Europe vs UK – New Study Summarises Fixed Broadband and 4G Coverage

The European Commission has published a new study from IHS Markit and Point Topic, which summarises the current state of broadband coverage across Europe and measures how close the EU is to achieving their Digital Agenda goals (i.e. 30Mbps for all, with 50% subscribed to 100Mbps+ by 2020).

At this point we should say that many of the headline figures in this report have already been covered in past progress updates from earlier this year (here and here) and similarly the information is based on data collected to the end of June 2016, which is now quite out-of-date. However the earlier studies focused exclusively on the 28 EU counties, while this one also includes data from Norway, Iceland and Switzerland.

Key Findings

* In the 12 months to the end of June 2016, 12.8 million new EU households gained access to high-speed broadband delivered via Next-Generation Access (NGA) networks

* By mid-2016, high-speed NGA broadband services (at least 30Mbps download speeds) were available to 75.9% of EU households.

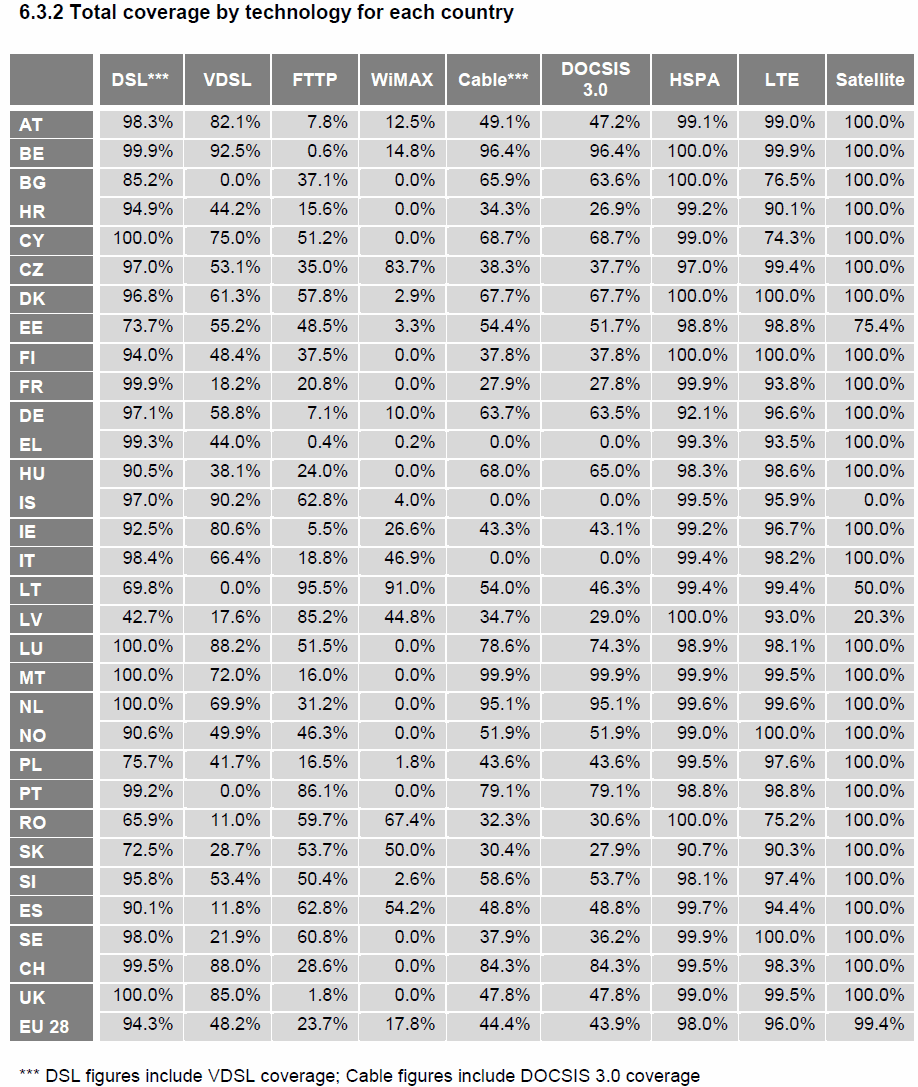

* Very-high-speed-DSL (VDSL / FTTC) continues to be the key driver of NGA coverage growth across the EU, increasing by 7.1% points and reaching nearly a half (48.2%) of EU homes.

* 4G LTE networks expanded at a fast pace and covered 96% of EU households by the end of June 2016.

* The gap between rural and national NGA coverage is closing, but remains significant with only 39.2% rural households across the EU having access to high-speed broadband services.

We don’t plan to go into too much detail here because to do so would be to repeat what we’ve already written in the two prior articles (linked above), although the report does note that broadband network operators across Europe continue to focus their deployment strategies on upgrading existing copper networks (e.g. VDSL2 / FTTC) “instead of investing in the typically more expensive deployments of fibre optic [FTTP/H] networks.”

Advertisement

Alzbeta Fellenbaum, Principal Analyst at IHS Markit, said:

“Since 2013, VDSL has been the fastest growing fixed broadband technology tracked by the study, and some countries have seen dramatic year-on-year growth in VDSL. For instance, VDSL coverage in Italy more than doubled during the twelve-month period to mid-2016, as coverage increased by 33.6 percentage points.

Iceland, Germany, Hungary and Slovakia also witnessed double-digit growth in VDSL coverage during the twelve-month period to mid-2016.”

However as the coverage of VDSL reaches maturity (it’s already around 90% in the UK) then we can expect to see more movement towards “full fibre” FTTP/H ultrafast broadband services, as well as future hybrid-fibre upgrades like G.fast and DOCSIS 3.1. Signs of this are already very evident in the UK (here and here) and Virgin Media’s existing EuroDOCSIS network can already do 350Mbps.

Such upgrades will be essential if the EU ever hopes to stand any chance of achieving their next non-binding goal for “all European households” to get a minimum Internet download speed of 100Mbps+ by 2025, with businesses and the public sector expecting 1Gbps+ (here).

The following table summarises the United Kingdom’s position across various different technologies vs the EU 28 average, which includes a useful breakdown for rural coverage. Take note that the figures for 4G (LTE) Mobile appear to reflect population rather than geographic network coverage.

Advertisement

The Report

Final Study on Broadband Coverage in Europe 2016 (PDF)Report Data Tables (MS Excel)

UPDATE 27th Sept 2017

The now almost customary comment from rural FTTH provider Gigaclear has just dropped.

Matthew Hare, CEO of Gigaclear, said:

“This summary of the current state of broadband coverage across Europe just reinforces what we already know – that the UK needs further investment into its ultrafast full fibre broadband infrastructure.

Key for us is that, across Europe, the telecoms industry continues to focus their deployment strategies on upgrading existing century old copper networks rather than investing in the superior full fibre network. This is resulting in wasted investment into a short term fix rather than a long term, future-proofed solution as well as misinformed consumers, who believe they are receiving a quality full fibre connection, when they are actually receiving limited part-fibre broadband.

At Gigaclear, we are investing hundreds of millions of pounds into new full fibre networks in rural areas, but what is needed is a national plan to ensure that everybody throughout the country has access to future-proofed connectivity that secures our digital economy and enables the UK to compete with the rest of the world.”

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Ofcom Preps Measures to Boost Competition for KCOM in Hull, East Yorkshire

Comments are closed