ThinkCX Claims UK ISPs with Biggest Price Hikes Lost Most Market Share

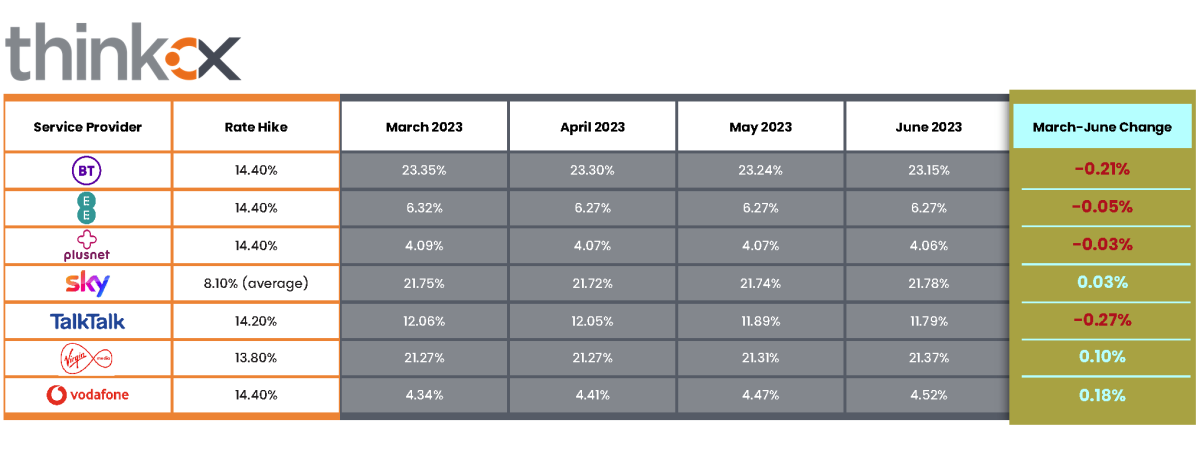

Telecoms analysts at global market intelligence firm ThinkCX have today released the results from their latest market share report on the UK’s broadband ISP market, which claims to show that providers “with the biggest price hikes lost the most ground to rivals“. But the shifts are fairly small, and it may not be telling the whole story.

In an ideal world, the price you pay when you first take a new broadband package would remain the same until the end of your contract term, but as we all know many providers don’t do that and will increase their prices mid-contract, often significantly and on an annual basis. The market’s largest ISPs (BT, Vodafone, TalkTalk etc.) are typically the worst offenders and hit consumers with hikes of over 14% around the March to April 2023 period (here).

But such rises do have consequences. According to ThinkCX’s findings, the market share for BT, EE, Plusnet, and TalkTalk (all of which increased prices by more than 14%) experienced a decline in the months following the mid-contract price increases. Customers who were dissatisfied with the sudden price escalation “actively sought alternative providers, resulting in a notable redistribution of market share in the industry“.

Advertisement

However, the research also showed that the market share for Sky Broadband, Virgin Media, and Vodafone experienced an increase in May, indicating a more favourable response from their customer base. But it should be noted that Vodafone’s growth rate, which had been quite high prior to the price hike, slowed noticeably after its 14.4% increase. Sky’s lower price increase (8.1% average) also corresponded with a broadly flat market share performance. “Generally, these three ISPs seem to be more successfully managing the balance between pricing adjustments and customer sentiment,” added the report.

On the other hand, it’s worth noting that ISPs which apply the ‘Inflation (CPI or RPI) + X%‘ rule for price hikes often make it harder for customers to exit their contract penalty free, thus in reality it’s difficult to know, from this short-term snapshot, how big of an impact the hikes really have (i.e. some may switch at the end of their term). Likewise, it would have helped to know how this compares with the normal baseline of movements from the prior quarters.

Furthermore, price hikes aren’t the only reason why consumers are switching ISPs right now, with the rising coverage of cheaper alternative full fibre (FTTP) networks being one of several other factors that must be considered. But the data above only looks at the largest players, which makes it tricky to gauge such impacts. One other complication on this front would be the fact that TalkTalk and Vodafone also sell via some AltNets (e.g. CityFibre). Suffice to say, take this data with a pinch of salt.

Advertisement

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Digital Infrastructure Adds 5 Locations to UK Full Fibre Rollout

FACTCO Bring Gigabit Broadband to Rothbury in Northumberland »

It’s very difficult to correlate the declared price increase with what people are actually paying due to the complexity of heavily discounted deals for new customers that don’t often see the sort of 14% increases that are made to standard tariffs, and the often very flexible retentions deals (for those with the skill and determination to get them). Even so, over at Virgin Media you can see how this all pans out in practice. VM are famous for regular and onerous tariff hikes well above inflation, yet their fixed line ARPU has remained resolutely stuck around £49 per month for Q3 since 2014.

Most of the large ISPs seem to be collectively gambling that they can raise their revenue and margins by the relatively new concept of non-cancellable, in-contract price rises at inflation plus amounts. Remains to be see whether that will have the intended consequence, or will work only in the short term, but then cause increased losses at the end of the fixed term – that’s what VM’s numbers would indicate is likely. I think BT and TT were first to go down this route for fixed line, and it’s interesting to see that in a relatively short period they’ve lost the sort of customer numbers that would worry me.

A pox on all the big ISP houses.

It was the increase in price for me and the stupid long contract. If plusnet have given me a decent price for even 18 months, then I would have stayed, but they pushed and pushed to get me onto Fibre, still with stupid long contracts, Well they did get me onto fibre, but not theirs.

These changes are so small they could well be sampling errors. Although with Virgin expanding their coverage all over the place, I wonder if their static market share gives a clue as to where the Altnet customers are coming from.

In the absence of legislation, neither the practice of long contracts (over 12 months) or annual price rises should be accepted by consumers, the fact we suffer both is a failure of the market. As consumers the best we can do is select a supplier who doesn’t do either of these things.

Fortunately I went to an AltNet who has rolling monthly contracts and a 2 year price fix.

Previously I was with PlusNet and they wouldn’t offer less than 18 months and couldn’t offer what I wanted, which was FTTP + VOIP phone. Subsequently they lost a customer who had been with them for 13 years.

I would say it is a failure of the regulator rather than the market,though I do take your point. Personally, I would simply ban all contracts longer than a very short period – eg max 3 months.

Shorter contracts would just mean bigger upfront costs or higher monthly costs as some of the fixed costs are spread across the contract length