Nexfibre Publish Q2 2025 UK Full Fibre Broadband Build Update

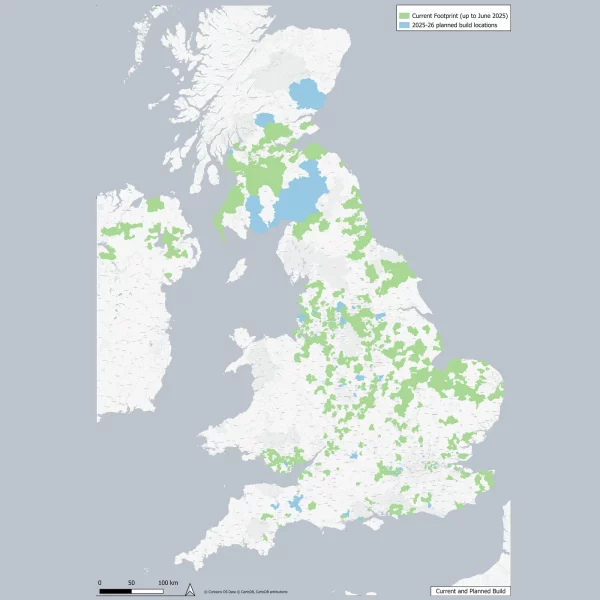

Network operator nexfibre, which shares some of its parentage with ISP partner Virgin Media (O2), has published their latest quarterly (Q2 2025) build update and confirmed that their new 10Gbps capable Fibre-to-the-Premises (FTTP) broadband network now covers 2.3 million UK premises. But its future remains uncertain.

Just to recap. Back in 2022 Telefónica, Liberty Global and InfraVia Capital Partners setup nexfibre as a new £4.5bn joint venture (here), which aimed to deploy an open access (wholesale) full fibre network to reach “up to” 7m UK homes (starting with 5m by 2026) in areas NOT served by Virgin Media’s own network of 16m+ premises. The funding reflects £3.3bn of fully underwritten financing and up to £1.4bn in equity commitments.

However, as existing readers will already know, nexfibre’s roll-out plan recently suffered a significant blow after Telefonica launched a Strategic Review of their global business (here and here). The decision has since resulted in nexfibre scaling back their roll-out – now aiming to reach just 2.5m premises in 2025 (down from c.3m) – and Virgin Media scrapping their related NetCo plans for opening up their existing consumer broadband network to wholesale (here).

Advertisement

The latest Q2 2025 build update from nexfibre continues to reflect this change and confirms that their full fibre network has now reached 2.3 million premises as ready for service (up from 2.2m in Q1). Much uncertainty now exists in the build plans for 2026 and beyond, which will probably only be answered once Telefonica and Liberty Global have decided on the best way forward. Not that you’d know it from listening to the company’s boss, where the focus continues to hint at a switch toward consolidation (waters where CityFibre and possibly Netomnia are also playing).

Rajiv Datta, CEO of nexfibre, said:

“nexfibre continues to make substantial progress in bringing full-fibre broadband to underserved communities across the UK. With coverage now exceeding 2.3 million premises, we are among the country’s largest alternative fibre operators.

Our optimised build plan remains on track, driven by the agility and commitment of our unique ecosystem of dedicated team members and partners. Together, we are delivering a technologically-advanced, XGS-PON-only network designed to serve generations to come. This long-term focus informs our view of the need for sustainable, nationwide competition in the fibre access market, which today is fragmented and subscale, yielding constrained business models and substantial financial stress.

Backed by strong investors and significant financial resources, nexfibre remains committed to creating a wholesale fibre access platform that will play a key role as the market moves toward meaningful consolidation and a structure capable of unlocking the full potential of world-class digital infrastructure.”

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Broadband ISP TalkTalk Publish UK Accounts to Reveal Surge in Losses

nexfibre.co.uk/wp-content/uploads/2025/08/nexfibre-Q225-coverageupdate-web.pdf

Already linked, in bold, in the article above.

“Our optimised build plan remains on track”. Well since you’ve already admitted your build has been scaled back it obviously isn’t, is it?

“Optimised” in this instance probably means “reduced”

The weird thing is that their map and coverage list don’t match up. The specific example I can see is that the map clearly shows current coverage in fife around St Andrews and west to Cupar, but if you look at the list of covered towns, Cupar isn’t on there either for current or 2025 coverage.

They still have yet to integrate UPPs existing footprint into their rollout plan

They should have put mustang(?) as their priority, upgrading existing connections.

Because they would likely, imho, get more money back.

Gavin,

For reference, Project Mustang has been known as FibreUp (FiUp) for some time now.

They would have benefitted from the NetCo split in the form of investment, specifically to ramp up

numbers. Although that won’t be happening for the foreseeable, FiUp will continue at apace.

They are installing new customers on the back of the project already.

Gig5 when?? 😀

Is Rajiv Datta’s comment “.. nexfibre remains committed to creating a wholesale fibre access platform …” a contradiction of the comments made by the Telefonica CEO, or is this an indication of a more nuanced approach from VMo2 to offering a wholesale platform to the market?

Only the NetCo is scrapped (Virgin’s own network), which is legally separate from nexfibre (that is not stopped). Confusing, I know, but that’s the way VMO2 want to do it..

I’m guessing that id VMO2 were afraid that if they just expanded their own network they would be classed by Ofcom as having “significant market power” and come under similar regulatory scrutiny that Openreach does. Creating a separate company is just a workaround.

there are some deployment choices that dovetail nicely with VM’s existing network, which is curious for a business that’s supposed to be separate to it.

The locations in Devon are all clustered around Exeter, which is a VM cabled city, though I believe the headend is down the road in Newton Abbot.

There are actual VM locations on the map too. Presumably they’re avoiding any overlap of the existing HFC and VM’s plans to upgrade that to FTTP as well.

@Mark Jackson: Indeed, which just raises questions about the future of the VMO2 joint venture around the “heritage” network infrastructure if it is considered unsuitable to be used to offer a wholesale product.

@Big Dave:

That indeed was their intention, and comments from the owners suggest it still is; thus, as you say, the separation of the infrastructure side would be a good move.

I am wondering now if Telefonica’s internal review and Liberty Global’s retrenchment have brought into doubt the cost-effectiveness of upgrading the heritage network. What if they are now thinking they could instead achieve their objective by the acquisition of a major network provider rather than going through the effort of building an alternative to their DOCSIS network?

@ Ivor: Looking at the Thinkbroadband maps, I can not see any nexfibre deployments in Exeter itself. Nexfibre appears to be focused on the conurbations surrounding Exeter, which would be a reasonable move.

Those splodges of green on the map are very generous.

They cover an entire region when in reality it’s a small estate next to me.

It is of note that there is relatively little overlap between CityFibre and Nexfibre deployments, while CityFibre has cabled numerous areas where VMO2 has a heritage network. This might be expected overlap, based on a reasonable assumption of higher returns in urban areas, but it also offers a quick-win around migration to FTTP if an acquisition was now thought to be a more cost-effective option.

lol still not included

towns in the middle of nowhere added, VM HFC town with 150,000 people and almost full VM coverage and nada for years now oh well thank god for altnets