April 2024 UK Gov Update on Project Gigabit Broadband Rollout

The Government’s Building Digital UK agency has released their April 2024 (spring) progress update on the £5bn Project Gigabit broadband rollout scheme, which is so far running 37 live contracts and procurements worth £1.9bn in state aid (£1.38bn for 31 signed contracts) to help extend coverage up to an extra 1 million hard to reach premises.

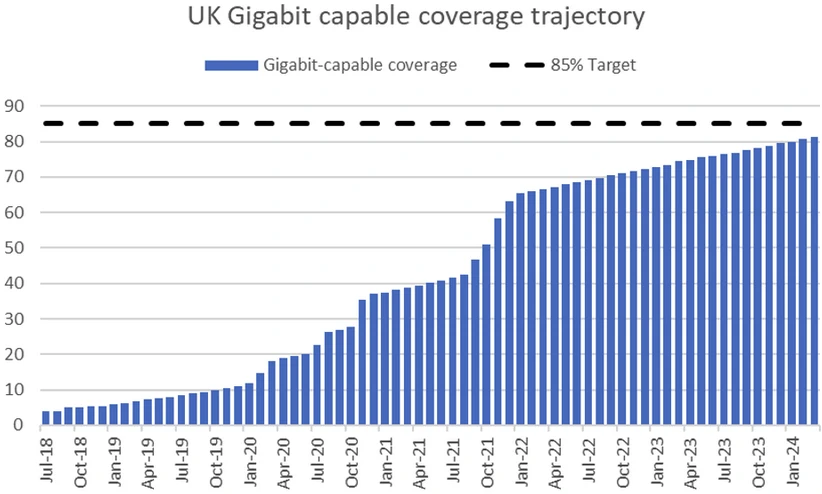

The project aims to extend networks capable of delivering download speeds of at least 1000Mbps (1Gbps) and uploads of at least 200Mbps to 85% or more of UK premises by the end of 2025, before rising to “nationwide” coverage (c.99%) by around 2030 (here). The funding released for this will depend upon how the industry responds, but there are still a lot of contracts yet to be awarded or even enter procurement.

The report notes that nearly 82% of UK premises can now access a gigabit-capable network (up from 79% in the December 2023 update) and Ofcom separately forecasts that gigabit coverage should hit around 87-91% by May 2025 (here), with purely commercial deployments alone (mostly focused on urban and semi-urban areas) being expected to deliver over 80% of that.

Advertisement

Project Gigabit is thus designed to focus on improving connectivity for those rural and semi-rural areas in some of the final 20% (5-6 million premises). This primarily consists of several support schemes, including gigabit vouchers (£210m), funding to extend Dark Fibre around the public sector (£110m) and gap-funded deployments with suppliers (rest of the funding) – known as the Gigabit Infrastructure Subsidy (GIS) programme.

Today’s article is focused upon the GIS programme and related procurement work, which sees ISPs bidding through a new Dynamic Purchasing System (DPS) to extend their networks across disadvantaged parts of the UK. Project Gigabit in England is centrally managed (by DSIT/BDUK – not local councils), although there may be variations in this for Scotland, Wales and Northern Ireland.

What’s New in the April 2024 Update

Since the last update in December 2023 (here), BDUK has now signed a total of 31 contracts (up from 16), valued at over £1.3 billion (up from £666m). The 15 newest contracts cover Kent, Leicestershire and Warwickshire, East and West Sussex, Bedfordshire, Northamptonshire and Milton Keynes, Buckinghamshire, Hertfordshire and East Berkshire, Nottinghamshire and West of Lincolnshire, West Yorkshire and York Area, East Gloucestershire, South Wiltshire, South Yorkshire, the Peak District, West Herefordshire and Forest of Dean, Cornwall and Isles of Scilly, Dorset and South Somerset, and Mid-West Shropshire.

However, there have been some problems too, with the latest update noting that the supplier initially awarded the regional deployment contract for Worcestershire (Lot 24 – valued at £39.4m for 18,400 premises) is “no longer able to sign” (most likely due to the current market strains of rising build costs and high interest rates etc.). “We are currently exploring alternative options for this procurement and will provide more details in the next Progress Update,” said BDUK.

Advertisement

The report separately notes that they are currently aiming to award the first two call-off contracts under the cross-regional framework in the summer. “We use the cross-regional intervention in areas where there has been minimal or no credible market interest in bidding for regional or local procurements, or where initial supplier appetite has fallen away,” said BDUK. Such contracts are so big that they’re only likely to be viable for the largest players to bid on (e.g. BT, VMO2/Nexfibre and CityFibre etc.).

As it stands, the vast majority of areas in England are already contracted or in procurement, although the same isn’t true for the devolved areas of Wales, Scotland and Northern Ireland – many of which are still in the preparation stage. But we do get an idea of the progress for these areas, which we’ve summarised below.

Status of Devolved Countries

➤ Wales

North West Wales, Mid Wales and South East Wales have been included within a call-off under the current cross-regional framework procurement. North Wales and South West Wales will be included within a further call-off once the framework contract is in place.

As of the end of March 2024, 4,600 homes and businesses in parts of Wales have been connected to gigabit-capable broadband using Gigabit Vouchers. The Welsh Government’s Superfast Cymru programme has successfully completed the delivery of gigabit-capable infrastructure throughout Wales, providing nearly 100,000 premises with access to high-speed broadband.

Following the short-term reopening of the Gigabit Voucher scheme in South West Wales (September 2023 to January 2024), and separately in North Wales (December 2023 to January 2024), a total of 39 projects covering over 15,500 premises were submitted to BDUK and have been approved.

➤ Northern Ireland

Project Stratum with Fibrus continues to “build ahead of target“, having delivered gigabit-capable broadband to over 75,000 premises to date (from the 84,000 contracted premises).

Pre-procurement market engagement for Project Gigabit build in Northern Ireland has been carried out and the procurement process will start shortly. It is anticipated this will extend coverage to up to an additional 60,000 premises.

➤ Scotland

The Scottish Government is expected to launch the first Project Gigabit procurement in Scotland, in the Borders and East Lothian areas, in April 2024, and is set to reach over 11,000 premises with gigabit-capable broadband.

Further procurements are expected to launch in phases throughout the rest of 2024 including in Dumfries and Galloway, Fife, Perth and Kinross, Aberdeen, Dundee and Moray Coast, and Orkney and Shetland, subject to market interest being confirmed. Central and North Scotland will be included within a future call-off procurement under the cross-regional framework contract that is currently in procurement, which will be delivered by BDUK.

The Scottish Government’s £600 million Reaching 100% (R100) programme has now provided gigabit connectivity to over 41,000 premises in Scotland across the three R100 contracts, including overspill. The R100 programme has received £52.2 million of UK government funding, including £2.7m new investment into the R100 Central contract area, which alongside £2.8m of Scottish Government reinvestment, is helping fund more than 1,000 additional hard to reach premises, following greater than expected commercial build in the region.

Gigabit Broadband Voucher Scheme projects continue to be built in Scotland. To date, 5,600 vouchers have been used to deliver a gigabit-capable connection to homes and businesses outside of suppliers’ commercial build plans.

Otherwise, you can see a summary of the wider contract progress below.

Live GIS Contracts (Signed)

Advertisement

| Area | Contract Awarded | Uncommercial Premises | Value |

|---|---|---|---|

| North Dorset (Lot 14.01) | Aug-22 | 7,000 | £6.3 million |

| Teesdale (Lot 4.01) | Sep-22 | 4,000 | £6.6 million |

| North Northumberland (Lot 34.01) | Oct-22 | 3,700 | £7.3 million |

| Cumbria (Lot 28) | Nov-22 | 59,000 | £108.5 million |

| Central Cornwall (Lot 32.02) | Jan-23 | 9,200 | £18 million |

| South West Cornwall (Lot 32.03) | Jan-23 | 9,400 | £17.6 million |

| Cambridgeshire and adjacent areas (Lot 5) | Mar-23 | 44,400 | £68.6 million |

| New Forest (Lot 27.01) | Mar-23 | 10,400 | £13.7 million |

| North Shropshire (Lot 25.02) | Apr-23 | 12,000 | £24 million |

| Norfolk (Lot 7) | Jun-23 | 62,200 | £114.2 million |

| Suffolk (Lot 2) | Jun-23 | 79,500 | £100.4 million |

| Hampshire (Lot 27) | Jun-23 | 75,500 | £104.1 million |

| North East Staffordshire (Lot 19.01) | 31st October 2023 | 5,900 | £16.5 million |

| South Oxfordshire (Lot 13.01) | Oct-23 | 5,500 | £17 million |

| North Oxfordshire (Lot 13.02) | Oct-23 | 4,200 | £9.4 million |

| Derbyshire (Lot 3) | Nov-23 | 17,800 | £33.4 million |

| Kent (Lot 29) | Feb-24 | 50,900 | £112.2 million |

| Leicestershire and Warwickshire (Lot 11) | Feb-24 | 38,600 | £71.5 million |

| East and West Sussex (Lots 16 and 1) | Feb-24 | 52,800 | £100.6 million |

| Bedfordshire, Northamptonshire and Milton Keynes (Lot 12) | Feb-24 | 25,700 | £51.4 million |

| Buckinghamshire, Hertfordshire and east Berkshire (Lot 26) | Feb-24 | 34,200 | £58.7 million |

| Nottinghamshire and West of Lincolnshire (Lot 10) | Feb-24 | 34,300 | 58.6 million |

| West Yorkshire and York Area (Lot 8) | Feb-24 | 28,000 | £60.9 million |

| East Gloucestershire (Lot 18) | Feb-24 | 4,400 | £16.8 million |

| South Wiltshire (Lot 30) | Mar-24 | 17,400 | £18.8 million |

| South Yorkshire (Lot 20) | Mar-24 | 32,100 | £44.4 million |

| Peak District (Lot 3.01) | Mar-24 | 4,400 | £10.7 million |

| West Herefordshire and Forest of Dean (Lot 15) | Mar-24 | 7,900 | £23.4 million |

| Cornwall and Isles of Scilly (Lot 32) | Mar-24 | 16,800 | £41.2 million |

| Dorset and South Somerset (Lot 14) | Mar-24 | 21,400 | £33.5 million |

| Mid-West Shropshire (Lot 25.01) | Apr-24 | 6,000 | £12 million |

Take note that, once a contract has been signed, it sometimes takes operators several months of engineering surveys before they can begin to build and reveal their rollout plan. Furthermore, the contract values above are only referencing public investment, but in some cases suppliers have also contributed their own private investment or made complimentary commercial commitments to expand into additional areas (e.g. CityFibre).

On top of the already agreed contracts, Project Gigabit also has a number of local, regional and cross-regional deals in the procurement phase for other parts of the UK (see below) and will be awarding contracts for these over the coming months and years. The dates and figures mentioned below are tentative estimates (subject to change) and will remain that way until after the contracts have been awarded.

Bidders on the related LOTS will be required to ensure that their networks and infrastructure are available for use by other ISPs via wholesale (open access). Various operators, both big and small alike (e.g. Openreach, Cityfibre, nexfibre (VMO2), GoFibre, Wildanet etc.), are already taking part and areas with sub-30Mbps speeds are being prioritised, albeit NOT to the exclusion of all else.

Alongside all this, the government and local bodies are also conducting various Public Reviews and Open Market Reviews (OMR), which is the process they use when trying to identify existing commercial coverage of gigabit-capable networks and any planned coverage over the next c.3 years. By doing that, they can more easily target their support toward areas where commercial projects will not go (i.e. the intervention area).

Live GIS Procurements

| Area | Est. Contract Award Date | Uncommercial Premises | Value |

|---|---|---|---|

| Worcestershire (Lot 24) | Jul-24 | 18,400 | £39.4 million |

| Cheshire (Lot 17) | Apr-24 | 16,400 | £43.1 million |

| Lincolnshire (including NE Lincolnshire and N Lincolnshire) and East Riding (Lot 23) | April to June 2024 | 73,800 | £118.9 million |

| North Yorkshire (Lot 31) | Apr-24 | 39,900 | £73.4 million |

| Lancashire, North Wiltshire and South Gloucestershire, West and Mid-Surrey, Staffordshire, West Berkshire Hertfordshire (Call-Off 1) | July 2024 to September 2024 | 57,100 | £149.7 million |

| West and North Devon, North West, Mid and South East Wales (Call-Off 2) | July 2024 to September 2024 | 47,100 | £139.1 million |

As stated earlier, there are also a sizeable number of projects that have yet to enter the procurement pipeline, mostly for parts of Scotland and Northern Ireland. But there are also several cross-regional procurements planned for parts of England where BDUK has struggled to attract much interest via past efforts. We don’t list these as such tentative plans are subject to frequent changes, but you can see them via the link at the bottom of this article.

Conclusion

Sadly, it’s taken a long time to get all of these contracts into procurement, let alone award them. The new and more automated DPS system was supposed to make all of this faster and more efficient than just handing the funds to local authorities, but we’re now into early 2024 and yet some areas still haven’t got any big GIS procurements going.

Otherwise, we should remind readers that this rollout is NOT an automatic upgrade, thus you will still need to order the service from a supporting ISP in order to benefit. Similarly, 1Gbps is the target speed, but slower and cheaper options will also exist on the same lines. Similarly, where full fibre technology is being used, multi-Gigabit speeds are also possible.

The focus on “gigabit” speeds also overlooks the fact that this largely relates to download performance, while BDUK’s technical definition states that this falls to a speed of at least 200Mbps for uploads (here). This is understandable, as not all gigabit networks today are actually setup to deliver true symmetric performance.

Lest we forget that there are a lot of real-world reasons why consumers buying a gigabit package might not actually be able to achieve the top speed, due to certain realities of how networks work (Why Buying Gigabit Broadband Doesn’t Always Deliver 1Gbps).

Finally, we should add that the Government has previously warned that those in the final 0.3% or so of premises may be “prohibitively expensive to reach” (i.e. under 100,000 premises) – roughly the same gap that the 10Mbps USO has struggled to fix. Solutions for those in the final batch of “Very Hard to Reach” areas are still being tested.

Project Gigabit April 2024 Update

https://www.gov.uk/government/publications/project-gigabit-progress-update-april-2024

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Quickline Win £44m South Yorkshire Gigabit Broadband Rollout Contract

O2 UK Extends 4G Mobile Coverage in Stirling via SRN Project »

Interesting news.

It’s really going wrong in Worcestershire /Lot 24, isn’t it?

Now, it’s a case of waiting until July 2024 (original planned date of signing was Q4 2023)…

I wonder which supplier was originally planned for Worcs?

My understanding is that it would have been Airband,

Gotta wonder why Gigaclear hasn’t been more widely used in Project Gigabit.

Are you counted as a premises passed if you have cable laid at your address but it hadn’t been switched on or activated yet?

Technically, are you gigabit capable if you can’t use it!

It depends whether that provider (or any other gigabit capable network) intends to go live at your address within the next 3 years and submitted their plans to the relevant Open Market Review. If they did, you are unlikely to be included in the project gigabit intervention area.

Probably the only thing this government managed well… But who knows how many Tory friends got rich this time

It hasn’t been managed well in Worcestershire (where it has been in procurement since October 2022). Also around £3.7bn is still to be committed to signed contracts.

It looks like they will sign contracts to cover around 1 million premises for Project Gigabit, by the end of 2024, which isn’t very impressive but I think they got off to a slow start.

Why does Milton Keynes (which is in Buckinghamshire) get mentioned alongside Northamptonshire and yet Buckinghamshire gets a separate listing ? Is the part of Buckinghamshire between M.K. and the Northants border classed as Northants or M.K. ?

Sometimes it’s down to how they’ve organised the clusters for intervention to be more attractive to suppliers, or a facet of how market interest helps to evolve the design of the procurements as time goes on. So you do tend to get these quirks across county borders, which usually make a bit more sense once you examine the public reviews/OMRs for each LOT and consider commercial plans.

Hampshire Lot 27 is also delayed. CityFibre won the lot but their press release said “Detailed planning in these locations has already begun and the first Project Gigabit connections are expected in early 2024.” but there has not even been an announcement on the availability information as of yet!

I’d love for another, different operator to get the Gigabit project for NI.. give people another option than the usual OR/Fibrus/VM..

I am still hoping for the announcement of Cheshire (Lot 17). Neighbouring exchanges to mine have already gone or are going gigabit fibre capable, either through Openreach or CityFibre, and in one case B4RN. Unfortunately, B4RN failed to persuade local farmers and British Rail that their project was sufficiently beneficial. Mine, though, is awaiting the Lot 17 award, which I was told the other day to expect by the end of May 2024. Were they too optimistic?

I find the lack of transparency here really disappointing. 5 miles from Cambridge, high tech centre of the fens, and we have no idea if we will have FTTP in five years time. Is it safe to assume that since we did eventually get FTTC in the village, we will eventually get FTTP by the 2030 target?

This is infuriating for us in the North east Lot 34 failed to sign contracts 8 months after the target sign date they closed the procurement & we’re now back to the back of the queue to get picked up as a Type C Procurement. If we’re now back where we started after 4 Years it really worries me that we’ll not see much more progress before 2030.

Seeing build progress for each contract in terms of number of premises that can order and actual take up would be very interesting. Could be FOIable if not published?

Hmm all sounds very nice but I live in London N12 and we don’t have FTTP yet. The Community Fibre rollout was started here but has sadly been put on hold. Virgin is available but is only 120M upload, also who wants to trust their Internet connectivity to a roadside cabinet with the doors hanging open? Still waiting for full FTTP…

It would be nice if many rural communties could access fibre let alone superfast gigabit. As usual the Government only has interest in making investment where electoral seats play a role they have zero interest in the South West of the countryPp

We were approached to collate details for our small cluster of properties in Honeybourne , Worcestershire for the voucher scheme . This was probably 3 years or so ago .

We did this but all delayed / postponed .

We are no further forward despite all sorts of promises . What irritates me is that the suppliers seem happy to provide coverage for the bigger schemes and these are awarded without due regard for the smaller , more difficult and less lucrative clusters . Surely there is the ability to award packages to include more than one scheme?

I’ve just found this article and live in the Worcestershire area, it appears to contradict what the Openreach website advises, which is they are currently building in my exchange:

“Build planned between now and Jun-2024”

I live in Kidderminster and have just ditched Virgin Media to sign up with EE.

I will not go back to VM but was hoping FTTP would be available in the next 6 months.

Out of interest, is there any info on when the Type C contracts are due for completion? Can see online that Call off 1-6 will likely be awarded later this year, but no timeline for completion.