Progress on BDUK Plan for £5bn UK Gigabit Broadband Rollout

Over the past few months’ we’ve seen the UK Government step-up market engagement exercises as part of work to develop a framework for their £5bn investment, which aims to ensure that “every home” can access “gigabit-capable” broadband by the end of 2025. As a result we now have a better idea of what this will look like.

At present it’s not unreasonable to assume commercial deployments will ensure that speeds of 1000Mbps+ (1Gbps+) should become available to around 70% of premises by the end of 2025, although aspects like overbuild between rival networks and uncertainty over long-term roll-out plans make it difficult to be certain of where the final figure is likely to land. Official reports tend to talk of 70-80% as an expectation.

Initially most of this will come from Virgin Media’s upgrade of their existing Hybrid Fibre Coax (HFC) and Full Fibre network to the latest DOCSIS 3.1 standard (covers over 50% of UK but on-going expansion could yet take them to c.60%). After that we have Openreach’s plan to build Fibre-to-the-Premises (FTTP) out to 20 million premises by the mid-to-late 2020s (costing c.£12bn), but much of that will overbuild Virgin.

Advertisement

On top of that there’s a growing mass of alternative network providers, which seem to be attracting significant investment and have some equally big deployment plans (2020 Full Fibre Build Progress). Headline examples include Cityfibre’s aim for around 8 million premises after 2025 and Hyperoptic’s aspiration for 5 million by 2024, among many others. We expect a fair bit of overbuild there too.

The Gigabit Broadband Framework (F20)

Last year the Government committed £5bn to help those in the hardest to reach final 20% (F20 – mostly rural) of the UK – about 6 million premises – gain access to “gigabit-capable” services using an “outside-in” approach to deployment (here). Since then a lot of market engagements have taken place with ISPs and, as a result, we’re now starting to build-up a picture of how the Framework for this will work.

At this stage we should stress that the following details are still very TENTATIVE and will no doubt change a bit before the final framework is agreed in the very near future. But broadly speaking the Government’s (DCMS) Building Digital UK team are expected to split the F20 project into three mechanisms. Naturally some of this will be similar to existing schemes, which have been proven to help.

BDUK’s New F20 Model

1. General Demand Side Interventions (i.e. providing fibre to public sector sites / buildings, which can later also be harnessed by network providers to reach other nearby properties). This also feeds into no.2 below because vouchers are also a type of demand side intervention.

2. Voucher Scheme for Premises (i.e. effectively a continuation of the current £200m Rural Gigabit Connectivity (RGC) programme that is due to end in March 2021, albeit possibly with much more funding and bigger vouchers. Such vouchers will also become available to a moderately wider area than the original RGC scheme, albeit still based around that F20 focus). A new website will make access to these even easier.

3. Direct Supply Side Intervention (i.e. this will gobble up most of that £5bn – we think about £4bn of the total – and on the surface will be similar to the original gap funded BDUK model, including the usual state aid approval and open procurement requirements). Suppliers will thus bid on contracts to deploy gigabit broadband in areas where the market has failed to do so itself, but the detail of how this works is different.

Both 1 and 2 above should be very familiar as the Government have been using targeted investments like that for a while via their various Voucher and Local Full Fibre Networks (LFFN) programmes. But where things start to get interesting is with no. 3, which on the surface sounds very similar to BDUK’s original superfast broadband programme but there will be some key differences this time around.

Advertisement

By the looks of it BDUK will adopt a bundle strategy for no.3, which seems to split areas up into bundle sizes of c.3,300 premises for procurement (naturally larger operators are calling for bigger bundles, to ensure economies of scale, and longer-term contracts). Bundles will be categorised to identify the areas’ most in need and to also factor the cost of delivery (a weighted combination of 11 models is used to estimate this).

At present the draft bundles are currently composed of premises grouped by Openreach (BT) exchange area – just for design purposes – and will of course exclude locations where existing “superfast” upgrades are already taking place or planned (the use of “superfast” here may be confusing as a lot of related contracts are now actually being delivered using gigabit FTTP).

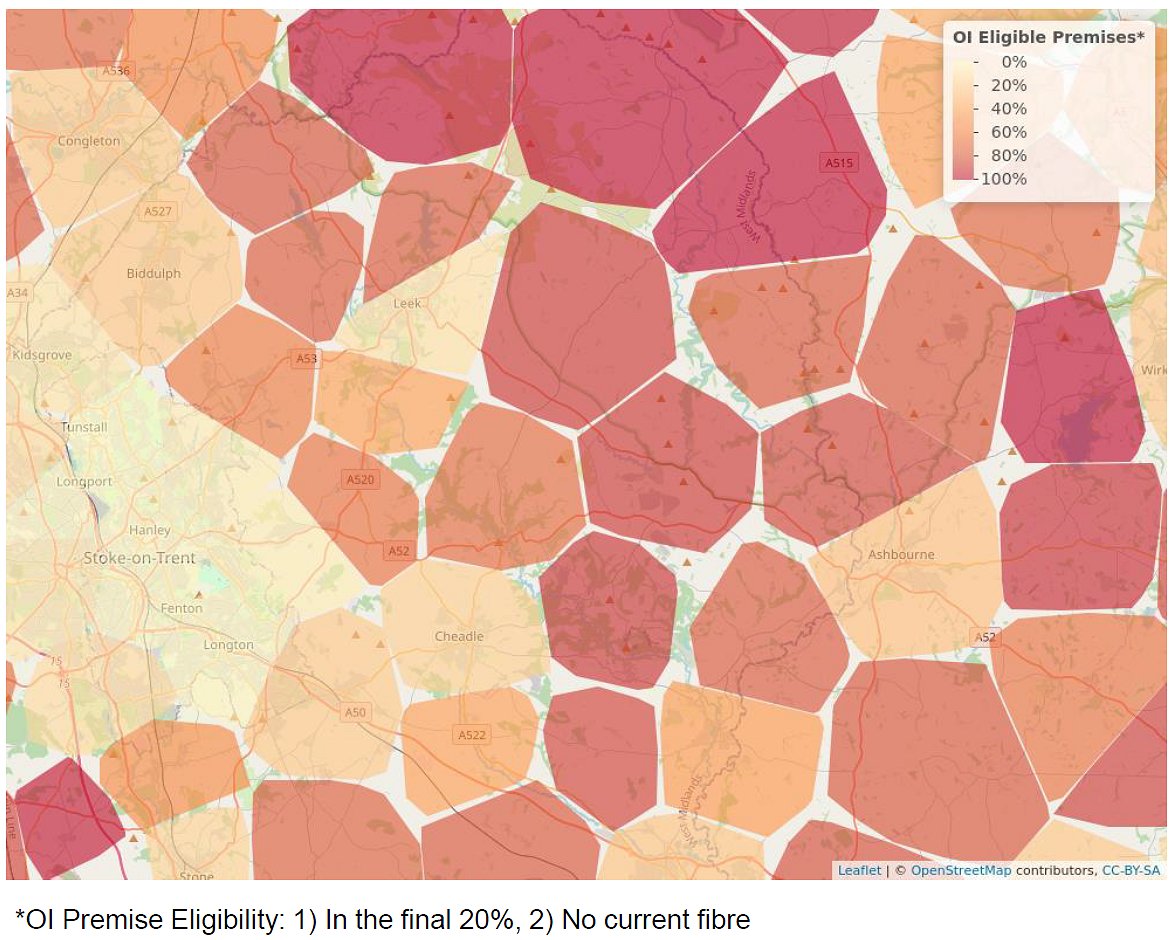

A recent report from BDUK uses an example from Staffordshire to illustrate how such bundles may look. The darkest red areas are those most likely to benefit from intervention with a high proportion of eligible premises. There are some complexities to how these are defined but, as that is subject to change, we won’t go into it now. All are based on a model of delivery that ideally takes 2-3 years to complete.

Example of Bundles in Staffordshire (Moorlands)

Advertisement

As a quick example. One of the bundles above, a little further to the North West of Ashbourne, is a red area and comprised of about 3,700 premises, which includes 3,250 that are deemed to be within the final 20% (i.e. 88% of the total). But by the sounds of it bundles may also come in different sizes (some are 1,000 premises and a few have already gone up to 8,000).

The F20 programme is, as previously reported, also taking a somewhat technology neutral approach (e.g. FTTP, wireless broadband / 5G or hybrid fibre coax are all potentially viable as delivery solutions). However, this doesn’t mean to say that all premises identified by the authority for intervention will receive 1Gbps speeds, indeed like past contracts there’s a lower real-world requirement in the detail.

F20 Speed Expectations

All premises identified by the Authority in the Intervention Area must be provided with:

○ Gigabit Capable Connectivity with a normally available download speed of at least 500Mbps and upload speed of 200Mbps.

○ In limited circumstances, Ultrafast Capable Connectivity with a normally available download speed of at least 50Mbps and 20Mbps upload.

In fairness many physical limitations (1Gbps router ports that only do c.970Mbps, slow WiFi, network congestion etc.) and restrictions on the performance of remote online servers mean that even the best 1Gbps connections today often can’t take full advantage of such speeds. However, most people, particularly in F20 areas, would be more than happy with speeds of 500Mbps and uploads of 200Mbps, if they could get those.

Nevertheless some consumers may be confused by the dilution of “gigabit-capable,” although we saw something similar with BDUK’s earlier “superfast broadband” scheme and this is thus fairly normal (e.g. the 2016 state aid agreement promoted 30Mbps+ speeds, but the contracted peak-time minimum requirement was for a connection that could deliver 15Mbps+ some 90% of the time).

Arguably a bigger query is the “limited circumstance” exception above, where “ultrafast capable” seems to have become 50Mbps+ (20Mbps upload). Most of the industry and EU tends to define “ultrafast” as 100Mbps+, although Ofcom prefers the somewhat wonky definition of 300Mbps+. In either case that’s well above 50Mbps and we’re not yet clear on what those “limited circumstances” would be.

Timelines

At present BDUK is currently still developing their approach and a new Dynamic Purchasing System (DPS) is expected to help handle this. However, the current expectation is that the target operating model for all this could be ready during the Autumn 2020 (we’re likely to hear about this at the next budget in October 2020).

After that the tentative plan suggests that the first suppliers (e.g. BT etc.) could be accepted onto the related DPS system in January 2021, although it’s worth remembering that the procurement and tender phase of such programmes can go on for a long time and we might not see any contracts being signed until around October 2021 (it’s not uncommon for delays to strike big projects, so it could be later).

In other words, and much like we reported last year (here), the first deployments might not then begin until the very end of 2021 or early 2022 and, once again, that’s assuming no delays. As usual any operators taking part in this will need to provide some details to confirm their financial eligibility and security, such as audited accounts for the previous three years. But otherwise the process looks as if it will be fairly open.

A wholesale requirement also seems set to play a role, much like it did with the earlier BDUK programme. Otherwise the procurement and delivery timelines for all this remain ambitious and could put additional strain on existing problem areas, such as the shortage of skilled fibre engineers.

Suffice to say that achieving that 2025 target on time still looks very shaky, although we don’t yet know whether the UK Government’s recent acquisition of OneWeb’s LEO broadband satellites will factor into this at some point (here). SpaceX also have a similar constellation. We’ve yet to see how any of those space-based platforms actually pan out and what the real-world performance or affordability is like.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Shetland Threatens to Go it Alone on Future Broadband Upgrades

It’ll also be interesting to see how the overlap with R100 maps out

Will R100 simply get additional funding & expansion of scope or will there be two overlapping projects?

R100 will be used as a reason to put Scotland at the very back of the queue for this funding so I wouldn’t worry about that.

Lot 2 and 3 will overlap as only half the premises are to be completed by 2021 and the rest by 2023. More important is whether FTTP is to be used by Openreach in all instances and hence the 500/200 capability will be met. So there is inevitable overlap.

As for LOT 1 this could drag on through 2021 or beyond therefore my view is that it should be withdrawn, restructured and procured again to the new model (encompassing any contract withdrawal issues).

Overall going forward my view is that providers should commit to specific coverage and there should be meaningful consequences if a provider fails to proceed in timely phased completions.

In Scotland the gigabit programme will essentially be used to focus on the bits that R100 misses, at least that is what the Scottish Government seem to be saying.

Mark, that makes no sense whatsoever.. Not what you said but what the Scottish government seem to be saying, R100 doesnt have Gigabit as its aim, while some are going to be FTTP thats not universal, People are still very likely to get 4G or worse connections under R100 to then exclude them from Gigabit funding as ‘Served by R100’ Surely not.

As for a Gigabit programme with 500Mbps and 50 Mbps expectations? Just how does that work, sure lop off overheads etc but those are some shamefull numbers to put into a programme called Gigabit “every home” can access “gigabit-capable” broadband, Except those that wont, sounds uncannily familiar to the R100 reaching 100% Government scheme that oh yes, doesn’t plan to reach 100%

A helpful summary of the proposal.

Is there any evidence that the existing LFFN projects have delivered much in the way of new build beyond the funded coverage to public sector buildings (most of which overbuilds existing infrastructure anyway)? Does the cost per premise of any additional coverage compare well to the more traditional BDUK approach?

The voucher scheme per premise also looks like an expensive gimmick as building “on demand” in this way is very inefficient compared to area-wide deployments. So that’s up to £1bn being spent with poor value for money, let’s hope the NAO and PAC take a close look.

Then there’s the third approach, with perhaps 1,500 or so lots, assuming each “bundle” will be tendered for separately. That seems like an expensive procurement process, with a lot of wasted admin costs to oversee it, compare the responses etc. Hopefully the process will allow for bidders to group bundles together to give economies of scale, otherwise it could drive up the cost per premise unnecessarily.

Have they thought about the development of a network-neutral wholesale platform? Without that it may prove difficult to persuade retail ISPs to connect to these disparate networks given the interconnect costs and complexities.

Since the LFFN seems to be primarily focused upon public sector buildings, then assessing beyond that would be to examine an aspiration rather than a solid target of the delivery contracts. Nevertheless, we do see various operators like Cityfibre, VXFIBRE and others making use of the Dark Fibre that gets built and ramping-up via commercial investment on top of those to reach homes and businesses. In doing so this also aids competition at the infrastructure level.

As for the voucher schemes, the RGC seems to be helping with a lot of rural FTTP delivery (e.g. B4RN) that wouldn’t have occurred – or would have taken longer to raise the investment from communities – without it. If you live in an area that benefits then you wouldn’t see that as an “expensive gimmick”.

Mark, hmm B4RN, I’d been thinking smaller than that, for the many in my position where the population density vs the long run back to any AG seriously impacts the effect of the vouchers. I look at the rural Moray and Aberdeenshire areas on the TBB maps and the scale of the problem is plain to see. It’d be eased a great deal if we were connecting back to the BDuk cabinets, but thats another issue.

You’re right of course if theres enough people to do a bigger deployment then it adds up but gaps between properties rapidly eat into that.

Post Covid-19 we need jobs, jobs, and more jobs.

This election promise of fibre for all by 2025 using £5bn is an election promise which is being kicked down the road because there is no easy way to deliver it.

BT has £788m in its accounts which will be dribbled back to Government/LA, leaving rural broadband upgrades incomplete.

We need a whitepaper from BT/OR showing that these monies could be converted into 5,000 apprenticeships running 5 years, not six months.

The peace-meal nature of LFFN, vouchers and creating lots of 3,300 premises misses entirely the challenges the economy now faces.

BT has an opportunity to make amends for the failed gambit it attempted abusing the subsidy process for FTTC and some FTTP. It is one of the few companies that could make an immediate contribution if it chooses too.

https://www.ispreview.co.uk/index.php/2020/05/bt-invest-12bn-on-fttp-broadband-for-20-million-uk-premises.html

You may be fixated with the original BDUK programme for well understood reasons, reality isn’t. The mooted £12 billion there strikes me as a somewhat more significant investment in the UK economy than obsessing over a few hundred million to make NGA For All feel justified over his comments that Openreach ripped the taxpayer off.

TL;DR give it a rest. It’s really quite absurd the way you disregard the huge sums being thrown at the commercial deployment and the likely heavy involvement of BT in these procurements as you’re obsessed with being proven right over blowing a whistle on the original BDUK programme.

@NGA

The problem with real long apprenticeships is that there is no tie in or pay back for the employer.

For historical political reasons the unions don’t like employees being tied in. However, the logic loop is broken – as this stops the union having more highly skilled members. In a lot of things in the UK the skills gap is the rate limiting factor.

Contrast that with Germany. There are tie ins with a bit out. They gave a nice skilled manual workforce.

We shut down our training centre as all we were doing was supplying well trained staff to everyone else who would pay silly money to get the staff in to fill a short term need.

Unfortunately, in construction and civils, there is little realisation as to the difference between a full time salaried job and self employed. All they look at is the hourly equivalent.

Glad to know it’s all still being fudged (1gbps means 50mbps for some unlucky people). It was the same with BDUK where you could call a connection superfast (i.e my connection is superfast and capable of 36mbps) but in actuality hits a far lower speed (I only get 20mbps in practice) while claiming job done.

I really wish they would discourage too much over build as we seem to be increasingly getting those with multiple options and those with none.

To be honest I’d be ecstatic with 50mbps so maybe I’ll be lucky one day in my small town.

Bang on Phillip, While 50Mbps would be an incredible boost for many, If thats the result then its a shameful failure.

“every home” can access “gigabit-capable” broadband by 2025 ! ok so the dates are going to slip and that unfortunately we’re just going to have to accept as it is after all a huge undertaking, but to have the brass ones to wate rthat down to 500Mbps let alone 50.

Will be keeping an eye on this, busy chasing FTTP all day but short version

Expect the 50 down might be 5G using 700 MHz band or other wireless with option for expansion to FTTP at some unspecified later date. That will not be counted as Gigabit capable in the thinkbroadband data

If a wireless provider deploys something that will do Gigabit (which will NOT be 700 MHz band due to physics) then it count, but mapping the distance versus speed will be crucial.

We enquired for the voucher scheme for our roads. The cost to connect 30 homes was £60k, and the vouchers covered about £10k of that. Then of course at least half of those houses have no interest. And the remainder are certainly not going to pay £3k plus to connect, especially when the neighbours who won’t pay get a fee ride anyway. I think this approach has very limited value.