Winter 2023 BDUK Update on UK Project Gigabit Broadband Rollout

The Building Digital UK agency has released their Winter 2023 (Dec) progress update on the £5bn Project Gigabit broadband rollout scheme, which is so far running live contracts and procurements worth over £2bn in state aid to help extend coverage to an extra 1.1 million hard to reach premises.

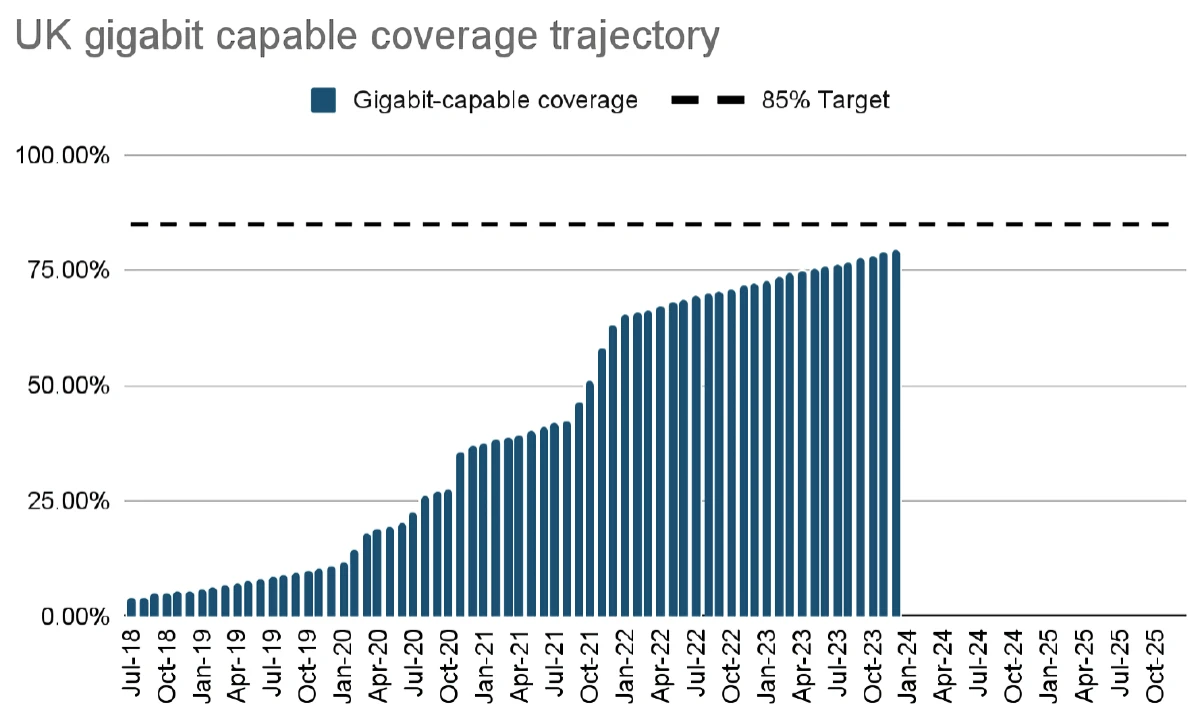

The project aims to extend networks capable of delivering download speeds of at least 1000Mbps (1Gbps) and uploads of at least 200Mbps to 85% or more of UK premises by the end of 2025, before rising to “nationwide” coverage (c.99%) by around 2030 (here). The funding released for this will depend upon how the industry responds, but many more procurements are due to enter the pipeline soon (see below).

The report notes that over 79% of UK premises can now access a gigabit-capable network (up from 77%), which falls to around 60% when just looking at FTTP (i.e. the gigabit figure is boosted by Virgin Media’s HFC upgrade – here). But Ofcom currently forecasts gigabit coverage to hit 87-91% by May 2025 (here), with purely commercial deployments alone being expected to deliver over 80% of that.

Advertisement

However, in order to properly understand the context of this project, we need to look at the rural vs urban divide in gigabit coverage, which helps to illustrate how most of the coverage progress has been dominated by commercial urban builds. In addition, it’s worth noting that UK gigabit coverage is just 51% for businesses (55% in urban areas and 28% in rural), although this does overlook many home based businesses.

Rural vs Urban – UK Gigabit Coverage

(Thinkbroadband Data)

| Urban Cover |

Rural Cover |

|

| England | 80% | 48% |

| Scotland | 77% | 28% |

| Wales | 53% | 30% |

| Northern Ireland | 97% | 74% |

Project Gigabit is thus designed to focus on improving connectivity for those rural and semi-rural areas in some of the final 20% (5-6 million premises). This primarily consists of several support schemes, including gigabit vouchers (£210m), funding to extend Dark Fibre around the public sector (£110m) and gap-funded deployments with suppliers (rest of the funding) – known as the Gigabit Infrastructure Subsidy (GIS) programme.

Today’s article is focused upon the GIS programme and related procurement work, which sees ISPs bidding through a new Dynamic Purchasing System (DPS) to extend their networks across disadvantaged parts of the UK. Project Gigabit in England is centrally managed (by DSIT/BDUK – not local councils), although there may be variations in this for Scotland, Wales and Northern Ireland.

Advertisement

What’s New in the December 2023 Update

Since the last update in September 2023 (here), BDUK has launched another 4 new procurements (North East Staffordshire, North Oxfordshire, South Oxfordshire, and Derbyshire) – worth a combined £76 million, which are expected to help upgrade up to another 33,000 hard-to-reach homes and businesses.

The combined value of all the 16 contracts signed so far comes to around £666m in public investment (up from £589m at the last update) and will upgrade 411,000 premises (c.£1,600 per premises passed), but this doesn’t include any private match-funding that may enable some of the contracts to reach many more premises through complimentary commercial expansion.

Otherwise, the total value of all the 39 live Project Gigabit procurements launched to date (inc. 23 live procurements and 16 live contracts) is around £2bn (unchanged from Sept 2023), which could see up to 1.1 million extra premises being passed by a gigabit-capable network (unchanged 1.1m). The totals have actually increased since last time but, as above, the recently signed deals were of the smaller variety, which due to rounding haven’t moved the needle much.

The vast majority of areas in England are already contracted or in procurement, although the same isn’t true for the devolved areas of Wales, Scotland and Northern Ireland – many of which are still in the preparation stage. But we do get an idea of the progress for these areas, which we’ve summarised below.

Advertisement

Status of Devolved Countries

➤ Wales

Areas across North West Wales, Mid Wales and South East Wales are included within the cross-regional procurement that launched in July 2023. North Wales and South West Wales will also be included within a further cross-regional procurement once a contract is in place. Further proposals for voucher projects in South West Wales are currently being considered by BDUK ahead of this process beginning.

As of the end of November 2023, BDUK has connected 3,800 homes and businesses in parts of Wales using vouchers. The Welsh Government’s Superfast Cymru programme has completed delivery of gigabit-capable infrastructure in Wales and in total, across all contracts, has provided just under 100,000 premises with access to gigabit-capable broadband.

➤ Northern Ireland

Project Stratum continues to build ahead of target, having delivered gigabit-capable broadband to 74,000 of the 84,000 contracted premises to date. ThinkBroadband reports that full fibre coverage across Northern Ireland has reached 94%, and both Project Stratum and Project Gigabit will help close the remaining connectivity gap, where required.

The Public Review for Project Gigabit closed in July 2023 and supplier returns have since been evaluated by the Department for Economy (DfE), supported by BDUK. In turn, work on the Intervention Area design and costing has now begun. Once completed, the procurement process will get under way. The release of tender documentation for appropriate interventions is anticipated in early 2024.

➤ Scotland

Following the publication of the Public Review in September 2023, the Scottish Government and BDUK carried out a pre-procurement market engagement exercise, seeking feedback from suppliers on potential Project Gigabit procurements in Scotland. Initial findings suggest that there is potential supplier interest in one regional procurement and five local procurements in the following areas; Borders, Midlothian, East Lothian Dumfries & Galloway, Fife, Perth & Kinross, Orkney, Shetland, Dundee, Aberdeenshire and Moray Coast.

BDUK will be looking at options for the rest of Scotland in more detail in 2024, and will be dependent on further market engagement activity.

The Scottish Government’s £600 million Reaching 100% Programme (R100), which has received £49.5 million of UK government funding, has now provided gigabit connectivity to over 37,000 premises across Scotland.

Gigabit Broadband Voucher Scheme projects continue to be built in Scotland. To date, 4,600 vouchers have been used to deliver a gigabit-capable connection to homes and businesses outside of suppliers’ commercial build plans.

Otherwise, you can see a summary of the wider contract progress below.

Live GIS Contracts (Signed)

| Area | Contract Awarded | Uncommercial Premises | Value |

|---|---|---|---|

| North Dorset (Lot 14.01) | 25-Aug-22 | 7,000 | £6.3 million |

| Teesdale (Lot 4.01) | 22-Sep-22 | 4,000 | £6.7 million |

| North Northumberland (Lot 34.01) | 14-Oct-22 | 3,700 | £7.4 million |

| Cumbria (Lot 28) | 29-Nov-22 | 59,000 | £108.5 million |

| Central Cornwall (Lot 32.02) | 19-Jan-23 | 9,200 | £18 million |

| South West Cornwall (Lot 32.03) | 19-Jan-23 | 9,500 | £18 million |

| Cambridgeshire and adjacent areas (Lot 5) | 23-Mar-23 | 44,400 | £69 million |

| New Forest (Lot 27.01) | 27-Mar-23 | 10,400 | £13.8 million |

| North Shropshire (Lot 25.02) | 19-Apr-23 | 12,000 | £24 million |

| Norfolk (Lot 7) | 28-Jun-23 | 62,200 | £114.2 million |

| Suffolk (Lot 2) | 28-Jun-23 | 79,500 | £100.5 million |

| Hampshire (Lot 27) | 28-Jun-23 | 75,500 | £104.2 million |

| North East Staffordshire (Lot 19.01) | 31-Oct-23 | 5,900 | £16.5 million |

| South Oxfordshire (Lot 13.01) | Oct-23 | 5,500 | £17 million |

| North Oxfordshire (Lot 13.02) | Oct-23 | 4,300 | £9.4 million |

| Derbyshire (Lot 3) | Nov-23 | 18,200 | £33.4 million |

| 410,300 | £666.9 million |

Take note that, once a contract has been signed, it sometimes takes operators several months of engineering surveys before they can begin to build and reveal their rollout plan. Furthermore, the contract values above are only referencing public investment, but in some cases suppliers have also contributed their own private investment or made complimentary commercial commitments to expand into additional areas (e.g. CityFibre).

On top of the already agreed contracts, Project Gigabit also has a growing number of local, regional and cross-regional deals in the procurement phase for other parts of the UK (see below) and will be awarding contracts for these over the coming months and years. The dates and figures mentioned below are tentative estimates (subject to change) and will remain that way until after the contracts have been awarded.

Bidders on the related LOTS will be required to ensure that their networks and infrastructure are available for use by other ISPs via wholesale (open access). Various operators, both big and small alike (e.g. Openreach, Cityfibre, nexfibre (VMO2), GoFibre, Wildanet etc.), are already taking part and areas with sub-30Mbps speeds are being prioritised, albeit NOT to the exclusion of all else.

Alongside all this, the government and local bodies are also conducting various Public Reviews and Open Market Reviews (OMR), which is the process they use when trying to identify existing commercial coverage of gigabit-capable networks and any planned coverage over the next c.3 years. By doing that, they can more easily target their support toward areas where commercial projects will not go (i.e. the intervention area).

Live GIS Procurements

| Area | Est. Contract Award Date | Uncommercial Premises | Value |

|---|---|---|---|

| Buckinghamshire, (part of) Hertfordshire and East of Berkshire (Lot 26) | Sep-23 | 34,200 | £58.8 million |

| Mid-West Shropshire (Lot 25.01) | Sep-23 | 6,000 | £12 million |

| Bedfordshire, Northamptonshire and Milton Keynes (Lot 12) | Nov-23 | 30,300 | £51.4 million |

| Leicestershire and Warwickshire (Lot 11) | Nov-23 | 45,400 | £71.5 million |

| North East England (Lot 4) | December 2023/TBC | 53,200 | £82.7 million |

| Kent (Lot 29) | December 2023 to January 2024 | 72,000 | £112.3 million |

| West and East Sussex (Lots 16 and 1) | December 2023 to January 2024 | 62,100 | £100.6 million |

| West Yorkshire and York Area (Lot 8) | December 2023 to January 2024 | 29,000 | £60.9 million |

| South Yorkshire (Lot 20) | December 2023 to January 2024 | 32,400 | £44.4 million |

| South Wiltshire (Lot 30) | Jan-24 | 19,000 | £24.8 million |

| Worcestershire (Lot 24) | Jan-24 | 18,400 | £39.4 million |

| Nottinghamshire and West of Lincolnshire (Lot 10) | Jan-23 | 35,700 | £58.6 million |

| Dorset and South Somerset (Lot 14) | January to March 2024 | 22,600 | £43.2 million |

| Cheshire (Lot 17) | January to March 2024 | 17,700 | £44.7 million |

| West Herefordshire and Forest of Dean (Lot 15) | January to March 2024 | 7,900 | £23.4 million |

| East Gloucestershire (Lot 18) | January to March 2024 | 4,900 | £16.6 million |

| Peak District (Lot 3.01) | January to March 2024 | 4,600 | £10.7 million |

| Mid/East Devon and West Somerset (Lot 6) | March to May 2024 | 6,300 | £18.4 million |

| Lincolnshire (including NE Lincolnshire and N Lincolnshire) and East Riding (Lot 23) | April to June 2024 | 73,800 | £118 million |

| Cornwall and Isles of Scilly (Lot 32) | April to June 2024 | 18,600 | £41.2 million |

| North Yorkshire (Lot 31) | April to June 2024 | 39,900 | £773.4 million |

| Lancashire North Wiltshire and South Gloucestershire West and Mid-Surrey Staffordshire West Berkshire Hertfordshire (Call-Off 1) | July 2024 to September 2024 | 57,500 | £149.7 million |

| West and North Devon, North West, Mid and South East Wales (Call-Off 2) | July 2024 to September 2024 | 47,100 | £139.1 million |

| 738,600 | £1,337.20 million |

As usual we can see that several procurements, which were due to be signed by now, are lagging behind a bit, but we consider that to be somewhat par for the course (most have come in a few short months behind their estimated award dates). The biggest change this time around was the failure to sign off the contract for North East England (Lot 4) with Fibrus, which we covered this week (here).

BDUK also said they were continuing to consult the market to understand interest for delivering gigabit-capable connectivity supported by government subsidy in the remaining parts of Shropshire, East Surrey, Essex and Herefordshire, where commercial deployment will not reach.

Conclusion

Sadly, it’s taken a long time to get all of these contracts into procurement, let alone award them. The new and more automated DPS system was supposed to make all of this faster and more efficient than just handing the funds to local authorities, but we’re now at the end of 2023 and yet some areas still haven’t got any big GIS procurements going.

Otherwise, we should remind readers that this rollout is NOT an automatic upgrade, thus you will still need to order the service from a supporting ISP in order to benefit. Similarly, 1Gbps is the target speed, but slower and cheaper options will also exist on the same lines.

The focus on “gigabit” speeds also overlooks the fact that this largely relates to download performance, while BDUK’s technical definition states that this falls to a speed of at least 200Mbps for uploads (here). This is understandable, as not all gigabit networks today are actually setup to deliver true symmetric performance.

Lest we forget that there are a lot of real-world reasons why consumers buying a gigabit package might not actually be able to achieve the top speed, due to certain realities (Why Buying Gigabit Broadband Doesn’t Always Deliver 1Gbps).

Finally, we should add that the Government has previously warned that those in the final 0.3% or so of premises may be “prohibitively expensive to reach” (i.e. under 100,000 premises) – roughly the same gap that the 10Mbps USO has struggled to fix. Solutions for those in the final batch of “Very Hard to Reach” areas are still being tested.

Project Gigabit Winter 2023 (December) Update

https://www.gov.uk/government/publications/project-gigabit-progress-update-december-2023

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Connect Fibre Win Derbyshire UK Gigabit Broadband Rollout Contract

“BDUK also said they were continuing to consult the market to understand interest for delivering gigabit-capable connectivity supported by government subsidy in the remaining parts of Shropshire, East Surrey, Essex and Herefordshire, where commercial deployment will not reach.”

By this, does BDUK mean they currently have no-one expressing an interest in, for example, anyone bidding for the Lot 14 (Herefordshire) contract (due to be awarded in early 2024)? Or does this refer to properties in those areas identified as being in the final 0.3% of properties (of which there will be some in those areas) that are prohibitively expensive to reach? I ask, because Lot 14, for example, is an area covered by the definition “where commercial deployment will not reach” but not within “the final 0.3% of properties” definition (at least at the moment!).

Actually, answering my own query, having gone to the actual report, I see the comment is in the section titled “Project Gigabit procurements”, and so the inference is no-one has expressed an interest in Lot 14, etc. yet!

> In addition, our market engagement in Essex and East Surrey has revealed significant planned commercial activity, leaving only a limited number of premises eligible for subsidy. The market has shown limited interest in bidding for what would be smaller-sized procurements in these areas, and so we will consider alternative interventions.

I am guessing that this includes Ashtead which doesn’t have fibre and has no plan from Openreach.