Summer 2023 BDUK Update on UK Project Gigabit Broadband Build

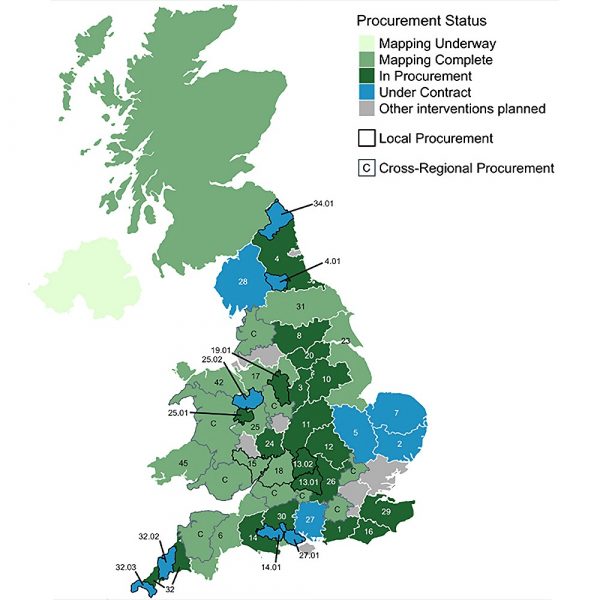

The Building Digital UK agency has published their latest quarterly update (June 2023) on the Government’s £5bn rural Project Gigabit broadband rollout progress, which has so far awarded rollout contracts worth a total of £589m (state aid) to help extend coverage to an extra 378,450 of the hardest to reach premises.

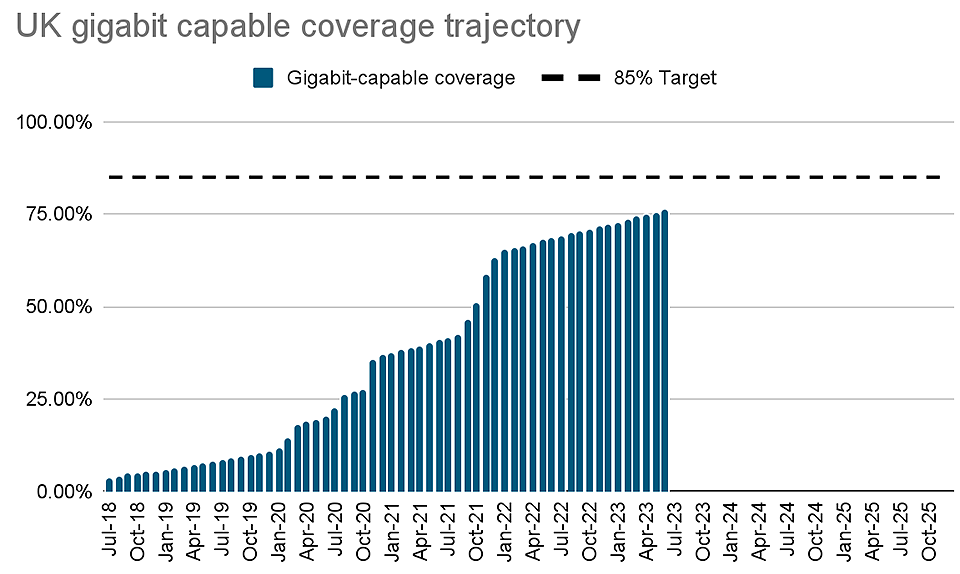

The project aims to extend networks capable of delivering “gigabit” (1000Mbps) download speeds to “at least” 85% of UK premises by the end of 2025 and then “nationwide” coverage (c.99%) by around 2030 (here). The funding released for this will depend upon how the industry responds, but so far around £1.4bn worth of procurements and contracts are already in the pipeline (more is expected to follow).

At present, over 76% of UK premises can already access a gigabit-capable network (details), which falls to 53% when just looking at FTTP (i.e. the gigabit figure is boosted by Virgin Media’s HFC upgrade – here). But Ofcom currently forecasts gigabit coverage to hit 92% by March 2025 (here), with purely commercial deployments alone being expected to deliver over 80% of that.

Advertisement

Project Gigabit is thus designed to focus on improving connectivity for those rural and semi-rural areas in the final 20% (5-6 million premises). This consists of several support schemes, including gigabit vouchers (£210m), funding to extend Dark Fibre around the public sector (£110m) and gap-funded deployments with suppliers (rest of the funding) – better known as the Gigabit Infrastructure Subsidy (GIS) programme.

Today’s article is focused upon the GIS programme and related procurement work, which sees ISPs bidding through a new Dynamic Purchasing System (DPS) to extend their networks across disadvantaged parts of the UK.

What’s New in the June 2023 Update

Since the last update on 27th Feb 2023 (here), BDUK has followed their initial contract awards by signing six new contracts in Cambridgeshire, the New Forest, North Shropshire, Norfolk, Suffolk and Hampshire – worth a combined £425 million (expected to help upgrade up to 284,000 hard-to-reach homes and businesses).

The combined value of all the contracts signed so far comes to around £589m in public investment and will upgrade 378,450 premises (c.£1,557 per premises passed). But the total value of all the Project Gigabit procurements launched to date (inc. those that have yet to be awarded) is around £1.4bn, which could see up to 895,000 extra premises being passed by a gigabit-capable network.

Advertisement

Elsewhere, BDUK also completed their initial analysis of the major English metropolitan areas, which has helped them to identify the “small pockets of poor urban digital connectivity [that] will remain unserved by the commercial market without government intervention.” In order to accurately ascertain how to best serve these premises, BDUK has chosen to pause their procurement timeline in related areas and engage the market, councils and other local stakeholders on the most suitable solutions.

In addition, BDUK’s market engagement in Essex and East Surrey has revealed significant planned commercial activity, leaving only a limited number of premises eligible for subsidy. The market has shown limited interest in bidding for what would be smaller-sized procurements in these areas, and so they’re now considering alternative interventions.

Finally, as part of ongoing work to refine the ways they use public funding to serve “uncommercial sub-gigabit premises“, BDUK are now considering the use of smaller, more flexible contracts to target sub-gigabit gaps in the network which the market may leave behind. “We are at an early stage, and will consult the market in detail on this new route to market in due course,” said BDUK.

However, so far most of the Project Gigabit contract awards have been for England, while the devolved countries of Wales, Scotland and Northern Ireland are still in the preparation stage. But we do get a good idea of the next steps for these areas.

Advertisement

Status of Devolved Countries

➤ Wales

Areas across North West Wales, Mid Wales and South East Wales will be included in a cross regional procurement [Type C] we plan to launch in the summer. In addition, we are planning to launch a regional procurement in North Wales by the end of the year, and we are finalising the most appropriate approach for South West Wales.

Type C procurements will appoint a single supplier to target premises (i.e. subsidise the design, build and operation of a new gigabit network) in areas where no or no appropriate market interest has been expressed before, or areas that have been descoped or terminated from a prior plan.

Active voucher projects continue to deliver in Wales, but the scheme remains paused for new projects as the intervention areas for procurement are finalised. As of the end of May 2023, we had connected 3,000 homes and businesses in parts of Wales using vouchers. In addition, a further 2,300 vouchers had been issued for connection within the next 12 months.

➤ Northern Ireland

Project Gigabit related procurements are still expected to begin in the autumn.

As of the end of May 2023, 8,300 homes and businesses in parts of Northern Ireland had been connected using vouchers. In addition, a further 1,300 vouchers had been issued for connection within the next 12 months.

➤ Scotland

The Scottish Government has committed to launch Project Gigabit procurements in the autumn.

Gigabit vouchers continue to be actively delivered in Scotland. There have now been 3,400 Project Gigabit voucher funded connections of which 400 benefited from the Scottish Government top-up. A further 800 vouchers have been issued for connection in the next 12 months.

Otherwise, you can see a summary of the wider contract progress below.

Live GIS Contracts (Signed)

| Area | Contract Awarded | Uncommercial Premises | Value |

|---|---|---|---|

| North Dorset (Lot 14.01) | 25-Aug-22 | 7,000 | £6.3 million |

| Teesdale (Lot 4.01) | 22-Sep-22 | 4,000 | £6.7 million |

| North Northumberland (Lot 34.01) | 14-Oct-22 | 3,700 | £7.4 million |

| Cumbria (Lot 28) | 29-Nov-22 | 59,000 | £108.5 million |

| Central Cornwall (Lot 32.02) | 19-Jan-23 | 9,200 | £18 million |

| South West Cornwall (Lot 32.03) | 19-Jan-23 | 9,500 | £18 million |

| Cambridgeshire and adjacent areas (Lot 5) | 23-Mar-23 | 44,400 | £69 million |

| New Forest (Lot 27.01) | 27-Mar-23 | 10,400 | £13.8 million |

| North Shropshire (Lot 25.02) | 19-Apr-24 | 12,000 | £24 million |

| Norfolk (Lot 7) | 28-Jun-23 | 62,200 | £114.2 million |

| Suffolk (Lot 2) | 28-Jun-23 | 79,500 | £100.5 million |

| Hampshire (Lot 27) | 28-Jun-23 | 75,500 | £104.2 million |

Take note that, once a contract has been signed, it sometimes takes operators several months of engineering surveys before they can begin to start the build. Likewise, the detailed rollout plan for these first contracts won’t be known until those surveys have been completed. Furthermore, the contract values above are only referencing public investment, but it’s hoped that suppliers may also contribute some of their own private funding.

On top of the already agreed contracts, Project Gigabit also has a growing number of local and regional deals in the procurement phase for other parts of the UK (see below) and will be awarding contracts for these over the coming months and years. The dates and figures mentioned below are tentative estimates (subject to change) and will remain that way until after the contracts have been awarded.

Bidders on the related LOTS will be required to ensure that their networks and infrastructure are available for use by other ISPs via wholesale (open access). Various operators, both big and small (e.g. Openreach, Cityfibre, Fibrus, Gigaclear, Virgin Media [VMO2] etc.), are expected to take part and areas with sub-30Mbps speeds are being prioritised, albeit NOT to the exclusion of all else.

Alongside all this, the government and local bodies are also conducting various Public Reviews and Open Market Reviews (OMR), which is the process they use when trying to identify existing commercial coverage of gigabit-capable networks and any planned coverage over the next c.3 years. By doing that, they can more easily target their support toward areas where commercial projects will not go (i.e. the intervention area).

Live GIS Procurements

| Area | Est. Contract Award Date | Uncommercial Premises | Value |

|---|---|---|---|

| North East England (Lot 4) | May-23 | 51,850 | £82.7 million |

| Worcestershire (Lot 24) | July to September 2023 | 18,400 | £39.4 million |

| Buckinghamshire, (part of) Hertfordshire and East of Berkshire (Lot 26) | July to September 2023 | 40,300 | £58.8 million |

| Kent (Lot 29) | July to September 2023 | 72,000 | £112.3 million |

| West and East Sussex (Lots 16 and 1) | July to September 2023 | 62,100 | £100.6 million |

| South Wiltshire (Lot 30) | October to December 2023 | 19,000 | £24.8 million |

| Bedfordshire, Northamptonshire and Milton Keynes (Lot 12) | October to December 2023 | 30,300 | £51.4 million |

| Derbyshire (Lot 3) | October to December 2023 | 18,200 | £33.4 million |

| Leicestershire and Warwickshire (Lot 11) | November 2023 to January 2024 | 45,400 | £71.5 million |

| Nottinghamshire and West of Lincolnshire (Lot 10) | November 2023 to January 2024 | 35,700 | £58.6 million |

| South Oxfordshire (Lot 13.01) | August to September 2023 | 6,500 | £17 million |

| North Oxfordshire (Lot 13.02) | August to September 2023 | 4,900 | £11.2 million |

| North East Staffordshire (Lot 19.01) | September to November 2023 | 6,200 | £16.6 million |

| West Yorkshire and York Area (Lot 8) | November 2023 to January 2024 | 29,000 | £60.9 million |

| South Yorkshire (Lot 20) | November 2023 to January 2024 | 32,400 | £44.4 million |

| Mid West Shropshire (Lot 25.01) | November 2023 to January 2024 | 6,000 | £12 million |

| Dorset and South Somerset (Lot 14) | January to March 2024 | 22,600 | £43.2 million |

| Cornwall and Isles of Scilly (Lot 32 ) | April to June 2024 | 18,600 | £41.2 million |

Finally, BDUK has a long list of future procurements in their pipeline (see below), which represents an indicative forward view of commercial activity to be undertaken by the programme. Some of the information provided is based on modelled data that will be superseded, while estimated contract award dates should all be taken with a pinch of salt as the targets do sometimes slip by several months (not unusual for such a complex scheme).

Future GIS Procurements

| Area | Est. Contract Award Date | Uncommercial Premises | Value |

|---|---|---|---|

| Cheshire (Lot 17) | January to March 2024 | 17,700 | £44.8 million |

| Herefordshire (Lot 15) | January to March 2024 | 7,900 | £21.5 million |

| Gloucestershire (Lot 18) | January to March 2024 | 4,900 | £15.6 million |

| Lincolnshire (including NE Lincolnshire and N Lincolnshire) and East Riding (Lot 23) | January to March 2024 | 74,200 | £119.3 million |

| North Yorkshire (Lot 31) | April to June 2024 | 41,900 | £63 to £127 million |

| Lancashire, North Wiltshire and South Gloucestershire, West and Mid-Surrey, Staffordshire, West Berkshire Hertfordshire | April 2024 to June 2024 | 57,500 | £149.7 million |

| (Call-Off 1) | |||

| West and North Devon, North West and Mid Wales, South East Wales | April 2024 to June 2024 | 47,700 | £139.7 million |

| (Call-Off 2) | |||

| Devon and North Somerset (Lot 6) | TBC | TBC | TBC* |

Sadly, it’s still taking far too long to get all of these contracts into procurement, let alone award them. The new and more automated DPS system was supposed to make all of this faster and more efficient than just handing the funding to local authorities, but it’s difficult to see the benefits when so many areas seem to be lagging behind and some won’t even see contracts awarded until mid-2024 or later.

On top of that, we’re still waiting for BDUK to launch a centralised website for clearly communicating their progress on each contract, which is something that we’ve previously been told was on the cards. The quarterly updates they issue are useful, but they’re too tedious for regular people to find and follow, unless you’re already familiar with the programme. A clean, clear and simple public website would help this.

However, we should remind readers that this rollout is NOT an automatic upgrade, thus you will still need to order the service from a supporting ISP in order to benefit. Similarly, 1Gbps is the target speed, but slower and cheaper options will also exist on the same lines.

The focus on “gigabit” speeds also overlooks the fact that this largely relates to download performance, while BDUK’s technical definition for the project appears to suggest that a minimum speed of 200Mbps would be acceptable when only looking at the upstream side (here). This is understandable, as not all gigabit networks today are actually setup to deliver true symmetric speeds, even though some may advertise them.

Lest we forget that there are a lot of real-world reasons why consumers buying a 1Gbps package might not actually be able to achieve the top speed, due to certain realities (Why Buying Gigabit Broadband Doesn’t Always Deliver 1Gbps).

Finally, we should add that the Government has previously warned that those in the final 1% may still be “prohibitively expensive to reach“, although they’ve recently clarified that less than 0.3% of the country (i.e. under 100,000 premises) are likely to fall into this category (roughly the same gap that the 10Mbps USO has struggled to fill). Solutions for those in the final 0.3% of “Very Hard to Reach” areas are still being tested.

Project Gigabit Summer (June 2023) Update

https://www.gov.uk/../project-gigabit-delivery-plan-june-update-2023

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« JT Plan £80m Rollout of 5G Mobile on Jersey – Channel Islands

May 2023 has passed and no news for North East lot 4.

Thankfully commercial builds have started to show an interest in my area so may have my first upgrade since getting FTTC in 2012 sometime this year or early next.

Anything planned for Greater Manchester, specifically M7 1RF and surrounding postcodes

My particular area seems to be in limbo surrounded by VM, Hyperoptic & OR but we’re being ignored

Your postcode is in Lot 36 and is listed as “White”, which means there is no commercial interest (in the next 3 years) and you will be visited at some point under the BDUK Project Gigabit rollout.

The OMR has been completed, and Lot 36 procurement start is slated for July to September 2023, and estimated contract award date is slated April to June 2024.

Thank you for that, have you got a link to all the info. I tried to find it myself but didn’t get very far

https://www.gov.uk/government/consultations/project-gigabit-merseyside-and-greater-manchester-lot-36-public-review

The closure notice gives the “latest” situation since the OMR completion, and the spreadsheet contains all the post code data for the lot

Perfect, thank you

I was surprised to see that the Cheshire procurement (Lot 17) has reduced from 57,500 estimated premises last time, to just 17,700 in the latest update.

Yes Peter, noticed this myself. It does seem a huge difference.

The most recent figure I can find is from the public review closure notice published at the end of March. This showed 54,996 eligible premises

A drop of 37,000 eligible premises within two months seems at least worthy of an explanation even if it’s a typo..

This figure is roughly equivalent to the entire city of Chester or over 10% of the 350,000 dwellings in the whole of Cheshire.

Someone’s declared their intent to build to areas in Cheshire that presently have no coverage.

It’s going to be Nexfibre or Openreach. If I were a betting man my money would be on Nexfibre building out from their existing networks.

Sorry, excluded Warrington and Halton in error. Still, a 6 or 7 percent shift in just a few weeks…

@XGS is On. Interesting. Do you think this more likely than a large shift to ‘under review’ ?

What would have helped is publishing the underlying postcode outcome spreadsheets that the figures were based upon.

These have appeared at the end of OMRs and Public reviews and provide the backup for the figures quoted.

Without them, the figures in the update are pretty meaningless.

As BDUK already have the spreadsheets, surely a few links to them is not too much effort.

I Live in TR12 6 area and have been waiting for FTTP for a while now. Apparently Wildanet have been proscribed to my area, however, when I have spoken with them they just say sometime in the next two years which is quite frustrating.

I’m in a TR16 6 area and am coded as white (no plans for the next 3 years). I am however also ineligible for gigabit vouchers as they have been paused for my area. I also contacted wildanet several times over the last 6 months and never heard anything more than “I’ll get the build team to look into that”.

I gave up a few months ago and got Starlink. Went from 200mbps.

When fibre is available I will switch to it but for now at least more than 1 person in the house can use the internet at the same time.

I’d like to know how they concluded that Essex will have only a limited number of premises eligible for subsidy. There are 95,000 Gigabit White premises in the latest OMR, a significant increase from the one just a few months earlier which seems consistent with recent news of several providers putting rollouts on hold or struggling to secure new funding and even Openreach slowing down to focus on existing areas.

Have you asked Cllr Wagland at Essex Council that question? I would be interested to hear what bull she gives you.

I don’t understand what is going on. All through the bidding process our postcode has been white and part of the scheme but now the contract has been awarded we are “under review”. All I want is clarity (& a gigabit line) but that seems to be too much to ask for. We still don’t know what is happening even after the contract has been awarded. When do we find out?

How can Virgin Media bid for them if they don’t wholesale?

It would be nexfibre bidding, with VM as the anchor retail ISP, not VM bidding directly.