Autumn 2023 BDUK Update on UK Project Gigabit Broadband Rollout

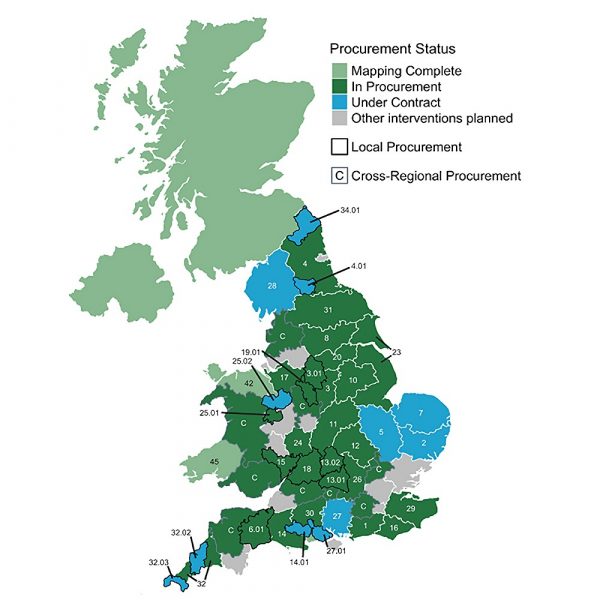

The Building Digital UK agency has released their latest September 2023 progress update on the Government’s £5bn Project Gigabit broadband rollout scheme, which is now running live contracts and procurements worth over £2bn in state aid (up from £1.4bn in July) to help extend coverage to an extra 1.1 million hard to reach premises.

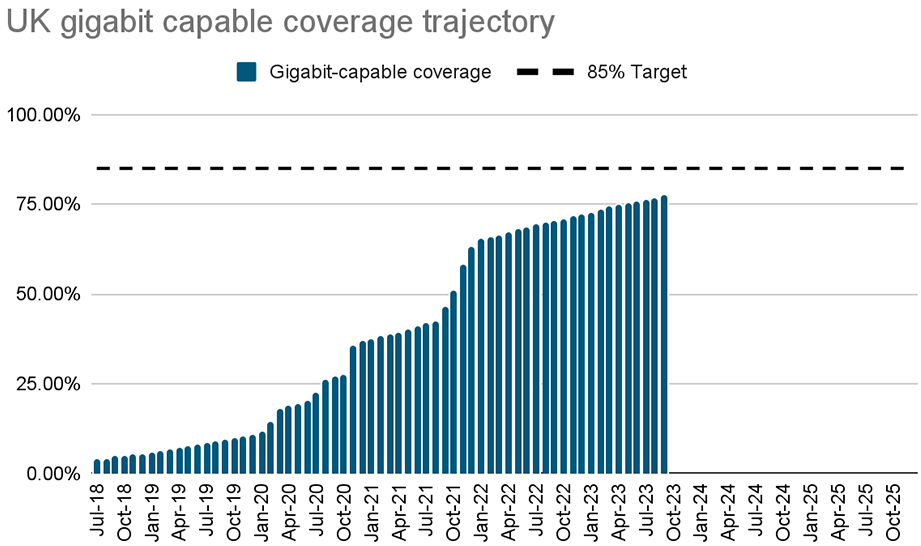

The project aims to extend networks capable of delivering download speeds of at least 1000Mbps (1Gbps) and uploads of at least 200Mbps to 85% or more of UK premises by the end of 2025, before rising to “nationwide” coverage (c.99%) by around 2030 (here). The funding released for this will depend upon how the industry responds, but many more procurements are due to enter the pipeline soon (see below).

The report notes that over 77% of UK premises can now access a gigabit-capable network, which falls to 56% when just looking at FTTP (i.e. the gigabit figure is boosted by Virgin Media’s HFC upgrade – here). But Ofcom currently forecasts gigabit coverage to hit 92% by March 2025 (here), with purely commercial deployments alone being expected to deliver over 80% of that.

Advertisement

At this point it’s worth looking at the rural vs urban divide in gigabit coverage, which helps to illustrate how most of the coverage progress is dominated by commercial urban builds.

Rural vs Urban – UK Gigabit Coverage

(Thinkbroadband Data)

| Urban Cover |

Rural Cover |

|

| England | 80% | 40% |

| Scotland | 76% | 29% |

| Wales | 65% | 38% |

| Northern Ireland | 95% | 78% |

Project Gigabit is thus designed to focus on improving connectivity for those rural and semi-rural areas in some of the final 20% (5-6 million premises). This primarily consists of several support schemes, including gigabit vouchers (£210m), funding to extend Dark Fibre around the public sector (£110m) and gap-funded deployments with suppliers (rest of the funding) – known as the Gigabit Infrastructure Subsidy (GIS) programme.

Today’s article is focused upon the GIS programme and related procurement work, which sees ISPs bidding through a new Dynamic Purchasing System (DPS) to extend their networks across disadvantaged parts of the UK. Project Gigabit in England is centrally managed (by DSIT/BDUK – not local councils), although there may be variations in this for Scotland, Wales and Northern Ireland.

Advertisement

What’s New in the September 2023 Update

Since the last update in July 2023 (here), BDUK has launched another 9 new local and regional procurements – worth a combined £597 million, which are expected to help upgrade up to another 260,000 hard-to-reach homes and businesses. This includes two large cross-regional (Type C) contracts that will target some of the hardest areas that have struggled to attract much interest from suppliers in other procurements.

The combined value of all the contracts signed so far comes to around £589m in public investment and will upgrade 378,450 premises (c.£1,556 per premises passed), but this doesn’t include any private match-funding that may enable some of those contracts to reach many more premises through a complimentary commercial expansion.

Otherwise, the total value of all the 39 live Project Gigabit procurements launched to date (inc. 27 live procurements and 12 live contracts) is around £2bn (up from £1.4bn in July 2023), which could see up to 1.1 million extra premises being passed by a gigabit-capable network. The project has also reached the milestone of the 100,000th voucher used to connect premises to gigabit-capable broadband (rising to 122,000 if prior voucher schemes are included) – they’ve published a related Evaluation Report for this, although the data in that report only goes up to 2021.

Voucher Evaluation Highlights

The report, which examined all vouchers issued and connected by March 2021, has found clear evidence that their use helped boost the average download speed in local areas beyond what the market could have achieved alone. This effect becomes more pronounced for premises in more rural areas. In addition, a survey of 4,000 households who received a voucher in this timeframe found 53% of residents reported that their broadband upgrade had increased their life satisfaction.

As a result of the upgrades to connectivity experienced by small and medium size enterprises that took advantage of gigabit vouchers, an additional 24,000 jobs were also created which, adjusting for inflation, resulted in a productivity boost of over £37 million. Notably, the evaluation also found evidence that vouchers contributed to a net reduction in carbon emissions of 7,600 tonnes CO2e over three years due the decrease in travel to work times as well as energy usage in workplaces.

The Project has now launched all of their currently planned pipeline of local and regional procurements that form part of their delivery in England. The latest procurements added to this list cover North Yorkshire, Cheshire, Lincolnshire and East Riding, West Herefordshire and Forest of Dean, East Gloucestershire, the Peak District, and Mid/East Devon and West Somerset.

Advertisement

However, the devolved countries of Wales, Scotland and Northern Ireland are still in the preparation stage, but we do get an idea of the progress for these areas, which we’ve summarised below.

Status of Devolved Countries

➤ Wales

Areas across North West Wales, Mid Wales and South East Wales are included in a cross-regional procurement launched in July 2023. BDUK still plans to launch a regional procurement in North Wales by the end of the year, while South West Wales will be included within a future contract procured under the cross regional framework. Further proposals for voucher projects will be considered in South West Wales before this process begins.

As of the end of August 2023, BDUK had connected 3,400 homes and businesses in parts of Wales using vouchers. In addition, a further 2,100 vouchers had been issued for connection within the next 12 months.

Meanwhile, the Welsh Government’s Superfast Cymru programme has now completed delivery of gigabit-capable infrastructure in Wales and in total has provided just under 100,000 premises with access to gigabit-capable broadband.

➤ Northern Ireland

Project Stratum (£173 million UK government funding and £24 million from Northern Ireland Department for Economy and Department of Agriculture, Environment and Rural Affairs) is also delivering ahead of target with 67,000 of the 85,000 contracted premises having received full fibre coverage to date.

The Northern Ireland Public Review completed in July 2023 and work is now under way to identify the remaining premises requiring support through Project Gigabit.

➤ Scotland

The Scottish Government’s April 2023 Public Review identified around 410,000 premises that are not currently in suppliers’ commercial or state-funded gigabit-capable broadband coverage plans. BDUK anticipates that a proportion of these will be reached through commercial delivery. The Scottish Government and BDUK are now undertaking pre-procurement market engagement with suppliers, prior to the launch of Project Gigabit procurements.

Highlands and Islands Enterprise have decided not to proceed with a local procurement for the Inverness and Highland City-Region Deal area. Premises in this area will now be incorporated into Scotland-wide plans. In the meantime, voucher-enabled build is still taking place on the North East coast from Inverness.

BDUK Gigabit Broadband Voucher Scheme projects continue to be built in Scotland and to date have delivered 3,900 vouchers.

The Scottish Government’s £600 million Reaching 100% Programme (R100), which has received £49.5 million of UK government funding, has now rolled out gigabit connections to over 31,000 premises across Scotland, as delivery continues.

Otherwise, you can see a summary of the wider contract progress below.

Live GIS Contracts (Signed)

| Area | Contract Awarded | Uncommercial Premises | Value |

|---|---|---|---|

| North Dorset (Lot 14.01) | 25-Aug-22 | 7,000 | £6.3 million |

| Teesdale (Lot 4.01) | 22-Sep-22 | 4,000 | £6.7 million |

| North Northumberland (Lot 34.01) | 14-Oct-22 | 3,700 | £7.4 million |

| Cumbria (Lot 28) | 29-Nov-22 | 59,000 | £108.5 million |

| Central Cornwall (Lot 32.02) | 19-Jan-23 | 9,200 | £18 million |

| South West Cornwall (Lot 32.03) | 19-Jan-23 | 9,500 | £18 million |

| Cambridgeshire and adjacent areas (Lot 5) | 23-Mar-23 | 44,400 | £69 million |

| New Forest (Lot 27.01) | 27-Mar-23 | 10,400 | £13.8 million |

| North Shropshire (Lot 25.02) | 19-Apr-23 | 12,000 | £24 million |

| Norfolk (Lot 7) | 28-Jun-23 | 62,200 | £114.2 million |

| Suffolk (Lot 2) | 28-Jun-23 | 79,500 | £100.5 million |

| Hampshire (Lot 27) | 28-Jun-23 | 75,500 | £104.2 million |

Take note that, once a contract has been signed, it sometimes takes operators several months of engineering surveys before they can begin to build and reveal their rollout plan. Furthermore, the contract values above are only referencing public investment, but in some cases suppliers have also contributed some of their own private funding to help extend beyond the original target (e.g. CityFibre’s Lot 7, 2 and 27 contracts).

On top of the already agreed contracts, Project Gigabit also has a growing number of local, regional and cross-regional deals in the procurement phase for other parts of the UK (see below) and will be awarding contracts for these over the coming months and years. The dates and figures mentioned below are tentative estimates (subject to change) and will remain that way until after the contracts have been awarded.

Bidders on the related LOTS will be required to ensure that their networks and infrastructure are available for use by other ISPs via wholesale (open access). Various operators, both big and small alike (e.g. Openreach, Cityfibre, Fibrus, nexfibre (VMO2), GoFibre, Wildanet etc.), are already taking part and areas with sub-30Mbps speeds are being prioritised, albeit NOT to the exclusion of all else.

Alongside all this, the government and local bodies are also conducting various Public Reviews and Open Market Reviews (OMR), which is the process they use when trying to identify existing commercial coverage of gigabit-capable networks and any planned coverage over the next c.3 years. By doing that, they can more easily target their support toward areas where commercial projects will not go (i.e. the intervention area).

Live GIS Procurements

| Area | Est. Contract Award Date | Uncommercial Premises | Value |

|---|---|---|---|

| North East England (Lot 4) | May-23 | 53,200 | £82.7 million |

| Worcestershire (Lot 24) | July to September 2023 | 18,400 | £39.4 million |

| Buckinghamshire, (part of) Hertfordshire and East of Berkshire (Lot 26) | July to September 2023 | 40,300 | £58.8 million |

| Kent (Lot 29) | July to September 2023 | 72,000 | £112.3 million |

| West and East Sussex (Lots 16 and 1) | July to September 2023 | 62,100 | £100.6 million |

| South Oxfordshire (Lot 13.01) | August to September 2023 | 6,500 | £17 million |

| North Oxfordshire (Lot 13.02) | August to September 2023 | 4,900 | £11.2 million |

| North East Staffordshire (Lot 19.01) | September to November 2023 | 6,200 | £16.6 million |

| South Wiltshire (Lot 30) | October to December 2023 | 19,000 | £24.8 million |

| Bedfordshire, Northamptonshire and Milton Keynes (Lot 12) | October to December 2023 | 30,300 | £51.4 million |

| Derbyshire (Lot 3) | October to December 2023 | 18,200 | £33.4 million |

| Leicestershire and Warwickshire (Lot 11) | November 2023 to January 2024 | 45,400 | £71.5 million |

| Nottinghamshire and West of Lincolnshire (Lot 10) | November 2023 to January 2024 | 35,700 | £58.6 million |

| West Yorkshire and York Area (Lot 8) | November 2023 to January 2024 | 29,000 | £60.9 million |

| South Yorkshire (Lot 20) | November 2023 to January 2024 | 32,400 | £44.4 million |

| Mid West Shropshire (Lot 25.01) | November 2023 to January 2024 | 6,000 | £12 million |

| Dorset and South Somerset (Lot 14) | January to March 2024 | 22,600 | £43.2 million |

| Cheshire (Lot 17) | January to March 2024 | 17,700 | £44.7 million |

| Lincolnshire (including NE Lincolnshire and N Lincolnshire) and East Riding (Lot 23) | January to March 2024 | 74,200 | £119.3 million |

| West Herefordshire and Forest of Dean (Lot 15) | January to March 2024 | 7,900 | £23.4 million |

| East Gloucestershire (Lot 18) | January to March 2024 | 4,900 | £16.6 million |

| Peak District (Lot 3.01) | January to March 2024 | 4,600 | £10.7 million |

| Cornwall and Isles of Scilly (Lot 32) | April to June 2024 | 18,600 | £41.2 million |

| North Yorkshire (Lot 31) | April to June 2024 | 39,900 | £73.4 million |

| Mid/East Devon and West Somerset (Lot 6) | March to May 2024 | 6,300 | £18.4 million |

| Lancashire, North Wiltshire and South Gloucestershire, West and Mid-Surrey, Staffordshire, West Berkshire, Hertfordshire (Call-Off 1) | April 2024 to June 2024 | 57,500 | £149.7 million |

| West and North Devon, North West, Mid and South East Wales (Call-Off 2) | April 2024 to June 2024 | 47,100 | £139.1 millio |

The North East England (Lot 4) procurement stands out above as its estimated award date is in the past (May 2023). According to BDUK, “The North East procurement remains at contract award stage and we are currently working on the finalisation of the contract” (i.e. the contract has technically been awarded, but for some reason it’s taking longer than usual to finalise the details).

Conclusion

Sadly, it’s taken a long time to get all of these contracts into procurement, let alone award them. The new and more automated DPS system was supposed to make all of this faster and more efficient than just handing the funds to local authorities, but we’re now nearing the end of 2023 and yet some areas still haven’t got any big GIS procurements going.

On top of that, we’re still waiting for BDUK to launch a centralised website for clearly communicating their progress on each contract (this is long overdue). The quarterly updates they issue are useful, but they remain tedious for regular people to find and follow, unless you’re already familiar with the programme. A clean, clear and simple public website would help this.

However, we should remind readers that this rollout is NOT an automatic upgrade, thus you will still need to order the service from a supporting ISP in order to benefit. Similarly, 1Gbps is the target speed, but slower and cheaper options will also exist on the same lines.

The focus on “gigabit” speeds also overlooks the fact that this largely relates to download performance, while BDUK’s technical definition states that this falls to a speed of at least 200Mbps for uploads (here). This is understandable, as not all gigabit networks today are actually setup to deliver true symmetric performance.

Lest we forget that there are a lot of real-world reasons why consumers buying a gigabit package might not actually be able to achieve the top speed, due to certain realities (Why Buying Gigabit Broadband Doesn’t Always Deliver 1Gbps).

Finally, we should add that the Government has previously warned that those in the final 0.3% or so of premises may be “prohibitively expensive to reach” (i.e. under 100,000 premises) – roughly the same gap that the 10Mbps USO has struggled to fix. Solutions for those in the final batch of “Very Hard to Reach” areas are still being tested.

Project Gigabit Winter (September 2023) Update

https://www.gov.uk/../project-gigabit-delivery-plan-september-update-2023

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Virgin Media O2 UK Tackles Data Poverty with Free WiFi Service

Lot23 just found out that my town is on the map as “deferred scope”.

It’s just a shame Openreach are so bad. No symmetrical upload, yes. it IS needed, especially if you work from home…. uploading large files on a 25-110mbps up is total crap

If those are your requirements order a leased line – There’s your gig symmetrical, if you really wanted you could get 10gig symmetrical via BT.

What your actual complaint is, is you want gig symmetrical for <£70/mo, with an amazing SLA for fixes, super low latency and no contention? Support available instantly there's a problem? Maybe some incentive freebies like 12mo of XBOX Game Pass ontop ??

If you *NEED* the speed, pay for it – it'll more than likely be available via BT, just not their consumer division.

Or you could use an altnet, if they've decided you're economically viable. (Though ISP Support, SLA, contention would all be question marks depending on the provider)

Well said Matt!!

I work for a big Civils and Design Consultancy and would love mega fast symmetrical connections to get super-fast VPN. The reality is the company’s VPN isn’t up for it…and the same for use of Office365 and other enterprise grade file sharing systems.

Most people working from are using office365 and their files are in the cloud and worked on in the cloud. Uploading huge files is not a common use case. And as others have said, you can pay BT for symmetrical service, or you can try an altnet.

You may as well complain that the Ford Fiesta is poor off-road. Ford sell other cars and their are other manufacturers. Products are designed to meet the needs of the market it is aimed at. If you need to upload huge files frequently consumer broadband is not for you.

> What your actual complaint is, is you want gig symmetrical for <£70/mo, with an amazing SLA for fixes, super low latency and no contention? Support available instantly there's a problem? Maybe some incentive freebies like 12mo of XBOX Game Pass ontop ??

Wow, that's not what he said at all. The decision by BT to not offer symmetrical speeds is completely arbitrary, as the technology allows it. This is the same company that wasted years trying to sweat their copper assets with G.Fast and all that nonsense.

Various alt-nets offer symmetrical speeds but sadly their services are only available to a small proportion of the population. Every other FTTP service across the world offers symmetrical speeds (at least as an option). In India (a market I'm familiar with), you can only order symmetrical packages with most providers (all the way from 30/30 to 1000/1000 with up to 10G as an option for businesses).

And in the UK, if you are a residential customer with BT/Openreach as the only FTTP provider, you are stuck with this ridiculous 10:1 ratio. It is not a product that is designed to meet the needs of the market, as someone else pointed out. It is what /BT/ decided is good for the market, that's it.

Why not offer a symmetric service for a slightly higher price for people who need it? Openreach CEO's claims that "very healthy order inflow" is proof that they were right is also complete nonsense. If people only have Openreach as an option, what else are they going to do but order that service?

> No symmetrical upload, yes. it IS needed, especially if you work from home

While I don’t work from home, I partially agree, especially if you have an offsite backup for all your data at another family members place.

With increasing download speeds people have found ways to make use of it, it’s the same with upload speeds, we find a way. In the WfH example, lots of data now lives in the cloud so it makes even more sense.

Some people have a side gig too, uploading quickly for clients is a huge benefit.

@Sonic – the Openreach CEO say the healthy order inflow “is proof we’re right”. He said he’s comfortable with the speeds they offer because all the evidence they see – including demand and extensive market research – suggests it’s right.

@Alex – asymmetric speeds is an artifact of a bygone era where internet usage primarily involved downloading web pages. Which means technology and protocols (like ADSL and VDSL) were designed to operate in that manner, to best make use of the existing copper infrastructure.

These days upload bandwidth is just as crucial as so much data is held in the cloud. And indeed, modern fibre technology allows symmetric speeds; they are designed to work that way. For a virtual monopoly company to then hobble that product to force a legacy/outmoded model is just disingenuous.

I’m not saying that they should make it symmetric across the board (although that would be nice). But offer symmetric speeds to people that need it, at a higher cost. The “we know what’s best for you” argument is what many people are tired of.

There are people who genuinely need higher upload speeds. And the company that has a stranglehold on internet services in this country goes “nope, tough luck”.

And please, enough with the “why don’t you order a leased line” thing. Not many can afford to spend 100s of pounds each month (not to mention thousands in installation costs) just for symmetric speeds. You can be not rich and still need symmetric speeds for your work.

I going to jump in on Sonics side here – while for 90% of users asymmetric is fine if you happen to be one of those who needs decent upload only having Openreach would be super annoying. I work with people round the world and none of them have asymmetric so why do we? Its not like the tech isn’t available… Its just an arbitrary decision of someone at Openreach that wreaks of the same sort of short term thinking that left us stuck with FTTC for so long. (No one is saying it should be free but why is the thinking so out of date?)

@Sonic thanks for the unsolicited history lesson.

You’re still arguing that they should bias their business plan to a minority use case. Which also happens to be you.

By their very nature they can’t do that.

They have to pursue a business case that addresses the whole country and accounts for the way they’re regulated. They have to invest in areas that others have the luxury of avoiding. They have to serve as many people as possible as efficiently as possible, not just people who want symmetrical speeds. And, even then, they’ll probably lose market share.

Have you actually seen what their investors think of even their very credible plan for doing that?

@Cheesemp You throw out “for 90% of users asymmetric is fine”

Where do you get your stats from?

@Sonic: “The decision by BT to not offer symmetrical speeds is completely arbitrary, as the technology allows it.”

Not so. Whilst XGS-PON supports it, GPON does not. When FTTP started being rolled out, GPON was the only game in town. XGS-PON line cards for OLTs remain significantly more expensive than GPON cards (“eyewatering” comes to mind), so any sane business would think carefully before populating their entire OLT estate with XGS-PON – it’s not as if consumer broadband is a high margin business, quite the opposite in fact. Margins are wafer-thin.

Until I properly understood the technology, the history (which is relevant for RoI), and the commercials, I thought the same as you. Now I see why most fibre provision is asymmetric – and, contrary to another assertion here, that’s nothing to with ADSL’s asymmetry, but how GPON first worked (as well as the actual demand for upload speed vs download).

MikeP – I’m confused. GPON supports 2.5 down and 1.2 up. So yes, it /is/ asymmetric, but you can still deliver 1g/1g (like Cityfibre does and many others). Which is why the 1g/100m choice on Openreach is a surprising one.

Alex – apologies for the way it sounded. My point is that Openreach already provide a variety of speeds on the product, so why not provide symmetric speeds up to 1g as an option? Remember, VDSL provides a significantly higher download/upload ratio (4:1). There even was a 40/20 product on VDSL.

The main cost difference between GPON and XGSPON is nothing to do with the line cards it’s the ONUs by a mile.

Cards are usually both XGSPON and GPON now. The XGSPON transceiver is more expensive but this may be balanced by combining PONs and moving to a 1:64 split as CityFibre, Verizon, AT&T, etc, did.

Mostly the ONUs.

Either way zero technical reason for the Openreach asymmetry to be as high as it is. None at all.

We’re Lot 4 & it’s good to hear that technically it’s been awarded but I hold out little hope of shovels hitting dirt anytime in the near future. Honestly the government realised early on there was no hope of hitting targets by 2025 so retargeted the figures to what the commercial rollout would achieve so their deadline was always 2030.

What you’ve said about the Website would help matters greatly as even my Local MP struggles to get answers to what’s going on let alone the layman.

Glad to see there has actually been some movement but sadly it’s a long way off for most of us so we’ll have to continue to seek alternative means of connection

One significant need for symmetric delivery is the NHS. More and more GP’s and consultants (except those who are continually striking) are expecting to improve their productivity by performing remote consultation and this demands very high resolution video (for data uploads).

So why is symmetric transmission not required as a standard for broadband?

They’re not using broadband. NHS data isn’t on the public Internet.

I keep a close eye on the Work (symmetric) leased line connection & the usage on that for most of the day (the one exception is whilst off site backups are running) & the usage is pretty close to 10:1 Download:upload

Not saying Symmetric wouldn’t be nice but if you are serious about upload & only have an Openreach option then you *can* get 200 up *but* you pay for it (https://www.cerberusnetworks.co.uk/connectivity-broadband/fttp# for one example).. my strong suspicion is that for the vast majority of people cost trumps upload bandwidth & 100Mbps up is plenty for most..

North East England (Lot 4) May-23 53,200 £82.7 million

Whats going on with this Lot, seems to be delayed a long time. Anyone know any updates…. Supplier awarded but not contracted and no further announcements?

On what basis are these GIS contracts awarded? I would have thought it would be based on the price bid by an Altnet, but there seems to be a value already allocated before the contracts are awarded. If it’s on the basis of quality and future proofing one would have thought Openreach would be winning at least some of these contracts, but they have none. Are Openreach even bidding? If not why not? Does anyone know?