UK Grows But Fails to Climb 2021 Full Fibre Country Ranking

The FTTH Council Europe has published their annual 2021 market panorama, which ranks the countries with the strongest subscriber penetration of “full fibre” (FTTP/H/B) based ultrafast broadband ISP networks. The good news is that the UK has continued to show strong growth, but we remain stuck at third from the bottom.

Until fairly recently the United Kingdom, which has suffered due to its somewhat historically lacklustre approach to adoption of Fibre-to-the-Premises (FTTP) technology, didn’t even appear in this ranking. But that began to change when the country showed up at the bottom of the table in 2019 and then, following another year of rapid growth, started to climb a few places for the last 2020 report (here).

The good news is that the 2021 panorama (see below) has once again shown strong growth for the UK. As before, much of this improvement has been fostered over the past 4 years by the Government’s increasing support for “gigabit-capable” networks, such as via their business rates holiday on new fibre, as well as connection vouchers, various other funding schemes (here) and regulatory changes via Ofcom to help support investment (here).

Advertisement

On top of that there has been a significant increase in competition between new FTTP ISPs over that same period (Cityfibre, Hyperoptic, Gigaclear, CommunityFibre, G.Network etc.), which has helped to drive the market forward at a pace never before seen in the UK (Summary of UK Full Fibre Builds). This has helped to complement big builds by the traditional incumbents, such as Openreach (BT) and Virgin Media.

At present most of this effort reflects commercial deployments in urban areas, although the Government’s new state aid funded £5bn Project Gigabit programme should soon help to extend that effort into the final 20% of hardest to reach (predominantly rural) premises. Suffice to say, fibre optic network growth is going to stay strong in the UK for a while.

The 2021 FTTH Country Ranking

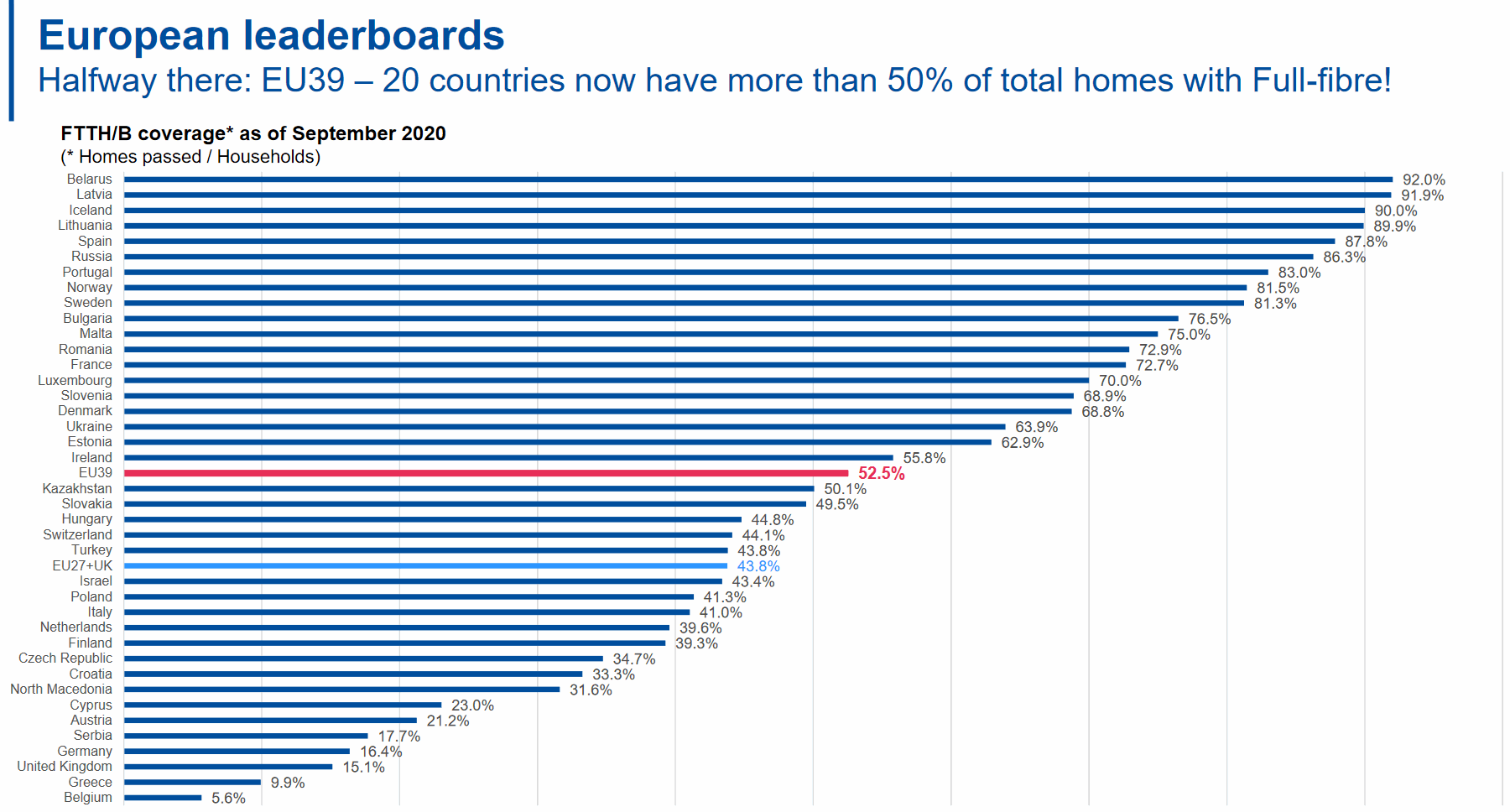

The latest data, which is taken from September 2020, shows that the UK now has a market penetration rate of 3.7% (up from 2.8% last year), a coverage figure of 15.1% (homes passed) and a take-up rate of 25% (up from 18.2% last year). We should point out that Ofcom’s figure for UK full fibre coverage in that same month was 18% (here).

Advertisement

The data indicates that FTTH coverage in the United Kingdom grew by 64% over the past year (+1.7 million extra premises), which is up from 50.8% in the previous year (+1.4 million extra premises). As such you might well be wondering why we haven’t jumped another place or two in the ranking. The answer is because Germany, which was our next closest target and the EU’s biggest economy, simply grew even faster, and they weren’t alone.

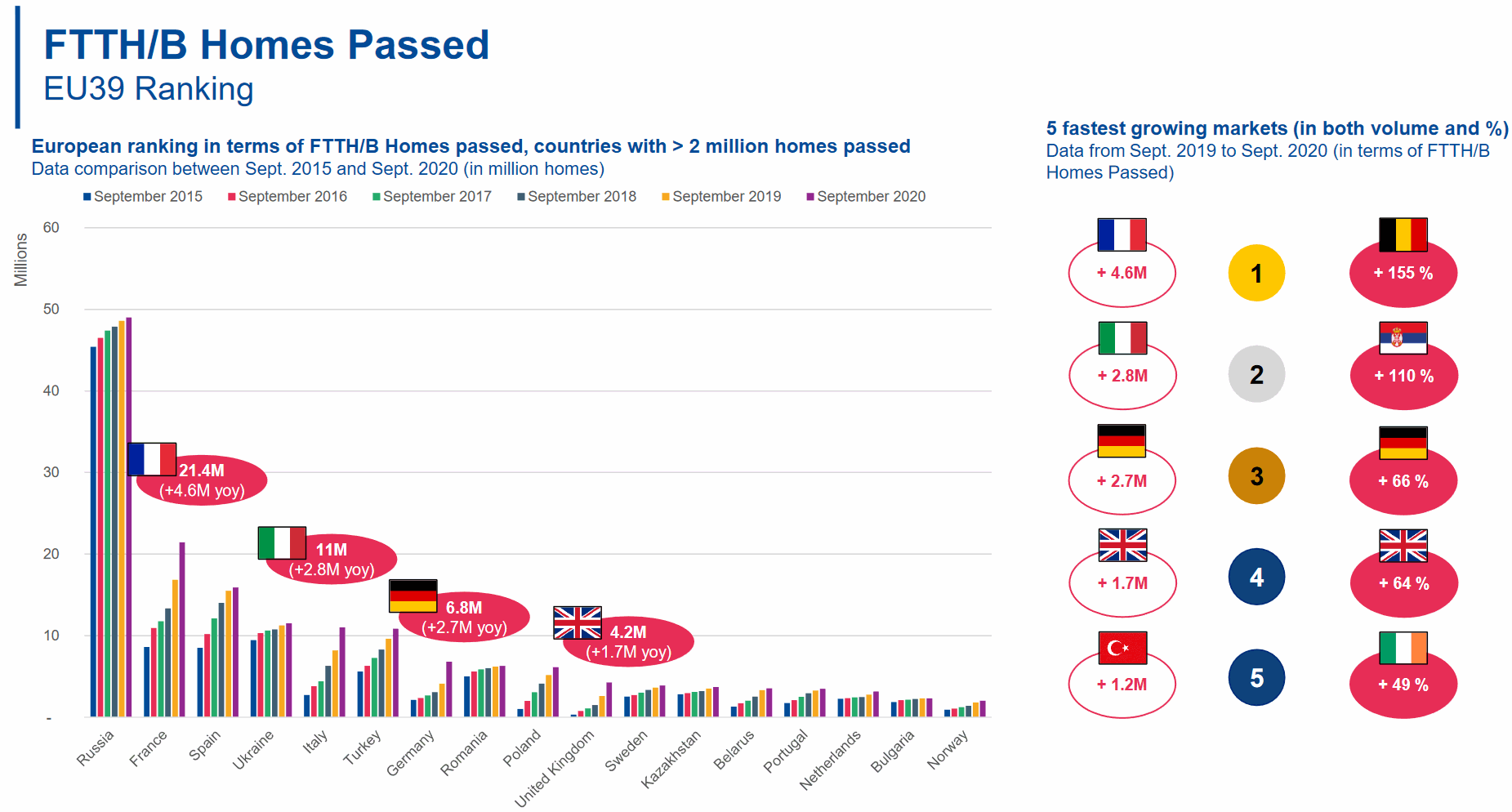

Overall, the total number of homes passed with Fibre-to-the-Home (FTTH/B) style broadband ISP networks in the 39 European countries surveyed reached nearly 183 million (up from 172 million last year). The main movers in terms of homes passed in absolute numbers were France (+4.6 M), Italy (+2.8 M), Germany (+2.7 M) and the UK (+1.7 M).

Advertisement

Similarly, the top 5 of the annual growth rates in terms of homes passed is headed by Belgium (+155%), Serbia (+110%), Germany (+66%), the United Kingdom (+64%) and Ireland (+49%).

Interestingly alternative network (altnet) ISPs (e.g. Cityfibre, Hyperoptic etc.) are still constituting the largest part of FTTH/B players, with a contribution of around 57% of the total fibre expansion across all the listed countries (up from 56% last year).

Vincent Garnier, Director General of the FTTH Council Europe, said:

“The telecoms sector can play a critical role in Europe’s ability to meet its sustainability commitments by reshaping how Europeans work, live and do business. As the most sustainable telecommunication infrastructure technology, full fibre is a prerequisite to achieve the European Green Deal and make the European Union’s economy more sustainable.

Competitive investments in this technology should, therefore, remain a high political priority and we look forward to working with the EU institutions, national governments and NRAs towards removing barriers in a way to full-fibre Europe.”

Despite all this good progress, it’s worth remembering that most of our fixed line internet connections will continue to be dominated by cheaper and often slower hybrid fibre (FTTC) and ADSL services, at least for the next few years.

On top of that the UK Government’s 2025 target for “gigabit-capable broadband” is technology neutral, which means that it can also be achieved via other gigabit technologies like Virgin Media’s Hybrid Fibre Coax (HFC) based DOCSIS 3.1 network and Fixed Wireless Access connectivity (e.g. 5G). Naturally, none of this will be reflected by the above ranking.

Nevertheless, most operators and the Government are continuing to focus their primary efforts on fostering full fibre services, which remains the technology of choice for the bulk of new contracts. On the whole it’s good to see the UK making progress, but there’s no escaping the fact that our late arrival still means that many other countries will have crossed the finish line long before we’ve even got halfway.

Finally, country-to-county comparisons never tell the whole story. For example, some countries have funded the deployment of fibre almost entirely from public money, while offering very little in the way of competition (e.g. consumer choice of ISPs). Likewise, other countries have a significantly larger proportion of people living in big apartment blocks (e.g. Spain, Portugal), which are a lot cheaper to serve than individual housing.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Ericsson Survey Finds Confused Demand for 5G Mobile in the UK

Openreach Adds 27 UK Locations to FTTP Broadband Rollout »

more work to do for busy openreach

I wonder what work you’ve done in 2021?