NAO Warn GBP1bn UK Rural 4G Mobile Rollout is Facing Delays

The UK’s independent public spending watchdog, the National Audit Office (NAO), has today published a new report into £1bn industry-led Shared Rural Network project (i.e. extending 4G mobile / broadband cover to 95% of the UK by the end of 2025), which finds that it’s “behind schedule” and at risk of cost overruns.

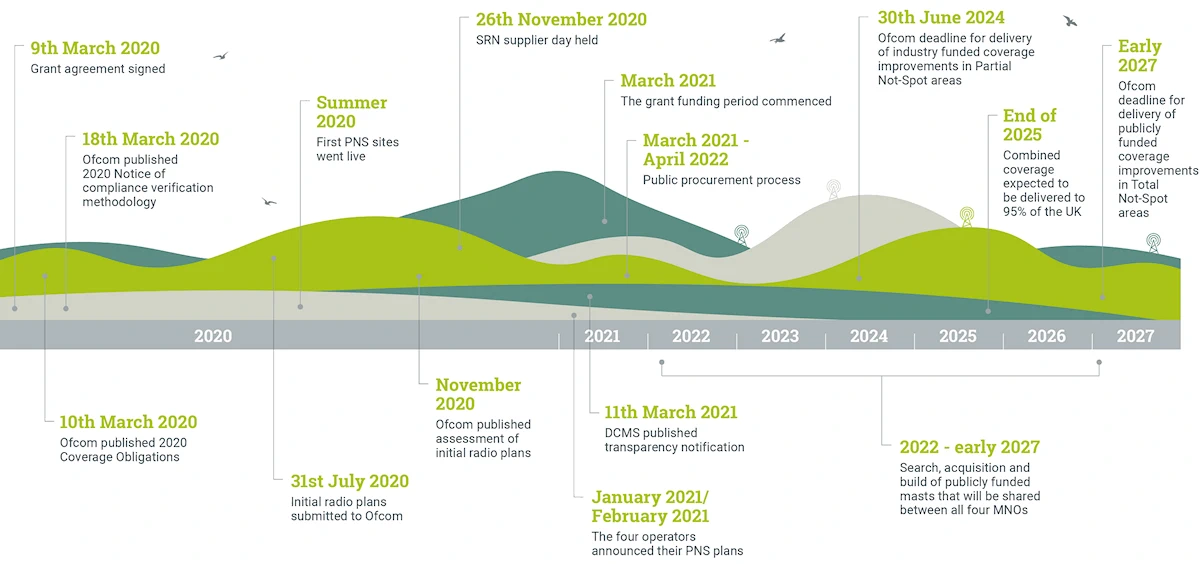

The SRN – supported by £501m of public funding and £532m from operators – involves both the reciprocal sharing of existing masts in certain areas and the demand-led building and sharing of new masts in others between the operators (MNO). But the 95% target is only when service is available from at least one operator, while the UK coverage forecast for SRN completion for all operators is actually just 84% (i.e. geographic areas where you’ll be able to take 4G from all providers).

The programme actually consists of two targets for mobile operators to meet. One of the first of those reflects the deadline for delivery of industry funded coverage improvements in Partial Not-Spot (PNS) areas (i.e. areas which receive coverage from at least one operator, but not all), which needs to be achieved by June 2024 (at this point 4G must cover 88% of the UK’s landmass).

Advertisement

After that, Ofcom has also set a deadline for improvements in Total Not-Spot (TNS) areas of early 2027. Just to be clear, Ofcom’s licence obligations commit each individual operator to increase its 4G coverage to 88% of UK landmass by June 2024 – and to 90% by January 2027 – with these individual obligations supporting the overall target of 95% by December 2025.

In addition, the government’s £501m of funding – spread over 20 years (until 2039-40) – is both intended to reduce TNS and will also be partly used to develop the Extended Area Service (EAS – building 4G coverage to the public onto the Home Office’s Emergency Service Network in remote areas).

As previously reported (here), EE (BT) recently became the first mobile network operator to report having achieved the first target for PNS areas, which they managed some six months ahead of schedule. But to be fair, EE did enter the SRN with the strongest geographic 4G coverage of any UK mobile operator, after having initially invested more than their rivals into improving rural 4G coverage.

Advertisement

Overall, this sounds like good news, and it is, but the wider programme has some significant problems to tackle.

Findings of the NAO Report

The new report confirms that Three UK, Vodafone and O2 are “each likely to miss their Ofcom licence obligation to provide 88% 4G coverage by June 2024” and have requested to “discuss an 18-month extension to the PNS element of the programme.” Such a development was reported by newspapers last year (here), although until now only Three UK has been willing to confirm any specifics.

Summary of Key SRN Findings

➤ Reasons for delay vary. Government and the MNOs took longer than expected to finalise mast locations, agree site sharing and access, and procure services. Progress on the programme has also been delayed by the COVID-19 pandemic, opposition from local campaign groups and local authorities’ capacity to handle planning applications.

As a result, DSIT’s funding of expenditure by the MNOs and Home Office on masts in 2022-23 and 2023-24 was almost £62 million (79%) lower than planned. As at January 2024, one EAS mast was operational for commercial 4G coverage, and the Home Office had made nine sites in total available to MNOs, compared to 75 planned by this date. Site acquisition on the TNS element is on track against a timetable agreed in 2023, with the first masts due to become operational in January 2025.

➤ Estimated costs have risen significantly on the programme, due to high inflation and other factors, although government does not yet know by how much in total. As a result of cost pressures, MNOs may no longer be able to deliver the level of coverage required within the current funding.

Under the terms of their grant agreement with the government, MNOs bear any additional costs. However, if costs are excessive, MNOs may not be obliged to meet individual targets, further risking the overall ambition to achieve 95% mobile coverage across the UK landmass.

➤ DSIT’s business case suggests the investment will deliver economic benefits of £1.352 billion through supporting tourism and business productivity in rural areas. However, the business case included limited evidence of the specific benefits of extending mobile coverage into remote or sparsely populated areas.

➤ Ofcom requires MNOs to meet a minimum download speed of just 2Mbps (megabits per second). DSIT anticipates an average download speed of 7Mbps for rural areas, though the Department acknowledges some areas will have lower download speeds. DSIT expects these lower speeds to meet current needs but recognises that advances in technology could lead to people requiring higher performance in the future, meaning the network may need upgrades.

➤ The NAO recommends improved oversight of MNOs on the SRN programme to enable effective decision making and sufficient focus on delivering the 4G performance for consumers and businesses. The Building Digital UK (BDUK) agency currently has oversight, but “although they provide BDUK with updates on progress, they do not routinely provide, for example, data on the level of coverage achieved, or forecasts“.

➤ By 2023, the SRN programme had contributed to a 1.3 percentage point increase in coverage. Ofcom reported that, as at September 2023, 92.7% of the UK landmass had 4G coverage from at least one MNO, up from 91.4% in 2020 and against a target of 95% by December 2025. This increase is predominantly due to additional coverage funded by the MNOs, including their delivery of the PNS element of the programme.

DSIT was unable to provide details of progress in meeting coverage targets for premises and roads, and is working with Ofcom to develop the necessary data, but it told us that the MNOs are confident that they will achieve these targets.

The report also touches on 5G services, specifically the Government’s new Wireless Infrastructure Strategy (WIS), which set out an ambition for “all populated areas to be covered by ‘standalone’ 5G (5G-plus) by 2030” (here). But as we’ve said before, the use of vague terms like “all populated areas” doesn’t really make for the clearest of targets, and we’d have preferred to see one based around geographic coverage.

The NAO said that achieving the 5G SA target will be “challenging” and called on the government to “establish target dates for taking key decisions about the outcomes it is seeking; determine the combination of enablers required to deliver 5G connectivity; collect data on the market’s ability to meet the UK’s future 5G connectivity needs; and learn lessons from delivering earlier digital infrastructure.”

Advertisement

Gareth Davies, Head of the NAO, said:

“Demand for mobile data access is expected to increase as data-intensive services become more popular and new technologies enable new uses, and government has set out a clear ambition for improved connectivity.

It is unclear whether the Shared Rural Network programme will achieve its coverage target on time; costs are higher than anticipated; and government has not clearly articulated the benefits of aspects of the programme, including increased connectivity in sparsely populated areas.

As government develops its 5G strategy, it will need to more clearly define what it is aiming to achieve in different parts of the UK and economic sectors, so that limited resources can be targeted where they deliver most value.”

The news of a potential delay probably won’t come as too much of a surprise to ISPreview’s regular readers, as past mobile infrastructure projects have often struggled to achieve their targets – either on time or more generally. Finding suitable sites, securing the necessary permissions through the planning system, obtaining power supply and fibre backhaul – particularly in remote rural areas, are all known bugbears.

On the other hand, BT’s Chief Security and Networks Officer, Howard Watson, recently highlighted how some issues, such as the impact of both the COVID-19 pandemic and long-delays (up to 500 days) in being able to secure planning permission for the sites, didn’t stop them being able to achieving their part of the project ahead of schedule (here). It’s all in the planning, claimed Watson.

The government have also recently introduced new legislation to help ease some of the challenges, particularly around infrastructure sharing, upgrades to existing sites and taller masts. But Ofcom has only recently consulted (here) on adopting some of those changes into their latest update to the Electronic Communications Code (ECC), which means operators have yet to fully benefit.

Ofcom are also expected to publish their own review of the SRN’s progress this year, which should provide a lot more information on how far behind the three operators really are and what they must do to correct that.

NAO 4G SRN Progress Report

https://www.nao.org.uk/reports/supporting-mobile-connectivity/

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Quickline Win GBP60m Yorkshire UK Gigabit Broadband Rollout Contract UPDATE

The landmass target seems laughably unambitious when Vodafone and O2 already exceed it, albeit not on 4G coverage.

With reference to the Wireless Infrastructure Strategy aim of achieving 100% coverage in populated areas – I would interpret that as ‘provision of a 2Mbps service within every Unique Property’ (i.e. every UPRN in UK).

To achieve this with 4G/LTE is difficult – with 5G SA extremely challenging!

One of the biggest issues I have with all of this is HOW the coverage data is gathered – at present this is gleaned for PREDICTED coverage data obtained from MNOs. This data has been demonstrated to to be somewhat optimistic in many cases. What is required is an independant, cost effective and accurate method of determining where the Not Spots are. Note – this is a little different from recording where coverage is; we need to actively record where coverage is NOT present to get an accurate picture.

It is clear that many of the Not Spots are not commercially viable. for MNOs to provide coverage to – so to achieve 100% coverage some form of Government grant funding will be required to cover the capital cost of putting in the infrastructure. To administer grant funding for covering Not Spots we need a very accurate data set showing which UPRNs are outside coverage before deployment of new RAN build, and then are in coverage after RAN build – so that payments can be made to the operator(s) providing coverage.

Collection of accurate coverage data is the key to solving our Not Spot issues!

Out of curiousity, I can understand the high frequency band issues, but why would 600-700MHz 5G SA be harder to provide 2M/Bs compared to 4G?

It’s possible this is one of those “600-700MHz isn’t really 5G” conversations…perhaps?

@Aled – it demonstrably isn’t 5G as marketed to the Man on the Clapham Omnibus.

It’s an unfortunate and inevitable effect of promoting a new tech with a range of benefits via a one-liner. HS2 suffers the same way.

One of the main issues that I have with SRN is that their planned deployments are based (totally) upon their incomplete and hugely optimistic coverage data. As a result, the majority of SRN new builds are destined to cover the areas of the country in which the MNOs ADMIT that they have little coverage. Sadly, these areas tend to be sparsely populated, so whilst the new masts may cover large areas of landmass, the number of UPRNs covered remains relatively small.

Within the the Government reporting of SRN results, I would like to see the inclusion of a metric which shows the cost per UPRN covered within the template of each new SRN mast. This will give a good indication of the value for money that each deployment offers. The Mobile Infrastructure Project (MIP) and the Scottish Government 4G Infill Project achieved Cost/UPRN figures of around £5k. If SRN achieves everything that they said they would at the start of the project, they should return a Cost/UPRN of around £3.7k. It will be interesting to see what the final figures end up at!

Agreed.

It would be interesting to compare say Open Signal real life coverage with the theoretical Ofcom data and see where all the missing notsspots, and near (ie only get intermittent coverage) not spots actually are

Isn’t that the point though?

An SRN is mostly pointless in areas that already have “enough” coverage.

“We want you to reach every home, sharing infrastructure where necessary, not have you all reach 97% and no-one cover the rest”

All that an SRN there would do is massage the value for money figures without providing any benefit to those without a signal.

No choice but having a service is better than not having a service at all, surely?

Wish I could benefit from the project but the rollout map shows my town as “deferred scope”

But every time they want to instal a mast the Nimby’s complain. They then complain they have no mobile signal