BDUK Reveal Responses to Broadband Connection Vouchers Consultation

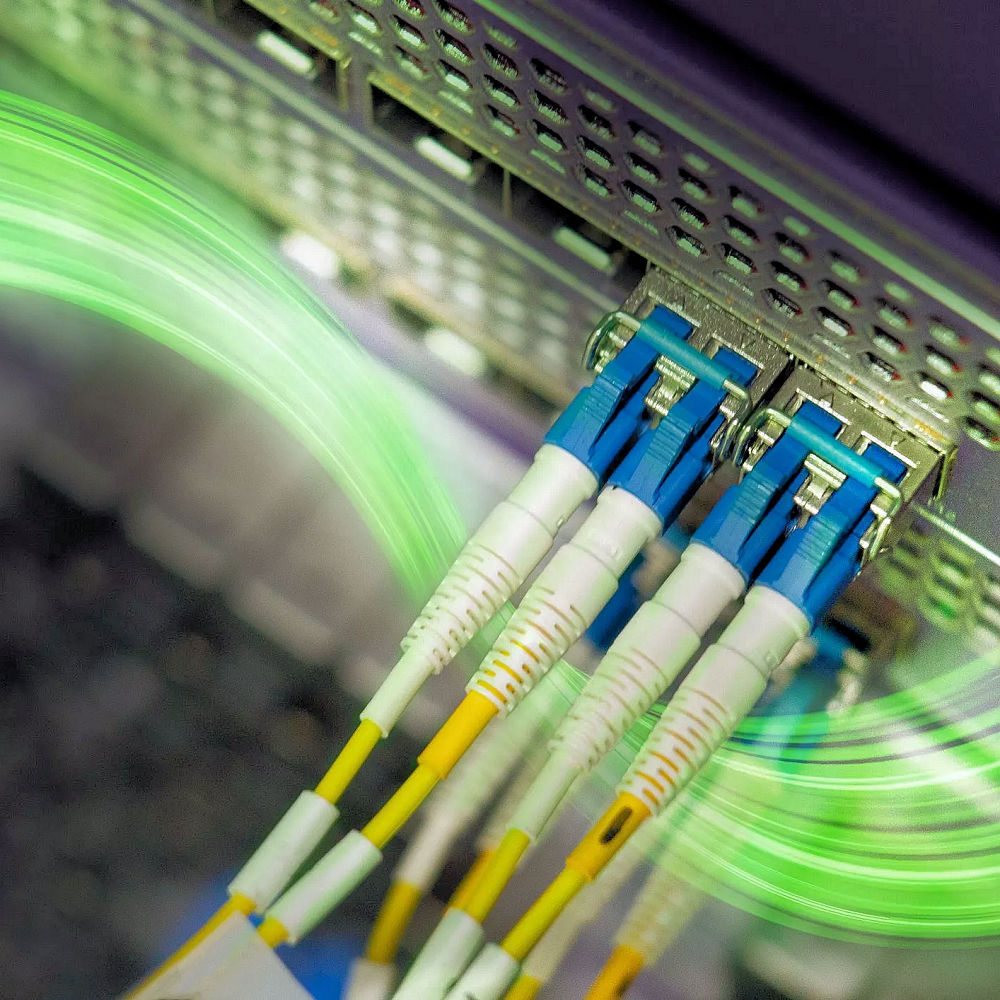

The government’s Broadband Delivery UK office has published details of the 31 responses that were received during the brief consultation on their new Connection Vouchers Scheme, which uses part of the £150 million+ “Super-Connected Cities” / Urban Broadband Fund to help businesses cover the cost of installing a new superfast broadband ISP service.

The original plan was designed to help expand the coverage of “ultra-fast” broadband (80-100Mbps+) into neglected areas by generally investing in new infrastructure but this was scuppered by a mix of legal challenges from BT and Virgin Media (here) and EU competition concerns over the use of state aid in urban areas where the private sector should not be struggling to invest (here).

By comparison the new scheme offers grants of between £250 and up to a maximum of £3,000 +vat for individual premises / businesses (i.e. any small or medium sized firm of up to 249 employees with a turnover no greater than around £42m per year) in selected cities to help them get connected to a superfast broadband (30Mbps) or faster service from their ISP.

The scheme is currently now being market-tested in five cities (Belfast, Cardiff, Edinburgh, Manchester and Salford) until the end of September 2013 and after that it will be rolled out to London, Birmingham, Bradford, Leeds, Bristol, Newcastle, Brighton and Hove, Cambridge, Coventry, Derby, Oxford, Portsmouth, York, Newport, Aberdeen, Perth and Derry (Londonderry).

Overall most respondents wanted to see more effort being put into raising awareness about the scheme and the benefits of superfast broadband. Further clarity was also requested over the prospect of using demand aggregation to help connect larger locations like multi-occupancy buildings and business parks.

Most also agreed that the vouchers should only be used for connection costs (ideally 100% of the connection fee) and that the schemes central website portal should not be the sole means of contacting the relevant ISPs. But there were also plenty of points that might need further examination.

Connection Vouchers Scheme – Points for Consideration

1. Voucher value – The proposed maximum and minimum voucher values are acceptable to many respondents. A number suggest they should be higher and have more flexibility i.e. £500 minimum to £4,000/ £5,000 maximum with local scope to allow for exceptions to this where required. A few others suggest the maximum voucher value should be lower.

2. Connection charges – A few respondents do not think that connection charges are a genuine barrier to digital connectivity. However, some other respondents identify the charges as a genuine barrier.

3. Permitted expenditure – A few respondents have some concerns over what the vouchers can be spent on, suggesting the limits to qualifying expenditure will disadvantage certain supplier groups or technologies. In particular, two main groups:

(a) Providers that choose to amortise the upfront connection over the contract term thereby making the connection charge low or zero, but the on-going monthly charges higher and the term longer; and

(b) Providers who have made historic investments in dark fibre and are not permitted to recover those costs under the scheme and so may lose the advantage of those investments.4. Market distortion – A few respondents raise concerns that the scheme might lead to a distortion in competition by favouring some types of supplier over others. A few other respondents stated that they will reserve judgement until the scheme has been implemented.

5. Length of market test – A few respondents indicate that a two month market test will not be long enough to conduct a meaningful and representative study of the scheme benefits due to the lead times for deploying many of the solutions. However, it should be adequate for testing interfaces and processes.

6. Money better spent in rural areas on the last 10% – Some respondents consider that support should be prioritised to those enterprises and citizens that are in rural and under connected areas. The view here is that access to and the uptake of broadband services will have a far greater impact on growth and bridging the digital divide in these areas.

7. Clarity on the State Aid position– Some respondents mention the importance of suppliers receiving clarity on whether the scheme will continue to be viewed as non-aid attracting and that the current uncertainty is limiting the number of suppliers willing to participate in the scheme. BDUK is in on-going discussions with the Commission to gain clarity on the position.

8. Desire for simple scheme – A number of respondents suggest the scheme should be as user-friendly as possible avoiding excessive bureaucracy. This includes standard processes and procedures across the participating cities whilst recognising the possibility of a degree of local flexibility.

9. Prevention of fraud – A few respondents mention that the auditing infrastructure needs to be designed so that it is able to both detect and prevent fraud. It needs to eliminate the very possibility of abuse as far as possible.

10. Voucher expiry date – A few respondents mention the need for an expiry date so that end users are incentivised to use their vouchers quickly.

11. Demand statistics – Many respondents raise the importance of suppliers having access to end user demand statistics from local authorities to enable them to target their offers effectively.

12. ’Home based’ businesses – One supplier suggests these types of business should be excluded from the scheme as the economics to residential areas are different. Alternatively, a few suppliers suggest including digitally excluded residents in the scheme.

13. Clarity on monitoring – One supplier is unclear how the capital only principle would be monitored in the event of internet service providers who purchase a wholesale service from a network provider. It questions whether it would be necessary for the wholesale product charges to be split between capital and operational expenditure.

ISPreview.co.uk notes that some responses in particular are also worth a read:

Highlighted Responses

BT response (PDF)

Federation of Small Businesses’ response (PDF)

Hyperoptic’s response (PDF)

INCA response (PDF)

ISPA response (PDF)

TalkTalk’s response (PDF)

Three UK’s response (PDF)

Virgin Media’s response (PDF)

The feedback will now be used to help inform the schemes final design, which may or may not be adjusted to take account of the many points that have been raised.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook and Linkedin.

« Zen Internet and PlusNet Top PC Pro 2013 Best UK Broadband ISP Awards

Latest UK ISP News

- FTTP (5512)

- BT (3514)

- Politics (2535)

- Openreach (2297)

- Business (2261)

- Building Digital UK (2243)

- FTTC (2043)

- Mobile Broadband (1972)

- Statistics (1788)

- 4G (1663)

- Virgin Media (1619)

- Ofcom Regulation (1460)

- Fibre Optic (1394)

- Wireless Internet (1389)

- FTTH (1381)

Comments are closed