UPDATE3 UK Gov Moots TAX on Broadband ISPs to Fix Internet Slowspots

The Government is allegedly anticipating that it will need another £500m to bring superfast broadband (24Mbps+) connectivity to the final 5% of premises across the United Kingdom, which may well be achieved through a new “levy” (TAX) on broadband ISPs. Warning, we’ve been here before.

The current Broadband Delivery UK programme and related projects, which are broadly overseen by the Department for Culture Media & Sport (DCMS), aims to make fixed line “super-fast broadband” services available to 95% of the population by 2017/18 (rising to 99% by 2018 when you include mobile and other fixed wireless solutions).

So far a significant chunk of this investment has come from the BBC TV Licence fee (Digital Switchover Budget), while local authorities have also stepped in to match with the central Government’s commitments. But squeezing future funding from the BBC will be challenging due to the proposed cuts and many councils are also braced for another round of tough austerity, which will similarly hinder their ability to commit funding.

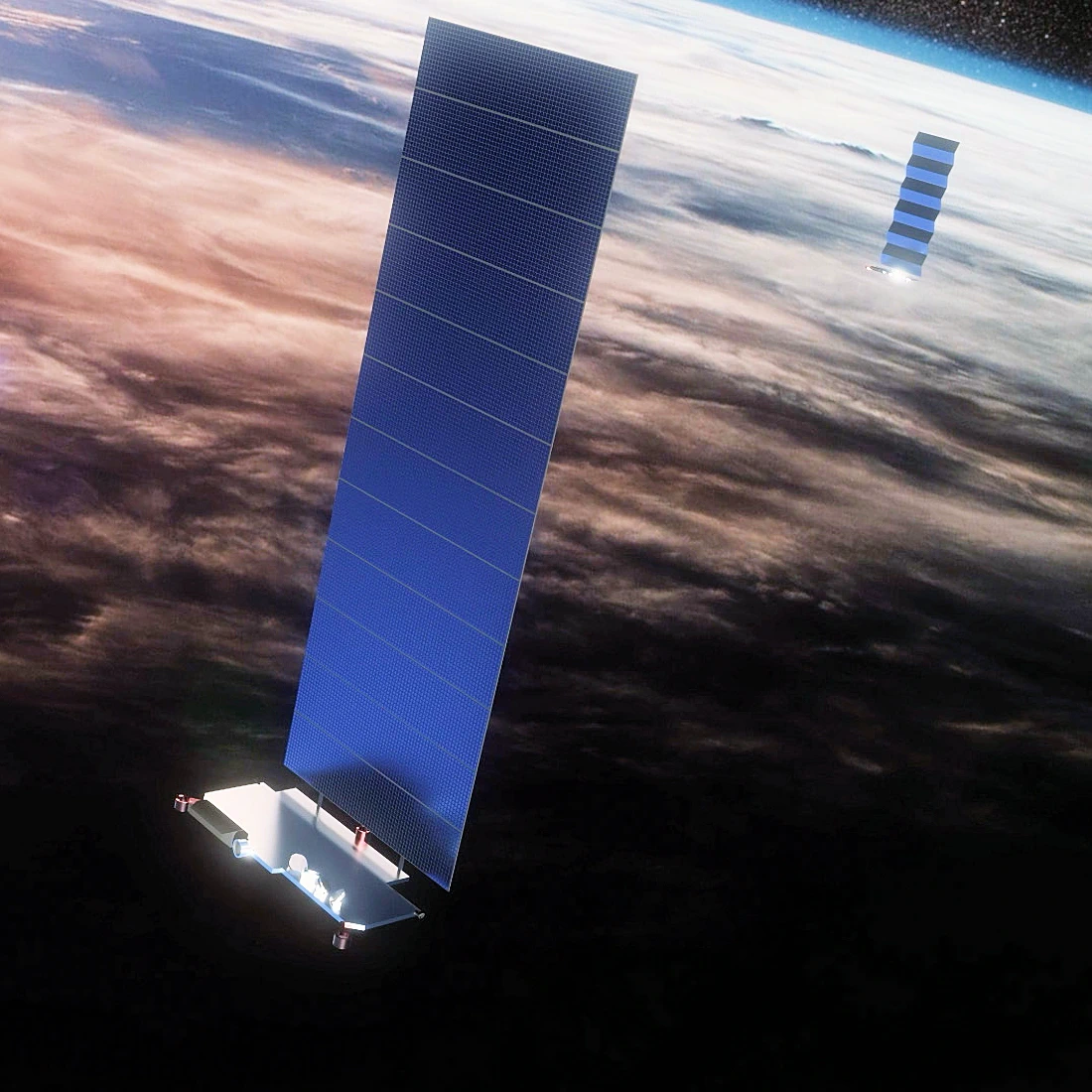

Furthermore it’s well known that reaching the final 5% will be an expensive business and that’s why seven Market Test Pilots (MTP) are currently being conducted as part of the £10m Innovation Fund, which is experimenting with various fibre optic, Satellite and fixed wireless technologies in order to identify the most viable alternatives. Never the less even some of these may struggle unless more investment can be found.

On top of that the Government has also proposed, albeit not yet committed to, raising the legally binding Universal Service Obligation (USO) from slow dial-up speeds to 5Mbps. Plus there’s an ambition for bringing “ultrafast” (100Mbps+) broadband to “nearly all UK premises,” although BT and Virgin Media can probably achieve most of that without state aid (save for the ‘UK Guarantees Scheme’ of course).

So where might the extra funding come from? According to an FT source, “That is very much the Treasury view, why should we find £500m to do the last 5%? … An industry levy is the direction of travel.” The word levy is of course, in the eyes of most people, merely political speak for a tax.

The report alleges that the Government is considering two options, either raising the funds through taxpayer money or imposing a levy on the industry (broadband, mobile and phone providers etc.). At present the idea of an industry levy appears to be winning favour and Ofcom’s CEO, Sharon White, has also suggested that such an option might be plausible (see last week’s Strategic Review Document for some vague and unspecific mentions).

At this point the Government has said that they’re “not going to comment until decisions are made,” although they might want to check their history first and engage closely with the industry before rushing into anything. One of the reasons for that is because we’ve been down this road before with the pre-2010 Labour Government and it didn’t end well.

The Labour Government of the day controversially proposed to put a 50p +vat per month tax (Next Generation Fund – generating up to £175m per year) on all fixed phone lines to help fuel the roll-out of next generation broadband services, which was bitterly opposed by ISPs and generally disliked by members of the public as well as other politicians.

In the end the idea was shelved just before the 2010 General Election, which saw the then coalition of LibDems and Conservatives come to power and fund BDUK through alternative methods (BBC Licence etc.).

Some Reasons Why the 50p Tax Flopped

* Internet providers would have ultimately put up their prices to compensate, thus effectively imposing a new tax on consumers by stealth and nobody likes stealth taxes.. except perhaps the headline writers for several major newspapers.

* It risked discouraging new connections from those in lower income brackets, as TalkTalk often warned; although most ISPs increase their prices by well above the level of inflation each year, so this was always a tricky argument.

* Many feared that, once the targets had been met, the Government might keep the tax in place and simply pocket the revenue for use in other non-telecoms related sectors.

* Questions were raised over the difficulty in gaining fair distribution of the money.

* Another big question mark hung over how the government might define a fixed phone line in the first place (did it include mobile and what about broadband-only lines? etc.) and if smaller ISPs would also be hit by the levy.

* Will £500m even be enough to do the job? This is currently a difficult one to answer definitively because it will depend upon technology choice and contract / tender flexibility (i.e. being very open to altnets).

Ironically the Conservative Party effectively pledged to scrap the 50p tax and now it seems to be reconsidering via a potentially similar approach, which could be described as somewhat of a U-turn. However at present it’s not known what form such a levy would take, although imposing it on consumer “phone lines” might not be the best tactic.

UPDATE 11:33am

The UK ISPA has responded to the concerns and also made a good point about undermining the investment of private altnets.

ISPA Secretary General, Nicholas Lansman, told ISPreview.co.uk:

“Whilst we have not seen any policy detail, we note that the Treasury under the Coalition Government scrapped the previous Labour Government’s plan, as part of the Digital Britain Review, to use a levy to pay for superfast broadband rollout with the current Chancellor describing the idea as an “archaic way” of achieving investment in broadband infrastructure. A Parliamentary Select Committee at the same time also said the idea for a levy was regressive for placing a disproportionate cost on the majority who would not benefit.

A number of providers are currently working to rollout superfast broadband across the country. A levy could undermine this ongoing investment. Delivering the final 5% is a challenge, but BDUK has been undertaking some encouraging work with industry through technology trials. Government would be better off focusing efforts on encouraging investment and competition.

Furthermore, broadband is an enabling industry that underpins the wider economy, so there is a case to be made for public investment to help support rollout to the 5% where the benefits will be most transformative.”

UPDATE 12:57pm

A few more ISP comments have come in.

A Spokesperson for Entanet said:

“So in essence the situation is this… As the Public Accounts Committee found in 2013, the Government created an effective monopoly for Openreach who have delivered late and over budget; so now they consider imposing a regressive tax which will fall disproportionately on poorer households to prop up Openreach’s failings. We cry foul.”

Adrian Kennard, MD of AAISP, added:

“BT are almost certainly best placed to spend this extra money making the last 5% better, so the money goes back to BT! Will it then be enough to pay the investment needed, who knows.

As you say, there is a huge question on “what is a phone line”. If the tax was on consumer lines, we’ll install business lines instead. If the tax is only on lines providing telephone service, that will create a problem for BT as they sell lines and things like call barring – they would have to have a way to charge 50p less for lines with all calls barred. In the end that would make our “broadband only” lines even more appealing as another 50p cheaper than getting a normal phone line from someone else.

Finally, you have the issues of what is trying to actually be achieved here. Whilst “superfast” 100Mb/s or even 20Mb/s is really “nice”, it is more than you need to have people “connected”. It is more than you need for streaming video even. There is a social need for the country to be properly connected, but the higher and highers speeds are more of a luxury and not something we should be taxing everyone else to pay for, surely?”

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook and Linkedin.

« BT’s “Fibre Broadband” Finally Arrives in Rothesay on the Isle of Bute

Latest UK ISP News

- FTTP (5508)

- BT (3513)

- Politics (2535)

- Openreach (2296)

- Business (2260)

- Building Digital UK (2243)

- FTTC (2042)

- Mobile Broadband (1971)

- Statistics (1787)

- 4G (1662)

- Virgin Media (1617)

- Ofcom Regulation (1459)

- Fibre Optic (1393)

- Wireless Internet (1389)

- FTTH (1381)

Comments are closed