UK FTTH Grows as Global Fixed Broadband Subscribers Hit 1 Billion

A new report has revealed that 81% of global fixed broadband ISP subscriptions were fibre optic (FTTH/B/C) and cable (DOCSIS) based during Q3 2018, while the total number of connections increased by 25.4 million (+2.6%) in the quarter to deliver a milestone total of 1.008 Billion!

The data, which was produced by Point Topic, notes that Cable networks (HFC DOCSIS platforms like Virgin Media) saw an annual growth rate of 4.5%, while “full fibre” (FTTH/P) networks surged by 22.9%, hybrid fibre (FTTC/FTTx) platforms grew by 5.8%, Satellite reported a rise of 2.8% and fixed wireless networks grew by 6.5%. Meanwhile old and slow pure copper line broadband (ADSL, SDSL etc.) services declined by -7.9%.

As usual China continues to be the largest fibre growth market, reporting an annual increase in ultrafast Fibre-to-the-Home (FTTH) connections of 25% and this constituted 82% of global FTTH net adds in the period. But Argentina (21%), Brazil (19%), UK (11%) and France (10%), among others, also saw “significant” FTTH quarterly growth rates.

Advertisement

We note that the United Kingdom’s quarterly growth rate of 11% also marks another improvement from the 10% reported in Q2. All of this is in keeping with the recent ramp up in fibre optic deployments from operators like Openreach (BT), Cityfibre, Gigaclear, Community Fibre, Hyperoptic, B4RN and others (Summary of UK Full Fibre Plans).

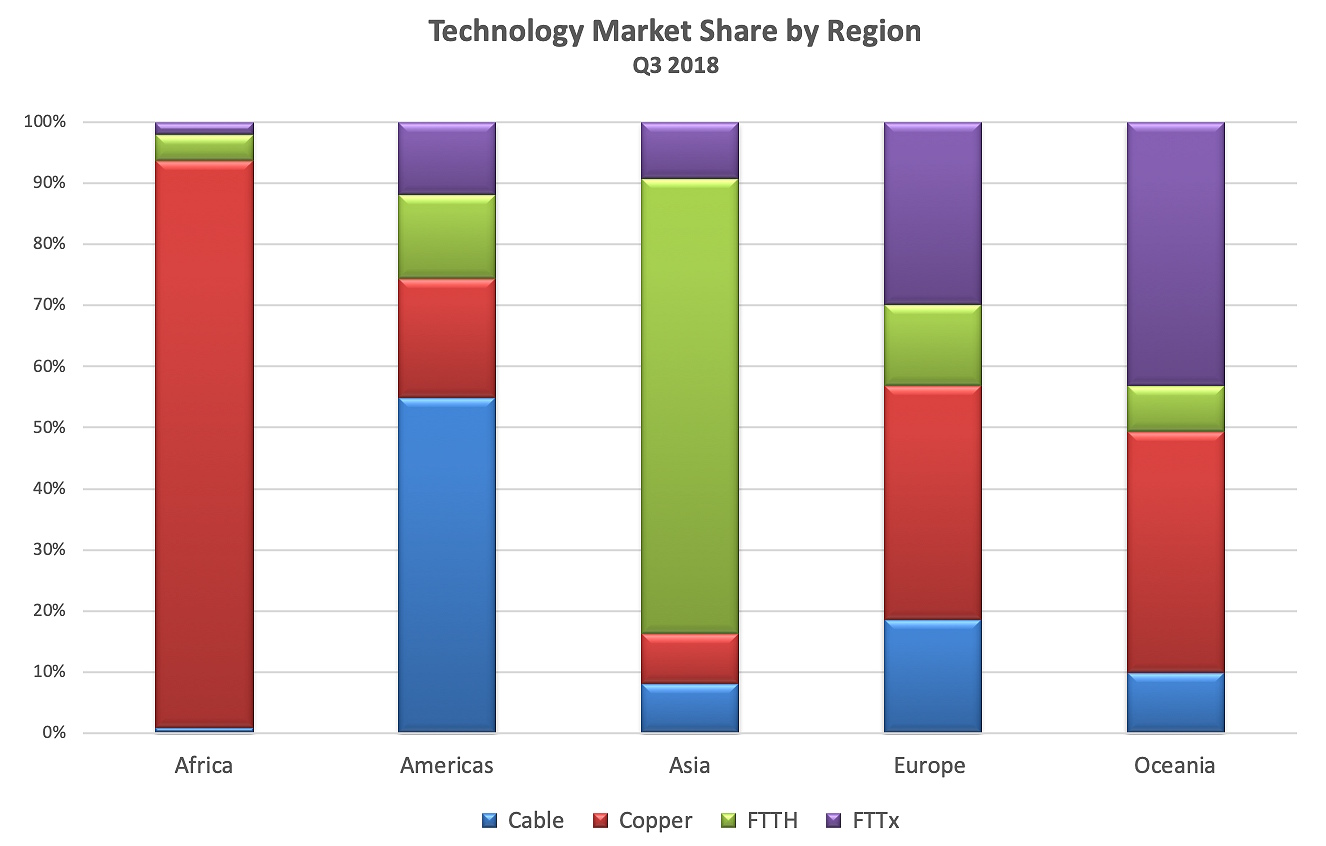

However it’s worth pointing out that, in Europe at least, FTTx hybrid fibre (FTTC / VDSL / G.fast) style broadband services are currently still growing their market share at a faster rate than other technologies. For example, a year ago FTTx services held a technology market share of around 24% but this has since grown to 30%. Over the same period FTTH has seen its share go from about 10% to roughly 14%.

Italy was among the top VDSL / FTTx growth markets, with quarterly growth of 14%. Meanwhile other countries, such as the United Kingdom, have already achieved near universal coverage of hybrid fibre networks and the on-going roll-out is now much slower (i.e. mostly focused upon the final 4% of rural premises). As highlighted above, the UK has clearly switched its focus to FTTH.

Advertisement

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Vodafone Attracted Most Broadband and Phone Moans in Q3 2018

Iceland Plan New Undersea Fibre Optic Link to UK or Ireland »

Comments are closed