UK Map Suggests Superfast Broadband Coverage Still on Target for 2015

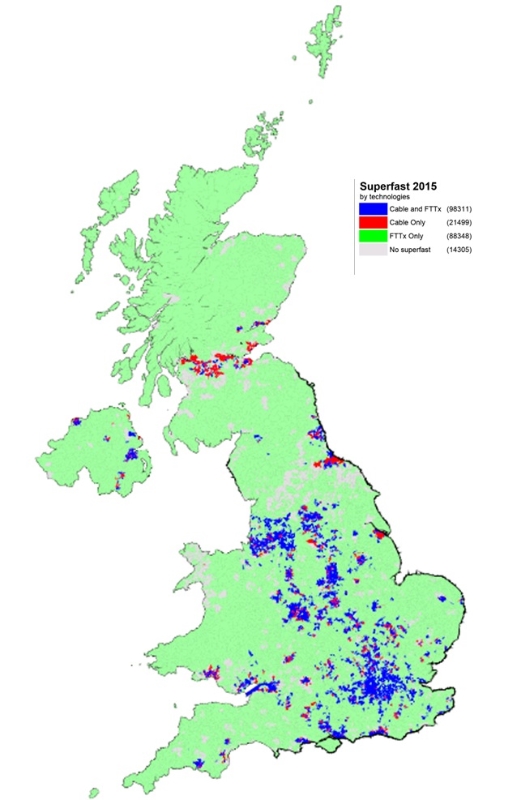

Telecoms analyst Point Topic has today published a new report on broadband coverage across the United Kingdom, which predicts that superfast (30Mbps+) availability could hit 90.8% by the end of 2015. ISPreview.co.uk has also been able to obtain an exclusive map that splits the presence of fibre FTTx and cable (DOCSIS) networks.

The new report claims that fixed line superfast broadband (30Mbps+) services were, at the end of 2012, available to 70% of households in the UK (note: it’s currently a few points higher at around 74%) and we’re told that coverage could reach 90.8% by the end of 2015 (assuming the current BT/BDUK rollout doesn’t slip again). But this will fall to just 83% in Wales and 84% in South West England.

Advertisement

The prediction is important because it would mean that the Government’s original target of 90% might still be met (two years late? maybe not), although this is admittedly a best case scenario. The Broadband Delivery UK (BDUK) office most recently clarified that it now expected to achieve 88% coverage by the end of 2015 and 95% by 2017 (here).

Taking a closer look

In terms of access technology, nearly 46% of premises (13.4 million) can currently access cable services (e.g. Virgin Media) and over 55% (16.3m) could get some form of fibre / FTTx (FTTC/P/H); this is taken as independent of any network overlaps.

As usual BT’s superfast FTTC/P technologies account for the lion’s share of the FTTx deployments and, at the end of June 2013, could reach 16 million premises out of a total of 20.7 million premises in enabled exchanges. Point Topic estimates that, on average, around 75% of premises are activated within the enabled exchange (back in 2011 Openreach told us the figure was more like 85%). BT’s £2.5bn commercial fibre rollout hopes to reach 2,000 exchanges by the spring of 2014 (66% coverage or 19 million premises passed) but they could reach 90%+ via BDUK in a few years’ time.

Meanwhile Virgin Media has shown little sign of expanding its cable platform, which is most likely due to basic to economics (significantly less demand outside of urban areas) and the fear of being labelled as an operator with Significant Market Power (SMP) by Ofcom (i.e. becoming subject to stricter regulation).

Advertisement

But it’s not just BT and Virgin’s game. At the end of June 2013 Point Topic had tracked 28 active altnet fibre suppliers across the UK. It’s estimated that these ISPs covered around 3% of premises in the UK and a few of them are already offering Gigabit (1000Mbps+) capable speeds, such as B4RN, Hyperoptic, Gigaclear and CityFibre (Gigler).

The chart below shows the top theoretical broadband speeds available to premises in the UK (June 2013 data). Take note that this considers network overlaps and so the results reflect the fastest network (i.e. around 30% can’t access a superfast service (e.g. cable) and cable would be beaten if faster FTTP or AltNets are available in the area).

Standard broadband

Point Topic’s report also contains lots of interesting information about standard broadband services. For example, it confirms that 2,546 BT exchanges serving 88% of UK homes and businesses are now enabled for WBC offering an up to 20Mbps broadband service via copper based ADSL2+ technology (up from 79% and 1,870 exchanges at the end of 2011); we know that BT also plans to reach about 92% over the next half year or so with its related WBC / 21CN network.

Meanwhile BT’s slower ADSL Max (up to 8Mbps) technology covers 99.9% of premises within the UK and is enabled at all but 86 telephone exchanges (73 of which are in Scotland). Practically all of those homes that reside in areas where only ADSL Max is available are rural (i.e. last 5-10% / not commercially viable to upgrade).

Advertisement

By comparison Local Loop Unbundled (LLU) services, which allows ISPs like Sky Broadband and TalkTalk to install their own kit in BT’s exchanges for cheaper and sometimes faster ADSL2+ products, continue to rise and can now reach 92.4% of homes and businesses in the country (up from 89% at the end of 2011 and 84% at the end of 2010); this exceeds BT’s own WBC / 21CN roll-out.

Sky Broadband’s LLU coverage has extended to a further 1.3 million premises following the recent acquisition of O2 and BE Broadband’s fixed line customer base, although they’ve still not exceeded TalkTalk’s reach. Overall LLU growth is slowing as commercial ISPs can only push so far into rural areas before running into issues of economic viability (much of the UK’s last 5-10% is rural).

The Maps

It should be said that not all of the details in the above article have come from Point Topic’s public report and some of the information has been supplied exclusively to ISPreview.co.uk. In fact we can’t thank Point Topic enough for going out of their way to produce a map for us that displays the 2015 coverage of UK superfast broadband by technology (below).

Just to clarify. The following map shows the predicted presence of, rather than actual coverage penetration, for fibre based (FTTx) and cable networks. In other words not everybody within the coloured areas will be able to receive the respective technology but you can get an idea of which areas are almost certain to be left out.

Another way of looking at which areas might be able to benefit from superfast broadband in 2015 is by using a “prediction” scale (red = less likely to get superfast connectivity / green = almost certain to get it).

The full report contains significantly more detail than we’ve covered here and is well worth a read.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Worcestershire UK Allow BT to Overlap Existing Superfast Broadband Network

Comments are closed