capable Fibre-to-the-Premises (FTTP) based broadband ISP networks across the country (Summary of UK Full Fibre Builds).

The Independent Networks Co-operative Association (INCA) last year forecast that such AltNets aspired to cover 29.9 million premises by the end of 2025, which in practice will result in a significant level of overbuild between some operators. As we’ve said many times before, dense urban areas may be able to sustain a level of overbuild between four or more operators, but the challenges grow as builds move into smaller towns and more rural areas.

Suffice to say that this has long been expected to result in a wave of industry consolidation, and to some extent we’ve already seen the opening salvos of that. For example, CityFibre acquired FibreNation from TalkTalk (here), Swish Fibre gobbled up People’s Fibre (here), the 4th Utility consumed Vision Fibre Media (here) and CommunityFibre has acquired Box Broadband (here).

Crucially, the aforementioned deals have protected existing customers from service loss, but that may not always be the case. One school of thought suggest that smaller players that suffer a significant level of overbuild may, over time, see the value of the fibre they have in the ground diminish to the point where finding a buyer becomes much harder – raising the risk of a damaging collapse (right now fibre in the ground still holds a lot of value).

One other risk is that some networks may place an inflated value on their fibre infrastructure, which could make it similarly difficult to find a buyer or weaken the models of those who do buy. At present, this is not such an issue, but it is one of those things that we believe may grow with time and Ofcom look to be taking that seriously.

According to the Telegraph‘s (paywall) industry source: “It seems to be a bit of a red flashing light that Ofcom is thinking about it at all. It cannot be entirely sustainable when you already have big network builders.” We’d tend to disagree with this statement, which seems like it came from a bigger player. In fact, it would be a red flashing light if Ofcom WERE NOT thinking about it, since the potential for such an outcome is quite obvious.

The regulator already has a Supplier of Last Resort style process for handling such situations and keeping people connected in the event of a failure, but it’s not perfect. As such, it’s perhaps only natural that they’d be talking with BT about this, although it’s not clear whether the newspaper meant the BT Group, including Openreach (more likely), or just the retail ISP. We’d expect Ofcom to engage with other ISPs too, but the choices may vary depending on which network areas are involved in a future collapse, should one occur.

An Ofcom Spokesperson said:

“We keep a close eye on the broadband market to make sure we know what’s happening on the ground, as part of our work to support fibre investment and protect customers. Usually, when a network company fails, it’s sold as a going concern and customers don’t experience a loss of service.

In the unlikely event that a network suddenly failed and ceased to provide services, we would work with alternative suppliers to help customers get reconnected as quickly as possible. This could be through Openreach or an alternative provider, depending on the circumstances.”

However, in the above examples, the biggest threat of collapse doesn’t necessarily stem from “runaway inflation” as much as it does an altnet that fails to both build fast enough and attract the necessary level of take-up by customers.

Such networks often like to grow at least an average 20% take-up to satisfy their long-term payback models (these may span up to 10-20 years), which is partly why so many altnets are pricing their new FTTP packages aggressively to compete – leveraging both the cost efficiencies of a new fibre network with the need to peel customers away from established ISPs. But cheaper prices do, during the rollout phase, make it harder to gain a return on your investment. Finding the right balance is never easy.

We should point out that, outside the UK, FTTP broadband services often become incredibly cheap in more mature markets – even those with similar economies to our own – thus there would seem to be some flexibility in the system for cheaper pricing to continue. Nevertheless, it is almost certainly unrealistic to expect that all the 100+ or so altnets currently building will survive. Many will consolidate and, yes, some will simply fail.

The consolidation that we have seen thus far has been at the smaller end of the scale and, as stated above, customers have generally been protected (it’s usually in everybody’s interest to retain them). We’d expect that gradual trend to continue for the next couple of years, but the strain may really start to show once more operators find investors becoming nervous about the results delivered after the first major phase of build has completed.

Right now, there’s still plenty of appetite from investors to spend big on fibre, but over time they’re likely to adopt more rationality and greater risk aversion. The big operators are not immune to all this, but they do have marketing, coverage and familiarity of brand on their side, which counts for a lot. But those smaller players are a big threat to them, so it’s also in their interests to talk up any negatives for altnets.

At this point we’re reminded of something that Ofcom’s former CEO, Sharon White, said in 2015 (here): “[Our] experience is that competition, not consolidation, drives investment and delivers low prices.”

UPDATE 5:29pm

We’ve had a comment from Giganet, which is an altnet itself.

Jarlath Finnegan, CEO of Network Builder and ISP Giganet, said:

“After decades of under investment, shoddy customer service, and lack of competition, the recent acceleration in full fibre infrastructure investment by alternative networks (alnets) has given the UK telecoms & connectivity market a welcome shake – which is great news for consumers.

There will always be winners and losers, but in the main these investments are built on sound principals. The regulator must ensure the market continues to support a more diverse and competitive sector which drives up standards and benefits the consumer.

Without the alnets’ significant investment, the future-proofing of the nation’s coast-to coast digital infrastructure will suffer.

At Giganet service comes first, and we believe our ethos, grounded in honesty and simplicity, will bring a new dynamic to the market that consumers have been denied for too long. As customers grapple with inflation and rising living costs, our flexible contracts, and our promise to abolish exit fees and mid-contract price rises, resonates.

We are delivering on our plan and have full confidence in our business and our ambitions for the future.”

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook and Linkedin.

« Starlink for RVs Product Launched on LEO Satellite Broadband Service

Virgin Media O2 UK Sees Record Mobile Data Traffic on Sunday »

Latest UK ISP News

- FTTP (5516)

- BT (3514)

- Politics (2538)

- Openreach (2297)

- Business (2262)

- Building Digital UK (2245)

- FTTC (2044)

- Mobile Broadband (1973)

- Statistics (1788)

- 4G (1664)

- Virgin Media (1619)

- Ofcom Regulation (1461)

- Fibre Optic (1395)

- Wireless Internet (1389)

- FTTH (1381)

I think there is a short term uptake threat (cost of living crisis) that people will choose to not buy any fixed internet provision for their homes at all and will make do with increasingly competent Mobile phone internet, on a PAYG basis in some cases.

This is also a threat to various streaming TV services (reduced use due to reduced bandwidth), and indeed TV license. Some people will stream from phone to TV wirelessly to get a good enough big screen experience for a few hours per day

So far, I haven’t seen enough evidence of this happening at a truly large scale. But what we have seen is cheaper FTTP altnets being moderately successful in peeling customers away from the big boys by offering faster broadband for less money, which at the time of such a crisis is naturally quite attractive for consumers.

It won’t just be concerns about cost of living changing demand from end customers, but also if firms can cope with cost inflation (labour, equipment costs) also impacting their margins at the other end.

No doubt Ofcom have seen what has happened in the energy market and don’t want to be blamed for not having something in place of needed.

There’s also the inreased cost of credit due to central banks raising interests which may make alt-net investors push for sell-offs before their assests are over-built.

interest *rates*

This issue here is they only talking to aka BT. There not talking to other AltNet about what there views if ABC’s AltNet get in to trouble. I would also think it would be advisable if they talk to business in the LLU space to see if they would be interested.

Also don’t forget business like Google/Amazon/Microsoft could also be possible interested party.

How many Altnets are close to 20% takeup today, it look like only the more established like Hyperoptric, City Fibre etc. With the amount of overbuild going on. E.g. three operators in Shipston ??? 20% doesn’t look likely in those areas.

The catch is that you can only really gauge take-up some c.2 years after an operator has completed a specific deployment. When operators are in-build, particularly if they’re ramping up like many are today, then an average figure of take-up – across the whole network – becomes less useful because it will be suppressed by the rapid rate of overall build.

Experiences do vary, of course. B4RN’s more social model, which involves volunteers, tends to rapidly generate high adoption. Openreach’s rollout is also ducking the usual trend, by showing steady take-up around 25% – despite a huge ramp-up in build. We see similarly strong take-up from Gigaclear, Hyperoptic and so forth – established players. Little data exists for all the newer entrants.

Taking Box as an example, £25 for 100mbps seems a lot more competitive than BT, if altnets can undercut them across the country perhaps we should be more worried about BT.

OFCOM pretty much force BT to be expensive, its to encourage competition and allow the altnets to gain foothold. Anytime BT look at cutting their prices see the outcry from Cityfiber/VM et al.

https://www.ispreview.co.uk/index.php/2021/09/rivals-sigh-as-ofcom-clear-openreach-fttp-broadband-price-cut.html

I suspect once the investment firms start wanting their money back post big-build, and we get provider consolidation then prices will creep up.

I doubt BT/OR are worried. Even the Altnet with the biggest ambitions (Cityfibre) aims eventually to cover 8 million properties – but that’s only 1/4 of the UK.

Virgin has a bigger footprint but hasn’t caused them any problems so far. And Virgin is going to have to spend big to replace its legacy cable TV network.

Seems like conspiring with the regulator to prepare a hole to push the AltNets into, dressed up as a safety net. Bonus is you take out the competition and stop their remains falling into the hands of competitors.

Can’t see anything attractive about picking up a failed altnet. Likelihood is they’ll have poor take-up with a few very unhappy customers sitting on a shoddy, hastily built network with incompatible components and IT systems. Why would Openreach want anything to do with that when they’ve got a massive new network of their own to worry about.

or perhaps not everything is some sort of conspiracy that benefits BT. As Mark has said, it’s actually the opposite, as Openreach’s pricing is regulated and anything BT Retail does is closely monitored too.

Not for the first time either. BT was banned from offering TV services and there’s that perennial anecdote from Cochrane about how BT was not permitted to get into fibre because it would have destroyed the brand new cable TV industry, and despite having it in their favour there was a period of consolidation and bankruptcy that became Virgin Media.

And +1 to what Alex said, taking over someone else’s network is actually more of a nuisance than you’d think. Why would Openreach want to deal with the integration hassles when it’s likely much easier to just build their own network in the way that works for them?

I suppose the argument for asking Openreach is scale. No matter where there’s a failed network, there’s an Openreach presence (exchanges, backhaul, core networks) that any other altnet would need to build from scratch.

Who says they have to take the network over?

If they failed as OR overbuilt they’d just move the consumers to OR network. Most of it is likely PIA in OR duct/poles so all they need to do is move house drops over to the OR network, swap the CPE. A pretty quick move.

If OR have not overbuilt then they would decide at cabinet level, likely just re route fibre back to nearest OR node if they don’t like the cab/kit. As it’s all GPON they don’t have to change much at all to adopt it – just the kit on the ends

even that isn’t as simple as you might suggest. Openreach may normally build their networks in a different way (smaller or larger splits, different fibre counts to allow for expansion etc) or use fibre products from another vendor (as in the physical stuff, not just the OLT/ONTs). So they may be reluctant to just swap out the bits on the ends and carry on.

OR also does not generally use active equipment in the street so there’s that to consider too

And what do you do about customers who used an alt net with no parallel option on Openreach, different speeds (esp lack of gig symmetric) or an ISP that doesn’t also sell services on OR, what do you do about wholesale pricing. Would BT itself have to step in as an ISP of last resort while customers decide where to go next?

Bit of a minefield really.

Yes there is an effort to create a SOLR framework, but that is not because there is an expectation that many altnets will cease trading and that, if that happens, an administrator would be unable to find a buyer for the fibre assets operated by any such altnet. On the contrary, it is likely that such assets will be of significant interest to other parties and only in very very extreme cases would there be no willing buyer for the assets and a resulting risk that consumers could lose services.

I fear that what we are seeing here is some parties misrepresenting the SOLR process to sow the seeds of fear in the minds of consumers to prevent them from taking up services delivered on altnet fibre networks. This should in my view be strongly discouraged and frowned upon.

An interesting comment from the Telegraph – we’ve been here before, btw. I think most people are aware of my views on a shared neutral access network.

Wait until broadband “switching” is introduced (currently sometime 2023). REM, all we want from ISPs is to deliver bits, which suggest they are a utility along with elec, gas, and water, all of whom tend to have one delivery point into residential properties.

Would shock the customers if it starts getting billed like a utility and they have to pay for what they use

Possibly a bit of confusion here. If end customers are worried about connecting to altnets, then that benefits Openreach and could eventually be the cause of altnets defaulting. This has nothing to do with how Ofcom regulates BT’s or Openreach’s prices.

Some really interesting comments and observations. I would suggest that BT/Openreach are worried about Alt Nets. I recall an interview with Mr Jansen CEO of BT quoting in the Guardian he drew the analogy that they are “in a football match which they[BT] know they are going to win BUT not sure by how much”. And that is at heart the issue, if easier to build areas overbuilt with competition and choice that then has the potential for consolidation it raises the spectre that some of their large distributors such as Sky etc have greater bargaining power that depresses margins and potential revenue volumes. At a micro level if Openreach were not worried about buildswhy then would Openreach appear to acclerate deployments where there are active Alt nets? Speak to any Altnet they will offer up examples of them building and coincidentally Openreach then appearing. I happened to be on a street where Openreach were installing fibre (FTTP) on poles one end and an alt net digging in the same street 50m away another Openreach engineers freely admitted they were chasing the Alt net as “they are the enemy”. That is not an isolated example Openreach senior management when asked denied such plans. . Having Alt nets drives competition and speed that otherwise I do not believe Openreach or BT would respond offer.

Openreach would love altnets to not exist. They were not interested in Leicester at all until cityfibre activated some areas and now suddenly the city has 2 planned exchanges, and guess what, they in part of the cityfibre enabled area.

Several points I will highlight here, 1 BT as privatised company were not allowed to make profit on investment of fibre until Ofcom indicated they would allow BT to make long term profits on fibre, also Gov gave tax incentives to all which helped BT offset their costs.

2 why have Ofcom not put an SOR on all to have the same standard of build, so that they are all comparable. This is a debacle waiting to happen as is evident from smart meters and other such waste of resource when not properly planned.

3 it is all very well guaranteeing the last mile speed but this is throttled back within the core, the important measurement is throughput.

Worked across TMT. Last role (before falling ill yet again) was in advisory / transaction . A few points. My 2 pennies.

Alt-Nets using PIA vs. building their own. Walked past OR and Alt-Net at a chamber recently. Stopped to chat. Blockages are an issue. Oh, I looked down the hole. It was full of water. Building own does not mean easier. First mover is a key strategy for some of these guys. Lots of delays. Also, lack of people / contractors. Supply chain might be an issue as well.

Valuation and modelling are greatly impacted by current macro climate. I’d even say that valuation / modelling are already off.

Long-term payback model impacted by deep discounting (from what I’ve seen).

Sure I had a couple of other points. But it’s 3:30am. Need beaury sleep.

Gist is, I foresee a wave of consolidation in the very, very near future.