BT Results See FTTP Broadband Surge to 7.2Million UK Premises

The BT Group has published their Q4 2021/22 results to March 2022, which saw the coverage of Openreach’s gigabit Fibre-to-the-Premises (FTTP) broadband ISP network grow by a record 752,000 premises in the quarter (up from +662K last quarter) to total 7.2 million. The operator also signed an FTTP co-provisioning deal with Sky Broadband.

The main issues of note since the last quarterly report have reflected an all too familiar dispute with the Communications Workers Union (CWU) over staff pay (here), as well as the recent decision to “pause” their rollout of Digital Voice (phone) services due to concerns over service outages (here) and the move to turn EE into their flagship consumer brand (here).

Otherwise, the operator’s main event continues to be their £15bn investment to deploy – via Openreach – a new full fibre broadband network to reach 25 million UK premises by December 2026. Some 6.2 million of those will be in rural or semi-rural areas (2.3m of the premises passed so far are said to be in “rural” areas).

Advertisement

Speaking of FTTP, Openreach has signed a new Memorandum of Understanding (MoU) agreement with Sky (Sky Broadband), which follows a “successful trial” and helps to establish a framework for FTTP co-provisioning. In other words, Sky’s engineers will now be able to “complete the majority of their FTTP in-premises provisioning activities” (this is usually the job of Openreach’s team) – that could save Sky some money.

Financial Highlights – BT’s Quarterly Change

* BT Group revenue = £5,168m (down from £5,369m)

* BT Group profit after tax = £388m (down from £455m)

* BT Group total net debt = £18,009m (increased from £17,741m)

Sadly, BT’s (EE) consumer division doesn’t publish full customer figures for their own retail broadband ISP, except on their ultrafast services. BT Consumer reported that they had 1.165 million FTTP customers (up from 1.053m last quarter) and EE’s “5G Ready” base now stands at 7.228 million (up from 6.418m).

Meanwhile, some 80.2% of BT’s fixed consumer base take a “superfast broadband” product (down slightly from 81.1% last quarter), which drops to 10.1% (up from 8.6%) for their “ultrafast broadband” (100Mbps+) products – includes both G.fast and FTTP. We also noted that 21.7% of BT’s customers are now taking both mobile and broadband (converged) – up slightly from 21.5%.

Openreach’s Network

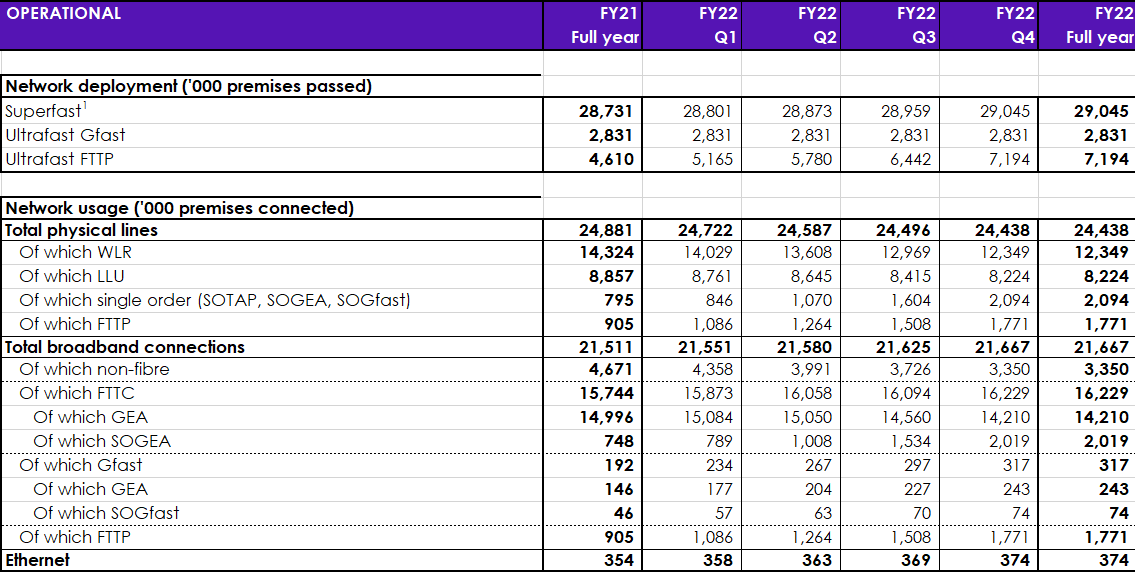

The table below offers a breakdown of fixed line network coverage and take-up by technology on Openreach’s UK network, which covers the totals for all ISPs that take their products combined (e.g. BT, Sky Broadband, TalkTalk, Zen Internet, Vodafone etc.).

Advertisement

The rollout of full fibre (FTTP) lines continues to grow, with +752,000 premises being added in the quarter (up from +662K last quarter). As for take-up, some 1.771 million FTTP broadband connections have been made on Openreach’s network (up from 1.508m), which equates to a take-up of 24.62% (up from 23.41% last quarter).

The rapid rollout of a new network almost always tends to suppress the take-up figures, thus Openreach is doing well to keep it level and even growing. One other figure worth mentioning here is that over 59% of FTTP orders in Q4 were for ultrafast speeds (100Mbps+), which also suggests that quite a lot of people are still taking full fibre on the slower but cheaper “superfast” (40Mbps to 80Mbps) plans.

Philip Jansen, CEO of BT Group, said:

“BT Group has again delivered a strong operational performance thanks to the efforts of our colleagues across the business. Openreach continues to build like fury, having now passed 7.2m premises with 1.8m connections; a strong and growing early take-up rate of 25%. Meanwhile, our 5G network now covers more than 50% of the UK population. We have the best networks in the UK and we’re continuing to invest at an unprecedented pace to provide unrivalled connectivity for our customers. At the same time we’re seeing record customer satisfaction scores across the business.

We have finalised the sports joint venture with Warner Bros. Discovery to improve our content offering to customers, aligning our business with a new global content powerhouse. Separately, we have strengthened our strategic partnership and key customer relationship with Sky, having now extended our reciprocal channel supply deal into the next decade and agreed a MoU to extend our co-provisioning agreement.

Our modernisation continues at pace and we are extending our cost savings target of £2bn by end FY24 to £2.5bn by end FY25. We delivered EBITDA growth of 2% this year as strong savings from our modernisation programme more than offset weaker revenues from our enterprise businesses due to well-known market challenges.

While the economic outlook remains challenging, we’re continuing to invest for the future and I am confident that BT Group is on the right track. As a result, we are today reconfirming our FY23 outlook for revenue growth, EBITDA of at least £7.9bn and also the reinstatement of our full year FY22 dividend, as promised, at 7.7 pence per share.”

By the end of the decade, BT said they expect to see an expansion of at least £1.5bn in normalised free cash flow compared to FY22, solely from lower capex and operating costs as they move towards an all-fibre, all-IP network. In addition, the move to FTTP will enable them to recover copper from their legacy network.

Advertisement

On the subject of copper recovery, which has come up a few times on these pages, BT’s initial estimates indicate that around 200k tonnes of copper could be recovered from their network through the 2030s. “We are currently undertaking trials to better understand the costs associated with recovering this valuable asset,” said the results. We’ll be keeping an eye on the results from that.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« ASA UK Bans Tesco Mobile Adverts Over Offensive Content

200 million kilograms of copper! that must be several KG per connection

There are lots in the ground not being used. I know of 600m of .9 100 pair cable just sat there unused.

LLP

Are those cables just abandoned or a spare/fallback connection for when things go wrong?

Openreach don’t have high pair count cables sitting in the ground round nothing on the off-chance there’s a cable cut, John.

In common with everyone else there’s resiliency deeper into the network but not the access layer. A cable is broken a new section is installed and spliced / jointed.

Will almost inevitably be some spare pairs in a cable but spare cables facing end users aren’t really a thing.

200k tonnes of scrap copper is worth about £1.5bn at todays prices, minus recovery costs.

The only downside of recovery I can think of is that leaving something in the ground at least occupies duct space to prevent silting etc. That said it would still be cost effective & more efficient to recover copper cables and replace it with plastic sub-duct that can be sealed for future use.

Honestly, if they are not already selling their copper as scrap metal I would be surprised.

It reads more like a cynical attempt at suggesting they have, like you say, £1.5bn of copper assets within the company. i.e. an attempt to truthfully massage and improve the stock market valuation.

Without being able to factor in the actual cost of sale and the activities required to facilitate the process, it’s harder to value it as an investment case.

Assets have to go on the balance sheet by law.

“We are currently undertaking trials to better understand the costs associated with recovering this valuable asset”

And how much will you spend fighting the thieves? They will help you recover it for free i’m sure

Should not be to difficult to work out the cost of recovering the cable. Cut it and pull it out. Unless blockages pulling out a heavy cable should not be difficult. What might be a problem is fibre in the ducts that’s quite fragile

If Fibre has gone in though you can be reasonably sure there are no blockages

Having an asset tied up in the ground and earning no revenues is no a good use of capital

Many ducts were already congested, made worse by having fibre pulled alongside. Pulling the copper out of these without damaging the fibre is going to be *really* difficult.

For a copper thief who just cuts, pulls and runs without caring about any damage caused, it is just about worth it. If it needs to be done in a careful and controlled manner, I don’t see it happening – except when needed to free up duct space, not for copper recovery.

But still no fttp hear its just on the door step but bts lies have put me off all ready tbh

Who actually funds the BT FTTP Roll out ?

Most of the Openreach FTTP rollout is done on a commercial basis, so BT do.

Not here after a year of faffing about BT openreach finally admitted I can have FTTP. They fixed their records and I can order with anyone I want…I even have an email from them. I have now tried with sky twice. The first order was cancelled as,surprise the records were not updated. And cancelled against as my current provider will not agree to port my telephone number over. I have this in writing from sky but my current provider are adamant its not them holding it up. Seriously What is the point in this country anymore.

I’ll be heading to one of their competitors building their own network. Had enough of shoddy maintainace and the lack of communication or accountability on openreach’s part. Completely broken trust with any BT product.

What a rediculous comment! You would put your faith in an unregulated company, not bound by any OFCOM policies good luck pal

I worked on cable recovery as a BT engineer for 7 years and I can say the amount of lead covered copper cables still in the ground is vast! Even redundant copper cables in big exchanges (Birmingham, London, Glasgow) is just waiting to be recovered!