Toob Adjust Planned UK Full Fibre Broadband Build in Waterlooville UPDATE

Hampshire-based altnet and UK ISP toob, which has built a gigabit speed Fibre-to-the-Premises (FTTP) based broadband network across parts of South England and also harnesses CityFibre’s network in other areas, appears to have recently removed the core part of Waterlooville (Hampshire, England) from their future roll-out plan.

The original £8m deployment across 20,000 premises in Waterlooville was announced all the way back in January 2024 (here), which at the time stated that construction was due to start within the “coming months“. The move made sense as, at the time, Virgin Media were the only major gigabit broadband operator with a strong level of coverage.

Since then, toob has expanded or begun the work of expanding around the edges of the town. On top of that, Openreach have begun a major expansion of their own FTTP network in the central area of the town, although much of that has yet to go live.

Advertisement

Finally, CityFibre has also covered a few modest patches within the same central area, which may be relevant given their off-net partnership with toob. But as it stands, they have roughly only reached around 20%+ of premises in the core area and future build plans beyond that remain uncertain, which still leaves space for toob to deploy their own fibre.

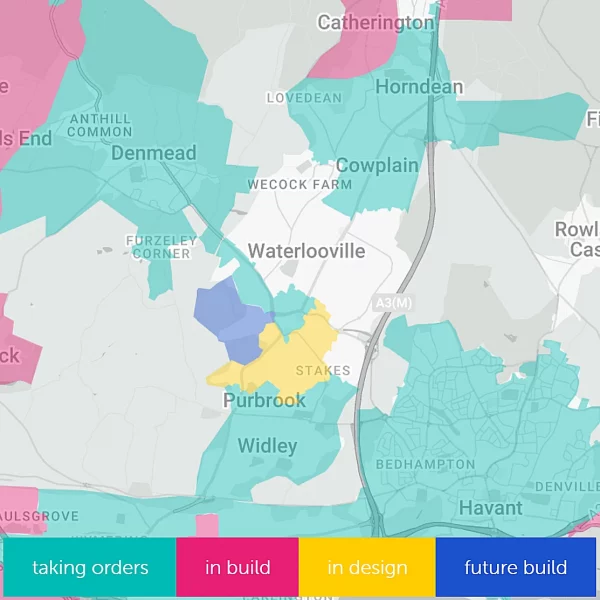

However, a key change appears to have occurred in November 2025, when toob updated their roll-out map of Waterlooville (pictured – top). The core / central part of the town had previously been listed as “future build” on their map, but after the update it appears to have been changed to indicate that no build is now planned for the area (i.e. it’s not given any colour coding at all).

Aaron, Resident of Waterlooville, told ISPreview:

“So I have called and emailed multiple times with no response. I reached out to one of their network guys on [redacted] and they mentioned they have pulled out of completing Waterlooville, which is odd, as they have completed Horndean, Cowplain, Denmead and Purbrook, so why leave the main core part of Waterlooville out, the ducts and cables run through it.”

ISPreview queried all this with toob yesterday and are still awaiting a response, although it’s likely that the Christmas period may be getting in the way of their ability to reply in a timely fashion (a common issue at this time of year).

The alternative network operator is currently being financed through equity from funds managed and advised by the Amber Infrastructure Group, as well as a large amount of debt financing provided by Ares Management’s Infrastructure Debt (here). At the end of 2023 this mix of equity and debt reflected a total commitment of £395 million.

Advertisement

UPDATE 10:17am

As somewhat suspected above, toob has now clarified that the change relates to the fact that partner network CityFibre are also expanding FTTP in the area (i.e. they want to avoid overbuilding).

A spokesperson for toob told ISPreview:

“At present toob has over 9,000 premises released for sale in Waterlooville with over 1,500 connected customers and we intend to continue build of the toob network in Waterlooville during 2026.

Since starting our network build, CityFibre have also been building parts of Waterlooville as a part of their BDUK contract. As a result, we have amended our build schedule to prevent overbuild. Once CityFibre have completed their work, we will re-assess any areas that are not covered by either network and determine whether these could be completed as a part of our network.

The good news for residents waiting for full-fibre connectivity in this area is that toob broadband will be available either via our own network or through our partnership with CityFibre.”

The catch is that this does perhaps create a period of uncertainty for some areas, which will hopefully be resolved next year sometime.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« North Yorkshire Council to Take NYnet Broadband Scheme National Across UK

Advertisement

Leave a Reply Cancel reply

Privacy Notice: Please note that news comments are anonymous, which means that we do NOT require you to enter any real personal details to post a message and display names can be almost anything you like (provided they do not contain offensive language or impersonate a real person's legal name). By clicking to submit a post you agree to storing your entries for comment content, display name, IP and email in our database, for as long as the post remains live.

Only the submitted name and comment will be displayed in public, while the rest will be kept private (we will never share this outside of ISPreview, regardless of whether the data is real or fake). This comment system uses submitted IP, email and website address data to spot abuse and spammers. All data is transferred via an encrypted (https secure) session.

It looks like Toob has flipped to customer acquisition mode since they are doing heavy advertising with very cheap deals on the cityfibre network which probably have barely any margin. Hard to see how they will remain sustainable while undercutting competitors by a long way but I suspect their investors are demanding customer growth over infrastructure build and this is what we are left with.

Hang on a minute, toob has scaled back their network commercial build so tax payer funds can pay for it instead? This is farsical and reflects badly not only on Toob and CityFibre but also BDUK for allowing this to even happen. Tax payer funds are only meant to be used where there is a market failure – in this case market failure has been caused by tax payer funding being made available.

I’d caution that the urban part of the build in this area may just be the “additionality” part (i.e. CityFibre’s commercial expansion, which directly benefits from the publicly funded BDUK side in other areas). So it might not actually be the subsidised bit, but I don’t know for sure; this is just normally how it works.

If Toob wanted to be a CityFibre reseller, they were probably best off doing so from the start. Rather than when they may well be running out of cash.

I have a friend of a friend who works for Toob, financially they’re not in a very good place.

The build over in Locks Heath has stopped too. I questioned ETA. Response, due to technical issue no more build. AKA you’ve run out of cash or only want the easy areas.

BT Openreach building more in the area.

I can see Toob being acquired