Investors Warn UK Infrastructure Projects are too Politicised

A new report from global law firm DLA Piper has warned that “excessive politicisation” of major UK infrastructure projects (broadband, energy etc.) is becoming a “significant turn-off” for risk averse investors, which comes at a time when the Government are trying to attract private investment to help upgrade the country.

According to the Organisation for Economic Co-operation and Development (OECD), which covers countries that support democracy and a market economy, the UK lags behind its peers and needs to spend an additional 0.4% of GDP between 2016 and 2030 to meet its infrastructure needs. Similarly the World Economic Forum ranks the quality of UK infrastructure as 24th in the world (i.e. at the lower end of the G7 countries).

The new DLA Piper report (UK Infrastructure: Defining the Future – PDF), which is based on a survey of 50 big infrastructure investors at CIO and portfolio manager level, therefore describes infrastructure in the United Kingdom as being “distinctly average.” It also found that 84% of major infrastructure investors believe that infrastructure projects have become too politicised.

Advertisement

Report Extract

Tellingly, more than half (55%) believe over-politicisation has a direct effect on the value for money of project proposals, with as many as 7 in 10 having been deterred from investing due to political concerns. Food for thought for policy makers indeed.

A long-standing major frustration for investors on large scale projects is the potential for changing priorities mid-project. To mitigate this risk, 43% would like to see the government take action by identifying and committing to projects which have robust cross-party political support.

Furthermore, a significant number (38%) feel the government should accept a higher degree of completion risk to incentivise greater private sector participation in long term projects, which are naturally fraught with greater risk.

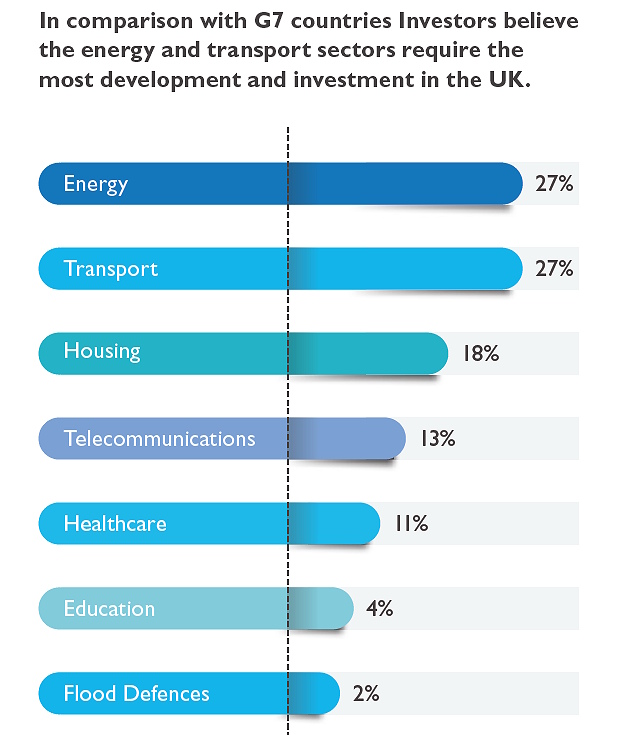

Despite this it’s noted that the political will to invest in and improve UK infrastructure has, “arguably, never been as strong.” On the other hand broadband / telecommunications appear to come surprisingly far down the list of areas that infrastructure investors believe may require the most development, with only 13% voting for it (27% voted for Energy and another 27% for Transport).

The report then proposes several changes that could help to improve infrastructure investment in the United Kingdom, such as by granting the Government’s National Infrastructure Commission (NIC) statutory independence and relaxing procurement rules (i.e. after Brexit).

We should point out that the 2018 Future Telecoms Infrastructure Review is due to be published soon, which will set out proposals for several ways to help boost investment and coverage of the latest “full fibre” (FTTP/H) broadband ISP and future 5G mobile networks.

The Top 5 Recommendations

1. Grant statutory independence to the National Infrastructure Commission

The sense that decisions on major infrastructure projects are stuck in a political bottle-neck is evidenced by the fact that nine out of ten (91 percent) investors think that the National Infrastructure Commission should be granted statutory independence in order to expedite the process.A major frustration for investors is when projects are scrapped or significantly altered mid-project. To combat this and encourage greater private sector involvement, various solutions are preferred by investors. These include the requirement on the Government to identify and formally commit only to projects which have cross-party political support and for the Government to take on a greater level of completion risk.

2. Optimism abounds

Despite targeted criticisms, investors are largely positive about UK infrastructure investment opportunities over the medium to long term. Two thirds (66 percent) of investors think net returns from investment in UK infrastructure will increase over the next ten years, while 55 percent foresee more opportunities for infrastructure investment over the coming decade compared to the previous one.In addition, four out of five (84 percent) expect their infrastructure funds to invest either the same amount or an increase in capital deployment over the next five years. Investors are equally positive about the government’s National Infrastructure Delivery Plan, with 88 percent viewing it as a stable, long term approach. They are also largely supportive of its procurement process.

3. Opportunity to improve regulation post Brexit

Despite almost two thirds (64 percent) of investors being broadly positive about the UK’s current procurement process, a resounding majority (88 percent) believe that relaxing procurement rules would attract more investment into infrastructure projects. Over three quarters (77 percent) would also like to see the government ‘have a greater appetite’ for pursuing projects under the Private Finance 2 (PF2) scheme, a reformed version of the Private Finance Initiative (PFI).4. Strong pull of the UK endures

The UK’s enduring cachet as an investment destination is evident when it comes to where investors are choosing to back infrastructure projects. The UK is the favoured destination for 84 percent of investors, followed by the US (66 percent) and Australia (59 percent). Given the complexities around infrastructure projects, and the fact that the investors polled are based in the UK, the fact that their investments are heavily weighted towards domestic projects is also likely to be a factor.5. Smart cities a clear driver of growth

‘Smart cities’ – cities which makes optimal use of interconnected information and communication technologies to enhance the quality and performance of urban services – were unanimously selected as having the greatest growth potential. Specifically, electric cars and autonomous vehicles were cited as having the biggest impact on UK infrastructure over the next five years. Investors believe that the rail and energy sectors require the most investment, with high-speed rail a priority for the former.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Virgin Media UK Extend to Ballyclare and Portadown in Northern Ireland

Comments are closed