Alternative Full Fibre ISPs Aim for 15.7 Million UK Premises by 2025

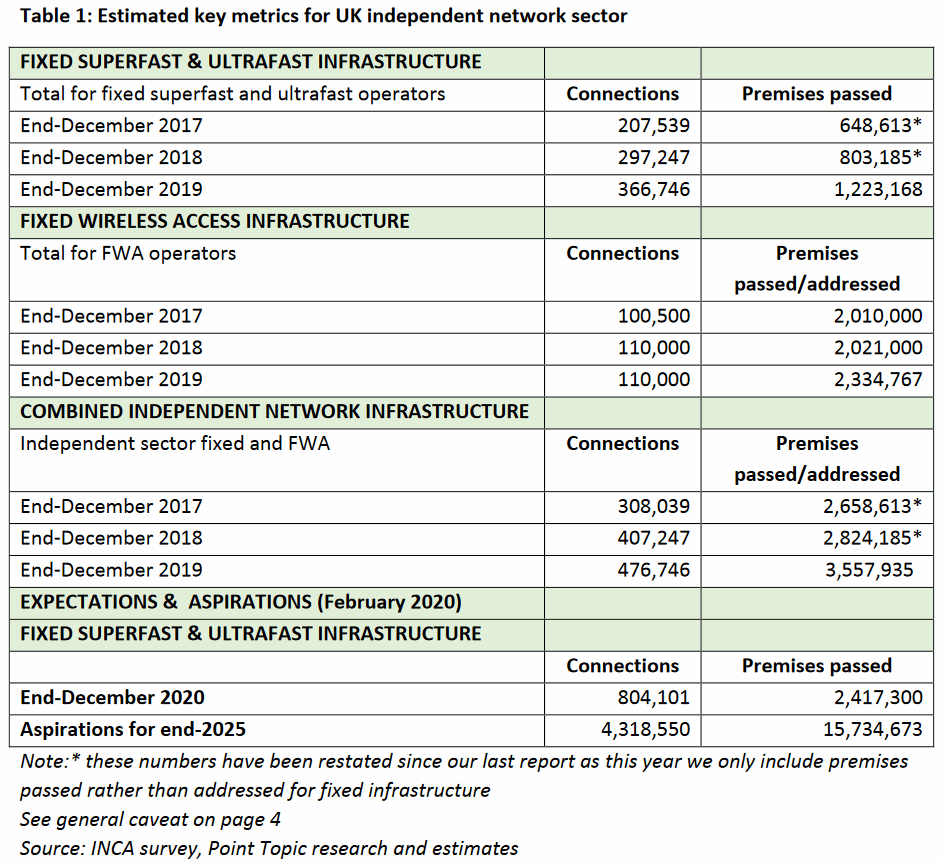

The Independent Networks Co-operative Association (INCA) and Point Topic have today estimated that alternative “full fibre” (FTTP/B) broadband ISPs grew their UK coverage by 50% in 2019 (up from 23% last year) and now reach 1,223,168 premises passed. Going forward such providers aspire to cover 15,734,673 by the end of 2025.

As usual the figures given above are lower than those stated in Ofcom’s recent update (here), which reported that ultrafast full fibre networks had passed over 3 million premises by September 2019 (10% UK coverage). The reason for this is because INCA has excluded Fibre-to-the-Premises (FTTP) deployments from established mainstream operators, including Openreach (BT), KCOM and Virgin Media, and focused its attention on independent alternative network (altnet) ISPs, such as B4RN, Cityfibre, Gigaclear, Hyperoptic and many more.

On top of that we’re pleased to see that INCA has finally revised the methodology for their figures, which now “only include premises passed rather than addressed” for fixed infrastructure. We think this is a good move as their previous estimates and forecasts gave an otherwise overly optimistic (some would say misleading) impression of coverage. One downside to this is that we can’t compare their previous forecasts with actual delivery.

Advertisement

As things stand the report predicts that altnet providers will deliver 2.42 million full fibre premises by the end of 2020, before rising to 15.73 million by the end of 2025. But the figures for 2025 are based more on roll-out aspirations and so should be taken with a pinch of salt, particularly since unexpected events like COVID-19 can easily disrupt such plans. Meanwhile the current take-up rate is 30%, which is a good result as fibre operators tend to look for 20-25%+ to help make their models viable.

Likewise the figures don’t weight for overbuild, they’re thus a raw overall total. Furthermore there is often a tendency for some operators to report technically unfinished or non-live builds (i.e. can’t order the service itself) in their premises passed figures, which can cause complicates when forecasting future coverage.

Elsewhere INCA’s report also estimated that 2,334,767 UK premises currently have the ability to order a Fixed Wireless Access (FWA) based broadband service via different altnet ISPs, although FWA coverage forecasts are prone to error due to complications with line-of-sight and fragmented supply. Being covered by FWA is also not necessarily the same as being covered and able to receive a superfast or better speed.

Advertisement

On top of this INCA reports that altnets have attracted financial-related “announcements” totalling £936m during 2019 and early 2020, which is in addition to an estimated £5.7bn of private investment-related announcements already made in relation to the sector (overall total so far of £6.6 billion). The intended capex spend by at least part of the sector from now until end-2025 is estimated at over £5.4bn.

Malcolm Corbett, CEO of INCA, said:

“The substantial increase from last year is very promising. These impressive results are reflected in the scale of investment in the UK’s digital infrastructure. We calculate that a commitment of £6.6bn has been announced for the independent operators. Coronavirus has demonstrated clearly the reliance we all have on connectivity.

We look forward to seeing Government continuing to prioritise renewal of the UK’s digital infrastructure, both fixed-line and wireless.”

Overall it’s clear that altnet providers are continuing to have an increasingly significant impact across the United Kingdom and that is set to continue for the foreseeable future, which is one of the reasons why major operators like Openreach have been ramping-up their own deployments. Never underestimate what a bit of competitive pressure can do, as well as the usual wheels of regulation and a stronger political drive toward fibre.

The Government has of course recently proposed to invest £5bn of extra public funding – focused on helping those in the final 20% of hardest to reach premises (outside-in strategy) – to help ensure that “gigabit-capable broadband” (via full fibre, cable / DOCSIS, 5G etc.) is able to reach every UK home by the end of 2025 (here). A framework for this is expected in 2021 but the target remains highly optimistic.

On the other hand the aggressive level of competition and future overbuild will inevitably produce some winners and losers, which tends to invite future consolidation as well as a few failures. Suffice to say that it’s always wise to take such forecasts with a pinch of salt.

Advertisement

Finally, it’s noted that altnet providers still have a number of familiar concerns, some of which (e.g. overbuild by Openreach), remain just as strong now as in previous years. Meanwhile other issues, such as the known problems with access to skilled civil engineers and wayleaves (legal access agreements), have crept up the list of importance in 2019.

However, the report notes that many of the operators’ concerns are still being addressed. Planning and street work delays and/or costs, which was last year’s top issue has moved down the list, suggesting that work done by Government and local authorities is starting to pay-off.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Wireless UK ISP Wildanet Get £400k to Grow Cornwall Network

Rural Broadband ISP Voneus Restructures Management Team »

My only issue with AltNets are you wouldn’t be able to change provider, ie if you get Hyperoptic you can’t change to Zen whereas Openreach you could change to any provider that want to use their FTTP.

In the future most altnets will probably end up being bought out just like the many small cable providers did to become just ntl and telewest then they joined and now it’s all virgin.

Ofcom and FTTP altnet providers are currently developing a new migration system that will include them. It’s in the interests of altnets that they develop this as they’re much more likely to benefit from people leaving established networks to join them than the other way around, at least that’s the thinking we see.

Touched on this subject a bit with Cityfibre recently:

https://www.ispreview.co.uk/index.php/2020/02/cityfibre-on-the-challenges-of-copper-to-full-fibre-migration.html

Given how diff many altnets are that sounds a bit of a headache tbh to setup. Obs consolidation will eventually end most of that as an issue.

Building new migration systems has always been a historical headache in the broadband sector (getting ISPs to agree is half the battle), but Ofcom are pushing this forward and backed by legislated changes to the EECC. One way or another it will become a reality. Consumers will definitely benefit from a smoother system.

Demand for full fibre speeds was already week before the plague. If we go into economic depression afterwards demand is going to be even weaker cut throat pricing even more important and fibre investment returns even shakier.

I would be surprised if we see anything like 15million by 2025

It’s actually had an uptick as people have been stuck at home and needed broadband more.

Once installs can happen again at a more normal pace this ‘brave new world’ should show itself more clearly.

Are you opposed to retraining to handle fibre or is it not an option? Would widespread uptake of FTTP endanger your job?

Just trying to work out whether your posts are for personal reasons or you’re hoping FTTP will be slow enough you can retire working on metal.