CBI Joins Calls for Infrastructure Bank to Fuel 1Gbps Broadband

The Confederation of British Industry (CBI) has today echoed existing calls for the UK Government to setup a new “Infrastructure Bank” to help deliver on their planned expansion of “gigabit-capable” and “full fibre” (FTTP) broadband networks, as well as to support roads, railways and housing.

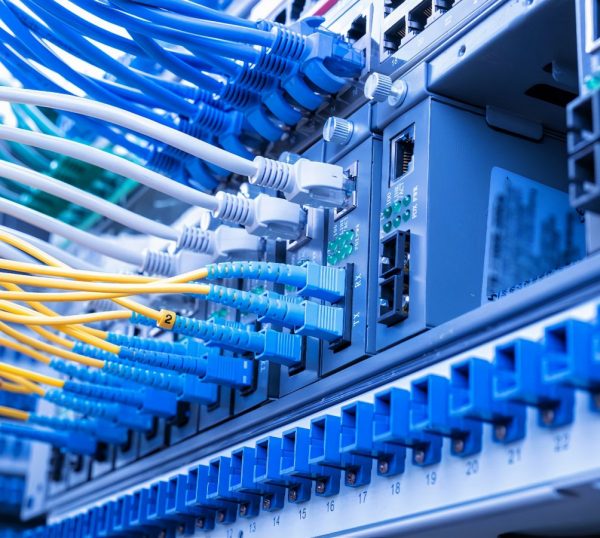

The Spring 2020 Budget included around £640bn worth of major infrastructure investment pledges and £5bn of that is due to go toward their aim of ensuring that “every home” can access a “gigabit-capable” broadband ISP connection by the end of 2025 (here). We now have a good idea of what that gigabit programme will look like (here), but we also know that the Government only promises to “go as far as we possibly can by 2025” (here).

At the same time the country, like so many others around the world, is currently reeling from the massive economic impact being caused by the COVID-19 pandemic, although such crisis’s tend to only encourage Government’s to spend big on infrastructure (i.e. as way of fostering future growth and supporting established industries).

Advertisement

However, infrastructure investment shouldn’t all come from public funding and there’s a desire to encourage more private investment too. At present the European Investment Bank (EIB) provides one existing avenue for this but, depending upon the outcome of the Brexit trade negotiations, we may soon benefit from a domestic UK replacement.

The CBI’s new report thus outlines the proposed bank’s role of focusing on crowding in private finance by reducing risks, promoting market stability, and increasing investor confidence. Other recommendations include giving additional powers to the National Infrastructure Commission (NIC) and Infrastructure and Projects Authority (IPA) – offering them greater independence and authority to hold government to account on infrastructure delivery.

Matthew Fell, Chief UK Policy Director at the CBI, said:

“Prior to the outbreak of Covid-19, businesses welcomed the government’s commitment to deliver an ‘infrastructure revolution’ and interpreted it as a clear sign that the government was serious about delivering on its levelling-up agenda.

While the UK government’s commitment to delivering infrastructure remains undeterred, the country’s fiscal position has substantially worsened. In this context, the private sector now has an even more important role to play in helping to bridge the funding gap needed to deliver the government’s vision for UK infrastructure.

To support its ambitious infrastructure agenda and provide better connectivity, at good value for taxpayers, the government must reinvigorate the UK infrastructure market tackling concerns about regulation and a lack of clarity about investment opportunities.

The government must commit to an approach that gives confidence to investors and capitalises on the attributes of businesses and public sector establishing itself once again as a world class destination for investment.”

If any of this sounds familiar then that’s because the NIC proposed the same idea earlier this year (here), although they’ve been somewhat light on the detail. On the broadband front we’ve also already seen plenty of existing projects and programmes that have brought public and private investment together (e.g. BDUK and the Digital Infrastructure Investment Fund). In other words, the creation of a new infrastructure bank wouldn’t by itself be a miracle fix, but it might certainly help.

Arguably the ability to reach a target like 2025 for gigabit broadband is no longer just a matter of funding, but rather more a problem of practical delivery vs unrealistic time-scales for significant infrastructure work. Even when you throw in variable 5G and fixed wireless technologies, getting to 2025 on time is extremely difficult (we highly doubt 100% coverage of 1Gbps+ is viable by 2025 and roll-out may well continue past that date for a few years, albeit at a reduced pace of deployment).

Advertisement

The incentive for all this is however quite clear. The CBI notes that for every £1 spent on construction activity, some £2.92 is created in wider economic benefit. Similarly, data suggests that when 1% of GDP is invested in infrastructure, economic output increases by 0.4% that same year, and grows by 1.5% within four years.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« ISP Sky Broadband Cuts 59Mbps Fibre and Phone to £25

Tesco Mobile Refreshes its UK Logo to Look Like Parent Firm »

In fairness I think the UK should have it’s own investment bank as I can’t see us being able use the EIB as i’m sure in the rules it is only allowed to be used by EU States or EFTA members.

EIB invests in startups in South Africa and other countries

Hopefully this will drive a realistic implementation of 5g and push it higher up the list than anything “fibre to the home” related.

Hopefully not.

OK so you have your viallage of In-The-Middle-Of-Nowhere has a 5G mast sprout out.

What is it to connect to.

Please don’t say GEA. Because that will have to be run out to In-The-Middle-Of-Nowhere.

By the time GEA is In-The-Middle-Of-Nowhere then the costs of hanging FTTP off of it using a different Lambda or Subtended Headend then start to look reasonable.

And Pleeeeeaaaaaseeee don’t think that 5G is going to do significantly better than 4G in rural: it won’t. If you have seen 5G deployments up close the very high , and therefore fastest, frequencies are very short range and therefore you need a node on every other lamp post to make it work. Or are you going to screw a 5G microcell onto every tree in every forest?

Nope for most of rural the answer is FTTP and that has been obvious for about two decades. Apart from those at BT who used to worship the God of Copper and prayed for intervention from the Divinity to allow line length physics to be washed away.

FTTP (PON or PtP) will fix the rural connectivity problem for good. The election and then WFH has made sure that this is now a national priority, as it should be.

A lack of money does not appear to be the main issue, heaps of cash is available today but isn’t getting spent, it’s a lack of competent people & businesses to organise the schemes and do the actual work.

Also it’s very well pledging for example the 5 billion for 1G for all, but how much of that is swallowed by the management and bid process and funding groups etc vs how much makes it to the end deployment. If i recall rightly for example the HIE don’t have a good record for cash funded vs real world results.

This sounds awfully like the National infrastructure bank concept Jeremy Corbyn’s manifesto proposed…