Ofcom Changes to Boost UK Full Fibre Broadband and Cut FTTC Prices

The telecoms regulator has today completed several wholesale market reviews, which among other things will force Openreach (BT) to adopt stiffer Quality of Service standards (installations and repairs), open up their cable ducts to rival ISPs and introduce a big price cut on 40Mbps FTTC broadband lines.

Ofcom’s review has largely chosen to leave newer “full fibre” FTTP/H/B and hybrid fibre G.fast broadband services alone (i.e. they don’t want to discourage the new services by being too heavy handed with regulation), while Virgin Media aren’t yet deemed to have Significant Market Power (SMP) like Openreach and have also escaped the regulatory hammer.

However the regulator has finalised new charge controls and changes for various other services and, to prevent BT from stifling new investment by rivals as network competition emerges, the operator will not be allowed to make targeted wholesale price reductions in areas where rivals are starting to build new networks (details).

Advertisement

Jonathan Oxley, Ofcom’s Competition Group Director, said:

“Full fibre meets the country’s future broadband needs, as demand for data soars.

Ultrafast speeds will allow people to download entire films, or businesses to share huge files, almost instantly. Full fibre will also underpin exciting technology like remote healthcare diagnostics, 5G mobile and connected devices.

The measures we’ve set out today will support the growing number of companies who have already announced plans to build full-fibre networks, and open the way for even more ambitious investment around the UK.”

Matt Hancock, UK Secretary of State for Digital (DCMS), said:

“Full fibre is vital to build a Britain that’s fit for the future. Ofcom’s measures will be instrumental in supporting full fibre roll-out by promoting competition and ensuring widespread availability of these services. The whole telecoms sector must now come together – in the national interest – to invest in the digital infrastructure that the UK needs and become a model of great customer service.”

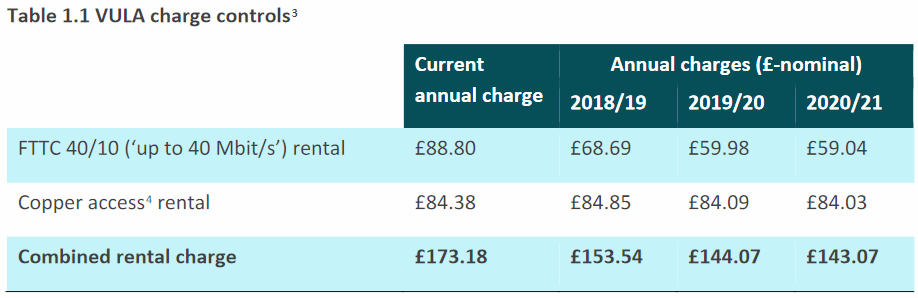

The most prominent change is surely their proposed price reduction on the ‘up to’ 40Mbps (10Mbps) upload tier of Openreach’s “superfast broadband” Fibre-to-the-Cabinet (FTTC / VDSL2) service. This service can already cover around 9 out of 10 UK premises and it’s fast growing towards almost universal coverage.

As a result Ofcom now believes that it’s time to cut the wholesale price of the 40Mbps tier, which should bring the price down much closer to the level of slower ADSL2+ based copper line broadband products and thus make it easier to shift subscribers off those older connections. On top of that BT/OR will no longer be subject to the detailed VULA Margin Condition test was imposed in 2014.

In the regulator’s view this change will “help BT’s rivals to compete for customers, while several build out their own full-fibre networks,” which is at least partly true. Internet providers like TalkTalk, Sky Broadband and other ISPs will no doubt rejoice and it will help to fuel stronger uptake, which is also good for the Government’s Broadband Delivery UK programme (i.e. clawback linked reinvestment of public funding to boost coverage).

On the other hand the regulator runs the risk of making slower FTTC so cheap that it could discourage investment in new / ultrafast networks, which might struggle to compete against the extremely low pricing. Lest we forget that both the Government and Ofcom are currently very keen to encourage more coverage of ultrafast “full fibre” FTTH/P broadband (example), especially via alternative networks.

Advertisement

A similar situation already exists in today’s market. Just under half of the broadband lines in the UK are still based off slower copper ADSL based lines and that’s partly because they’re so cheap and not everybody sees a need for the faster services (FTTC, HFC DOCSIS, FTTP etc.), which tend to attractive a higher monthly premium.

Quality of Service

The review will also introduce stronger service performance and quality standards, which would require Openreach (BT) to install and repair related services more quickly than they do today. The targets for this have been tweaked a bit since the original March 2017 proposal (here), but they still represent a big improvement.

Openreach will be required to (by 2020/21):

- Complete at least 88% of fault repairs within one or two working days of being notified, up from 80% today;

- Complete at least 97% of repairs within seven working days;

- Provide an appointment for 90% of new line installations within 10 working days of being notified, compared to 80% within 12 days currently; and

- Install 95% of connections on the date agreed between Openreach and the telecoms provider, up from 90% today.

Ofcom states that these rules will also be complemented by a range of other improvements, such as the new system for automatic compensation when things go wrong (here).

Advertisement

Cable Duct and Pole Access

As expect the regulator has also finalised their approach to Duct and Pole Access (DPA), which allows Openreach’s existing telegraph poles and underground cable ducts to be used by rivals in order to deploy new ultrafast broadband services (e.g. FTTP/H). Openreach will also have to repair faulty infrastructure and clear blocked tunnels / ducts where necessary for providers to access them, which can be very expensive.

Ofcom states that this measure, which is already being used by providers such as Virgin Media and Cityfibre, will “fundamentally change the business case for building new networks … It could cut the upfront costs of laying fibre cables by around 50% – from £500 per home, to £250. It could also reduce the time required for digging works, enabling fibre to be installed in some streets in a matter of hours, where it would have taken days.”

Openreach must also ensure there is space on its telegraph poles for extra fibre cables connecting homes to a competitor’s network. And it must release a ‘digital map’ of its duct and pole network, so competitors can plan where to lay fibre. On many of these points Openreach is already way ahead of the regulator and has started to implement most of the changes via a revised Physical Infrastructure Access (PIA) product.

Key Decisions (DPA / PIA)

• Access to BT’s ducts and poles. BT must allow other telecoms providers access to deploy their own networks in BT’s underground ducts and chambers or overhead on its telegraph poles. This network access obligation also requires Openreach to make adjustments to the existing infrastructure, so it is ‘ready for use’ – repairing faulty infrastructure and relieving congested sections where necessary.

• Enabling greater flexibility in the use of ducts and poles. We are relaxing the current PIA usage restriction to allow ‘mixed usage’: telecoms providers can deploy local access networks offering both broadband and non-broadband services, provided the primary purpose of the network deployment is the delivery of broadband services.

• Access on equivalent terms to ensure a level playing field. BT is subject to a ‘no undue discrimination’ condition, requiring strict equivalence in respect of all processes and sub-products that contribute to the supply and consumption of duct access, unless BT can demonstrate that a difference is justified. We will support these measures through ongoing monitoring to ensure that they are effective.

• Access to digital maps to support large-scale network planning. Telecoms providers must be provided with integrated access to digital maps with Openreach’s duct and pole network records, including detailed location information and the extent of spare capacity.

• Processes to ensure efficient network deployment. BT is required to publish a Reference Offer, setting out how operational processes (e.g. ordering PIA, clearing blocked ducts) will work, together with relevant terms and conditions including service level agreements and guarantees.

• Pricing to support competitive investment. We are setting a cap on PIA rental charges which results in significant reductions compared to current rental charges. Costs associated with making the existing infrastructure ready for use will be recovered from all users of the infrastructure, up to a limit of £4,750 per kilometre, with other ancillary charges required to be cost-based. We are also placing financial reporting requirements on BT, so that we can monitor the effectiveness of the pricing regulation and the ‘no undue discrimination’ condition, in terms of the recovery of costs between BT’s own use and that of other telecoms providers using duct and pole access.

We should point out that it’s long been possible for ISPs to access Openreach’s existing ducts via the old PIA solution, although rivals complained that this was often cumbersome (administration), suffered from awkward costs and was intended more for helping to connect residential homes (i.e. using it to provide leased line style rural backhaul or big business connectivity wasn’t possible, although this helps alternative networks to build a more economically viable model). The new approach seeks to rectify many of those failings.

A number of trials have already been conducted (here), although these did suffer from a few problems with blocked ducts, limited duct space, cost and a lack of maps for new cables causing various hiccups (here and here). Improvements have been made since then but BT still warns that not all of their ducts will be usable.

An Openreach Spokesperson said:

Overarching

“Ofcom’s statement gives us certainty on their approach to key products and we welcome Ofcom’s intention to support investment in full fibre networks. But to incentivise further FTTP investment, infrastructure builders – including Openreach as the largest FTTP builder in the UK – need to be certain they can secure a return on their investment and a fair bet. In particular, we will need to look carefully at geographic pricing restrictions and need to define future fair bet conditions in more detail.

In the meantime Openreach is getting on with the job of making Fibre-to-the-Premises broadband available to three million premises by the end of 2020. That puts us on the right trajectory to cover ten million premises with FTTP by the mid-2020s if the conditions are right. We want to go significantly beyond that – to the majority of the UK – but the pace and extent of our investment will depend on how quickly other key enablers can be realised. We welcome Ofcom’s comments around support for a future digital switchover.”

On MSLs/service

“Continuing to improve service is our number one priority, having exceeded Ofcom’s broadband targets for the last three years. We view these as a minimum, not a target, and we’ve been making great strides over the last year in reducing the number of faults on our network and speeding up new connections and repairs. We’re determined to go even further so we support the ambition of higher service standards.”

Ducts and Poles

“Our ducts and poles have been open since 2011 and we have been sharing a digital map of this network for more than a year.

We’ve been making the process more accessible and user-friendly and we’ll now work closely with our customers to consider how to develop and implement these latest proposals effectively.”

BT estimates that the price changes in today’s Ofcom WLA draft statement, for the directly charge controlled products, will have a year on year adverse financial impact on Openreach’s revenue and profit in 2018/19 in the range £80m – £120m.

The operator added that there will also be further year on year impacts on Openreach, resulting from price reductions to the directly charge controlled products, in each of the successive two financial years in the range of low to mid tens of millions of pounds. Additionally, Openreach’s cost base will increase as a result of meeting the more demanding minimum service levels required in WLA markets.

Conclusions

Overall Ofcom notes that “full fibre” (FTTH/P) broadband services are currently only available to around 3% of UK premises and they believe that today’s changes will deliver a significant improvement. Indeed recently a number of alternative network (AltNet) providers have announced significant investments and the regulator expects that these could boost coverage to 20% by 2020.

For example, Hyperoptic aim to cover 2 million urban premises with FTTH/P by 2022 (aspiration for 5 million by 2025), while Vodafone with Cityfibre will reach 1 million by 2021 (aspiration for up to 5 million by 2025) and Virgin Media plan 2 million by around 2019/20. Not to mention all of the work by smaller operators and Openreach’s own plan for 3 million by 2020 (aspiration for 10 million by c.2025). TalkTalk has also proposed a similar deployment.

One caveat with the above is that we don’t yet know how much overlap (overbuild) will exist between these rival FTTP/H deployments, which is a significant factor and difficult to predict. In some areas we might potentially see a choice of several FTTH/P providers and streets being dug up several times, although hopefully natural competition will help to balance things out and some consolidation may follow as new networks grow.

On the other hand today’s improvements are largely as expected and won’t change the viewpoint that Ofcom remains fixated on fostering a market of cheap broadband services, which sounds good for consumers but does make it harder to sell faster “full fibre” lines (i.e. if you can do everything you want with a 40Mbps FTTC today for only a little money then would you pay significantly more for FTTH/P? Plenty would but is it enough to make the model work).

Likewise precious few of today’s measures will do anything to support Openreach’s on-going calls for more flexibility in regulation, which they say is needed if they are to solidify a plan for expanding their FTTP network to 10 million premises by around 2025 (currently they’ve only put a solid strategy in place for reaching 3 million premises by 2020).

2017/18 Wholesale Local Access Market Review

https://www.ofcom.org.uk/../wholesale-local-access-market-review

UPDATE 8:48am

Budget ISP TalkTalk has sent in its response and we expect more to follow.

A Spokesperson for TalkTalk said:

“Ofcom’s strong decision is good news for consumers, competition and investment. We have long argued that Openreach has no incentive to invest in the full fibre broadband that Britain needs when it could make excess profits by overcharging for copper-based services. Ofcom’s move not only protects customers in today’s market, but also ensures Openreach and others are encouraged to invest in the full fibre networks of tomorrow.”

UPDATE 9:42am

Hyperoptic has offered a comment.

Dana Tobak, CEO of Hyperoptic, said:

“We welcome the news of Ofcom’s draft statement on the Wholesale Local Access market. In particular its recommendations for supporting investment in Full Fibre network build by limiting the lowering prices on the 40 Mb FTTC product, allowing mixed use for duct and pole access which will allow infrastructure builders to create stronger business cases for more investment and ensuring equivalence of inputs with respect to BT’s own use of DPA.

Of course, the details matter, and matter significantly, so final implementation of the statement needs to follow in both spirit and operational processes.

We look forward to Openreach’s publication of a reference offer, which fully matches or exceeds Ofcom’s statement, given its independence from the BT Group. This will ultimately create a better digital future for the UK, not just serve the interests of BT retail.”

We’ve also added Openreach’s comment above.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Cityfibre Calls on Ofcom to Rethink its Approach for Full Fibre

Comments are closed