Gov Encourages Pension Firms to Invest in UK Science, Tech and Digital

The UK Government has today launched a new Innovation Cluster Map, which forms part of a fresh drive to encourage pensions firms to commit more of their private investment toward the country’s science and technology sectors, which could include anything from research into new vaccines and medicines to AI or future satellite broadband technologies etc.

According to the Science Minister, Lord Vallance, some $16bn was invested into UK start-ups and scale-ups last year (we’re not sure why they’re using dollars), and more than $8bn has been raised in the first half of 2025 – exceeding France and Germany combined. But the government wants to see more money going toward this field as part of efforts to boost growth via their ‘Plan for Change’.

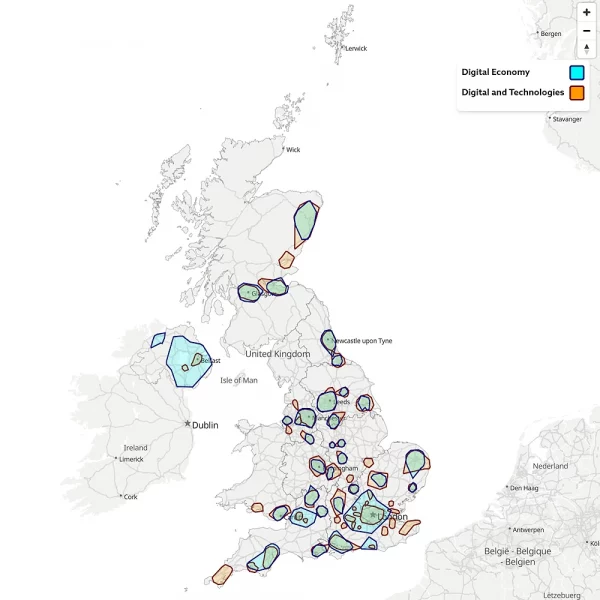

In order to support pension firms to invest with clarity, the Government has introduced its new Innovation Cluster Map, which is said to outline pockets of outstanding research and commerce across different parts of the UK (i.e. helping investors to better identify the companies, sectors and regions of the UK to target for investment).

Advertisement

The map identifies areas (clusters) and regions where networks of businesses and research institutions are benefitting from close proximity to one another, boosting the effects of research, development, and innovation. “This means investors know where to seek out expertise and crucially how to make the most of the skills that exist around the country,” said the announcement.

Science Minister, Lord Vallance, said:

“There are far too many UK companies operating at the cutting-edge of emerging technologies, like AI, biotechnology and quantum to which UK investors are underexposed.

Through our Industrial Strategy, we are building an environment where public funding, streamlined regulation and partnerships with industry are channelling investment into science and technology.

Encouraging greater flows of capital into the sector is another piece of the puzzle, supporting companies to grow and jobs to be created.”

The map may be of some use to investors, although it appears to only give quite a high-level view across some fairly wide geographic areas, usually accompanied by various statistics. In that sense it seems to be more of a starting point for roughly locating areas of interest for investment, although beyond that its applications appear to be quite limited.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Emtelle UK Expands Fibre Supply Deal to Support Highland Broadband

So then, thousands of good grade people are flooding out of the UK to study pharmacy, dentistry and medicine abroad. Why?? The worhtless entrance exam which proves nothing. 99.99% are not returning.

That is quite a claim. Do you have any evidence to support it?

Politically motivated interference in investment decisions invariably ends in disaster.

This has likely come about because the government has exhausted its ability to influence decisions with targeted funding. Next, they will have to offer something like increased tax right-offs.

I work for the NHS, can you claim anything??

The amount of frankly angry Consultants as regarding student standards is well know, except to the people who always believe whatever the mainstream media say. I did St John ambulance training and worked directly with senior Dr’s and med students. All bar one out of at least 1000 say the system has collapsed.

Which is nonsense.

It is doctors who are filling the consulting queues with referrals. Further, there are substantial amounts being spent on the NHS. None of which has anything to do with the pressure the government is trying to place on pension funds while also threatening to charge a one-off tax on their funds.

It is Dr’s who cannot get training posts. The number of Dr’s leaving the UK has everything to do with their work pressure as seen in the lack of postgraduate courses. As the number of training posts be it undergraduate or postgraduate is falling, by this regime shutting down new places for med students, then good students leave. This is well known in the medical field. But those who rely on whatever rubbish spewed out from the mainstream media are utterly ignorant of facts. As the well worn saying “not in the public good”.

You know absolutely nothing. Which is the norm.

Their pensions, as I am on the NHS pension scheme has nothing to do with the large number of quangos, be it admin or clinical as it is a separate issue.

undergraduate intakes are at record highs and will likely increase as per NHS planning documents

https://www.officeforstudents.org.uk/for-providers/finance-and-funding/medicine-and-dentistry-funding/medical-and-dental-intakes/

https://www.england.nhs.uk/publication/nhs-long-term-workforce-plan/

post graduate places are also at record highs and planned to increase as per the 10YHP

https://medical.hee.nhs.uk/medical-training-recruitment/medical-specialty-training

https://www.gov.uk/government/publications/10-year-health-plan-for-england-fit-for-the-future

Why are you using the discussion section of a broadband services-focused site to rant about a pay dispute?

What a jumbled incomprehensible map. Sums up the current government

I rather double down and buy more Tesla and Nvidia than risk money in a dying economy which even charges “stamp duty” taxation on simply buying a uk stock.

Back to topic

Ahh, britain the gambling nation, now governmental guidance to gamble with people pensions, which since the government sanctioned the decline/demise of Defined Benefit schemes have become nothing more than slightly tax advantageous time constrined saving schemes, all pension provision risk absolved by employers and the collapse of loyalty between employee-employer for a monthly cash payoff.

The characterization of Britain as a “gambling nation” has increasingly become intertwined with discussions about its financial systems, particularly in relation to pensions. The decline of Defined Benefit (DB) schemes has led to significant shifts in how individuals [have to] approach retirement savings.

The Shift from Defined Benefit to Defined Contribution Schemes

Defined Benefit Schemes: These plans guaranteed a specific retirement benefit based on salary and service years. ** Once a hallmark of employee-employer loyalty, they effectively transferred most risks to employers** now just offloaded to -.

Defined Contribution Schemes: With the decline of DB schemes, many individuals are now relying on Defined Contribution (DC) plans. ** These schemes place the investment risk on employees **, resulting in uncertain retirement outcomes.

The move to DC schemes has fundamentally changed the relationship between employees and employers, shifting from long-term commitments to more transactional arrangements.

Government Guidance and Pension Regulations

The government’s stance on pensions, particularly in allowing greater investment choices that can resemble gambling, raises concerns:

Investment Risks: Encouraging individuals to invest their pensions in various assets [and or vaporous], including some high-risk options, can lead to significant losses. This resembles gambling, where the stakes are personal savings and future security.

Tax Advantages: While the tax benefits of contributing to pensions are enticing, they can create an illusion of safety. Many individuals may not fully understand the risks involved in their investment [gambleing] choices.

Societal and Economic Implications

The implications of this landscape are profound:

Erosion of Trust: The breakdown of loyalty between employee and employer diminishes the sense of security that an assured monthly payout would provide. This could lead to increased anxiety regarding retirement.

Financial Literacy Challenges: Many individuals lack the financial education necessary to navigate complex investment options, which can lead to poor decision-making.

Retirement Insecurity: As individuals gamble with their pensions, the risk of inadequate savings and financial instability in retirement becomes increasingly real.

All courtesy of UK gov…

Another off-topic rant.

Just because the gov say that places and training places are getting more, it does not reflect ground reality.