Gov Issue Summer 2022 Update on UK Project Gigabit Broadband Rollout

The Government’s Building Digital UK (BDUK) programme has today published the latest quarterly Summer 2022 update for their £5bn Project Gigabit broadband rollout scheme, which reveals that they’ve launched new procurements in Hampshire and Shropshire, but are struggling in Staffordshire and Hertfordshire.

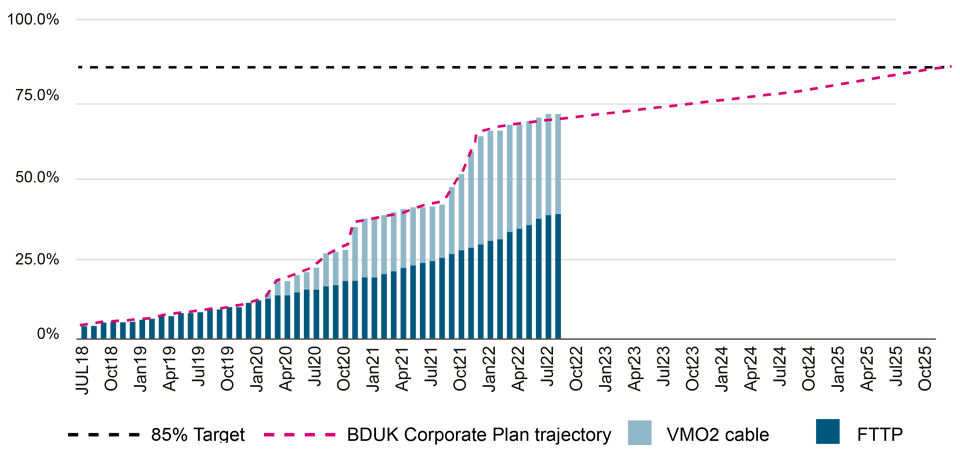

Project Gigabit seeks to extend networks capable of delivering download speeds of 1000Mbps (1Gbps) to reach at least 85% of UK premises by the end of 2025 and then “nationwide” coverage (c.99%) by around 2030 (here). The funding released for this will depend upon how the industry responds. So far only £1.2bn has been released from the budget up until 2024, but more is expected to be unlocked once the industry shows it can deliver.

At present around 70% of UK premises can already access a gigabit-capable network (c.38% via just FTTP) and that’s mostly thanks to Virgin Media’s upgrade of their existing HFC lines (here). Generally, it’s hoped that commercial builds alone could push gigabit coverage up to around 80% by the end of 2025 (mostly in urban areas).

Advertisement

The new project is thus designed to focus on improving connectivity for those rural and semi-rural areas in the final 20% (5-6 million premises). This consists of several support schemes, including gigabit vouchers (£210m), funding to extend Dark Fibre around the public sector (£110m) and gap-funded deployments with suppliers (rest of the funding) – better known as the Gigabit Infrastructure Subsidy (GIS) programme.

Today’s article is focused upon the GIS programme and related procurement work, which sees ISPs bidding – via a new Dynamic Purchasing System (DPS) run by BDUK – to extend their networks across semi-rural and rural parts of the UK.

What’s New in the Summer 2022 Update

The big news this time around is that BDUK has managed to award their first deployment contract under the new programme, which went to North Dorset and has been covered in a separate news item this morning (here). But that was only a smaller local supplier procurement for c. 7,000 premises and bigger regional contracts are set to follow (e.g. the £109.2m one for 60,800 premises in Cumbria / LOT 28).

As it stands, the total value of Project Gigabit’s procurements launched to date is over £690 million, which if delivered would see up to 498,000 extra premises being passed by a gigabit-capable network. But a lot of areas have yet to enter the procurement phase and this doesn’t factor in future extensions to contracts that do get signed, so this is by no means a complete picture.

Advertisement

However, there is bad news for a number of areas, such as Shropshire and Staffordshire, as well as part of Hertfordshire, which seem to be struggling to find much interest from potential suppliers.

Live GIS Contracts (Signed)

| Area | Contract award date | Supplier | Uncommercial Premises | Value |

|---|---|---|---|---|

| North Dorset (Lot 14.01) | August 2022 | Wessex Internet | 7,000 | £6.3m |

Live GIS Procurements

| Procurement Type | Area | Contract award date | Uncommercial premises in procurement area | Indicative Contract Value |

|---|---|---|---|---|

| Local | Teesdale (Lot 4.01) | August 2022 | 4,100 | £6.6 million |

| Local | Cornwall (Lot 32.03) | Oct-22 | 9,750 | £18 million |

| Local | Cornwall and Isles of Scilly (Lot 32.02) | Jan-23 | 9,500 | £18 million |

| Local | Lot 27 Hampshire (Lot 27.01) | April to June 2023 | 10,500 | £14.5 million |

| Local | Lot 25 Shropshire (25.01) | April to June 2023 | 7,300 | £10.8 million |

| Local | Lot 25 Shropshire (25.02) | April to June 2023 | 12,200 | £24 million |

| Regional | Cumbria (Lot 28) | Sep-22 | 60,800 | £109.2 million |

| Regional | North East England (Lot 4) | Nov-22 | 61,800 | £89.6 million |

| Regional | Cambridgeshire and adjacent areas (Lot 5) | Nov-22 | 49,700 | £68.6 million |

| Regional | Norfolk (Lot 7) | Mar-23 | 86,200 | £114.2 million |

| Regional | Suffolk (Lot 2) | Mar-23 | 87,200 | £100.4 million |

| Regional | Hampshire (Lot 27) | April to June 2023 | 88,600 | £104.1 million |

The dates and figures mentioned above are naturally estimates (subject to change) and will remain that way until after contracts, as well as engineering surveys, have been awarded. In addition, the contract values above are only referencing public investment, although it’s expected that suppliers may also contribute some of their own private investment to each contract.

Advertisement

BDUK also has a long list of upcoming procurements in their pipeline (see below). But as noted earlier, some projects (e.g. Scotland and Wales) haven’t even got this far yet. This pipeline represents an indicative forward view of commercial activity to be undertaken by the programme. Some of the information provided is based on modelled data that will be superseded.

Bidders on the related LOTS will be required to ensure that their networks and infrastructure are available for use by other ISPs via wholesale (open access). Various operators, both big and small (e.g. Openreach, CityFibre, Gigaclear, Virgin Media [VMO2] etc.), are expected to take part and areas with sub-30Mbps speeds are being prioritised, albeit NOT to the exclusion of all else.

Alongside all this, the government and local bodies are conducting various Public Reviews and Open Market Reviews (OMR), which is the process they use when trying to identify existing commercial coverage of gigabit-capable networks and any planned coverage over the next c.3 years. By doing that, they can more easily target their support toward areas where commercial projects will not go (i.e. the intervention area).

Future GIS Procurements

| Procurement Type | Area | Est. Contract Award Date | Uncommercial premises in procurement area | Indicative Contract Value |

|---|---|---|---|---|

| Regional | Lot 24 Worcestershire | July to September 2023 | 45,600 | £50 to 84 million |

| Regional | Lot 13 Oxfordshire and West Berkshire | July to September 2023 | 67,000 | £67 to 14 million |

| Regional | Lot 29 Kent | July to September 2023 | 109,500 | £119 to 203 million |

| Regional | Lot 26 Buckinghamshire, Hertfordshire and East of Berkshire | July to September 2023 | 137,100 | £140 to 237 million |

| Regional | Lot 19 Staffordshire | TBC | 70,800 | £72 to 123 million |

| Regional | Lot 1 West Sussex | July to September 2023 | 56,700 | £66 to 112 million |

| Regional | Lot 16 East Sussex | October to December 2023 | 41,200 | £49 to 83 million |

| Regional | Lot 12 Bedfordshire, Northamptonshire and Milton Keynes | October to December 2023 | 81,300 | £84 to 144 million |

| Regional | Lot 3 Derbyshire | October to December 2023 | 57,000 | £64 to 110 million |

| Regional | Lot 30 Wiltshire and South Gloucestershire | October to December 2023 | 84,800 | £85 to 145 million |

| Regional | Lot 9 Lancashire | October to December 2023 | 82,000 | £90 to 153 million |

| Regional | Lot 22 Surrey | October to December 2023 | 99,400 | £101 to 171 million |

| Regional | Lot 11 Leicestershire and Warwickshire | November 2023 to January 2024 | 112,900 | £114 to 194 million |

| Regional | Lot 10 Nottinghamshire and West of Lincolnshire | November 2023 to January 2024 | 89,700 | £90 to 152 million |

| Regional | Lot 8 West Yorkshire and parts of North Yorkshire | November 2023 to January 2024 | 125,200 | £128 -to 218 million |

| Regional | Lot 20 South Yorkshire | November 2023 to January 2024 | 56,800 | £59 to 103 million |

| Regional | Lot 17 Cheshire | January to March 2024 | 74,300 | £85 to 144 million |

| Regional | Lot 6 Devon and Somerset | January to March 2024 | 159,600 | £198 to 337 million |

| Regional | Lot 15 Herefordshire | January to March 2024 | 23,700 | £30 to 60 million |

| Regional | Lot 18 Gloucestershire | January to March 2024 | 44,700 | £40 to 80 million |

| Regional | Lot 23 Lincolnshire (including NE Lincolnshire and N Lincolnshire) and East Riding | January to March 2024 | 105,700 | £106 to 180 million |

| Regional | Lot 14 Dorset | April to June 2024 | 56,500 | £62 to 105 million |

| Regional | Lot 21 Essex | April to June 2024 | 78,400 | £79 to 135 million |

| Regional | Lot 31 Northern North Yorkshire | April to June 2024 | 28,200 | £25 to 42 million |

However, BDUK notes that following significant soft market testing and pre-procurement market engagement with suppliers in Shropshire and Staffordshire, they have “established that there is currently no interest from the market in responding to our proposed regional procurements in these areas.”

BDUK also had “similar feedback” in relation to the eastern part of Hertfordshire. “We are therefore deferring the launch of the regional procurements in these areas and are actively looking at options to provide coverage in these areas at a later date. In July, we successfully launched two local procurements in Shropshire which will deliver coverage to up to 19,500 premises,” said the programme team.

This is a significant setback for the programme, although smaller local procurements may help to resolve some of the fallout (assuming those can attract some bidders).

Nadine Dorries MP, UK Digital Secretary, said:

“As more contracts are awarded in the coming months, we’re also pressing ahead with launching more procurements. Our market engagement is key to their success, and I look forward to seeing suppliers set out their plans and then delivering the connections that will bring benefits to people in hard-to-reach areas in all parts of the UK.

BDUK’s work alongside local councils, suppliers and other key stakeholders remains absolutely key, and the UK continues to enjoy a buoyant telecoms sector: since May, £5 billion has been invested in the market, and more than 25 suppliers have announced or finalised new gigabit-capable broadband deployment plans. We will continue to work closely with them to achieve 85% gigabit coverage by 2025, and as close to 100% as soon as possible thereafter.

It is an extremely exciting time for the sector. I am very proud of the pivotal role BDUK is playing in delivering for the public, and we have recently appointed a new permanent chair, Simon Bladgen CBE, to lead the agency as it delivers our critical digital infrastructure projects. This will help us to continue to do what we do best – boosting communities, levelling-up regions and supporting people to thrive wherever they work, learn or live.”

As we’ve said before, some areas (e.g. Wales, Scotland etc.) have yet to even begin procurement and some of their builds might thus not even start until 2025, although both Scotland and Wales are at least moving very close to procurement. Meanwhile Northern Ireland’s Gigabit Open Market Review (OMR) is scheduled to launch in early Autumn 2022, which will help to identify which areas are still in need of public investment.

However, we should remind readers that it often takes network operators several months of engineering surveys before they can begin to start a rollout, once a contract has been signed, which means that construction on the first areas won’t start until late 2022 (e.g. North Dorset). Likewise, the detailed rollout plan for these first contracts won’t be known until those surveys have completed.

At this point it’s clear that BDUK’s centralised approach to procurement, which is moving at a slower pace than we’d like, is also deficient in its ability to clearly and plainly communicate the progress of this programme to regular folk. Project Gigabit’s current quarterly updates are too hard to find and complex to meet this need.

The old Superfast Broadband (SFBB) programme, which saw contracts being locally managed, often resulted in local authorities setting up dedicated websites with plenty of details, maps and updates on their respective deployment contracts (although the quality of such sites did vary). We have been told that BDUK are still planning to do something similar for Project Gigabit, but in an ideal world they would have done this already.

We should remind readers that this rollout is NOT an automatic upgrade, thus you will still need to order the service from a supporting ISP (1Gbps is the target speed, but slower and cheaper options will also exist). Likewise, no specific network coverage checkers will be available for areas in this programme, at least not until AFTER the contracts have been awarded and the necessary engineering surveys are completed.

Finally, we should add that the Government has previously warned that those in the final 1% may still be “prohibitively expensive to reach“, although they’ve recently clarified that less than 0.3% of the country (i.e. under 100,000 premises) are likely to fall into this category (roughly the same gap that the 10Mbps USO has struggled to fill). Solutions for those in the final 0.3% of “Very Hard to Reach” areas are currently being consulted upon.

Project Gigabit Summer 2022 Update

https://www.gov.uk/../project-gigabit-delivery-plan-summer-update-2022

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Thousands of BT and Openreach Workers Head Back to Picket Lines

Zzoomm was up here a few minutes ago, drilling and digging by the telegraph pole, I thought they were done, now there is a roll of I presume fibre stuck halfway up the pole, I wonder if that is what is going to go through the trench that they dug a few weeks ago.

Near me OR contractors put in poles for fibre, strung the cable (partially), and then had to move a pole because it was over the 70 metre limit, which resulted in the next hop still being over the 70 metre limit. Obviously they were not using a linear tape measure!!

It was so obvious and we all waited to see when it would be sorted.

It would be interesting to know how many of those 0.3% “out of this world” premises have existing phone lines. i.e. there must already be a bit of wet string travelling over poles, underground, along wayleaves to an exchange. Therefore, there is already supporting infrastructure.

Verses, the number of those properties that are not connected in any way for which fibre would bring something new

Problem is, a lot of the standing wayleaves state “Maintenance only”

thousands of homes like that in the moray and Banffshire area around me. we’re all on mains power and every old farms got telephone poles running to them, That’s the reason ‘Hard to reach’ irritates me so much, It’s not hard, It’s more expensive.