A Quick Look at the Changing Growth of UK Full Fibre AltNets

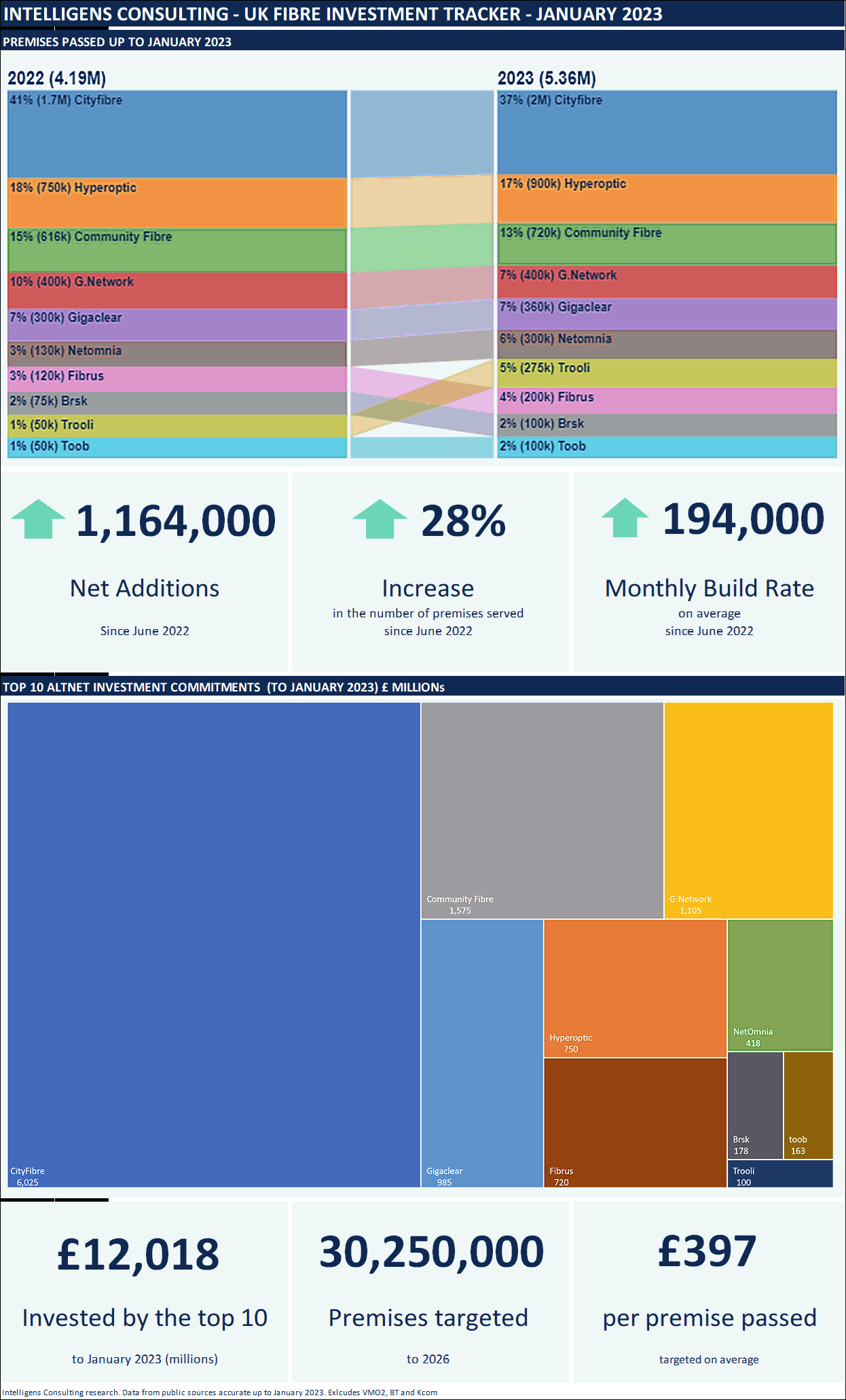

We’ve recently been talking a lot about the challenges being faced by alternative broadband network providers (AltNets) and related ISPs in the UK, so it’s worth taking a minute to scan over the latest data from Intelligens Consulting. This summarises the build plans and changing market shares of the largest ten players.

At present around 73% of UK premises can already access a gigabit-capable broadband connection (via any fixed line technology) and that drops to over 45% when only focusing upon Fibre-to-the-Premises (FTTP) lines (here). Established players like Openreach (9.6 million premises) and Virgin Media (15.6 million premises) are the biggest players in this, but over 100+ AltNets also have serious plans.

The new data from Intelligens Consulting doesn’t reveal much that wasn’t already in the public domain, but it does provide a useful – if simplistic – overview of how some of the largest AltNets are faring (data covers the last 6 months) in their quest to challenge the established giants. At least in terms of their committed investment, build pace and premises passed etc.

But there are a few caveats to consider. The data below doesn’t include the crucial figure of take-up (this is tricky since only some AltNets are willing to share such info.). On top of that, it’s also missing some of the most current data (e.g. CityFibre topped 2.5 million premises passed last month, with 2.2 million Ready for Service). This is important because a lot can change (build pace) in the space of a month, thus percentages for market share(s) may not be accurate if the data for every entry isn’t in perfect sync with the operators. Likewise, not all AltNets report their premises pass figures.

All of this is relevant because the UK’s market for AltNets is currently very crowded and overbuild between rivals, even in some less economically viable locations, is on an upward trend. Not to mention the industry-wide strains being felt from rising build costs, growing pressures from investors to deliver viable take-up and competitive threats from Openreach (here and here). A wave of market consolidation is widely anticipated to follow (here and here).

Short Summary of the Report

Overall, the report finds that the top 10 full fibre AltNets now pass 5.4 million premises (Jan 2023 figure), compared to 4.2 million premises in June 2022. This additional 1.2 million premises is a 28% increase upon the number of premises passed just six months ago.

The report claims that “CityFibre has reduced its dominance over the altnets” (i.e. its build share dropped from 41% to 37%), which is put down to significant gains made by Jurassic Fibre, BRSK, Fibrus, Trooli and Netomnia (YouFibre). But as we said earlier, the new report didn’t use CityFibre’s latest figure.

Over the last six months, the top 10 AltNets were also found to have achieved an average monthly build rate of 194,000 premises passed per month, which is an average weekly build rate of 48,500 premises. But that still puts them behind Openreach’s weekly figure of 62,000, although many AltNets are still in the early ramp-up phase of deployment. Now for the infographic..

“Our research estimates that the top 10 altnets will build full fibre networks serving around 30 million premises by around 2026/27. [Virgin Media O2] estimates that it will build fibre to 23 million homes, while Openreach plans to build fibre to 25 million homes by 2026. Collectively, the top 10 altnets, VMO2 and Openreach will reach at least 78 million homes with fibre by 2026.,” said the report.

The suggestion above is that, on average, each UK home will have access to 2.78 fibre connections (roughly three providers). But overbuild will of course be higher in urban areas (some locations may be able to sustain four or more players) and lower in rural ones, although we have seen some rural areas where three or more FTTP networks are building (the viability of that is highly questionable).

“Provided they don’t overbuild each other’s networks and they connect premises to generate cash, we have seen altnet business plans work. Smaller altnets already serving rural areas are less likely to be threatened by Openreach and VMO2 where demand for reliable high-speed connectivity is high and sticky,” concluded the report. In fairness, rural builds cost significantly more and thus carry greater risk, so smaller AltNets will still be threatened by the likes of Openreach and VMO2 encroaching into such areas.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook and Linkedin.

« O2 UK Recommits to Inclusive EU Mobile Roaming as Standard

Latest UK ISP News

- FTTP (5512)

- BT (3514)

- Politics (2535)

- Openreach (2297)

- Business (2261)

- Building Digital UK (2243)

- FTTC (2043)

- Mobile Broadband (1972)

- Statistics (1788)

- 4G (1663)

- Virgin Media (1619)

- Ofcom Regulation (1460)

- Fibre Optic (1394)

- Wireless Internet (1389)

- FTTH (1381)

There is no way Hyperoptic has a higher build rate than Community Fibre

Also the 2023 numbers between Netomnia and Gigaclear seem swapped

Zzoom just hit 100k, not toob though

The latest official data I have personally on those is:

CommunityFibre – 720,000 premises (Dec 2022)

Toob – 100,000 premises (Oct 2022)

Gigaclear – 380,000 premises (Jan 2023)

Netomnia – 300,000 premises (Nov 2022)

This goes back to what I said about the difficulty of gauging market build share when the public data sources are of a different age.

My point is that “official” investor numbers need to be taken with a big grain of salt, especially when the Thinkbroadband data does not corroborate the numbers by a very significant factor. Community Fibre currently shows as only a 10k build rate when they’ve at least been doing 20-35k. I would place bets on them beating Hyperoptic to 1 million

Other anomalies I detect: Brsk having 75k and only growing 25k when they have been building at ~10k a month, or Gnet being completely stagnant

@Wilson, Hyperoptic has been going for quite some time, They are in more parts of the country and have partnered with multiple house builder like Barratt Homes and CALA Homes

Have a look on TBB maps and you’ll see thier coverage.

No need agreements to build SDU and Community Fibre got that figured out. Besides Islington just signed with them and they have way over 30k MDU stock, which is more than the fraction of Baratt that HO hasn’t covered

toob passed 100k in Oct?

https://fibreprovider.net/news/toob-connects-its-10000th-customer

CityFibre in distress. Trooli looking for a buyer.

As interest rates rise and poor takeup bites, altnet business plans become exposed.

Can anyone confirm if Cityfibre are continuing with their build plan, or are slowing it up or even putting it on hold?

Where you seen that Trooli are looking for a buyer? Can’t find anything when I search it

Altnet seeks buyer as cable dream frays – Sunday Times

https://twitter.com/JamieNimmo63/status/1622190775827156992

Trooli has also recently appointed Davis Duggins to the board. I have noticed they have pretty much stopped their expansion works around my area.

https://www.telcotitans.com/network-and-infrastructure/uk-altnet-trooli-hires-restructuring-guru-as-sale-talk-resurfaces/6171.article

‘Premises Passed’ numbers are interesting but ‘Take-Up’ numbers are far more important.

That’s what brings the money in so alnets can start paying off their huge debts, keep investors happy and remain in business.

You are dead on, walking down my street which has around 52 houses, I have counted 5 FTTP, 3 zzoomm and 2 openreach, I know it is still earlyish days as they have only been available on the last 2 months or so of last year, so some people will be waiting for contract to run out I suppose or waiting until the end of March before they do anything. But this also seems to be the same in other places, a lot of people are not changing to FTTP.

Next general election is 23 months away, many people think it’s will be a win for Labour.

If Labour once again start talking about ‘free broadband for all’ that would really throw a spanner in the works and make investors very twitchy.

The Labour party contesting the next election might as well be a different party to the one that contested the last election, the change at the top has been so dramatic. There is no chance that they’re going to propose to, say, nationalise Openreach at less than the annual cost of the Openreach wages bill 😀

The economy is far too battered to dump a bunch of billions to kill the competition like Corbyn promised a few years ago

Still, watch them raise taxes further. There are countless ways in which they can screw up. I mean they can’t even decide on the basic definition of the word woman

G.Network adding nothing between June and today seems about right. Very good at digging roads up, abysmal at enabling areas for service.

I predict that the altnets won’t get close to 30 million premises passed by 2026. Rather they’ll be increasingly squeezed out by Openreach over that period and the weaker ones will go bust or be aquired by larger companies.

30 million properties is more or less every home in the UK – there’s no way they’ll do that.

If there are 30 million Altnet connections, it will mean substantial amounts of overbuild in the urban areas.

No way have Trooli got to 275k from 50k in 6 months. Build a network? They couldn’t build their own breakfast!

mental 100+ alt nets and still zero interest in my area, roll on this Virgin PIA, if they ever decided to finalize it.. o.0

being on 20mb sucks so bad.

Same here. No Altnets around for miles.

And the ones that do exist further up the country are rubbish.

Waste of money.

Just OR and Virgin here.

I am suppressed we have not seen some consolidation of the alt nets. They must be burning through cash pretty fast. High interest rates will not help. The unknown is what the take up is. I doubt it is that high. In many cases they are competing against 2 or 3 other FTTP providers. Most alt nets are closed networks as well whilst Open reach FTTP will be sold via several companies

I was informed by my local council that an altnet will be providing fttp in to the town.

Not heard a thing from OR, then two emails

You let us know you’re interested in Ultrafast Full Fibre, and we wanted to touch base with some good news

– your area is in our build plans, and Full Fibre should be available at your house by .

You let us know you’re interested in Ultrafast Full Fibre, and we wanted to touch base with some good news

– your area is in our build plans, and Full Fibre should be available at your house by Dec/2026.

Spot the difference?

Well 2026 is whats on their map, so no change there.

Hopefully the altnet will start soon.