Report Predicts 5G Mobile Will Deliver 50Mbps Speeds to 90% of UK by 2026

A new study from the Cambridge Judge Business School, which examined the cost, coverage and roll-out implications of future 5G networks in Britain, has forecast that the roll-out of “ultrafast” Mobile Broadband will reach 90% of the population by 2026. But £12bn of funding may be required for rural areas.

Admittedly creating such models is very difficult to do at a time when 5G is still in the R&D phase and won’t be deployed commercially around the UK until 2020 onwards. On top of that we still don’t know precisely which radio spectrum bands 5G will adopt, although Ofcom are preparing to auction several compatible bands and more will follow. Suffice to say that such models should be taken with a pinch of salt and the report agrees. On top of that the research seems to define 50Mbps as being “ultrafast“, although nearly everybody else sets the bar for that definition at 100Mbps+.

Nevertheless the results claim that “policy makers need to be cautious regarding large headline speeds in rural areas“. If these are desired politically, then it states that financial support (e.g. state aid subsidy) may be required and thus it may be more appropriate to “focus on achieving near-ubiquitous coverage” of a moderate level using spectrum resources to support the vertical industries that 5G will purportedly enable.

Advertisement

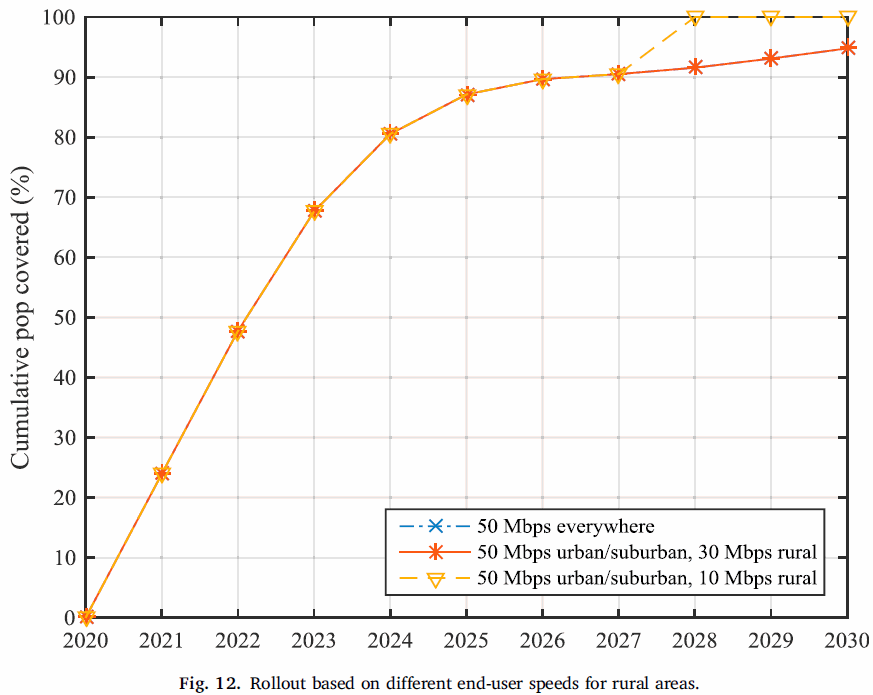

The economics of the 5G roll-out show that, for the “business-as-usual scenario“, some 90% of the population could be covered by 2026. However, 3.7% of the population would be left out of the 5G footprint by 2030, even if the same investment intensity is assumed for the last few years of the study period.

Sharing small cell infrastructure would improve the business case pushing towards near ubiquitous coverage by 2030. However the study says this is “unlikely to occur” because investing an additional £12 billion to cover the final 10%, while the first 90% may “only” require £6 billion, “may not be an attractive prospect for industry or government“. Instead “it may be more appropriate to compromise on capacity in rural areas to achieve greater coverage of a lower speed target.”

In other words, offering 50Mbps to urban/suburban areas and 10Mbps for rural areas “does not exhibit exponentially increasing costs in reaching the final 10%“, which is because the integration of new spectrum on existing macrocells is said to be “sufficient to meet end-user demand of 10Mbps in rural areas due to low population density” (note: spectrum costs are not included here).

Advertisement

The lack of a “killer-app” for 5G also suggests a “high probability that market-based 5G ultrafast broadband infrastructure will mainly be the prerogative of urban and suburban areas“, at least in the foreseeable future within Britain.

These results suggest that policy makers need to be cautious regarding large headline speeds in rural areas. If these are desired politically, then financial support may be required. However, it may be more appropriate to focus on achieving near-ubiquitous coverage of a moderate level using spectrum resources to support the vertical industries that 5G will purportedly enable. Unless we see a new ‘killer-app’ for this generation, there is a high probability that market-based 5G ultrafast broadband infrastructure will mainly be the prerogative of urban and suburban areas. At least in the foreseeable future within Britain.

The timely rollout of 5G networks will become increasingly important to achieve the productivity benefits desired by industrial policy, as well as dealing with digital divide issues. The contribution of this research is the quantification of the cost, coverage and rollout implications of 5G based on different policy options. Indeed, as the rollout of telecommunications infrastructure is inherently spatial and temporal, this is a necessary exploit and one that is becoming increasingly valuable considering the geographical disparities in provision that have arisen in the rollout of previous generations.

Further research needs to focus on refining the costs of both spectrum and infrastructure deployment (including exploring backhaul costs), calibration of investment levels against coverage obligations, and the rollout of 5G in relation to competition, pricing and take-up. Indeed, greater refinement and exploration of the time lag taken for rollout between different levels of capital expenditure would help decision-making processes involving both operators and government.

Moreover, sensitivity analysis is one key tool that can help to identify the cost boundaries which have the largest impact on telecommunications coverage and capacity, and should be explored in future work. While the focus here was on network densification and additional spectrum, the increased spectral efficiency gains of 5G is an area of future uncertainty that requires analysis.

One aspect that seems to be overlooked here is that modern 4G networks are already starting to reach Gigabit (1Gbps) class levels of capability (albeit shared capacity), not least by harnessing some of the technological upgrades that future 5G networks will build upon. In keeping with that the potential to deliver speeds of 50Mbps already exists within current networks, without specifically needing 5G.

On the other hand the 50Mbps figure used in the above report for 5G represents an average end-user experience in a well-populated, well-shared (well-used) cell. Certainly you can get speeds of 50Mbps and above on today’s 4G networks, although the real-world limits of the technology mean that many (especially at the edges of a network) often cannot achieve that. Mind you, 5G still has a lot to prove.

Most of the hype around 5G centres on its multi-Gigabit speeds (up to 20Gbps) but that is only likely to be achieved in urban areas where significantly higher frequencies and more spectrum can be used (e.g. 28GHz). Ofcom has already signalled that rural areas may be stuck with lower frequency bands in order to facilitate better mobile coverage at the potential cost of service speed (here).

Advertisement

NOTE: EE expects their 4G network to achieve 95% geographic coverage of the UK by the end of December 2020, although not all of that will be capable of stable 50Mbps+ speeds.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« South Yorkshire Broadband Rollout Hit by Main BT Subcontractor Collapse

Comments are closed