Ofcom – Gigabit Broadband Covers 70% of UK as 5G Hits 67-77%

Ofcom has published their Connection Nations 2022 UK digital infrastructure report, which reveals that “gigabit-capable” broadband ISP networks cover 70% of the UK (21 million premises), which is up from 47% last year, and outdoor 5G mobile cover from at least one operator is available to 67-77% of premises (up from 42-57%).

The report provides a general summary of broadband and mobile network availability and data usage from across England, Scotland, Wales and Northern Ireland, although it’s largely based off data that was gathered a few short months ago (September 2022).

Before we begin, it’s important to note how Ofcom defines the different performance classes of fixed broadband. In that sense, “Decent Broadband” means a 10Mbps+ download speed with 1Mbps+ uploads (i.e. the Universal Service Obligation), while “Superfast” is 30Mbps+, “Gigabit” equates to 1Gbps+ (1000Mbps+) and “Full Fibre” essentially means a pure Fibre-to-the-Premises network (these are also gigabit capable).

Advertisement

As usual, we’ve split our summary of the key results from this report into categories for fixed line broadband and mobile networks.

Fixed Line Broadband Coverage

The main focus during 2022 has been on the rapid deployment of “full fibre” FTTP broadband networks by various providers (Summary of UK Full Fibre Build Progress), which predominantly continues to reflect the efforts of commercial investment in urban areas. Admittedly, that is starting to change, albeit too recently for today’s report to reflect.

The Government’s new £5bn state aid funded Project Gigabit ambition, which aims to make gigabit speeds available to at least 85% of UK premises by the end of 2025 and “nationwide” coverage by 2030 (here), is likely to boost the current rollout by focusing its support on those in the hardest to reach rural areas (i.e. the final 20% of premises). But the first contracts are only just starting to be awarded now.

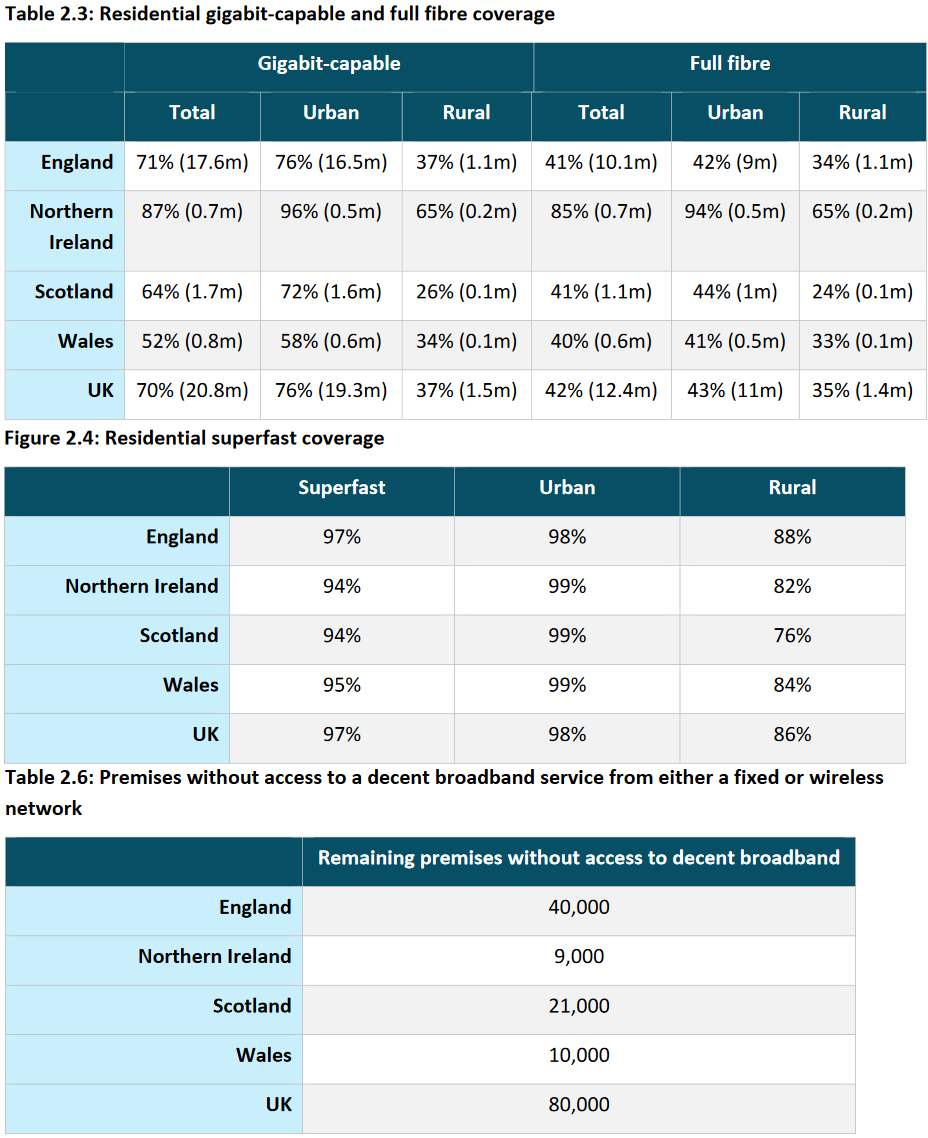

Overall, the picture today is that UK “full fibre” network coverage has risen from 10% in 2019 (3 million premises), 18% (5.1 million premises) in 2020, 28% (8.2 million premises) in 2021 and now stands at 42% (12.4 million premises). Meanwhile, “gigabit” coverage, which is being driven by both FTTP and Virgin Media’s DOCSIS 3.1 network (there’s a lot of overbuild between these two), has grown from 47% last year to 70% now (20.8 million premises).

Advertisement

Elsewhere, “superfast” coverage improved slightly to 97% (28.7m premises), which falls to 86% in rural areas (up from 83% last year). But the number of premises that cannot get a “decent broadband” service is 0.3% or 80,000 premises (down from 0.4% or 123k premises last year). However, this is only true if you include 4G and fixed wireless coverage into the figure, but if you just looked at fixed line solutions it would be c.2% (half a million premises).

Sadly, many of those that remain in sub-10Mbps areas are often too expensive for even the USO to fix (here and here), but the gap is expected to fall. Ofcom’s report predicts that the number of premises unable to get 10Mbps (decent) broadband could fall to 52,300 by March 2025.

Ofcom also provides some useful data on the rural vs urban coverage split for superfast, decent broadband, full fibre and gigabit lines below – split by region.

Advertisement

In terms of take-up, some 73% that are able to get a “superfast broadband” service actually take it (up from 69% last year and 60% in 2020). Meanwhile, 25% have taken a “full fibre” network, which is up from 24% last year. The reason this hasn’t changed much is due to the rapid pace of build (i.e. building at a faster pace than people can sign-up), which tends to suppress adoption figures until builds slow and maturity of coverage is reached.

As for the take-up of gigabit-capable networks (at any speed), Ofcom states that around 38% of customers are on such a network, which is higher than the full fibre figure above because this will also be including users of Virgin Media’s older Hybrid Fibre Coax (HFC) network.

Elsewhere, the average monthly data volume per household on fixed broadband connections has increased over the past year to 482 GigaBytes (up from 453GB last year or 6.4%). We couldn’t see a similar figure for mobile / mobile broadband networks.

Lindsey Fussell, Ofcom’s Network and Communications Group Director, said:

“Millions more people are benefitting from faster, more reliable internet as the rapid rollout of full-fibre broadband continues. That can be particularly important at this time of year, as online shopping peaks and people stream festive favourites.

It’s also encouraging to see more people in hard-to-reach areas get access to decent broadband, as work continues to connect rural communities.”

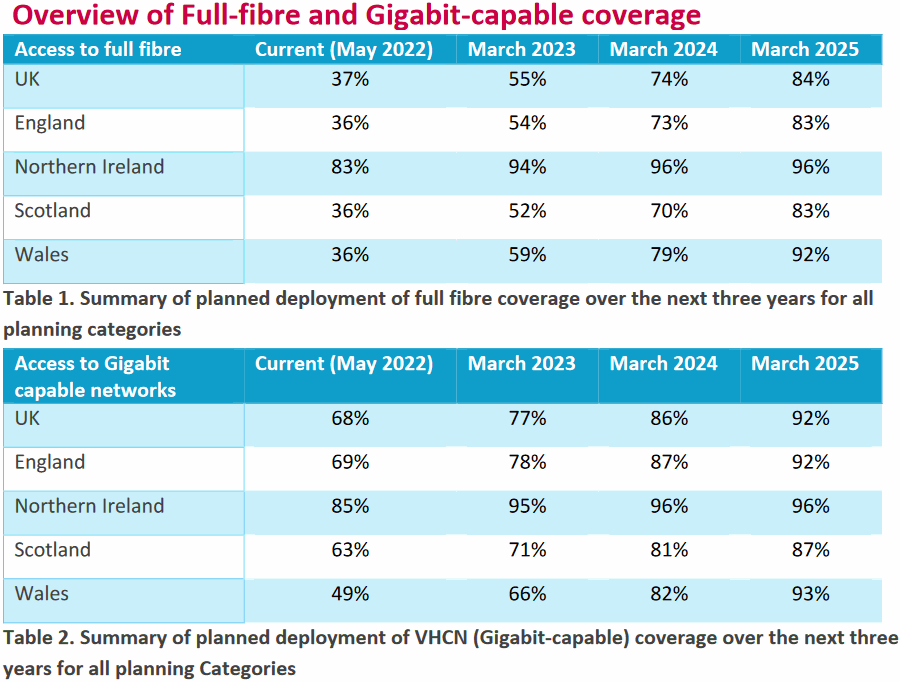

The regulator has also produced an additional report that attempts to predict how coverage will unfold by March 2025. If all network deployments are realised as planned, the number of properties covered by full fibre will increase from 11.0m (as of September 2022) to 24.8 million by March 2025 (84% of UK), while gigabit-capable coverage could be in excess of 90%.

Ofcom also looks at overbuild between gigabit-capable rivals. “We estimate that up to 66% of properties will be able to take VHCN (gigabit capable) services from two or more providers” by 2025.

Mobile Coverage

The report includes coverage data for mobile networks too, such as via the usual 4G and 5G based platforms that most people should be familiar with. The UK has four primary network operators (MNO) – O2 (VMO2), Three UK, EE (BT) and Vodafone – plus an assortment of virtual operators (MVNO) that piggyback off those.

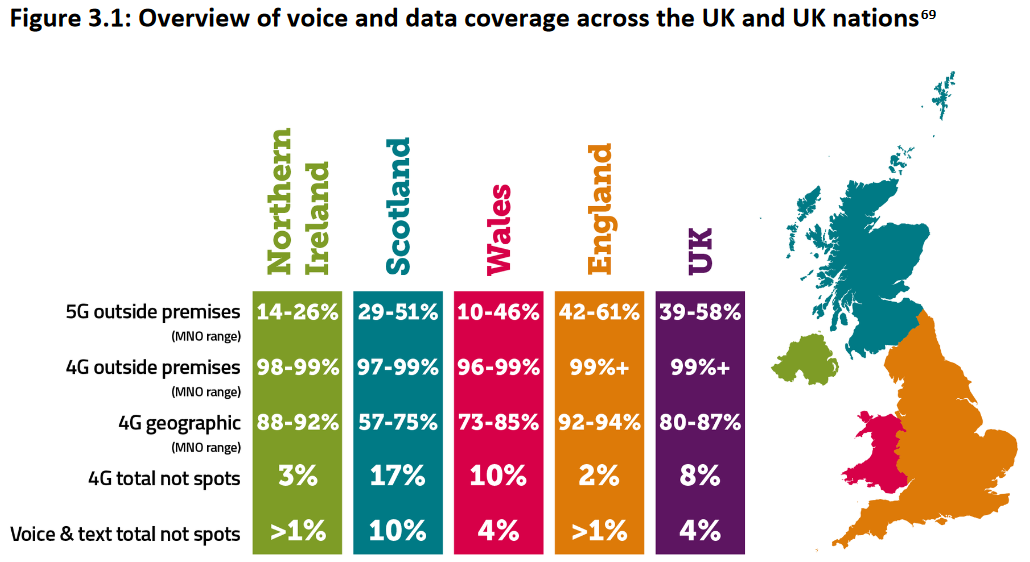

Ofcom found that between 80-87% of the UK’s landmass (geographic coverage) can now access a 4G network if you look across all operators (up from 79-86% last year) – with EE having the strongest coverage. The new £1bn Shared Rural Network agreement aims to push geographic 4G coverage to 95% from any one operator by the end of 2025 (here) and, in the long run, this should also aid 5G.

On 5G, the regulator found that it is available from at least one MNO (operator) in the vicinity of around 67-77% of UK premises (up from 42-57% last year). The technology has around 12,000 mobile sites across the UK (up from c.6,500 in 2021) and 86% of these sites are in England, with 8% in Scotland, 4% in Wales and just 2% in Northern Ireland.

However, 4G continues to carry the majority of mobile data traffic (accounting for 87% of total data traffic), with 4G coverage from at least one MNO (EE) also reaching 92% of the UK’s landmass. Data traffic carried over 5G has increased more rapidly, rising from 3% of all traffic in 2021 to over 9% this year, generated from a device pool which now includes c. 20% 5G capable handsets.

Elsewhere, we were able to find some geographic 4G coverage figures for individual mobile operators across rural vs urban areas.

2022 Geographic UK 4G Coverage by Operator

Urban Areas (2021 Figure)

EE 99% (98%)

O2 99% (98%)

Three UK 99% (98%)

Vodafone 99% (99%)Rural Areas

EE 85% (81%)

O2 80% (72%)

Three UK 77% (75%)

Vodafone 80% (76%)

Otherwise, you can check out the full Connected Nations 2022 report online.

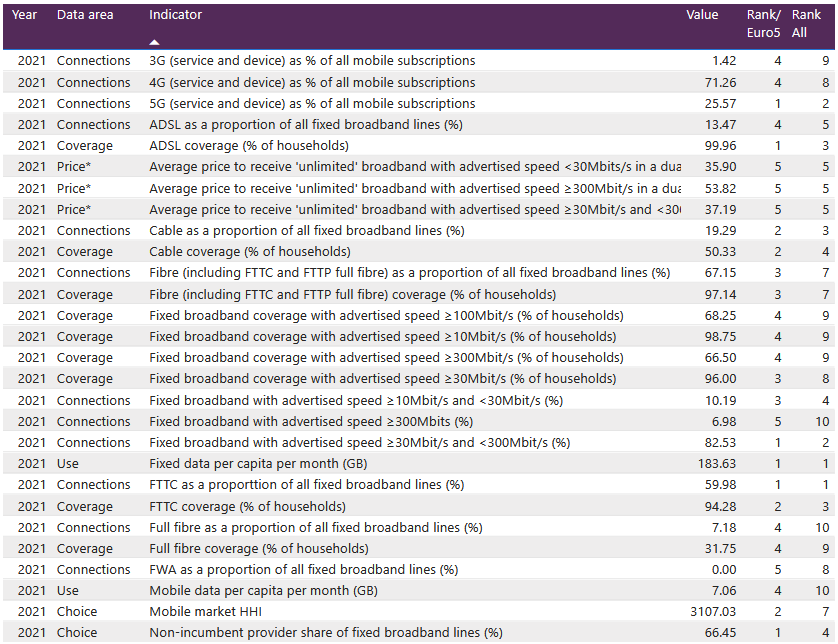

International Comparison

Alongside this report, Ofcom has also published their latest international comparison, which pits the United Kingdom’s broadband and mobile connectivity against both the EU’s four major economies (France, Germany, Spain and Italy) and various other large countries. The data on this front is from 2021 and thus the figures below are lower than those reported above.

UK Summary

Overall, we still do well for “superfast” coverage, but are near the bottom for full fibre, although that rollout is currently going through a rapid ramping-up phase. We think the FTTH Council Europe’s country ranking (here) shows this difference better than most.

UPDATE 11:09am

We’ve had a comment from Openreach.

CEO Clive Selley, Openreach, said:

“It’s great to see continued progress on upgrading the UK’s digital infrastructure, especially given the challenges every business is facing right now. This is a massive, complex, national engineering project and the economic, social and environmental benefits are going to be vast, so I’m proud that Openreach is leading the way – building further and faster than any company out there.

We’ve already reached nine million homes and businesses and we’re building to hard-to-reach rural communities as well as the more densely populated parts of the UK.”

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Openreach Hikes UK Copper Broadband and Cablelink Prices

EE UK Extends 4G Mobile Coverage to Over 500 Rural Areas »

I reckon Mark Twain could appropriately describe the Ofcom figures: “There’s…..” My experience is that the grass is always greener elswhere when it comes to actual broadband Internet connectivity and I live in an industrial town.

All statistics are an average across a group. Some towns and cities have almost ubiquitous gigabit while others have virtually none.

Very Sad there figures for superfast uptake where estimated at 73% meaning the USO review will not be triggered. Sadly the availability of Mobile broadband I suspect is skewing these figures as many of those with superfast available to them will have opted for 4/5g connections & therefore are not counted in the overall figures

“Superfast Broadband” is defined as speeds over 30mbps. Out of 180 countries tested, this speed would put you in 106th place. The UK currently sits at 56th with speeds averaging just under 70mbps.

The top 30 countries in this list average 1Gbps (with the top 5 around 2Gbps)…why is the UK lagging so far behind? (greed/pricing probably)

BTW ‘decent’ broadband speed as defined by the UK government is 10mbps – which would put you in 150th.

What list is this, Dan?

I can’t believe that there are countries where the average customer has 2.5 Gbit Ethernet in their home so I presume this is based on the highest bandwidth product available in which case if 2/3rds of the UK can get gigabit even if the rest get 1 Mb the average is still going to be over 650 Mb.

At least part of the reason the UK may lag behind is the requirement to advertise median peak time speeds. If operators could advertise ‘up to’ speeds and Openreach sell on that basis we’d have higher tier advertised products.

I know of plenty of places where people get less than half their headline rate at peak times and get a fraction of their top speed when they leave their country.

The fact remains that if you want (wanted) decent fibre of 500Mbps or over, you had to go through the rigmarole of getting Openreach to put it in via the government scheme. It’s what we did in our village.

Having a look at the kinds of speeds you can get now with ‘regular’ fibre even in London it is still very slow by comparison, eg https://broadband.deals/virgin-media

I’m on Virgin Mobile, and since they transferred to the o2 network I can barely get 3G a lot of the time let alone 4/5G. It is an absolutely terrible network

Sorry. No 5G here. 4G is just awful here.

I’ve a 5G signal though it’s no faster than the 4G+ one and nothing to write home about given I’m in a city of over 100,000 people.

https://www.speedtest.net/my-result/a/8913004642

If “too hard to reach” premises currently have a phone, what happens when copper is turned off? If it’s too expensive to pull fibre through where the copper lay, will it be too expensive to recover the copper line? What will these remote locations do in an emergency? They are often in places where a phone box is still retained because there is no mobile signal.

I’m thrilled you put “too hard to reach” like that.

I’m not “too hard to reach” I’m not profitable. There are poles all the way to our house that carry a copper line installed decades ago so given the advancements in vehicles and equipment I really doubt it’s got ‘harder’ to deploy to me and the others living here.

The copper remains and SOGEA will be offered for broadband with VoIP for voice.