Audit Office Casts Doubt Over Value of N.Ireland Broadband Contract UPDATE

The Northern Ireland Audit Office (NIAO) has today raised concerns over the number of properties that will be covered by the £165m state aid supported Project Stratum rollout in Northern Ireland, which highlights that some premises may have been “commercially viable” for FTTP broadband delivery without subsidy.

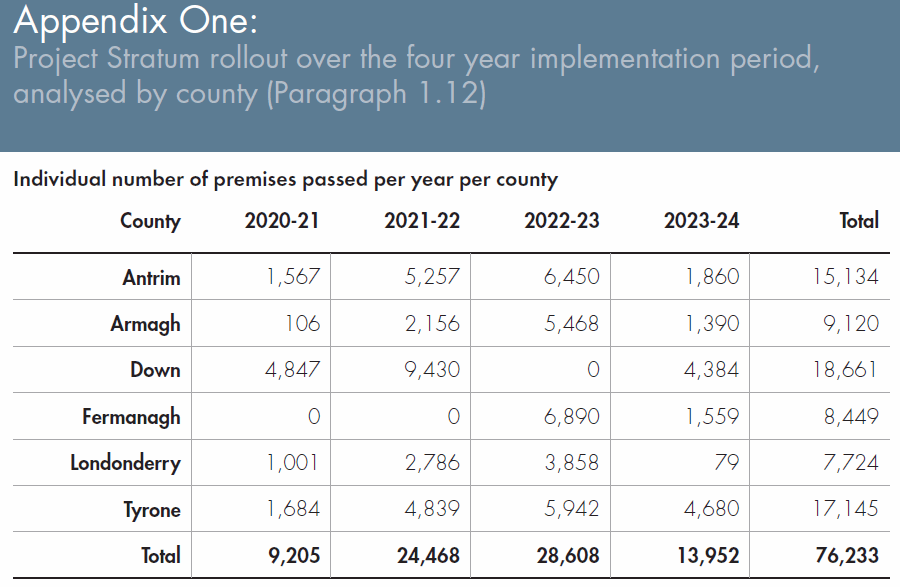

Under the contract, which was awarded last year, UK ISP Fibrus – the winning bidder – will be required to spread a gigabit-capable Fibre-to-the-Premises (FTTP) broadband network to a further 76,233 premises in disadvantaged rural areas by March 2024 (84,500 if you include the recent expansion). The operator has already completed 15,000 premises (here).

The intervention area reflects some of the hardest to reach premises (mostly rural), which were not previously expected to benefit from such connectivity as part of any commercial plans (i.e. they required state aid support). Both BT (Openreach) and Fibrus bid on the same contract, although the NIAO’s new report questions whether enough weight was given in the judging process to the differing coverage commitments.

Advertisement

According to the NIAO’s latest report, both bids were reviewed by a panel and scored out of 100 marks, with coverage commitments being allocated a max of 30 of those points (i.e. how many premises within the intervention area would be reached). BT’s bid covered 100% of the target intervention area, while the proposal from Fibrus covered almost 97% (i.e. Fibrus’ bid omitted c.2,500 premises, which would have cost an estimated £24m extra to reach).

The report also notes that in September 2020, shortly after the contract was handed to Fibrus, the unsuccessful bidder (BT) submitted details to the Department of its planned further investment to extend FTTP coverage, which included 16,000 premises that had previously been identified within the Project Stratum target intervention area – a somewhat controversial move by the operator (here).

Subsequently, in April 2021, BT further announced that it intended to invest £100m in the next 12 months to expand the availability of 1Gbps broadband to a further 100,000 premises and maintain its current network. BT confirmed that the investment would cover rural villages across Northern Ireland, including villages that already featured in the Project Stratum intervention area. BT has noted that it is normal that plans can change because of operational issues and that the updated premises data it provided in September 2020 reflected changes to its commercial build and future plans that had occurred since its last Open Market Review (OMR).

Mr Kieran Donnelly CB, Report Author, said:

“This ambitious Project aims to widen access to high speed broadband in Northern Ireland, and specifically to help redress the disparity between access in urban and rural areas. I am surprised, therefore, that the procurement scoring methodology allowed the solution proposed by Fibrus to score so highly in relation to coverage given that it did not propose to cover the full intervention area and the cost of making up the shortfall, estimated at £24 million, will be so substantial.

While I accept that the scoring method was undertaken in line with the tender documentation issued to bidders, in my opinion it did not make sufficient reduction in the scoring to account for the impact of delivering less than 100 per cent coverage. At the same time, I want to recognise that the Department has done a lot of things well in the procurement, learning lessons from past procurement processes.

Project Stratum was intended to provide high speed full-fibre broadband to the target intervention area on the basis that these areas were commercially unviable. The fact that BT have now released plans to invest in the Project Stratum target intervention area raises questions about whether some of the premises included within the project were already commercially viable, and if the overall level of public subsidy afforded to this project was required.”

A Spokesperson for Openreach said:

“Openreach engaged fully with the Project Stratum tender process. We wish the Department for Economy well with this important project, and we continue at pace to expand our Ultrafast Full Fibre network delivering gigabit capable broadband to almost 75% of premises across Northern Ireland.”

It’s important to note that the questions being raised over “whether some of the premises included within the project were already commercially viable” doesn’t just reflect criticism upon the Northern Ireland Executive and their decision-making process. But also whether BT’s original bid was a fair representation of what they could actually deliver via their own private investment at the time.

Advertisement

Build plans certainly do change, but rarely do we see them change quite as fast as Openreach’s did after they lost the contract – a lot of the premises they viewed as unviable quickly became viable again, which some may view as undermining Fibrus’ deployment plans. We have actually covered this issue before (here), so the NIAO are just catching up.

In conclusion, the NIAO states: “As the project has only recently commenced, we consider that it is too early to conclude definitively on value for money. However, some of the issues we have identified mean that it will be difficult for the Department to prove that value for money has been maximised.” We also get an overview of the project’s build predictions.

The report also reveals that Fibrus are contributing £46m to the Project’s network build costs, which will be measured and monitored under the terms of the contract. This brings the overall network build cost of Project Stratum to £211 million (we’re not entirely sure if that total includes the recent coverage expansion). The NIAO has also published a spoken summary of the report via YouTube:

Advertisement

UPDATE 11:15am

Added a comment from Openreach above.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Quickline Appoint New COO and CTO Ahead of UK Fibre Rollout

yes it is amazing how fast an area becomes viable once an altnet steps up.

But you don’t mind the this alt net seems to be taking money and isn’t offering the tax payer value for money. Just like a lot of the Gigaclear Government funded work too which is either years behind or just isn’t going to happen.

And where do you stand on alt nets using the courts to increase the cost of FTTP to the UK consumers?

Pretty obvious though really, No FTTP then no need to compete for business so no need to build.

Isnt it funny how Openreach/BT can suddenly claim within a short time that previously unviable premises are now viable! I wonder if they had won the Stratum contract would that have happened, or rather they would have still claimed the public subsidy?

The timing seems very suspicious to me.

Perhaps the BBC should do an investigation, rather than just reporting the NIAO which doesnt seem to understand the framework rules governing such public contracts.

To be fair it does become a lot more viable once your business is at risk of losing 70k odd customers. I think pound for pound openreach could have delivered more value if they had got the contract. In the long run it’s hopefully going to be give customers more choice though.

Stratum had been delayed slightly in the Fermanagh area. Was due to go live to a few thousand homes at the end of November been told they only just got the build finished then and it will now be early Jan.

One thing that does annoy me a it though is that some of the local towns and villages they had to build though in this area to reach stratum areas went live a month or two ago and we are still waiting…

I am in a rural NI village and BTO laid FTTP across the whole village in December 2020. Last month Fibrus overlaid the same BT footprint with their own FTTP.

I’m not sure why Fibrus would do this while many other areas still have nothing.

The Gas services need a fibrus kick in the but also. Phoenix gas want £6k off 4 house for 50 mtr lane. they stopped the service at a bend of the lane even though they had made 25-30 mtr service for 1 small hairdressing business at the bend in the lane. You do the math.

Bt stopped their fibre, at their green box, where? i hear you ask. Well at the bend in the lane.

so i’m on oil, hybrid broadband and irrelevant for the foreseeable.

BT are a force of knowledge and experience!

They take their time but thats good business accumment, they had it easy, then fibrus so they now compete. Thats life.

Lets see if fibrus can produce the goods.

Someone in Stormont fell out with someone me thinks.