UPDATE8 ISP O2 UK and BE Sell Home Broadband and Phone Service to Sky

Mobile operator O2 UK (BE Broadband), which is owned by Spanish multinational Telefonica, has today confirmed that their struggling fixed line Home Broadband and Home Phone service is to be taken over by arch rival BSkyB (Sky Broadband) for a consideration of £180 million.

The move, which was first rumoured during early January (here), will see BSkyB acquire O2 and BE Broadband’s entire consumer broadband and fixed-line telephony business. It will also turn Sky Broadband into the country’s second largest broadband ISP after BT and just ahead of Virgin Media.

But few will be surprised by the development. O2 (BE) have been bleeding subscribers from their unbundled (LLU) and BT-based Home Broadband service since December 2010, when the operator reached a peak of 671,600 customers. At the last count, in Q4-2012, O2’s related customer base had shrunk dramatically to total just 560,100.

Jeremy Darroch, Sky’s CEO, said:

“Sky has been the UK’s fastest-growing broadband and telephony provider since we entered the market six years ago. From a standing start in 2006, we have added more than 4.2 million broadband customers. The acquisition of Telefónica UK’s consumer broadband and fixed-line telephony business will help us accelerate this growth.

We believe that the O2 and BE consumer broadband and telephony business is a great fit, with customers used to high-quality products and strong levels of customer service. We look forward to welcoming these new customers to Sky and giving them access to our wide range of high-quality products, great value and industry-leading customer service.”

Ronan Dunne, CEO of Telefónica UK, added:

“Sky offers great value, totally unlimited broadband which includes unlimited fibre services. As we focus on delivering best-in-class mobile connectivity, including next generation (4G) services, we believe this agreement is the best way of helping our customers get the highest quality home broadband experience from a leading organisation in the market.”

Certainly customers have had a lot to be frustrated about. Past price hikes, routing problems, concern over network congestion (here), the continued lack of a viable superfast broadband product, drama over GoldenEye’s piracy letters (here) and efforts to disconnect heavy users (here) have all resulted in one big headache for both the operator and their customers.

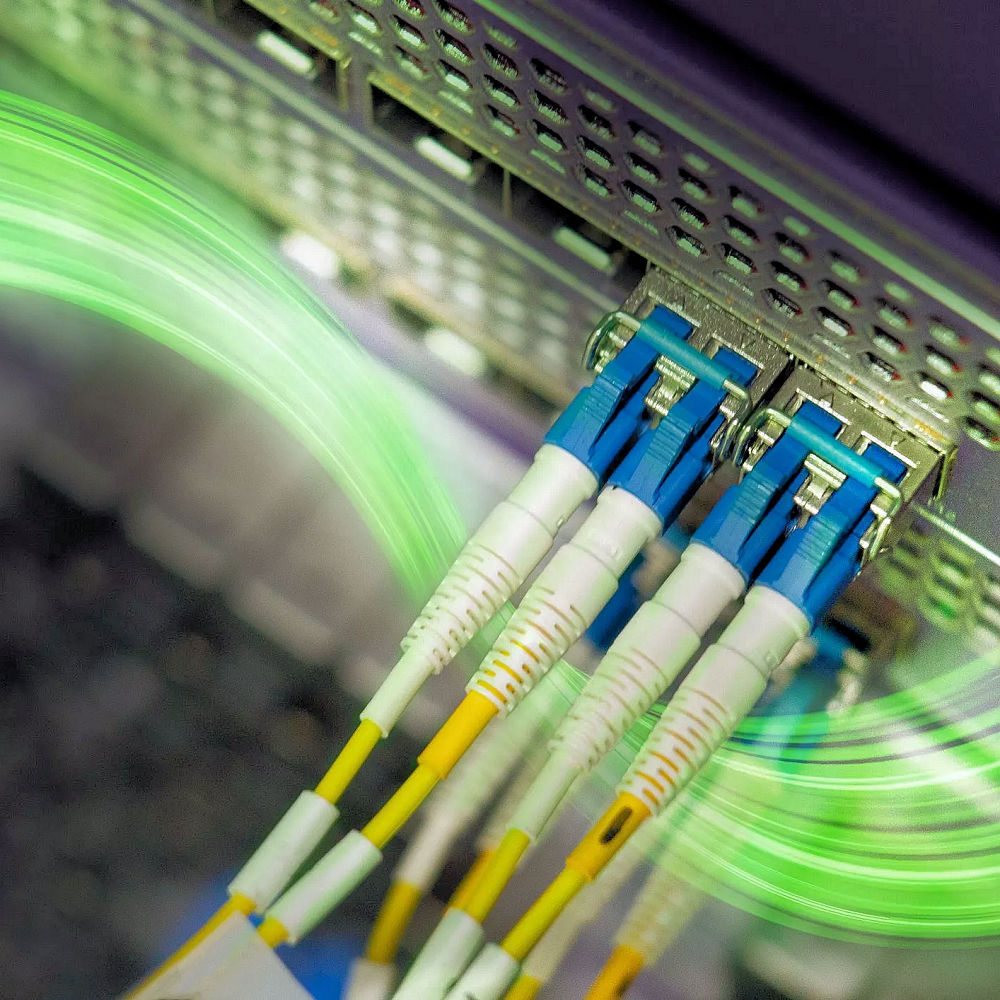

On top of that O2/BE’s broadband platform has struggled with capacity problems and efforts to upgrade the network to a new and more capable core haven’t progressed as swiftly or smoothly as the management would have liked. Meanwhile Sky’s more capable unbundled network uses similar hardware to O2 (e.g. Alcatel’s Broadband Management Gateway) and thus in theory it should be a relatively painless task to manage their subscribers.

O2 has also needed to re-focus its efforts on their forthcoming 4G based Mobile Broadband network, which has always been the businesses primary focus and somewhat leaves Home Broadband without much direction for the future.

So what’s going to happen?

Sky will first pay a “consideration” of £180 million to Telefónica UK for the consumer broadband, home phone and line rental customers served by the O2 and BE. The related customers will then become Sky customers for those services on completion.

An extra contingent amount, not exceeding £20 million, may be payable dependent upon the successful delivery and completion of the customer migration process by Telefónica UK. Post completion, O2 and BE customers will be migrated onto Sky’s fully unbundled (LLU) broadband and phone network (reaches 84% of all UK homes and supports FTTC superfast broadband).

The acquisition itself, which will be funded from “existing cash reserves” and is expected to be “accretive to earnings per share in the second full year of ownership“, is due to complete by the end of April 2013 and is subject to regulatory clearance.

Sky, unlike O2, has recently been investing heavily to add new capacity to its broadband platform and thus today’s move is unlikely to cause too many headaches in terms of unexpected network congestion. On the other hand you can never be sure until it happens.

We are currently attempting to find out precisely how Sky intends to handle the service transition from a customer’s point of view. Many of the BE/O2 packages are different from Sky Broadband’s vanilla offerings (e.g. BE Pro offers faster 1.9Mbps upload and static IP addresses) and thus we’re keen to understand precisely what the new owner has planned.

UPDATE 7:55am

As we understand it the details are still being finalised and for the short-term (around 6 months or so) customers on O2 and BE should not expect any immediate changes to their current package or support. After this Sky will begin to migrate customers over to their own network in managed phases (expected to take around 18 months in total).

Sadly both sides say that it’s a bit too early to go into any kind of detail about the migration, thus we’re unsure what will happen to those customers whom have advanced packages with static IP allocations and faster upload speeds. Sky suggests that the majority can expect to benefit from their lower prices and FTTC options, although price isn’t the only factor here.

Customers will be contacted ahead of the migration to help them understand the options. We strongly hope that Sky will recognise how BE and O2 also had more advanced packages and options, which went quite a bit beyond the Sky Broadband Unlimited product (e.g. line bonding). But we fear they might not. Reminds us a bit of the UK Online acquisition.

UPDATE 8:38am

O2 have setup a web page with more information, albeit mostly already covered above in more detail:

http://www.o2.co.uk/broadband/broadbandchanges

UPDATE 11:57am

It’s interesting to note that the official announcement made no mention of O2 Wholesale, which supplies business clients like ISPs. Several of those ISP clients have now posted updates and been in contact to discuss the situation with us.

According to AAISP, “O2 Wholesale is being retained by Telefonica and will maintain its access to the network“. However Sky will be “taking over ownership and day to day operation of the LLU network” and “will integrate the current ISAMs into their network“. In other words “O2 Wholesale will become a customer of SKY with a wholesale agreement in place so that they can continue to provide wholesale services to partners as normal“.

Fluidata have also confirmed the same to us directly.

UPDATE 12:10pm

Telecoms analyst Ovum has made some interesting observations.

Emeka Obiodu of Ovum said:

“The news of the takeover is significant on several fronts. Firstly, it makes BSkyB the second largest broadband provider in the UK. This strengthens the hand of BSkyB in the market as the company would now be able to boast of having a bigger TV customer base, and more broadband customers than its main rival – Virgin Media. Such a prospect will concern Liberty Global a bit when it moves to take over Virgin Media in February.

Secondly, the battle for pay-TV and broadband supremacy in the UK has now intensified strongly. BT, the largest broadband provider, has spent heavily to win TV rights, and earlier this week, took over ESPN’s UK and Ireland TV channels. Now BSkyB, the UK’s largest pay-TV provider, has moved swiftly to become the second largest broadband provider. Such a consolidation, in addition to Virgin Media, will undoubtedly convert the UK’s pay-TV and broadband markets into a three-way fight. It doesn’t have to be bad for consumers, but some may not like it.

Thirdly, for those who don’t like the consolidation of the market to three main pay-TV and broadband providers, this is the inevitable consequence of technology changes and intense competition. Local loop unbundling has largely run its course and any broadband provider that wants to remain relevant in the future will need to outline a path to fibre. But that costs money. And with retail prices so low, and the return on investment tough to earn, pure-play broadband providers will struggle to survive. The market is now left with players that are able to spread the cost of fibre across more services, with its attendant economies of scope benefits.

Fourthly, for O2, this is significant as it now puts its hopes for a broadband future on LTE, combined with Wi-Fi. In the recent auction it won spectrum in the 800 MHz band, which will be good for providing coverage, albeit with limited capacity. But it is interesting that it didn’t get spectrum in the 2.6GHz band, which would have been good for high capacity broadband over shorter distances. Whether this was a strategic choice or a result of being outbid remains to be seen, as Ofcom is yet to publish the bid history. However, it means that for its broadband services O2 will have to rely on 800MHz spectrum and its existing spectrum holdings (unless a rival is willing to trade spectrum) combined with the Wi-Fi push it instigated in 2011. Its own fixed line home broadband service is no longer an option.

Fifthly, this sale reduces the power of UK mobile operators in the converged space. At a time when telcos across Europe are intensifying efforts to offer converged (fixed, mobile, broadband, TV) services, mobile telcos in the UK are making themselves much more reliant on mobile. EE still retains a presence in the fixed telecoms space but its offering is increasingly infrastructure-light. Ultimately, this is a dangerous scenario as it might reduce the strategic maneuvererability of the UK’s mobile telcos in a converged future.”

UPDATE 12:23pm

BE has written to their customers (email and a posted letter to follow) in order to confirm the sale. Apparently a special web page, much like O2’s above, has also been setup with more details but the site is currently refusing to load due to heavy traffic.

http://www.bethere.co.uk/broadbandchanges

UPDATE 12:33pm

BE’s main site may be struggling but they have posted a blog update, although it doesn’t say much that we don’t already know.

http://blog.bethere.co.uk/2013/03/a-new-future-for-be-with-sky.html

UPDATE 4th March 2013 (9:03am)

At O2’s discretion some Home Broadband customers whom contact the ISP asking for a MAC (migration) code have been offered 12 months of free broadband service, while a few others have also been offered £100 rebates off their mobile bills.

However we would caution customers, especially those still under an on-going contract, not to jump ship just yet. At least not until O2/Sky have revealed their customer facing plans for the migration (expected by late spring 2013).

At present no major contract changes have “officially” been presented and thus it’s often best to wait until this happens as it would represent a material change to the terms and thus you would, in theory, be able to exit the contract without penalty. On the other hand a savvy customer could always argue later that such a material change was inevitable after last week.

Meanwhile AAISP are offering Ex-BE/O2 customers, specifically those whom are considering whether or not to adopt their Home::1 package, the ability to have the same size block of IPv4 addresses, as they had with BE, for “no extra charge“.

Another ISP, Fidonet, are also offering “unlimited” ADSL2 broadband to Ex-BE/O2 customers at £20 per month with the first 6 months at half price. Potential customers should quote offer code “BeSwitched” when subscribing.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook and Linkedin.

« Ofcom Publish Latest UK Telecoms Complaints Data to January 2013

Latest UK ISP News

- FTTP (5513)

- BT (3514)

- Politics (2535)

- Openreach (2297)

- Business (2261)

- Building Digital UK (2243)

- FTTC (2043)

- Mobile Broadband (1972)

- Statistics (1788)

- 4G (1663)

- Virgin Media (1619)

- Ofcom Regulation (1460)

- Fibre Optic (1394)

- Wireless Internet (1389)

- FTTH (1381)

Comments are closed