ThinkCX Reveal Subscriber Take-Up Rates for UK FTTP AltNet Providers

Telecoms analysts at global market intelligence firm ThinkCX have published a new Altnet Investment Scorecard, which attempts to identify the “winners and losers” in the UK’s rollout of full fibre broadband ISP networks by identifying the accomplishments of alternative networks in signing up actual new customers.

As we’ve said before (see here, here and here), the presence of so many AltNets in the market – all of which are building new gigabit-capable infrastructure (often overbuilding rival networks) – will, when combined with the current inflationary and other cost pressures – place a squeeze on the investment tap. Due to this, some projects may have to slow their build and focus more on generating take-up, while others may face consolidation.

One of the most useful measures when examining an operator’s likely Return on Investment (ROI) is to examine subscriber growth relative to the competition. But the problem is that very few AltNets actually release any take-up data, which is partly because people have a tendency to take it out of context (e.g. rapid builds will often suppress the take-up figure relative to network coverage).

Advertisement

In other cases, AltNets may simply not be performing as well as they would have hoped and so won’t feel inclined to broadcast that. But as we’ve always said, you can only really start to judge take-up properly by looking at areas where a network has been live for a couple of years, although we rarely see that level of detail.

The amount of take-up an operator needs to be viable can also vary between locations, so a single figure doesn’t always give you the whole story. For example, smaller rural communities often need much higher take-up than more competitive urban areas.

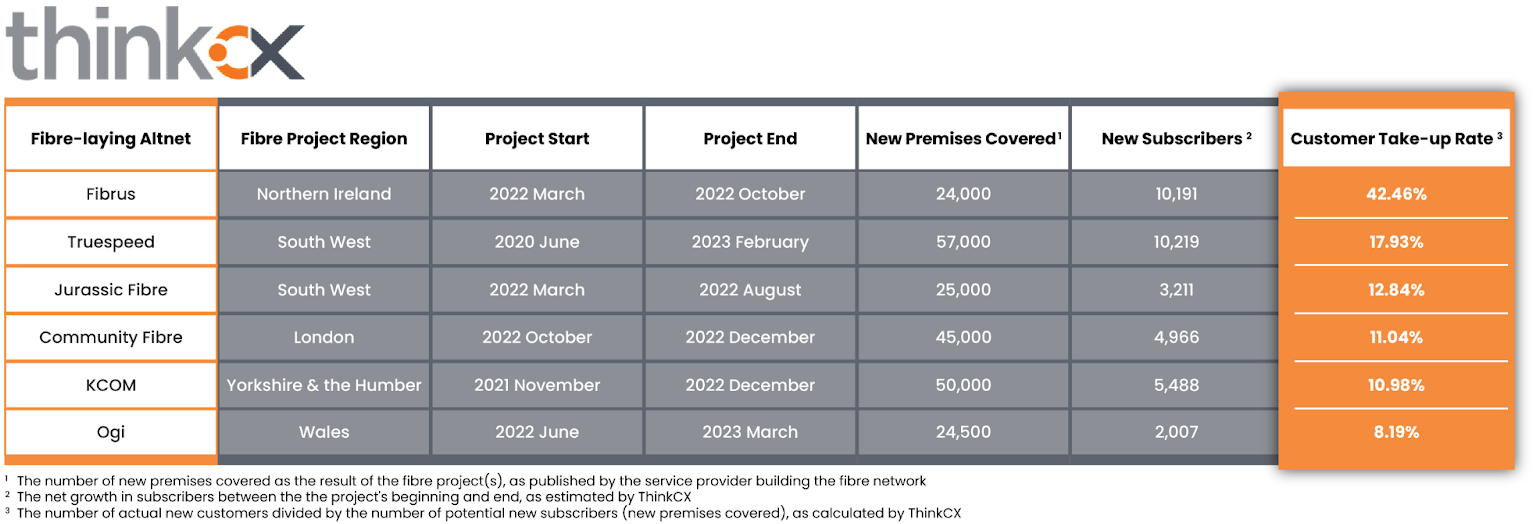

Despite this, ThinkCX’s new scorecard attempts to identify altnets’ accomplishments in signing up actual new customers, rather than solely claims of their premises passed. The full report is private (paid), but they have been kind enough to include sample data from six different UK networks deployed over the last 2 years (selected because they have a regional focus and are better suited for illustrating than using nationwide figures).

Apparently, this has been calculated using retail subscriber data for each altnet (Fibrus, Truespeed, Jurassic Fibre, CommunityFibre, KCOM and Ogi), although it does NOT account for wholesale network access supplied via other retail ISPs (if any). The accuracy is also somewhat dependent upon the credibility of the premises passed figures being released by the providers themselves.

Advertisement

Just to be clear, this is looking at a specific period of regional build and take-up, rather than an overall coverage total. But the data for Truespeed does seem to be much closer to their overall figures, since the provider has previously (Feb 2023) reported having covered 60,000 premises (up from 50k in Sept 2022) and being home to 13,000 customers (up from 11,500) – equating to 21.67% take-up.

On the other hand, Thinkbroadband informed us that Fibrus added over 60,000 premises in N.Ireland between March 2022 and October 2022 (this would drop that take-up figure a fair bit), so we still have questions about the accuracy of this data.

Ron Smouter, VP Sales and Marketing at ThinkCX, said:

“Reliance on ‘premises covered’ as an ROI measurement device is fatally flawed because it only tells half the story and is based on potential subscribers instead of actual subscribers. The market has seen the supply of private equity significantly curtailed in recent months as investing firms begin to look more carefully for evidence of success to support their M&A and investment plans.

The day of reckoning has arrived with our Altnet Investment Scorecard giving the most accurate picture yet of subscriber take rates – real subscriber acquisition relative to the size of potential subscriber coverage for each FTTH network area.

The data used here shows that, while the reach of each project is broadly similar (approx. 25,000 to 50,000 new potential subscribers), the take rates tell a wildly different story. The highest is 5 times that of the lowest, and only 1 of the altnet projects yielded a new customer take up rate in excess of the roughly 25% ‘break even’ figure for FTTH projects generally assumed by investors.

In any event, measuring the revenues generated by new customers divided by the total investment is a far more direct and meaningful ROI calculation than dividing the number of new premises covered by the total investment. But until now, determining the actual number of new subscribers resulting from a network building project has been a futile undertaking, as the UK altnets generally have no obligation to report their subscriber acquisitions. And frankly, until now, there hasn’t been an objective analytics firm like ThinkCX capable of precisely measuring customer take up rates in the UK’s regional broadband markets.”

At this point, some of you might be wondering how ThinkCX is actually able to figure out such subscriber data when it isn’t usually published by the providers. The answer is that they measure data from internet connected consumer devices that are using residential ISPs (e.g. it’s possible to tell what ISP each device is using and to calculate a figure based off that). A number of specialised search engines exist for pooling such data.

Advertisement

Using labels like “Project Start” and “Project End” is, however, a little bit confusing, as all the listed operators have ongoing builds and some of those began long before the listed start date (e.g. Fibrus began their N.Ireland build in 2019). But these labels just reflect ThinkCX’s data gathering period, although there does appear to be a lot of variation.

ThinkCX said they regularly benchmark their data against Ofcom figures and quarterly releases by the larger ISPs and claim to have very high accuracy (~99%).

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Honest Mobile SIM to Work Across ALL UK Network Operators UPDATE

Reliance on take up is also fatally flawed as it ignores the cost per subscriber and per premises passed.

The start and end dates are apparently arbitrary. This means nothing.

I clicked on this thinking I would just trash the numbers but surprisingly enough they look believable to me, well done. This is an ad for a VPN and why everyone should get one

Just the representation can be a bit misleading, Fibrus is not adding customers faster than Community Fibre and Ogi has 24k total, not just added in the last 6 months

Ripe for consolidation. Some will be picked up cheaply no doubt, but I’d put money on it happening – one day.

Ouch, apart from Northern Ireland, those take up percentages are terrible.

How much longer will the investors keep pumping money in?

Something’s going to go bang.

Further evidence that the real

people do not need it yet

Exactly correct, the majority simply don’t need, don’t want and aren’t prepared to pay for high speed FTTP connections, not yet anyway.

But unfortunately the money men/investors won’t be hanging around waiting for take up percentages to improve, they’ll simply pull out, sell up and move on to something with a better/quicker return.

The problem with that thought process is that the timescale to build out and actually connect premises up to a full FTTP network and get coverage close to the existing copper telephone network is 10 to 15 years from now. If you wait till people actually need it then it is too late. The way to think about it is would you be happy with the internet speeds you had 15 years ago today? The answer to that is almost certainly no, so you need to plan now for what you a decade from now. The other thing to remember in all this is that all the expense is in getting the fibre installed and that fibre is good for all time. Nothing is *EVER* coming along to replace it. You can cheaply replace the equipment at either end for better speeds. Single mode fibre from 30 years ago put in for 10Mbps is good today for 1Tbps.

@Jonathan

Yes I agree, build the infrastructure now, before people really need it.

But the problem is who’s going to invest all that money in the infrastructure when the majority of people are ready or willing to sign up to use it?

The owners of these Altnets aren’t internet enthusiasts who love high speed internet or care about the people employed by the Altnets. They are in it for one reason and one reason only, to make money.

Obviously Virgin Media’s 5.8 million customers aren’t real people then. Since their coverage is around 16.1 million their take up rate is around 36%.

OK, so these figures explain Trooli throwing their legs in the air and bailing out.

Also explains Cityfibre’s redundancies at the beginning of the year and then ‘leaking’ that Cityfibre is up for sale after the meeting between Virgin Media’s Mike Fries and Cityfibre’s Greg Mesch.

ThinkCX also forecast that during 2023 we’ll see a frenzy of mergers and acquisitions (M&A) among the altnet community.

How many potential subscribers are constrained by being on a contract with a provider who will charge an arm and a leg to exit? Many altnet FTTP initial rates can be lower than the FTTC/ADSL contracted rates some are paying to OR ISPs, so cost apart from extortionate termination fees, is not always a valid reason for not changing to Full Fibre. One advantage of using an altnet is that one can, for a trial period have FTTP without losing an existing FTTC connection. There needs to be more publicity about the future benefits of changing to optic connection.

Why is the country’s largest ISP allowed to still claim super fast fibre on FTTC and then only guarantee a download speed as low as 2Mb/s?

Most of them are still building the network so it can take time to get new subscribers many of whom maty be waiting for their existing contract to exoire

Most of them are still building the network so it can take time to get new subscribers many of whom maty be waiting for their existing contract to exoire

In the last 4 years, Quite a few marketing/technical data jargon heavy, data wishful thinking, overly optimistic business plans did the rounds. As greed generally overcomes fear, some landed big headline grabbing lumps of promised/committed investment money(debt). Construction starts, and is slower and more costly than budgeted. The design of these networks is often poor with ‘premises passed’ often stranded (unserviceable) for years. Robust Interconnectivity and Backhaul are often poorly designed contracted and implemented. In the early months/years, there is a propensity for the very senior management to be very ‘optimistic’ in their reporting to investors of ‘premises passed’. The pressure to accelerate the build can lead to picking lower cost easier areas to build. This leads to a reduction in duct construction and an increase in plastic boxes and bundles of fibre strung up poles. The result is more stranded unserviceable ‘premises passed’ are reported to investors, as the Altnet senior managers ‘need’ the next tranche of money (debt) from the investors. Eventually the amount of ‘premises passed’ is measured against the amount of installed and billable customers. The best metric to measure and data to capture to see ‘how deep’ or otherwise the bath is:- = premises passed that are connectable and serviceable, measured against the amount of connected customers being billed (net of leavers/cancellations). Of course metrics like Enquiries, New orders, old orders, pending installations etc may or may not inform management forecasting, but only if the data is robust. Now with massively increased costs construction, operations and debt………..it’s going to get very interesting.

Fibre take up is governed by 2 things: marketing & availability…get those 2 right and then just perhaps. We have to remember that technology picked up the shortfall in ADSL & to a certain extent FTTC, so most people are used to the ‘wheel of death’ as the norm! Until streaming, gaming & the IoT needs MORE bandwidth & speed it really doesn’t matter how you spend on Mktg or indeed the availability of FTTP, take up will only be from a small % who NEED fibre. Just some Friday thoughts!