Telecoms Analyst Firm Expects UK FTTP AltNet Consolidation

Telecoms data analysts at global market intelligence firm ThinkCX have published a new update that forecasts how increasing consolidation in the United Kingdom’s overcrowded market for alternative broadband network (altnet) providers could play out during 2023. Needless to say, the new update holds few surprises.

As we’ve said more than a few times over the past couple of years (see here, here and here), the presence of more than a hundred AltNets in the market – all of which are building new gigabit-capable broadband infrastructure (often with overbuild of rival networks) – will, when combined with inflationary and other cost pressures – place a squeeze on the investment taps.

In response, some AltNets may have to slow their pace of build in order to focus on generating enough take-up to satisfy investors. Some will probably succeed in this, while others may not. At the same time, slowing the rollout is a risky thing to do in such an aggressively competitive market, where the ability to go live before your rivals does matter (assuming you’ve got the marketing right, otherwise consumers won’t know you exist).

Advertisement

Sooner or later, the outcome of all this will be reflected by a wave of consolidation. But we should point out that consolidation (mergers and acquisitions) isn’t only born out of a struggling party or parties and may also occur between two relatively successful players, although the goal of both is the same – a positive future outcome for the network and business.

The new report from ThinkCX, which reflects the detail they share via their commercial market intelligence platform, largely echoes the aforementioned beats and highlights how “recessionary shocks in the wider economy are leading analysts and market watchers to forecast a cooling off in 2023 – leading to a frenzy of mergers and acquisitions (M&A) among the altnet community.”

Guy Miller, Telecoms Entrepreneur and CEO at MS3 Networks, added:

“There’s still a lot of investment available to fuel further fibre growth, but it’s only around one-third the level of ask in the market at large and this is likely to trigger more consolidation among providers in the year ahead.

Understanding the market dynamics at a local and regional level will be incredibly important to building M&A investment cases, particularly for operators looking to build a concentrated subscriber base or branch out into underserved areas.”

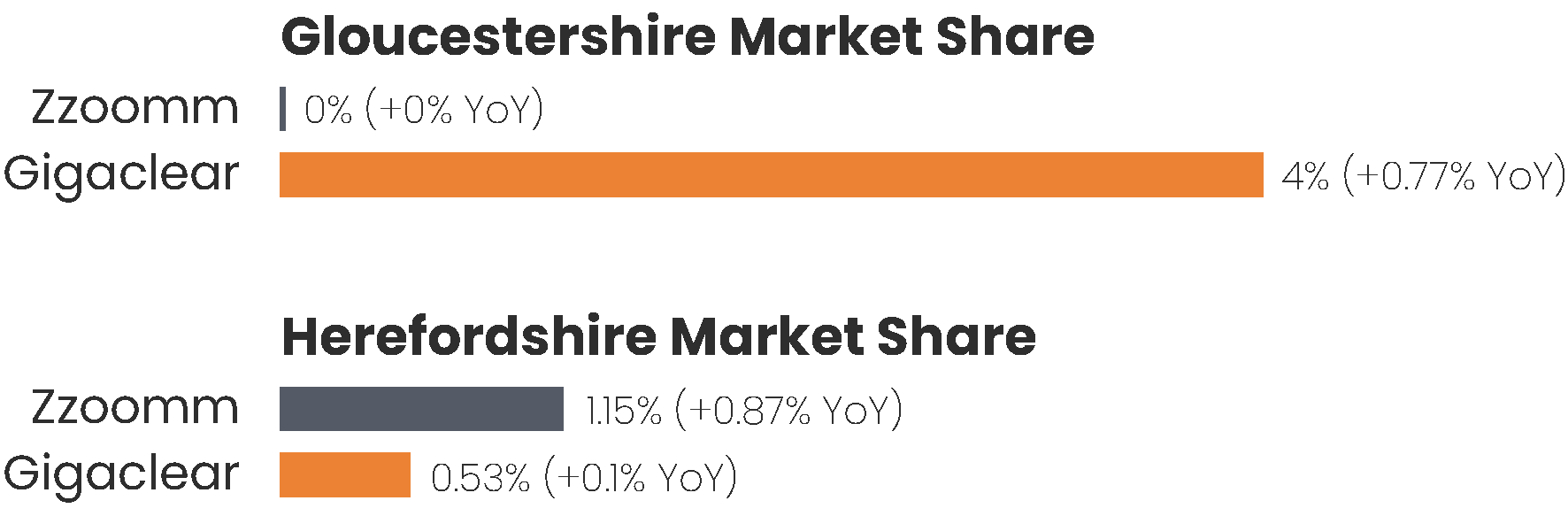

Sadly, most of ThinCX’s data isn’t freely available to the public, but their summary does include a very limited example from Herefordshire and Gloucestershire in England. For example, in Herefordshire, the data claims to show that the provider with the fastest growing market share is Zzoomm, which has added 0.87% total market share in the last 12 months alone (to 1.15% in total). This is said to be comparable with the market share of Gigaclear (0.53%) and Zen (0.75%).

However, the analyst notes that the picture is somewhat different in neighbouring Gloucestershire, where Zzoomm does not figure at all and Gigaclear is the fastest growing provider (adding 0.77% total market share in the last year, to 4%). “Among the many altnets operating in this county, Zen has only 0.39% market share and is falling,” added ThinkCX.

Advertisement

“As this example shows, market share for these altnets can be highly localised – providing niche business case opportunities for investors looking to expand penetration without committing to new digs. These market share numbers reflect actual service subscriptions, not simply homes passed, and are based on independent technical evidence rather than how customers, providers or vendors have responded to surveys or provided estimates,” said Ron Smouter, VP Sales and Marketing at ThinkCX.

The example data is interesting, but without more context it doesn’t tell us much, not least since different network operators will have different levels of commitment, in different counties, and they may also be at different stages of deployment.

For example, Gigaclear is a much older rural-focused provider (i.e. slower to build and deploying in areas of significantly lower density of premises) and in some counties they have state aid contracts that are growing closer to completion, while others still have a long time left to run. Take note that Zzoomm hasn’t, so far as we can recall, announced any build plans for Gloucestershire.

Advertisement

Furthermore, the mention of Zen Internet, which isn’t depicted in the illustration itself, does seem to be a little bit confusing since they aren’t building full fibre at all and are more of a retail ISP. But retail ISPs do have some relevance due to the attraction of their customer bases and impact at wholesale. Market consolidation may thus involve some of them too.

Otherwise, we don’t know exactly when this period of consolidation will fully kick off and become a much more regular feature of our news, but privately we are already seeing some early indications of strain at a few operators. Given enough time, that may inevitably lead to changes in the market, and perhaps sooner rather than later for some.

Lest we forget that some evidence for this already exists. For example, CityFibre acquired FibreNation from TalkTalk in 2019/20 (here), then in 2021 we saw Swish Fibre gobble up People’s Fibre (here), the 4th Utility consumed Vision Fibre Media (here) and CommunityFibre acquire Box Broadband (here).

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Ofcom Probes UK ISP BT Over Clarity of Customer Contract Info.

i assume the comparison between gigaclear and zzzooom is the Matthew Hare factor

Soon: Analyst forecasts the sun to rise in the east tomorrow morning…..

There are already two high-speed providers in my area, VMO2 DOCSIS and CityFibre FTTP. Rather than Openreach upgrading to FTTP, it would be better IMO to allow consolidation as long as consumers are protected against price-gouging.

Haha, in my town VMO2 is upgrading their network to FTTP only to downgrade it at every home back to DOCSIS (RFoG). Even in the estate where they’ve built their network from scratch few months back. This is a complete nonsense considering OR with FTTP, Netomnia and OFNL are in town.

I hope they won’t get taken over by someone like Openwretch, they’ll kill synchronous.

I’m pretty sure that Openreach will offer synchronous services if there is sufficient demand from their ISP customers.

You mean symmetric service?

and that’s the nail on the head “if there is sufficient demand” – so you never tried to ask an ISP to register your “demand” for symmetric services then? It’s impossible as they have no system or care. The operator will just laugh at you and say they have what they have.

I’d rather not wait for Openwretch to decide in 100 years time if an upload speed bump is allowed or not, or wait for them to ask the tax payer for any funding programmes to move anything on.

Without data, this is a nothing burger. Adding Zen who does not even build a network just makes it a joke

You don’t need data to know that investors will want a payback within 10 years, and that for most altnets, the market share required to achieve this is unviable, especially in the fragmented market that makes up the altnet space.

Well, payback and interest costs are the kiss of death for most infrastructure investments, so rather than a sound business plan most altnets are based instead on a wish and a prayer, hoping for a profitable exit to some greater fool (a bit like Liberty Global’s investments in Virgin Media). The fundamental problem is that the payback time investors need would mean the price to use is is too high for the market, and market based returns won’t give the needed rate of return. In other fields (gas, electricity, water) regulators solve the problem by inventing a fictitious regulated asset base value, and then offering a risk-free return on that, but that won’t happen here. There’s some (eg Hyperoptic) that perhaps aren’t vulnerable to this mismatch between financing costs and long lived low return assets, but the bulk of the altnets need to consolidate – and I suspect that random permutations of technology will make that a big headache.

An altnet needs to target areas which don’t have fibre yet, and it needs to be able to come up with a realistic rollout plan, something where many altnets fail.

Gnewton

An altnet needs to target areas which don’t have fibre yet, and it needs to be able to come up with a realistic rollout plan, something where many altnets fail.

so where would you suggest they then build ?

@Fastman: “so where would you suggest they then build ?”

Areas or towns which are predominantly without fibre, with low or no competition, and the realistic prospect of sufficient takeup rates.

And an altnet needs to have a proper project management and resources to follow through with a rollout plan, and not to leave areas half-finished for years.

It also helps to pay attention to little details, such as good customer services, not relying CGNAT, to offer IPv6 support, etc. We know of altnets where you can’t even use simple things like a CCTV equipment, port forwarding, etc. It’s these little details where altnets need to pay attention and distinguish themselves from future potential competition.

I recently came across an altnet whose marketing department doesn’t even know its own coverage area, which ended up promising 24 months contract price freezes (which in principle is good) and other benefits to new customers in large areas not even covered by its fibre service!

As it is, we can expect a number of altnets to fail as a business, or to be swallowed up by competitors.

Lets hope Openwretch/BT get swallowed up by an ALTNET then, otherwise they will be trying to kill them off so they can monopolise Broadband again and sign the death warrant for symmetric services and any new innovation for faster speed.

really

behave and try and have some sense in what you post

this is the most riduculous post i seen in a long while

Marketing and keeping customer informed of rollout progress is abysmal in fact it is pretty much non existent with both alt nets and openreach

I know altnets who do marketing campaigns to areas not even covered by them.

Also, as part of the lack of proper rollout plans, I have often seen fibre being deployed on roads, and then nothing happens for 1 or 2 years, allowing a competitor to take away all the potential customers during that period, thus for the 1st altnet to have wasted its investment.