Alternative Full Fibre ISPs Aim to Cover 3.38 Million UK Premises by 2020

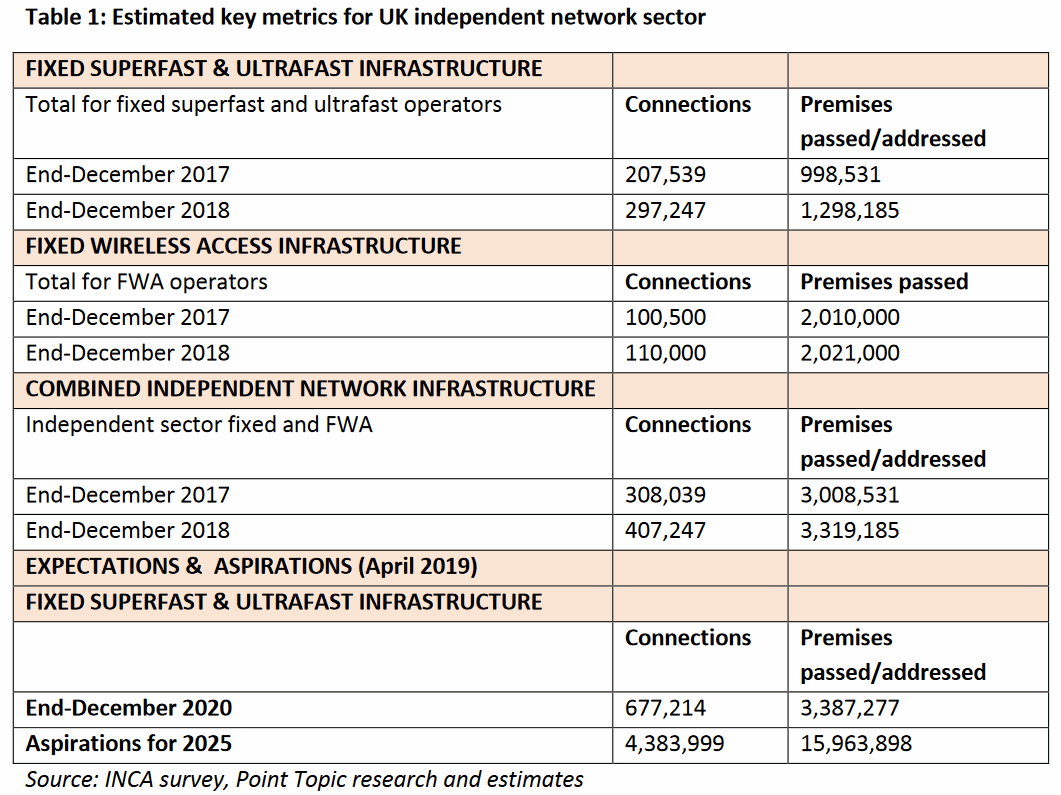

A new report from the Independent Networks Co-operative Association (INCA) and Point Topic has estimated that alternative “full fibre” (FTTP/B) broadband ISPs grew their coverage by 30% in 2018, reaching 1,298,185 UK premises. Related providers are now forecast to reach 3.38m premises by the end of 2020 and 15.96m by 2025.

The figures are notably lower than Ofcom’s recent update (here), which reported that ultrafast full fibre networks had now passed around 1.8 million premises by January 2019 (7% UK coverage). The reason for that is largely because INCA has excluded Openreach’s (BT) rollout of Fibre-to-the-Premises (FTTP) and focused its attention on independent alternative network (altnet) ISPs, such as B4RN, Cityfibre, Gigaclear, Hyperoptic and many more (Summary of UK Full Fibre Plans).

In addition, INCA’s report also estimated that 2,021,000 UK premises had the ability to order a superfast or ultrafast broadband capable Fixed Wireless Access (FWA) based service via different altnet ISPs, although this figure has only risen by a tiny amount since 2017 (most likely due to the growing focus on full fibre). FWA coverage forecasts are also prone to error due to complications with line-of-sight and fragmented supply.

Advertisement

Nevertheless this means that, according to INCA, the United Kingdom’s independent broadband infrastructure providers (both full fibre and wireless) are currently estimated to “pass or address” nearly 3.32 million premises. On top of that private sector investment announcements totalling £3.36bn have been made within the past year alone relating to altnets (doesn’t represent the entire market and, for example, excludes prospective investment in FibreNation via TalkTalk).

At this point we must caution that any predictions for future coverage are much harder to gauge, not least because deploying FTTP/H/B is a slow and expensive process that can easily be delayed by complicated problems (wayleaves, permits and permissions, blocked cable ducts etc.).

However, at least some of the aforementioned problems could be resolved or improved as a result of the Government’s Future Telecoms Infrastructure Review (FTIR) proposals, many of which are now in the process of being implemented via Ofcom and new legislation.

Advertisement

INCA’s Key Concerns

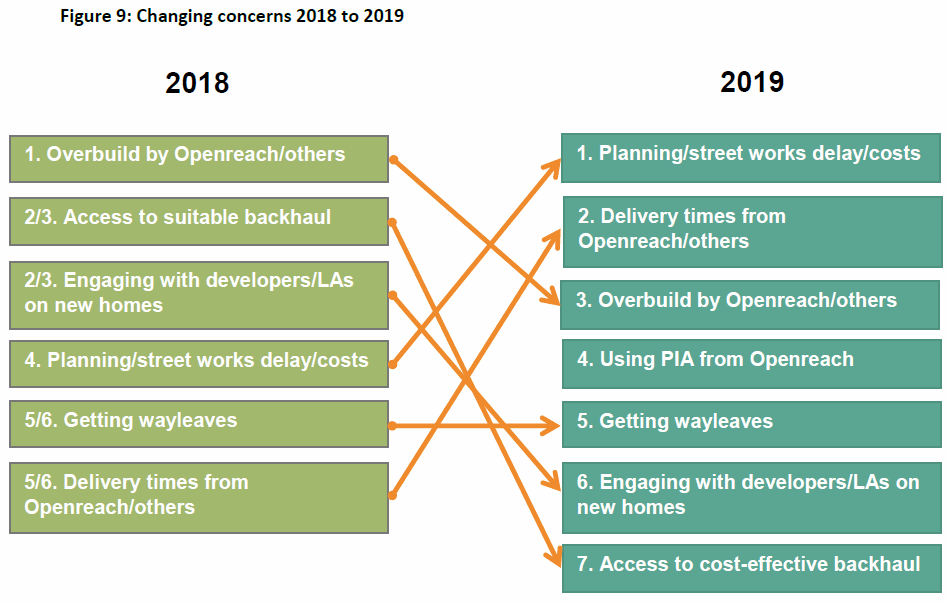

• Planning and street works delays and/or costs, delivery times from Openreach and other operators, and overbuild are the top three concerns for independent network operators

• Using Passive Infrastructure Access from Openreach ranks fourth in this year’s list

• Access to cost-effective backhaul services and engaging with developers and/or local authorities on new build housing plans have both moved down the list of key concerns

• In addition, there is general concern in the industry about access to labour with suitable skills in a post-Brexit environment.

On top of that there is a tendency for some operators to report technically unfinished or non-live builds (can’t order the service itself) in their premises passed figures, which can cause complicates when forecasting future coverage. Not to mention the issue of overbuild that is created by multiple overlapping fibre optic networks, which not only creates a messy civil engineering situation but won’t do much to help overall UK coverage.

Coverage is important here because the Government has set an ambition, albeit at present a largely unfunded one, to achieve “nationwide” coverage of Gigabit capable full fibre broadband networks by 2033.

Malcolm Corbett, INCA CEO, said:

“These latest figures are very promising. The scale of investment in the UK’s independent network sector over the past year has reached an impressive level, with £3.36bn of private funding being committed. This has contributed to the flourishing independent sector in the UK and the great work that is being done to connect homes, schools and businesses across the country.

It is crucial, however, that we stay mindful of the challenges identified in the report. For the government’s ambitious targets to be met, our main concerns remain – planning and street work costs, delivery times from Openreach, access to ducts and poles, and overbuild. Access to a pool of labour with suitable skills in a post-Brexit era is an additional concern which needs to be addressed.”

Annelise Berendt, Principal Associate at Point Topic, added:

“It is super to see the independent network operator sector so vibrant and ambitious. Independent operators have a significant role to play in promoting a healthy, well-functioning broadband sector as the UK looks to deliver on its ultrafast targets. This report highlights they are stepping up to this role, playing their part both now and for the future.”

Broadly speaking the direction of travel continues to be a positive one and we fully expect that the ramping up of full fibre deployments will continue for many years to come. On the other hand it’s worth considering that INCA and Point Topic’s future forecast seems to be at least partly based on some of the more optimistic predictions from altnet providers, which may or may not come true.

The aggressive level of competition and overbuild will inevitably produce winners and losers, which tends to invite future consolidation as well as a few failures. Suffice to say that it’s always wise to take such forecasts with a pinch of salt.

Advertisement

2019 INCA AltNet Broadband Report

https://www.inca.coop/sites/default/files/independent-network-report-inca-spring-2019.pdf

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« 2019 Report Ranks UK 27th in World for Mobile Broadband Speeds

Cross-Party MPs Launch Another UK Rural Broadband Inquiry »

Comments are closed