Ofcom Study Confirms Loyal Broadband and Mobile Users Pay More

A new report from Ofcom on annual pricing trends has found that 80% of UK households purchased bundled services in 2018 (broadband, tv, phone and / or mobile), which is down from 81% last year. But those who remain loyal to their broadband ISP (i.e. staying after the contract is up) will end up paying more.

The national telecoms regulator reported that just under a third (31%) of households purchased a dual-play landline and fixed broadband bundle, while the same proportion purchased a triple-play service consisting of landline, fixed broadband and pay TV.

The high take-up of bundles means that bundled service prices are more relevant than standalone prices (particularly those of fixed telecoms services) to many UK homes. On top of that bundles remain the cheapest option, although it’s worth remembering that a focus on price alone will always overlook key aspects like service or support quality and any value added extras.

Advertisement

Interestingly the gap between the price of a superfast (30Mbps+) and standard fixed broadband connection has also discovered to have narrowed to the point at which there is “little or no difference for some packages“.

The average monthly price premium for superfast vs standard broadband, when purchased as part of a dual-play bundle, fell from £8 in 2012 per to £4 in 2017, while it fell from £6 to £3 for superfast broadband purchased as part of a triple-play bundle. However, the decline in the superfast price premium is primarily due to increases in the price of standard broadband packages.

Most of the major broadband ISPs also tend to offer big discounts on their bundles during the first 12, 18 or 24 month contract term (after this the more expensive post-contract pricing tends to kick in), which makes it cheaper to switch. Data shows that around four in ten bundle users were outside the minimum contract period with their existing provider in July-September 2017.

Advertisement

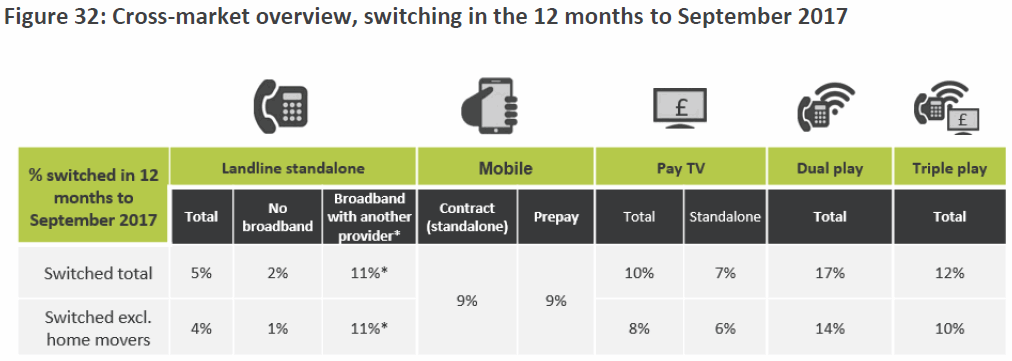

Ofcom found that the incidence of switching is highest among dual-play customers (17% switched at least one service in their bundle in the 12 months to September 2017). By comparison standalone landline users were the least likely to have switched (5%), particularly if they had no fixed line broadband service (2%).

Elsewhere Ofcom noted that there was a notable increase in the price of BT’s cheapest non-discounted dual-play ADSL bundle between Q4 2015 and Q1 2018, up by £19 per month (79%) in real terms to £42.99 per month. There were also increases for the other ISPs included in their analysis during this period, but these were much smaller, ranging from 1% for Sky Broadband to 5% for EE.

From Q2 2017 onwards, BT’s cheapest dual-play standard broadband bundle had “unlimited” data whereas, before this, data use was capped, so the price increases outlined above are not for like-for-like services. Comparing the price of BT’s cheapest non-discounted “unlimited” dual-play standard bundle shows there was a smaller, but still “significant“, £11 per month (33%) real-term price rise between 2015 and Q1 2018.

Advertisement

Additional Findings from Ofcom’s Study

* Many people could upgrade their broadband at no extra cost. The gap has narrowed between the prices of superfast broadband and the price of standard broadband. (Superfast broadband is a connection that can deliver speeds of 30 Mbit/s.) Some providers now offer up to 25% off bundled services over the minimum contractual period.

* New products that give consumers more flexibility and choice have emerged. TV viewers who pay for channels can watch content in more ways than ever before. These include streaming video services such as Amazon Prime and Netflix, and more tailored pay-TV bundles. Mobile users can choose from ‘zero-rated’ tariffs, where data used to access certain applications (such as Facebook, WhatsApp or Spotify) does not count against their monthly usage allowance.

* Prices have fallen for many customers with standalone landline services. From 1 April 2018, BT reduced its monthly line rental price by £7 per month (from £18.99 to £11.99) for customers who only have a landline, without any broadband, after our review found they were getting poor value for money.

* More choice can mean more complexity for consumers. While more choice and product personalisation can benefit consumers, they can also be confusing. Complexity may lead consumers to disengage from the market, and they can end up paying higher prices by sticking with their current provider. Most people choose bundled services for convenience and value. But the quantity of promotional discounts, call packages, broadband speeds and contract lengths available make it more difficult for consumers to compare bundles.

* Around 1.5 million mobile customers whose contract includes a handset, are still paying the same price after the end of their minimum contract period. Receiving a handset as part of a pay-monthly service is popular, as it allows consumers to pay for an expensive handset in instalments. But most tariffs that provide a handset continue to charge the same monthly fee after the minimum contract period has expired. Around 1.5 million people1 may be spending more than necessary by continuing to pay a monthly fee that includes the cost of a mobile handset after their initial minimum contractual period has ended.

* Even if mobile consumers do exit their contract at the end of the minimum period they will typically pay more for the device than if they bought it separately and used a SIM-only (SIMO) contract. We looked at some of the major providers’ tariffs including the iPhone 8, and found consumers could end up paying over £200 more for the handset through a mobile contract. That is equivalent to an interest rate higher than that of many credit cards.

As usual the key advice that Ofcom has for consumers is to shop around and switch, as well as suggesting that they be aware of their usage needs (i.e. don’t buy lots of something if you won’t use most or all of it, such data, texts or minutes etc.) and be mindful of the end dates for any promotion periods or contracts.

The regulator is currently working to improve this area, such as by proposing to require that providers “proactively inform” their customers when they are approaching or are at the end of their minimum contract term (here). Ofcom has also included a useful summary of their key metrics, which we’ve pasted below.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Carlisle Court Fines Virgin Media UK £385K for Unsafe Street Work

Comments are closed