BDUK Study Shows Benefits of UK Superfast Broadband Project UPDATE

The Government has posted a useful State Aid evaluation of the UK National Broadband Scheme (Superfast Broadband Programme), which identifies a number of strong benefits from the £1.9bn (public) programme that has so far helped to extend “superfast broadband” (30Mbps+) connectivity to nearly 97% of premises.

The SFBB programme, which is being managed by the Building Digital UK team, was first setup back in 2010 to help extend high-speed broadband connectivity to areas that were not expected to benefit from commercial rollouts (commercial coverage of “superfast” lines reaches c.76% and SFBB has helped to go beyond that toward 97%).

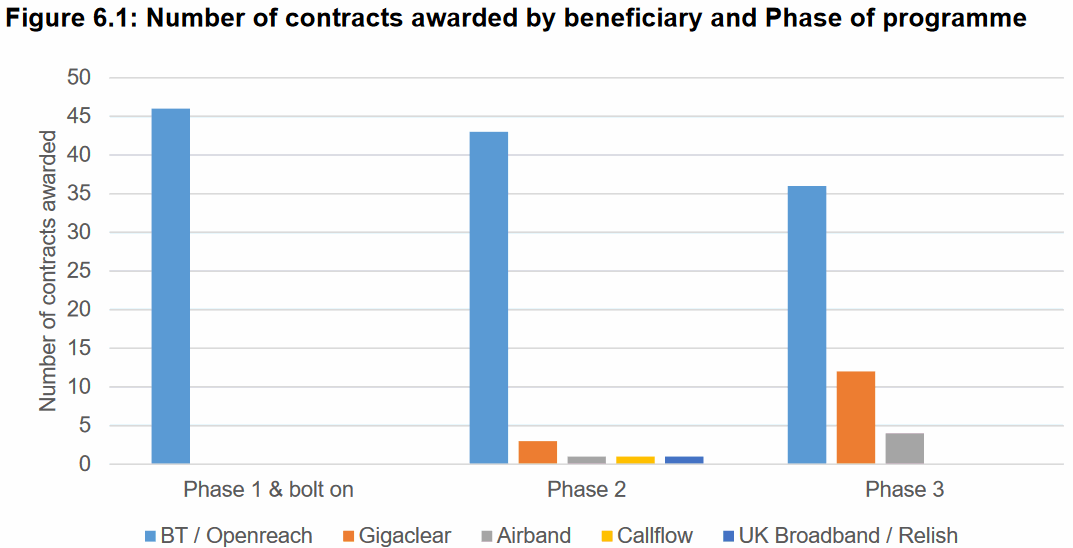

The programme is technically split into three phases (see below) and remains on-going today, albeit at a much lower level of build than the earlier phases. Indeed, we expect the government’s new £5bn Gigabit Broadband Programme (F20) to start doing most of the heavy lifting from around early 2022, after contracts have been signed (assuming no delays).

Advertisement

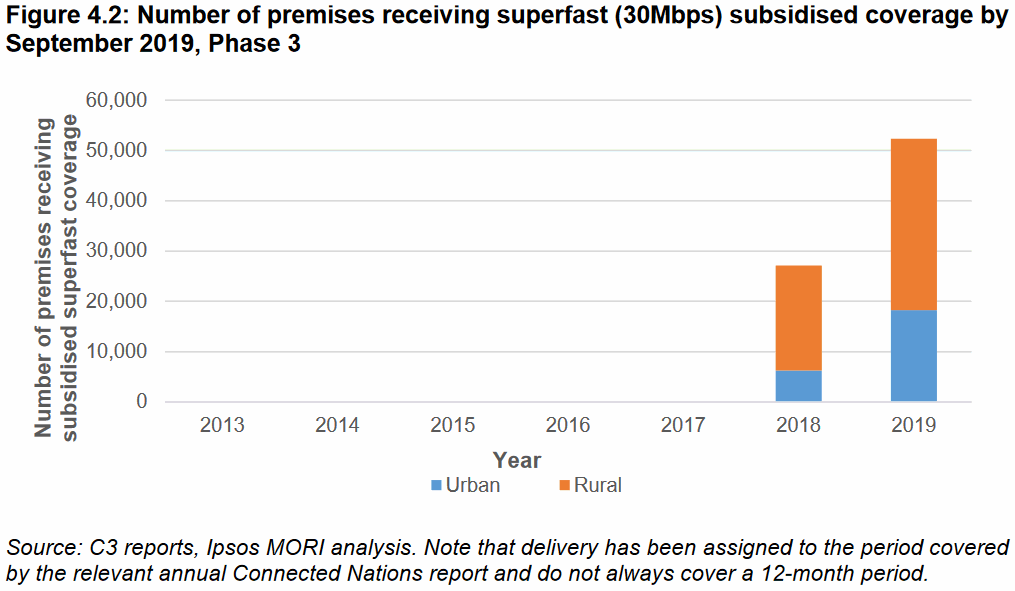

Crucially, the latest evaluation report on this programme, which was commissioned by DCMS and carried out by Ipsos MORI, largely focuses upon the most recent Phase 3 of the project (they’ve already done past evaluations on the earlier phases). Most of the build under this started in 2018 and is often much more “full fibre” centric than earlier contracts.

BDUK Phases One (Finished Spring 2016)

Supported by £530m of public money via the Government (mostly extracted from a small slice of the BBC TV Licence fee), as well as significant match funding from local authorities and the EU. The public funding is then roughly matched by BT’s private investment. Overall it helped to extend “superfast broadband” (24Mbps+) services to cover 90% of premises in the United Kingdom.

BDUK Phase Two

Supported by £250m of public money via the Government, as well as match funding from local authorities, Local Growth Deals and private investment from suppliers (e.g. BT, Gigaclear, Airband, Call Flow etc.). This phase extended superfast broadband services to 95% of premises in time for the end of 2017, but some newer contracts are on-going (e.g. the Welsh Government’s new programme).

BDUK Phase Three

Similar to Phase Two, albeit without a solid coverage target, and funded under a new state aid judgement covering contracts awarded between 2016 and 2020 (State aid SA. 40720 (2016/N)). So far, contracts awarded under Phase 3 by mid-2020 have involved £391m in public funding and mostly focused on extending FTTP coverage.

So far phase 3 contracts appear to have increased the number of premises with superfast coverage by 10,800 to 29,300, and the number of premises with FTTP coverage by 19,000 to 30,300. We recall that, overall, the SFBB programme – across all its phases – has added about 400,000 FTTP premises (the rest was done via FTTC instead, with a little via FWA / wireless).

Phase 3 contracts also increased the average upload speeds of connections (by 0.9Mbps to 3.9Mbps) and the maximum download speeds of connections by 6.2Mbps to 16.9Mbps, although the context for how this was calculated wasn’t immediately clear (we assume it’s looking across the intervention area and so take-up of the new networks will play a role).

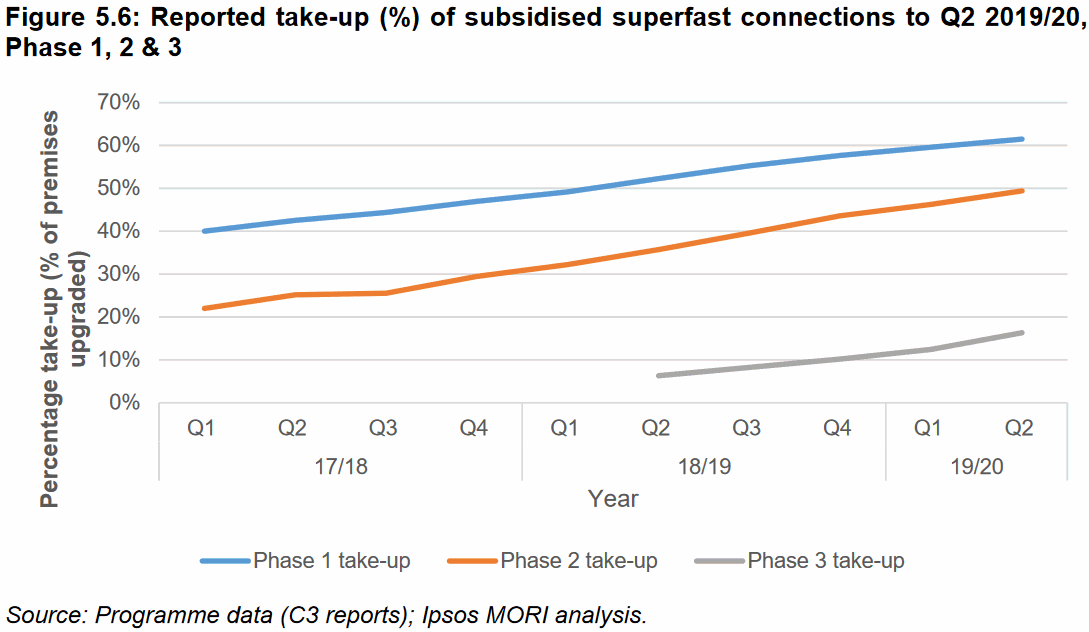

We should point out that take-up grows organically over time (slowly over several years) and in Phase 3, which is much younger, it’s now edging toward the 20% mark. As a rough comparison, the older Phase 1 in this report goes past 60% and Phase 3 seems to be following a similar trajectory (one catch here is that the take-up chart below starts at a much later year than Phase 1/2 actually began).

Advertisement

The measure of take-up is also important for another reason because the contracts use it to gauge clawback (gainshare). If take-up proved to be higher than anticipated at the tendering stage, network providers were required to return a share of the excess revenues generated from additional take-up to the investment fund, which local authorities can then use to reinvest into future broadband improvements (a chunk of the Phase 3 funding will thus come from earlier contracts).

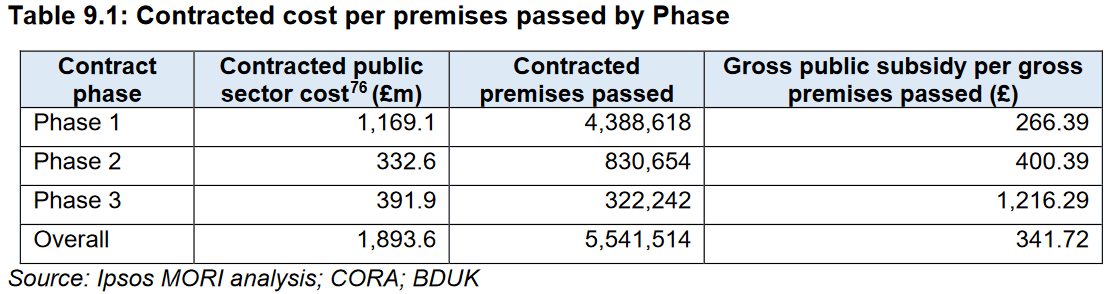

Overall, the SFBB programme is now forecast to return £860m of tax payers’ money for reinvestment. The gross public sector cost (i.e. before clawback) per additional covered premises over three years was £890 for Phase 3 contracts (in 2019 prices). However, the public sector savings from the clawback mechanism is expected to reduce the net cost per additional covered premises from £890 to £790 for Phase 3 contracts (given the early stage of delivery, these estimates are highly uncertain).

Advertisement

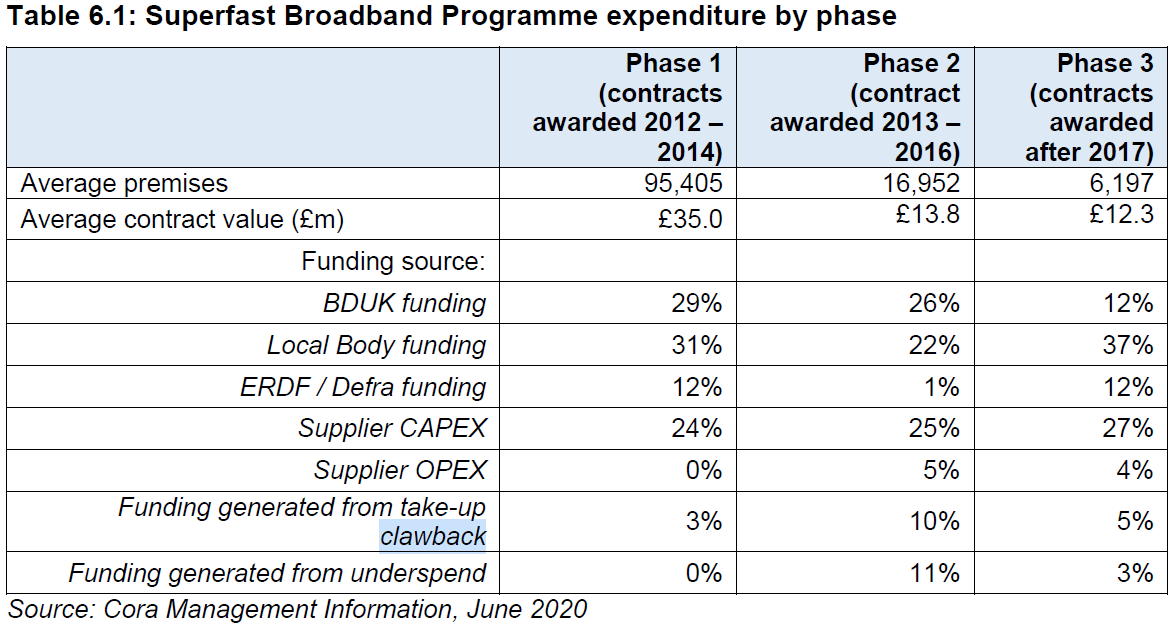

We should add that there is a substantial difference between the gross value of public spending associated with the contracts awarded (overall total of £1.9bn) and forecast public spending before clawback (£1.7bn in 2019 prices and £1.5bn in nominal terms). This is largely driven by underspending on Phase 1 contracts. The gross value of the public spending associated with contracts at the point they were awarded was £1.2bn. However, final claims were only made for £689m of public funding. You can see how all of this has affected the phases below.

Finally, the report also attempts to summarise some of the other positive economic impacts from the SFBB programme (some of this data has been published before). Otherwise you can read the FULL REPORT on the Government’s website and there’s also a useful SUMMARY OF KEY IMPACTS.

Economic Impacts of the SFBB Programme

The findings of the evaluation indicate that the programme has led to a range of economic and social benefits in the areas benefitting from subsidised coverage between 2012 and 2018. The key results included:

• Local employment impacts: Subsidised coverage was estimated to have increased employment in the areas benefitting from the programme by 0.6 percent, leading to the creation of 17,600 local jobs by the end of 2018.

• Turnover: Subsidised coverage also increased the turnover of firms located in the areas benefitting from the programme by almost 1.0 percent by 2018, increasing the annual turnover of local businesses by £1.9bn per annum.

• Number of firms: The evidence indicated that a share of these local economic impacts were driven by the relocation of firms to the programme area. The evidence indicated that subsidised coverage increased the number of businesses located in the areas benefitting by around 0.5 percent – suggesting the programme may have encouraged the relocation of economic activity to rural areas.

• Turnover per worker: There were also signals of efficiency gains – turnover per worker of firms in the areas benefitting rose by 0.4 percent in response to subsidised coverage. This was not solely driven by more productive businesses moving into areas with improved broadband infrastructure. Firms that did not relocate over the period also saw their turnover per worker rise by 0.7 percent by 2018, indicating that subsidised coverage has also raised the efficiency of firms. However, the strength of these gains appeared to decay with time because these firms employed more workers as time passed.

• Wages: The impacts of the programme were also visible in wages. Employees working for firms located in the areas benefitting from subsidised coverage saw their hourly earnings increase by 0.7 percent in response to the upgrade. This gives greater confidence that the programme led to an increase in productivity.

• Unemployment: Local job creation also appeared to translate into reductions in unemployment, with the number of unemployed claimants falling by 32 for every 10,000 premises upgraded by 2018.

• House prices: The programme led to an increase in house prices (of between £1,700 and £3,500) suggesting that buyers valued the technology.

It is important to note that while most of these findings account for the possibility that businesses benefitting from the programme may have claimed market share from local competitors, they should not be interpreted as net economic impacts at the national level. At the national level, the programme is estimated to have resulted in:

• Economic benefits: The programme is estimated to have led to a cumulative total of £1.1bn in productivity gains between 2012 and 2019. This rises to between £1.6bn and £1.8bn over the 2012 to 2030 period.

• Social benefits: Based on its impacts on house prices between 2012 and 2019, the programme is estimated to have led to social benefits valued at between £0.7bn and £1.5bn. The estimated Benefit to Cost Ratio (BCR) was £2.70 to £3.80 per £1 of net public sector spending based on its impacts between 2012 and 2019. Allowing for future economic benefits to 2030, the BCR is estimated to rise to £3.6 to £5.1 per £1 of net public sector spending.

UPDATE 2nd Feb 2021

We’ve been informed that, since the report was completed, a further £640 million of contracts have been taken forward as part of the SFBB programme, thus bringing the total spent on the programme from £1.9bn (as published above) to £2.6bn.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Hyperoptic to Rollout Full Fibre to 8000 Poplar HARCA UK Homes

Openreach UK Raises Price of Highest Maintenance Level 4 »

Interesting summary:confirms I guess what we all already know i.e.decent broadband is so essential to the ways we and live work these days and brings economic and other benefits.My concern -as someone who lives in a rural area – is that we are being ignored in all this…seems unlikely (if ever) that any commitments to provide SFBB to my little village will ever happen.The statement in the study about Phase 2 is puzzling…with mentions of upgraded services to 97% of h/holds…97% of what?Where I live we struggle to get 5 or 6mps via BT landline.Have now given up waiting for any improvements and opted for 4G mobile instead.So v.frustrating:Govt.and BT etc need to do more to bring us into the 21st century!

You dont have to live in a rural area, market towns are getting sub 24Mbs (the old standard).

An DOI response from DCMS showed over 610,000 properties were getting less that Superfast 24Mbs so it stands to reason there will be more if Superfast 30Mbs is used.

I think it depends on location, the cotswolds town i live in certainly hasn’t suffered from House price drops with average price of 650000.Poor Broadband or mobile doesn’t factor into their decision to buy, more likely the exclusive location. More retired or well off than unemployed. The area doesn’t live in the real world i suppose.

Crucially, the government has no idea what they’re throwing money at.

Superfast is certainly NOT 30Mbps in 2021, superfast should be classed as 100Mbps minimum IMHO in this day and age. To throw billions of pounds at something offering to deliver so little, just shows how completely out of touch they are.

even worse, they totally ignore upload speed. like nah people don’t need that..

I wrote to the council about a lack of fibre, they replied back that as a SME i can apply for a voucher. I write to BDUK and they say i’m not in a rural area so nope you can’t have a voucher.

I give up.

No fibre, no 5G. I suppose i should be grateful there’s *shudder* virgin media here.

You may be included on the Market Towns incentive, published on isppreview last year.

My area is on this, yipee gone to colour purple, however its subject to a consultaion betwee Ofcom, OR and others, due to report in March 2021. It appears to be centered around how to pay for it.

A SME locally to me paid 10K, including vouchers, to OR and then waited over a year to OR to clear the ducts on the final stretch.

He has to run his business on a 8Mbs download I beleive, for over a year, while OR has the funds.

OR needs to be nationalised, totally divorced from BT, when the next election?

Buggerlugz

you wrote to the council about a lack of fibre and you have access to virgin media

that what you want not have been covered under BDUK if even you were rural

I don’t understand the thresholds.

I was covered by a BDUK rollout and my initial Sky FTTC contract guaranteed a speed of 31.

If I renew with Sky or go to BT they are now guaranteeing a speed of 21 which is below the original definition of superfast (which was 24).

Should I complain to BDUK as they paid OR for 24 or 30 minimum ?

Depends on whether or not the change is due to a line fault, capacity at the ISP or a rise in cross-talk interference. Either way, you should complain to your ISP as they hold your contract.

Line tests came back clean and the speed guarantees are the same with a few other ISPs.

But to the point of increased cross-talk… shouldn’t BDUK and OR factored that in when deciding on FTTP or FTTC ?

It makes me wonder about the numbers reported for households who originally could get superfast but due to cross-talk through takeup now can’t (ie they were just above the target but cross-talk has now put them below).

It would appear not, DSLAM in my town was ‘improved’, this meant an extra frame bolted on the side, and this DSLAM is providing a ‘service’ over 1000m.

I suspect those rolling out these service’s fail to understand the concept of distance and radio signals and do it all by postcode.

Is there a way to lookup whether Openreach FTTP at a location was funded by BDUK, community vouchers or commercial rollout?

It was installed recently here less than a year after FTTC had been put in so I’m curious as to what happened.

Where abouts? A exchange and cab number?

confused why do you need to know, did you pay for it and is it a complete overlap

FTTP will be a Pon it wont be a CAB number

Fastman: I’m mainly just curious. It’s entirely possible we’ve just fallen into an overlap between two projects – the FTTC cabinet is some way away and was providing sub-superfast estimates.

Yes Yes: FTTP so it’s not connected to the local cabinet or exchange. I believe the engineer said it was ultimately hooked up at Norwich and that the line was thirty something miles (kilometers?) long. I know he had to spend some time ringing around and getting the dimmer (power level?) turned up before it’d work.

You can tell via the codelook website if an FTTC cabinet was commercially funded or BDUK funded.

You can’t really see if an FTTP deployment was BDUK or not unless you are told by the local BDUK authority.

Page 86 is key but the findings that many will be paying nothing for Phase 1 are not reflected in Table 8.1.

This is because the newly named ‘implementation clawback’ the new name for BT’s capital is not reported upon.

This little bit if truth telling on Page 86 needs to be overlayed across the rest of this report.

The challenge remains is to bring the monies within the process to contract and delivering about 500k more mostly English rural premises.

Delivering Gigabit could then re-focus on the transition to full fibre rather than inventing a procurement that is not needed.

I was getting 9mb on FTTC thanks to a BDUK upgrade and this was included in the number of properties that had super fast delivered. Absolute joke of a programme