O2 UK Rejected – BT Confirm EE Selected as Exclusive Acquisition Target

National UK telecoms giant BT has this afternoon moved to bolster their plans for launching a new consumer 4G mobile service in Q2-2015 by confirming that they’ve entered a period of exclusive talks to buy EE (Everything Everywhere) from joint owners Deutsche Telekom (Germany) and Orange (France) which, unless there are complications, effectively rules out a deal with O2.

The smart money was initially focused on BT making an offer for O2, which would have been a few billion pounds cheaper, easier (i.e. a single owner in Telefonica vs EE, which is still in the process of post-merger restructuring) and is unlikely to have attracted as much regulatory scrutiny as an EE deal probably will (i.e. EE owns a lot of radio spectrum and one dominant Telco buying another dominant Telco often raises competition concerns). Not to mention that O2 started life well over a decade ago as a Joint Venture between BT and Securicor (aka – BTCellnet / mmO2).

Advertisement

On the flip side EE’s 4G network is significantly more advanced and has superior coverage, not to mention that they’ve already established a Mobile Virtual Network Operator (MVNO) partnership with BT to launch the new 4G network. By comparison a purchase of O2 would have complicated BT’s current consumer mobile timescale and might have meant further delays due to the change of platform and added administrative hassle on top.

BT Statement

The period of exclusivity will last several weeks allowing BT to complete its due diligence and for negotiations on a definitive agreement to be concluded.

The proposed acquisition would enable BT to accelerate its existing mobility strategy whereby customers will benefit from innovative, seamless services that combine the power of fibre broadband, wi-fi and 4G. BT would own the UK’s most advanced 4G network, giving it greater control in terms of future investment and product innovation.

While continuing these exclusive discussions, BT will progress its own plans for providing enhanced fixed-mobile converged services for businesses and consumers, in line with previous announcements. It remains confident of delivering on these plans should a transaction not take place.

The key headline terms, which are non-binding, include a purchase price of £12.5bn for EE on a debt/cash free basis. The consideration for EE will be payable as a combination of cash and new BT ordinary shares issued to both Deutsche Telekom and Orange. Following the transaction, Deutsche Telekom would hold a 12% stake in BT and would be entitled to appoint one member of the BT Board of Directors. Orange would hold a 4% stake in BT. In considering the financing of the cash element, BT has a range of options and is mindful of the importance of maintaining a conservative financial profile.

BT expects significant synergies mainly through network and IT rationalisation, back-office consolidation and savings on procurement, marketing and sales costs. In addition, BT expects to generate revenue synergies through selling fixed-line services to those EE customers who do not currently take a service from BT, and by accelerating the sale of converged fixed-mobile services to BT’s existing consumer and business customers.

The exclusivity agreement does not require the parties to enter into a transaction and there can be no assurances that one will occur. If a transaction is agreed, approval by BT’s shareholders will be required as a condition of the purchase.

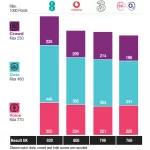

EE has 24.5m direct mobile customers1 and reported Adjusted2 EBITDA of £1,588m for the twelve months to 30 June 2014.

It’s worth pointing out that BT’s MVNO hook-up with EE came at the cost of their previous agreement with Vodafone. Since then Vodafone has responded by pledging to re-enter the fixed line broadband market next spring 2015 and separately Sky Broadband are also looking to offer a mobile solution (here), which looks set to be supplied by Vodafone.

Vodafone has also been spotted sniffing around almost every fixed line ISP in the market, although Virgin Media (Liberty Global) is believed to be the more attractive target for them. Separately Three UK had also expressed an interest in buying either EE or O2, although clearly one of those options now looks to be off the table.

In any case today’s preliminary deal makes a lot of sense. In one fell swoop BT could soon secure itself a significant position in the United Kingdom’s mobile market. Big quad-play providers are nothing new around Europe, although consumer appetite for such services in the UK remains more uncertain territory.

Advertisement

So what happens next? No doubt this will put pressure on Vodafone, Sky Broadband and Three UK to finalise their future direction(s). Vodafone in particular will need to stop dithering and make a decision about their future, while the same goes for Sky. Meanwhile Three UK’s parent could purchase O2, but their current position in the market is unique enough that they could equally afford to simply ride out the storm.

On top of that Sky, Virgin and Vodafone have all hinted that they plan to oppose BT’s deal through the usual regulatory channels and appear to suggest that today’s move will give the fixed line giant too much market power. The operators are perhaps banking on the fact that similar regulatory pressure played a part in forcing BT to demerge Cellnet all those years ago, although today’s market is very different.

Otherwise it remains unclear whether or not EE will adopt BT’s branding or operate the business at arms-length, much like they appear to do with sibling PlusNet. Others may also question why BT is willing to do such a huge deal for mobile (we of course note that it’s on a debt/cash free basis), yet they’ll only take a smaller risk (i.e. without recourse to state aid) in order to bring fixed line superfast broadband connectivity to 100% of the country.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« UK ISP TalkTalk Raises Early Broadband and Phone Termination Charges

Comments are closed