Alternative Full Fibre ISPs Cover 5.46 Million UK Premises in 2022

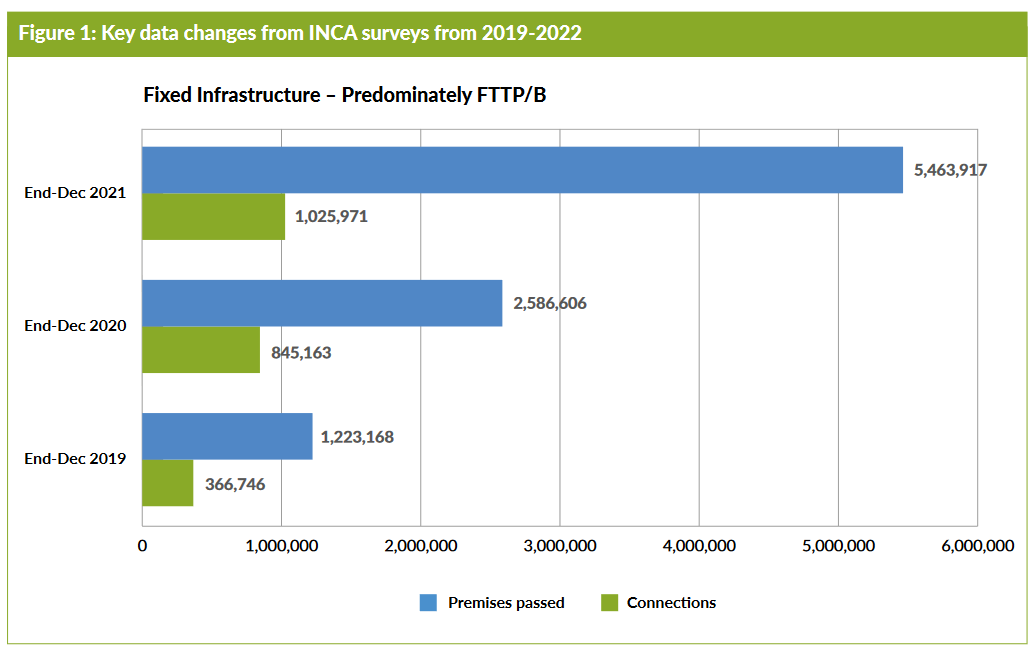

The Independent Networks Co-operative Association and Point Topic have published their 2022 report into the impact of alternative “full fibre” (FTTP/B) broadband networks, which reveals that such providers grew their UK cover by 111% in 2021 (up from 110% last year) to cover 5.46 million premises and could hit 11.6m this year.

As usual, the new figures are lower than those stated in Ofcom’s latest Connected Nations 2021 report (here), which found that full fibre networks had passed over 8.2 million premises by September 2021 (28% of the UK). The difference stems from the fact that INCA’s data excludes Fibre-to-the-Premises (FTTP) deployments from the two largest operators – Openreach (BT) and Virgin Media (VMO2) – in order to focus on independent alternative networks (altnets) like B4RN, Cityfibre, Gigaclear, Hyperoptic, CommunityFibre, G.Network and many more (Summary of UK Full Fibre Builds).

The new report predicts that gigabit-capable altnet providers will cover 11.6 million premises by the end of 2022, but they seem to have wisely stopped forecasting the more aspirational targets for the next 5 years as such things are highly subject to change (e.g. Hyperoptic originally planned to cover 2 million UK homes by 2021 and 5 million by 2024, but they recently updated this to 2m by the end of 2023 – here).

Advertisement

Similarly, last year’s report from INCA predicted 6.637 million premises would be achieved by the end of 2021, but this year’s report notes that the UK actually ended 2021 with a real-world total of 5.5 million premises passed by altnets. The progress is still fantastic, but it reflects the challenge of converting aspirations and expectations into reality.

One other caveat is that these figures aren’t weighted against the potential for overbuild with rival networks and are thus more of a raw overall total from all operators. Furthermore, there can be a tendency for some operators to report technically unfinished or non-live builds (i.e. you can’t yet order a live service) as Ready for Service (RFS), which can cause complications when forecasting live coverage.

Meanwhile, the current take-up rate to the end of 2021 is reflected as 1,025,971 connections, which equates to 18.78% of 5.46 million premises passed. By comparison, the figure for 2020 was significantly higher at 32.67% (i.e. 845,163 connections out of 2,586,606 premises passed).

Advertisement

The sharp fall in the take-up rate is a bigger drop than we expected to see over that period, albeit one that does largely reflect the fact that a lot of projects began or ramped-up their rollout last year, thus the take-up figure ends up being suppressed by the rate of new build. Nevertheless, Openreach has been able to maintain a comparative rate of around 25%, despite a similarly huge ramping up (here).

The current forecast is for FTTP connections (customers) to reach 1.4 million by the end of 2022 (out of 11.6m premises passed) and then there’s an aspiration for 10.3 million live connections by the end of December 2025. But, as mentioned earlier, there are no premises passed forecasts for 2025 to give context.

A Word About Wireless Networks

The report also includes some data on Fixed Wireless Access (FWA) broadband networks, which are often used to help cover remote rural areas with “superfast” (30Mbps+) or better speeds. Such networks are estimated to cover more than 2 million UK premises (unchanged from last year’s similarly vague figures), although wireless signals are highly variable and so producing an accurate coverage figure is extremely difficult.

Financial Impact of AltNets

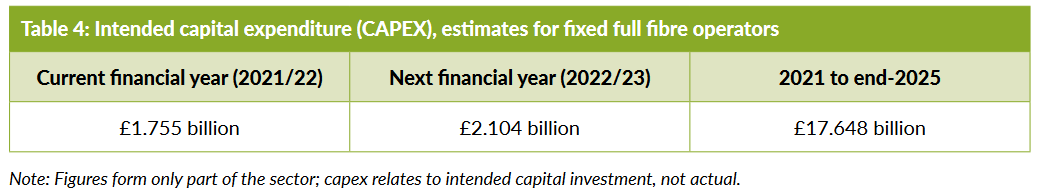

Finally, the study estimates that altnets have an intended capital expenditure (CAPEX) spend – from now until end-2025 – of over £17.7 billion, with operational expenditure of at least £1.5 billion. But some of this may not be new money (i.e. re-announcements of existing funding) and related build commitments are frequently quite aspirational, thus such figures should be treated with caution.

Advertisement

By comparison, investment and expenditure commitments in altnets totalled £5.7 billion up until the end of 2021. All told, investment in full fibre by the major suppliers, AltNets and government funding combined are expected to reach £36.7 billion.

Some previous studies have predicted that it would cost £30bn to cover the UK in fibre, but those studies didn’t factor in the unknown quantity that is competitive overbuild (i.e. multiple operators spending money to build rival networks in the same areas).

Malcolm Corbett, CEO of INCA, said:

“This continued high level of investment, coupled with commitments from others in the private sector like BT and Virgin Media, and the money being put in by government, shows that the UK is on track, for the first time in its history, to have proper broadband infrastructure competition. Independent network operators are a key piece of this connectivity jigsaw which will offer consumers real choice and drive innovation in the broadband services they consume.”

Overall, altnets are continuing to have a significant impact across the United Kingdom and that is set to continue for the foreseeable future, which is one of the reasons why major operators like Openreach (BT) and Virgin Media (VMO2) are ramping-up their own builds (competition). The favourable changes via regulation (Ofcom) and a stronger political drive toward fibre have also helped altnets, albeit not always in their favour (here).

Speaking of political drive, the Government’s new £5bn Project Gigabit scheme has also promised to further boost such networks by supporting operators to deploy across the final 20% of predominantly rural premises, which often fall into the economically unviable trap (i.e. state subsidy is required to go further).

The goal is to make gigabit-capable networks available to at least 85% of UK premises by the end of 2025 (commercial deployments alone should hit about 80%+) and then “at least” 99% by 2030, but there are growing question marks over how altnet friendly the gap-funded contracts will be (some view Building Digital UK as having tailored it more to favour the biggest operators).

One challenge in all this is that the increasingly aggressive level of competition within the market, when coupled with rising levels of overbuild between networks, will perhaps inevitably produce both winners and losers. Such an outcome tends to invite consolidation, as well as the odd failure (early examples here and here). Suffice to say that it’s always wise to take forecasts like INCA’s with a pinch of salt.

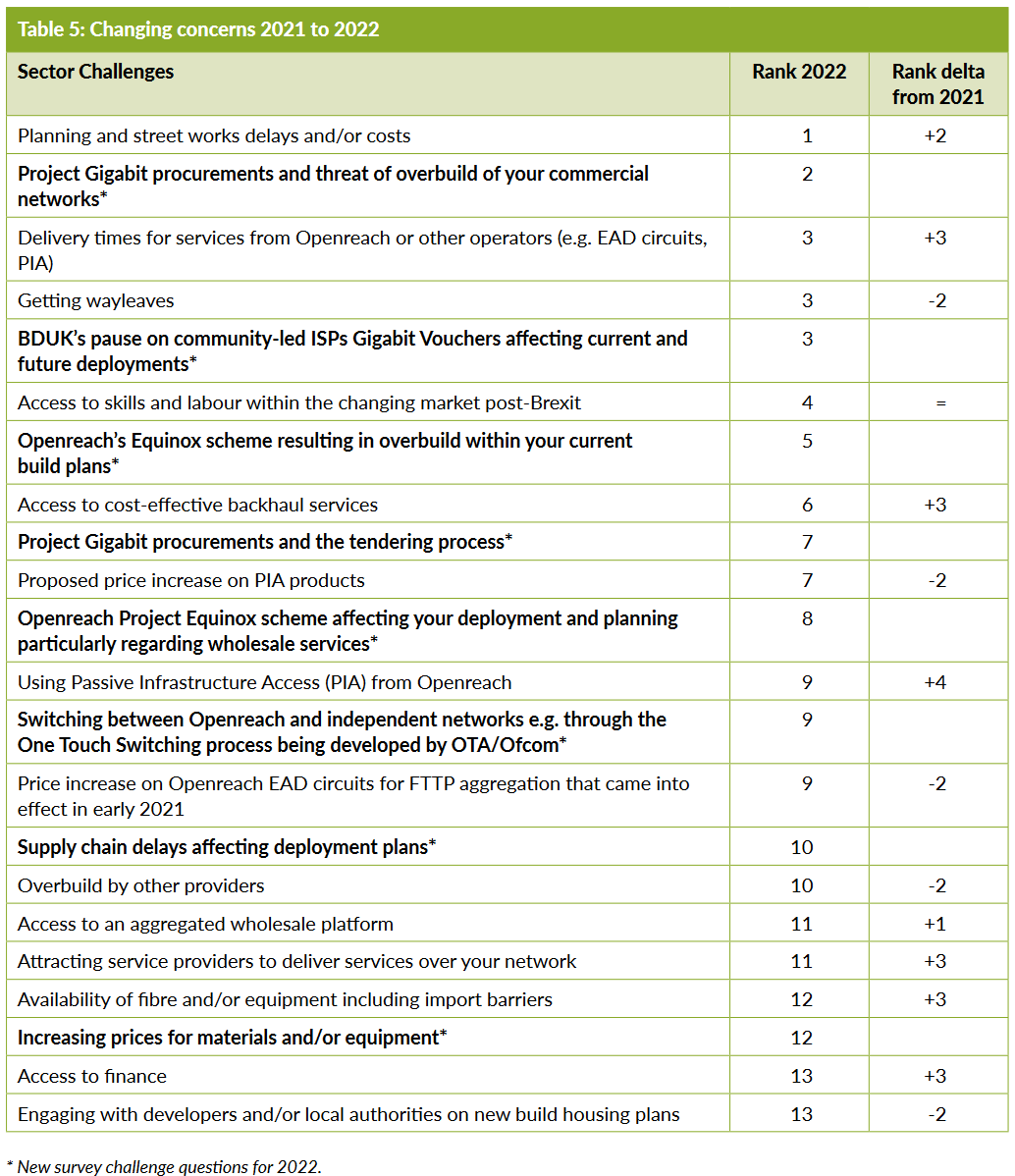

Finally, it’s noted that altnet providers still have a number of familiar concerns, some of which (e.g. overbuild by Openreach), remain almost as strong now as in previous years. Meanwhile, other issues, such as the known problems with planning / street works delays and wayleaves (legal access agreements), have reduced slightly in importance.

In addition, there’s some concern that a few altnets might struggle to adapt to Ofcom’s new ‘One Touch Switch‘ migration process in time for its launch in April 2023. INCA asked its members how ready they were, which found that just 8% were “substantially ready” and 72% were only at the start of the process. A few others hand’t even begun the process (we’ve certainly come across the odd one that didn’t know it applied to them too).

UPDATE 4:18pm

We’ve had a comment come in from Giganet.

Jarlath Finnegan, Chief Executive Officer at Giganet, said:

“Today, access to fast, reliable broadband is as essential to households as access to water and energy – so many functions of our everyday lives depend on it. That’s why it’s so reassuring to see such high-level investment from independent broadband providers propelling the UK forward in the delivery of nationwide full fibre infrastructure.

This future-proofing endeavour requires a diverse and competitive independent offering. As the sector doubles in size and benefits from continued growth, this can only help to drive competition, improve standards and ultimately benefit customers.

We are also confident in the sector’s ability to thrive. We are on track to connect 500,000 customers over the next 3 years and our success to date has led to us being named Overall Fibre Provider of the Year at the inaugural UK Fibre Awards 2022.

At Giganet, we want to challenge the status quo with an offering that’s grounded in honesty and simplicity. As homes and businesses turn to independent providers, we pride ourselves on our flexible contracts, and our promise to abolish exit fees and mid-contract price rises, as consumers continue to feel the pinch of rising living costs.”

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Gigaclear Extend Rural FTTP Broadband to 300,000 UK Premises

Broadband ISP Pine Media Launch Mesh WiFi Solution for Homes »

Is there a central website where you can check for alternative FTTP providers in your area? Seems to be difficult which ones are available (if any) by having to know about each one and check on their website separately.

A checker on Ofcom website seems to cover the alt nets. Although I found that if the house has been recently build it doesn’t recognise it for a while

https://bidb.uk/ This site shows WHAT FTTP is in your area/ who is planning to build in your area:)

Thank goodness for altnets. Power to the people. Keep up the good work.