Home and Small Business UK Broadband Lines Top 26 Million – Q4 2017

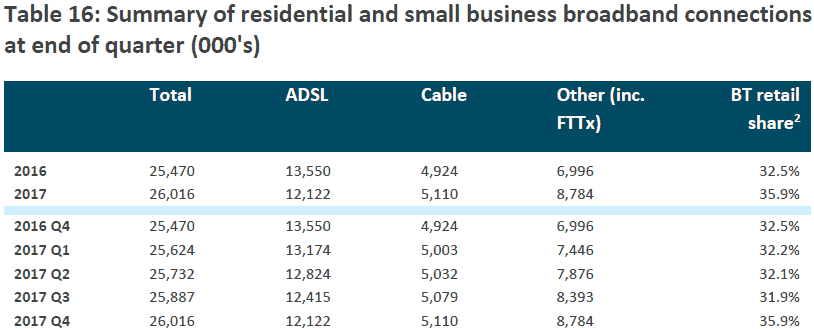

The latest Q4 2017 Telecoms Market Data Tables from Ofcom have confirmed that the United Kingdom is home to a total of 26 million fixed home and small business broadband lines (up by +546,000 since Q4 2016), with 53.4% being faster full fibre or hybrid-fibre based (FTTC, FTTP/H, Cable etc.) services.

Once again the results reveal an on-going trend of older and slower copper ADSL broadband lines being replaced (mostly migrations or upgrades) by faster internet connection technologies. Cable (DOCSIS) based lines, such as those supplied by Virgin Media, now make up 19.6% of the total and “fibre” (FTTC/P/H/B) based connections hold 33.8% (mostly via Openreach’s FTTC / VDSL2 technology).

Meanwhile BT’s Consumer / Retail division has suddenly regain a sizeable chunk of its market share (jumping from 31.9% to 35.9%) in the final quarter of 2017, which is largely because Ofcom has now started to include the broadband lines that were acquired as a part of the EE merger. Previously rival ISPs had been slowly eroding BT’s hold. We will keep an eye to see how the future growth of rival FTTP/H and G.fast services impact this.

Advertisement

The update also reveals that the total number of fixed phone / exchange lines (including PSTN and ISDN channels) is now 33.1 million, which reflects 26,661,000 residential lines (up from 26,482,000 in 2016) and 6,437,000 business lines (down from 7,083,000 in 2016). In both markets BT lost the most lines, with Virgin Media and other ISPs picking up some of their connections in the residential market. Meanwhile business lines suffered a general decline across the board.

Elsewhere total UK fixed line voice revenues were £2bn in Q4 2017, which is down by 2.3% (£48m) from the previous quarter and down by 3.9% (£84m) compared with Q4 2016. Overall UK landlines generated 12.6 billion minutes of outgoing calls in Q4 2017, a quarterly decrease of 1.7% (214 million minutes) and 17.6% (2.7 billion minute) fall compared with Q4 2016.

Meanwhile mobile telephony services generated £3.9bn in retail revenues in Q4 2017, which represents a £31m (-0.8%) decrease from the previous quarter and a £45m (1.2%) increase compared to a year ago. The UK is also home to 84.2 million mobile subscriptions and that’s up by 0.3 million (0.3%) from a year ago.

Advertisement

The total number of outgoing SMS and MMS messages was 18.39 billion in Q4 2017, which is down sharply from 22.20 billion a year ago.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« BT Research Finds Faster Broadband Helps to Sell N.Ireland Homes

Comments are closed