BT and Axione Lock Horns Over Scotland’s R100 Broadband Plan

The Scottish Government’s future £600m R100 (Reaching 100%) superfast broadband rollout programme could be facing a problem after sources told ISPreview.co.uk that Axione, one of three remaining bidders for the contract, had allegedly set its lawyers on BT (Openreach) over claims of anti-competitive behaviour.

At the time of writing Openreach and Axione have both informed us that they wouldn’t be commenting, but equally they didn’t deny that such a situation had arisen. Meanwhile we caught the Scottish Government a little late on Friday and as such they’re still checking whether any guidance or background can be offered, but they too have a policy of not commenting when it comes to ongoing legal proceedings.

The R100 project was first formally unveiled at the end of 2017 and its aim is to go beyond the existing £428m Digital Scotland (DSSB) scheme with BT by aspiring to make “superfast broadband” (30Mbps+) ISP networks available to “every single premise in Scotland” by the end of 2021 (here and here); March 2022 as a financial year.

Advertisement

Several suppliers including BT, Gigaclear, Axione and SSE Enterprise Telecoms were originally known to be bidding to supply the new scheme, which currently states that there will be 178,948 premises eligible for intervention across three regional lots (i.e. more may be required to reach 100% coverage).

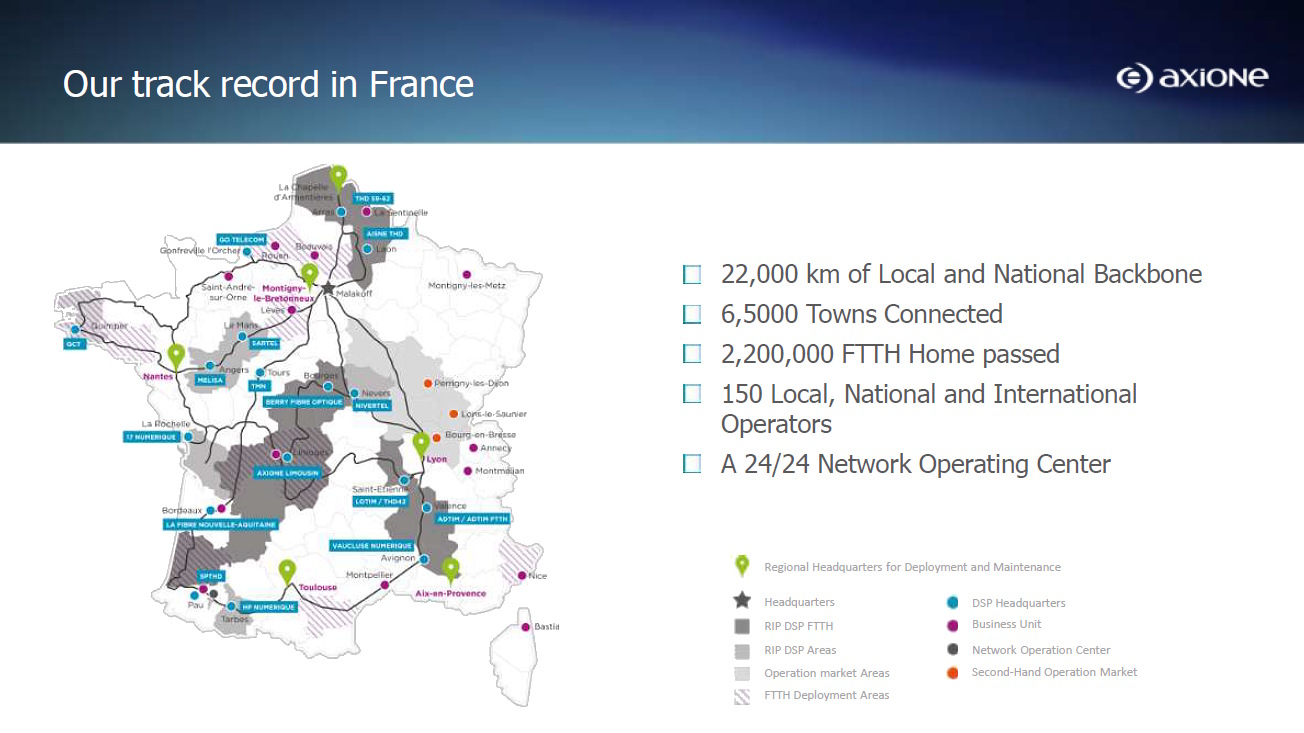

Few people in the UK will be familiar with Axione as they’re not a household name over this side of the channel (no real presence in the consumer market), but as a wholly-owned subsidiary of the French Bouygues Group they’ve been building a lot of Fibre-to-the-Home (FTTH/P) infrastructure across parts of France and a little in Ireland. FTTH is increasingly important given the UK’s new hope for universal coverage by 2033 (here).

Arguably the uncertain outcome of Brexit and Axione’s lack of a significant pre-existing presence in the United Kingdom – at least around consumer fixed line broadband infrastructure – will have made them more of an outside bet compared with BT and Gigaclear (the latter is only present in England). On the other hand Scotland’s contract is a significant and attractive prospect for such an operator, which will have fuelled serious interest.

Advertisement

In the meantime any kind of legal problems could threaten the Scottish Government’s hope of being able to sign their first supplier contracts in January or February 2019. We may be able to update this article further next week, although it’s proven to be particularly difficult to get hold of our usual contacts during the summer holiday period.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Government Seeks Suppliers for 5G Trial on Trans Pennine Route

Comments are closed