Gov Issue Spring 2022 Update on UK Project Gigabit Broadband Rollout

The Government’s Building Digital UK team has today published a Spring 2022 progress update for their £5bn Project Gigabit broadband rollout, which among other things adds new regional procurements in Norfolk and Suffolk and two local supplier procurements in Cornwall, potentially extending 1Gbps speeds to c.190,000 premises.

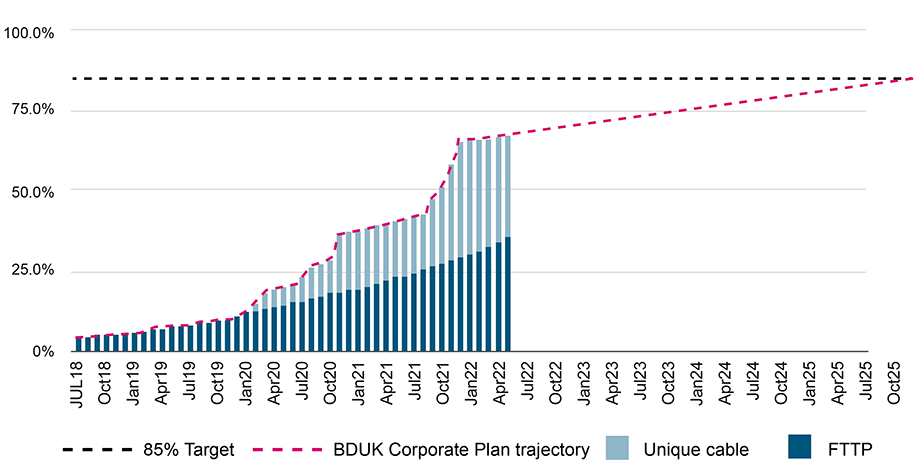

Project Gigabit is designed to extend such download speeds to reach at least 85% of UK premises by the end of 2025, before hopefully nationwide coverage (c. 99%) by around 2030 (here). The funding released for this will depend upon how the industry responds. So far only £1.2bn has been released from the budget up until 2024, but more is expected to be unlocked provided the industry shows it can deliver.

The update notes that around 68% of UK premises can already access a gigabit-capable network (c. 36% via just FTTP) and that’s mostly thanks to Virgin Media’s upgrade to their existing HFC lines (here). Generally, it’s expected that commercial builds could push gigabit coverage up to around 80% by the end of 2025 (mostly urban build), but public funding will then be needed to tackle the rest due to the disproportionately high cost of deployment.

Advertisement

It’s worth noting how such figures are split. In January 2022, 70% of urban premises across the UK had access to gigabit-capable connections (up from 39% in Jan 2021), along with 30% of rural premises (up from 19%). At the same time, 66% of residential premises and 40% of businesses premises had access to gigabit capability (Ofcom’s Spring 2022 update).

The project is designed to focus on improving connectivity for those rural and semi-rural areas in the final 20% (5-6 million premises). This consists of several support schemes, including gigabit vouchers (£210m), funding to extend Dark Fibre around the public sector (£110m) and gap-funded deployments with suppliers (rest of the funding). Today’s article is largely focused upon the latter, which sees ISPs bidding – via a new Dynamic Purchasing System (DPS) run by BDUK – to extend their networks across rural parts of the UK (usually split via larger ‘Regional’ contracts and smaller ‘Local’ ones).

What’s New in the Spring 2022 Update

The update starts with a summary of key BDUK progress and developments, which also mentions the completion of their original £164m Local Full Fibre Networks (LFFN) programme, which pre-dates the recent addition of £210m (see above) under Project Gigabit to help connect public sector sites to full fibre (the addition is effectively an extension of that schemes). The new fibre built by this scheme has, in quite a few areas, also made it easier for commercial deployments to extend to reach nearby homes and businesses via FTTP.

BDUK’s Key Quarterly Achievements (Spring 2022)

➤ BDUK reached a milestone of over 100,000 broadband vouchers issued (7,000 were issued in the last quarter alone), worth more than £185 million, with 65,000 claimed to date to support households and businesses with the additional costs of securing gigabit-capable connections.

➤ The Local Full Fibre Networks programme concluded on 31st March 2022, having delivered gigabit connectivity to more than 5,000 public buildings and 500 public assets – via a total of 39 projects, including schools, hospitals and community centres, with a government investment of £164 million. That’s 2,700km of fibre and 1,100km of new ducting laid, mostly in hard to reach areas, which includes upgrades to:

- 1,262 schools and colleges

- 348 libraries

- 53 hospitals

- 658 health centres including GP surgeries

- 627 council-owned offices

- 222 community centres

- 155 leisure centres

- 201 fire and ambulance stations.

➤ BDUK launched new regional procurements in Norfolk and Suffolk and two local supplier procurements in Cornwall, extending gigabit-capable connectivity to up to around 190,000 premises.

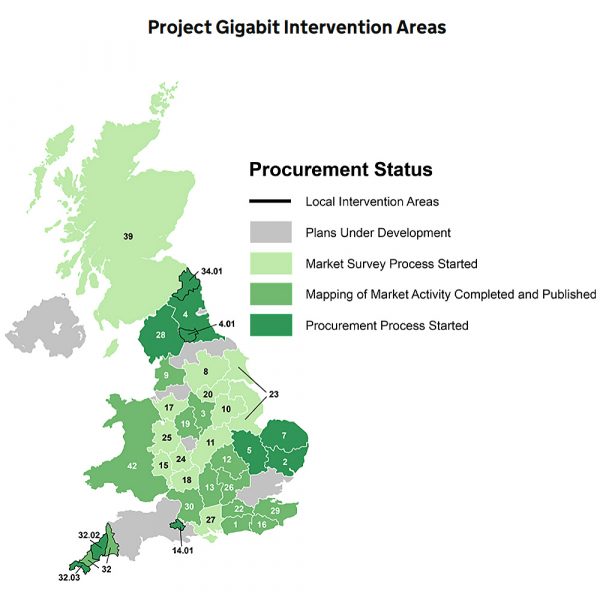

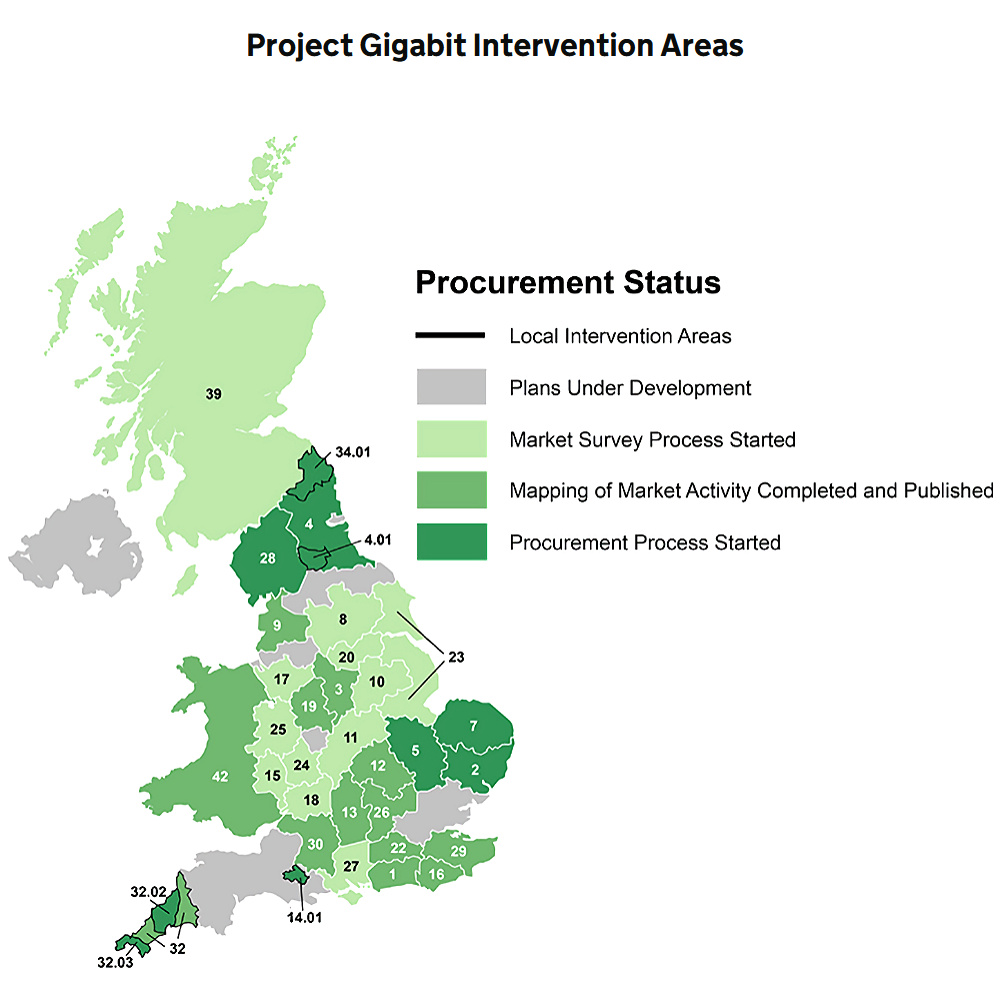

➤ BDUK has now completed over 20 market engagement exercises across the UK: Leicestershire and Warwickshire (Lot 11), Nottinghamshire and West of Lincolnshire (Lot 10), West Yorkshire and parts of North Yorkshire (Lot 8), South Yorkshire (Lot 20) and Scotland (Lot 39) Herefordshire (Lot 15), Lincolnshire and East Riding (Lot 23), Cheshire (Lot 17), Gloucestershire (Lot 18), Oxfordshire and West Berkshire (Lot 13), Kent (Lot 29), Buckinghamshire, Hertfordshire and East of Berkshire (Lot 26), Staffordshire (Lot 19), West Sussex (Lot 1), East Sussex (Lot 16), Bedfordshire, Northamptonshire and Milton Keynes (Lot 12), Derbyshire (Lot 3), Wiltshire and South Gloucestershire (Lot 30), Lancashire (Lot 9) and Surrey (Lot 22) and Wales (Lot 42).

➤ On 1st April 2022 BDUK launched as a new Executive Agency of DCMS to deliver Project Gigabit and the Shared Rural Network (details).

As for those gap-funded supplier procurements (regional and local), which will see network suppliers (e.g. BT, CityFibre, VMO2 etc.) bid to help extend gigabit-capable broadband coverage to homes and businesses in the final 20% of the UK. Today’s update notes that there are now contracts worth £543m (public funding) in total for telecoms firms to bid on across the UK and this is expected to connect up to 380,000 hard-to-reach premises.

Advertisement

The first contracts under this are expected to be “awarded from August” this year, but you then have to allow several months for engineering surveys before the rollout plan and build itself can begin. As we’ve said before, this will probably take us into early 2023 and that’s just for the first contracts. Some other areas (e.g. Wales, Scotland etc.) have yet to even begin procurement and some of their builds might thus not even start until 2025!

As mentioned earlier, Norfolk (Lot 7) and Suffolk (Lot 2) have both moved into the procurement stage this quarter, with an estimated contract award window of March 2023. Similarly, they’ve been joined by two smaller local supplier procurements in Cornwall and the Isles of Scilly, which will be awarded to a supplier a little quicker than the aforementioned pair.

Gigabit Infrastructure Subsidy (GIS) – Live Procurement Pipeline

(Spring 2022)

Advertisement

| Procurement Type | Area | Contract award date | Uncommercial premises in procurement area | Indicative Contract Value |

|---|---|---|---|---|

| Local | North Dorset (Lot 14.01) | Aug 2022 | 7,100 | £11.0 million |

| Local | North Northumberland (Lot 34.01) | Aug 2022 | 3,900 | £7.3 million |

| Local | Teesdale (Lot 4.01) | Aug 2022 | 4,100 | £6.6 million |

| Local | Cornwall (Lot 32.03) | Oct 2022 | 9,750 | £18 million |

| Local | Cornwall and Isles of Scilly (Lot 32.02) | Jan 2023 | 9,500 | £18 million |

| Regional | Cumbria (Lot 28) | Sept 2022 | 60,800 | £109.2 million |

| Regional | North East England (Lot 4) | Nov 2022 | 61,800 | £89.6 million |

| Regional | Cambridgeshire and adjacent areas (Lot 5) | Nov 2022 | 49,700 | £68.6 million |

| Regional | Norfolk (Lot 7) | Mar 2023 | 86,200 | £114.2 million |

| Regional | Suffolk (Lot 2) | Mar 2023 | 87,200 | £100.4 million |

The dates and figures mentioned above are naturally estimates (subject to change) and will remain that way until after contracts, as well as engineering surveys, have been awarded. In addition, the contract values above are only referencing public investment, although it’s expected that suppliers may also contribute some of their own private investment to each contract.

Finally, BDUK also has a long list of upcoming procurements in their pipeline. But as noted earlier, some projects (e.g. Scotland and Wales) haven’t even got this far yet. This pipeline represents an indicative forward view of commercial activity to be undertaken by the programme. Some of the information provided is based on modelled data that will be superseded.

Upcoming Procurements

| Procurement Type | Area | Procurement start date | Est. contract award date | Uncommercial premises in procurement area | Indicative Contract Value |

|---|---|---|---|---|---|

| Regional | Lot 27 Hampshire* | June – Aug 2022 | Apr – Jun 2023 | 99,000 | £120 million – £215 million |

| Regional | Lot 25 Shropshire* | June – Aug 2022 | Apr – Jun 2023 | 42,600 | £40 million – £75m |

| Regional | Lot 24 Worcestershire | Sep – Nov 2022 | Jul – Sep 2023 | 45,600 | £50 million – £84 million |

| Regional | Lot 13 Oxfordshire and West Berkshire | Sep – Nov 2022 | Jul – Sep 2023 | 67,000 | £67 million – £114 million |

| Regional | Lot 29 Kent | Sep – Nov 2022 | Jul – Sep 2023 | 109,500 | £119 million – £203 million |

| Regional | Lot 26 Buckinghamshire, Hertfordshire and East of Berkshire | Sep – Nov 2022 | Jul – Sep 2023 | 137,100 | £140 million – £237 million |

| Regional | Lot 19 Staffordshire | Sep – Nov 2022 | Jul – Sep 2023 | 70,800 | £72 million – £123m million |

| Regional | Lot 1 West Sussex | Sep – Nov 2022 | Jul – Sep 2023 | 56,700 | £66 million – £112 million |

| Regional | Lot 16 East Sussex | Dec 2022 – Feb 2023 | Oct – Dec 2023 | 41,200 | £49 million – £83 million |

| Regional | Lot 12 Bedfordshire, Northamptonshire and Milton Keynes | Dec 2022 – Feb 2023 | Oct – Dec 2023 | 81,300 | £84 million – £144 million |

| Regional | Lot 3 Derbyshire | Dec 2022 – Feb 2023 | Oct – Dec 2023 | 57,000 | £64 million – £110 million |

| Regional | Lot 30 Wiltshire and South Gloucestershire | Dec 2022 – Feb 2023 | Oct – Dec 2023 | 84,800 | £85 million – £145 million |

| Regional | Lot 9 Lancashire | Dec 2022 – Feb 2023 | Oct – Dec 2023 | 82,000 | £90 million – £153 million |

| Regional | Lot 22 Surrey | Dec 2022 – Feb 2023 | Oct – Dec 2023 | 99,400 | £101 million – £171 million |

| Regional | Lot 11 Leicestershire and Warwickshire | Feb – Apr 2023 | Nov 23 – Jan 24 | 112,900 | £114 million – £194 million |

| Regional | Lot 10 Nottinghamshire and West of Lincolnshire | Feb – Apr 2023 | Nov 23 – Jan 24 | 89,700 | £90 million – £152 million |

| Regional | Lot 8 West Yorkshire and parts of North Yorkshire | Feb – Apr 2023 | Nov 23 – Jan 24 | 125,200 | £128 million – £218 million |

| Regional | Lot 20 South Yorkshire | Feb – Apr 2023 | Nov 23 – Jan 24 | 56,800 | £59 million – £103 million |

| Regional | Lot 17 Cheshire | Apr – Jun 2023 | Jan – Mar 24 | 74,300 | £85 million – £144 million |

| Regional | Lot 6 Devon and Somerset | Apr 2023 | Jan – Mar 24 | 159,600 | £198 million – £337 million |

| Regional | Lot 15 Herefordshire | Apr – Jun 2023 | Jan – Mar 24 | 23,700 | £30 million – £60 million |

| Regional | Lot 18 Gloucestershire | Apr – Jun 2023 | Jan – Mar 24 | 44,700 | £40 million – £80 million |

| Regional | Lot 23 Lincolnshire (including NE Lincolnshire and N Lincolnshire) and East Riding | Apr – Jun 2023 | Jan – Mar 24 | 105,700 | £106 million – £180 million |

| Regional | Lot 14 Dorset | Jul – Sep 2023 | Apr – Jun 2024 | 56,500 | £62 million- £105 million |

| Regional | Lot 21 Essex | Jul – Sep 2023 | Apr – Jun 2024 | 78,400 | £79 million – £135 million |

| Regional | Lot 31 Northern North Yorkshire | Jul – Sep 2023 | Apr – Jun 2024 | 28,200 | £25 million – £42 million |

We should remind readers that this rollout is NOT an automatic upgrade, thus you will still need to order the service from a supporting ISP (1Gbps is the target speed, but slower and cheaper options will also exist to order). In addition, no specific network coverage checkers will be available for areas in this programme, at least not until AFTER the contracts have been awarded and the necessary engineering surveys completed.

Finally, BDUK have now adopted a live, searchable source of procurement information alongside other DCMS procurement opportunities (see here). This is because the list was starting to get a bit too long for normal summaries.

Project Gigabit Spring 2022 Update

https://www.gov.uk/../project-gigabit-delivery-plan-spring-update

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« CityFibre to Start GBP28m 1Gbps Broadband Build in Stockton

Welsh Government Give Local Broadband Fund a GBP9m Boost »

‘Unique cable’?

They mean Virgin Media’s HFC / DOCSIS 3.1 network, which is about 14.3 million premises.

Looks like the procurement dates have been pushed back for Hampshire. The Hampshire Superfast Broadband website states “Hampshire is in Phase 1B of the procurement timeline with procurement documents expected to be issued at the end of April 2022.” but cannot see anything yet.

The dates have been pushed back by a few months for Hampshire. For the New forest its just another delay, as some areas have been waiting since 2018.. And then Hampshire ran out of money

Thomas Bibb CEO of Exascale has informed me that they are planning the whole of Telford, Walsall, Dudley, Stafford and South Staffordshire within the next 3-5 years.

Good news for my area – Telford 🙂

They’ve been talking about a big expansion for the past few years, but until they make that public then I’m inclined to take it with a pinch of salt. Do you have a copy of where they said that?

Will email you Mark Jackson

No doubt we’ll get the usual “why can’t they do me sooner?” whinges, but these updates give a good overview of how the overall scheme is moving forward.

I’m not whinging, just would like to know roughly this section of RCT (Rhondda Cynon Taf will be scheduled… It can’t be that difficult surely? I’m told Tonypandy is being done, but on my journey through there, I haven’t seen hide or hare, especially on the poles. Unlike the half a job project here in Tylorstown that OR started on the poles just up the road from me then they stopped?? No one knows why either which is err, strange or typical depending on the frame of mind you’re in.

Today it’s partygate with the Government going Pinocchio, will we have a Fibregate?

Where’s LOT 42 on the list? Or does 42 mean 2042? Sorry, I’m getting cynical and sarcastic in my later life since moving to “Rural” South Wales.

Ferndale is my exchange, but no news of anything yet… Other than a half finished project OR started then shelved, used to it by now to.

They haven’t even moved that into the procurement pipeline yet. As usual, devolved administrations like Wales and Scotland require a bit more time for the usual.. politics.

@Mark Jackson ah, so it’s 2042 then! I’m a bit marked as OR have refused to replace a almost 1 mile stretch of aluminium that’s faulty and causing at least 60+ houses in the area including ours to have flaky so called “Superfast Fibre” it’ll hold for 2 days then drop, so my love for OR isn’t great as a registered blind person I’ve thought this over 2 years so far! Any input would be awesome if you or anyone can point me in the direction of someone?