Consumers View UK Broadband ISP Market as Complex and Risky

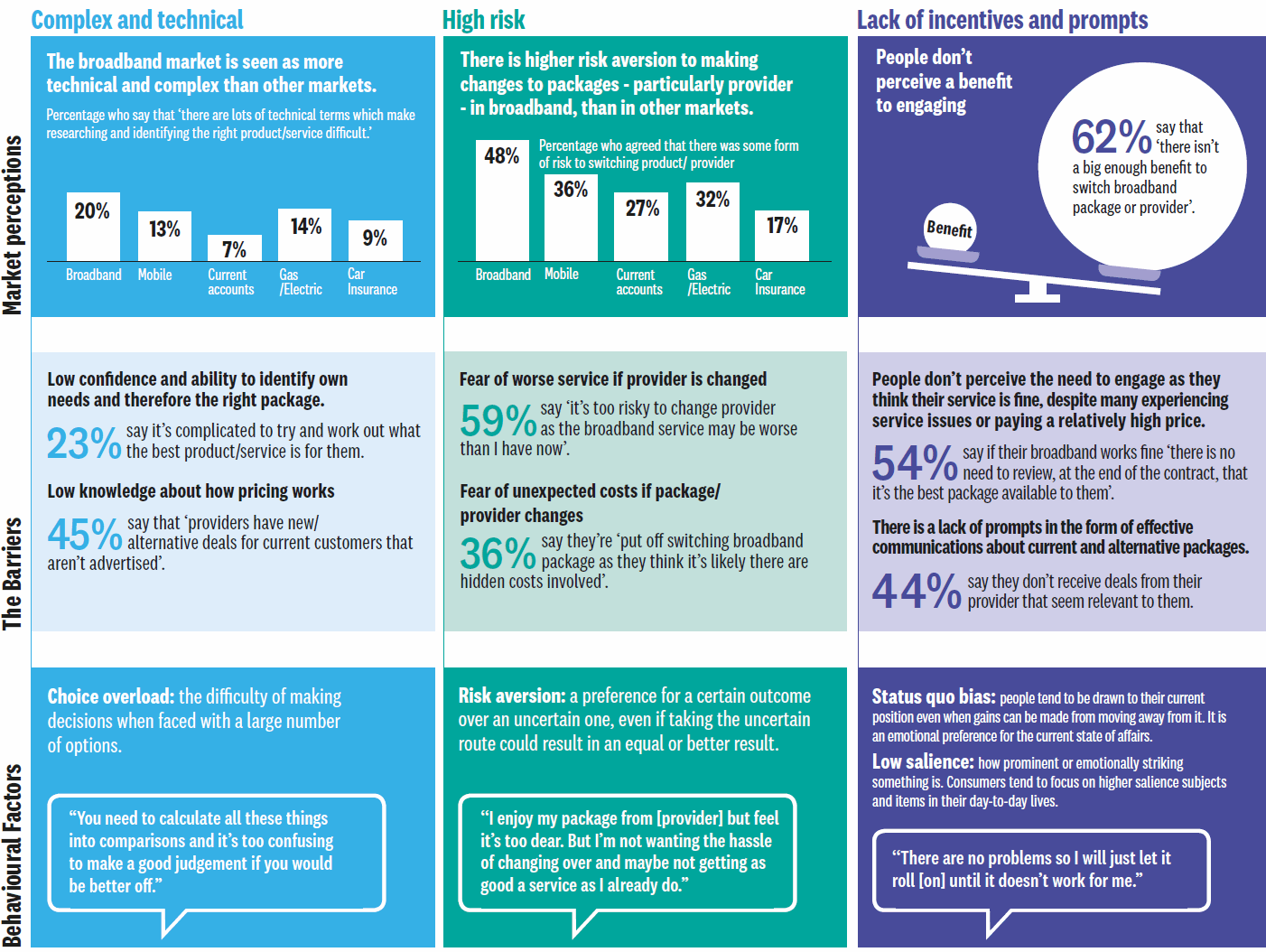

Which? has conducted a detailed piece of qualitative research into consumer engagement within the UK’s broadband ISP market, which perhaps unsurprisingly found that 20% of people view the market as complex (more than any other sector) and 48% view switching packages as risky (again, more than any other sector).

The study itself – ‘Consumer Engagement with Broadband‘ – is based off a survey of 2,069 UK adults (conducted online by Populus between 4th and 6th September 2019), of whom 1,714 said they were responsible for making decisions about broadband. Sadly it’s quite a long, laborious read and as such we’re just going to summarise some of the key findings below.

Overall six key barriers to broadband engagement were identified. These relate to the confidence and ability of consumers to understand their needs and identify a relevant package, their knowledge of how pricing works in the market, their beliefs around the risk of making changes and their evaluation of their current service.

Advertisement

None of that will come as much of a surprise given all of the many different connection technologies (ADSL, FTTC, FTTP, DOCSIS HFC / FTTP, Wireless, Satellite etc.), underlying network platforms (Openreach, Virgin Media and masses of alternative networks) and consumer ISPs that exist in this market (c.200). Granted life is simpler if you only look at the largest 5-6 ISPs but even they have a lot of differences to consider.

In particular many consumers were found to lack awareness of what alternatives may be available with their current provider, or have concerns about contacting them. Some 44% of those who never or hardly ever made changes to their contract agreed that they don’t receive deals from their provider that seem relevant to them.

Meanwhile 42% said that they think their ISP will try to “oversell” them if they call them to talk about a new deal (see our Retention Tips guide). Overall the report goes on to identify a handful of important lessons that the industry, regulator and others should take away from the findings of this research.

Advertisement

Five Important Lessons for the Industry

1. When designing new interventions to foster consumer engagement (such as data portability initatives), they must take a consumer-centric approach and the design must be informed by rigorous ex ante consumer testing. We welcome Ofcom’s recent proposals to require ISP to take part in trials in relation to measures which seek to address how customers engage in the communications market.

2. In relation to solutions that have been already announced or implemented to foster engagement (e.g. end-of-contract notifications), it is essential that ex post evaluations and reviews are undertaken to understand whether the interventions are successfully delivering on their original aims.

3. The industry needs to reflect on whether current communications with consumers help ensure that they are on the right package for their needs. It must also consider the long-term impact of those communications on consumers’ trust in the industry and the resulting knockon effect on consumers’ willingness to engage to take advantage of better services delivered by investments in new technologies.

4. There is an opportunity for companies to offer more tangible incentives which resonate with consumers and which differentiate themselves from others in the market. Our research shows that current incentives, such as the promise of faster speeds from superfast, are only resonating with a small number of consumers.

5. Consumer groups, in conjunction with industry and Ofcom, must work together to help consumers better understand the broadband market and the benefits of engagement. This includes working to raise consumer expectations such that they are providing the right demand-side competitive pressure for companies to improve their services.

One issue we have is with no.4 above, not least since other studies we’ve seen have tended to show that demand for faster speeds, low prices and better reliability/quality remain key driving points for most consumers. Likewise any ISPs that create a wider variety of ways to differentiate themselves via new “tangible incentives” may ironically risk further confusing consumers by adding, rather than subtracting, complexity into the market.

Ultimately broadband is an aggressively competitive market and will thus perhaps always be unavoidably more complex and variable (performance) than that of linear utility suppliers, such as Water, Gas or Electricity. At the moment a big chunk of the market is also so focused upon building new networks that few have stopped to think about the additional confusion of choice that this will invariably create for consumers.

Over the longer-term we’d expect natural market consolidation to help reduce some of this complexity, although Ofcom may need to consider further changes in order to ensure smoother switching between the growing patchwork of different networks. Likewise we’d like the see Ofcom moving to ensure that basic coverage data is shared so that sites like ours can build coverage checkers with data from all of the networks (both big and small), not only those who are voluntarily willing to share.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Openreach Discount 10Gbps Cablelinks for FTTP Broadband ISPs

Sky UK’s New G.fast Ultrafast Broadband ISP Package is Live »

Comments are closed