Q2 2017 – BDUK Extend “Superfast Broadband” to 4.55 Million UK Premises

The Government’s £1.6bn+ Broadband Delivery UK programme has published its latest progress update to the end of June 2017, which confirms that the scheme has so far helped 4,551,226 extra premises across the United Kingdom to be put within reach of a fixed “superfast broadband” (24Mbps+) network.

Today it’s estimated that approximately 93%+ of premises in the United Kingdom can access a fixed line superfast broadband connection and BDUK’s goal is to cover 95% by the end of 2017, before potentially rising to around 97% by 2020. Meanwhile the Government seems intent to tackle the final 3% via a mix of alternative network providers (altnets) and the forthcoming 10Mbps Universal Service Obligation (USO).

Otherwise most of the BDUK linked deployments have been supported by Openreach’s (BT) ‘up to’ 80Mbps Fibre-to-the-Cabinet (FTTC) and a small bit of their 1Gbps Fibre-to-the-Premise (FTTP) technology. More recently we’ve seen altnets like Gigaclear, Call Flow, UKB Networks and Airband win a number of contracts and we expect to see more of that going forward, particularly around the final 3% of premises where BT may struggle.

Advertisement

Q2 2017 Progress Report

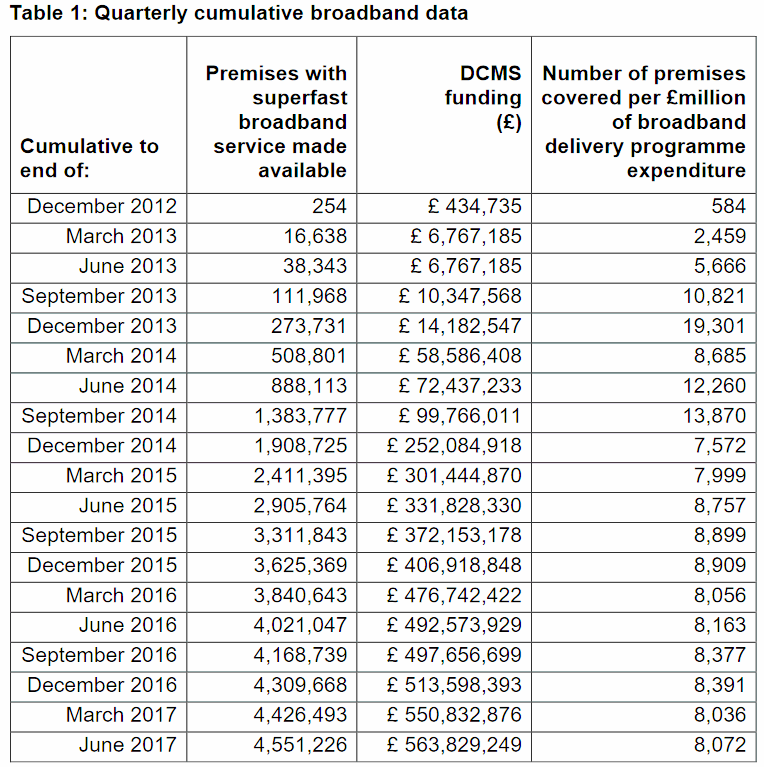

The “premises passed” figure used below only reflects those homes and businesses (premises) able to access “superfast” speeds of 24Mbps+ as a result of BDUK linked investment (i.e. it excludes those that have benefited but which only receive sub-24Mbps speeds). Similarly the data excludes “overspill effects” of BDUK-supported projects on premises which already have superfast broadband.

NOTE: The table only shows state aid from the Government’s project (BDUK) and does NOT include match-funding from local councils, the EU and other public or even private sources.

The headline figures used above are said to be cash based (i.e. when grants are made or budgets transferred). On an accruals basis, which matches costs incurred to the timing of delivery, cumulative BDUK expenditure to the end of June 2017 has been estimated as £590,305,914 and that equates to 7,710 premises covered per £million of BDUK expenditure (expenditure is higher for this because the work has been delivered in advance of payment).

Advertisement

The roll-out pace has slowed over the past year but that is not a surprise because the programme is now focusing on the most challenging rural and some tedious sub-urban locations (e.g. Exchange Only Lines), which take longer to reach, cost more and deliver fewer premises passed in the same space of time.

There’s also a question mark over the impact of clawback (gainshare) on the figures, which forces BT to return some of their public investment when take-up goes beyond the 20% mark in related areas. So far up to £465 million could potentially be returned (here), which can then be reinvested into further broadband improvements. Most of this may be used to bridge the gap between 95% and 97% coverage by 2020.

NOTE 1: Prior to BDUK the commercial market (i.e. purely private investment) had already enabled operators like BT and Virgin Media to extend the reach of superfast broadband to around 70% of UK premises. However the major operators’ tend to view many of those in the final 30% as being “not commercially viable,” hence the reason for BDUK being setup to boost the roll-out via public investment.

NOTE 2: Future deployment phases, such as those aiming to deliver coverage above 95%, will be adopting the slightly improved 30Mbps+ definition for “superfast broadband“. The EU and Ofcom have been using this definition for many years, although official BDUK contracts were slow to do the same.

Advertisement

NOTE 3: The above expenditure figures exclude support for Connection Vouchers, the Mobile Infrastructure Project, the Rural Communities Broadband Fund, the Market Test Pilots and DCMS administrative expenditure.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« New Study Claims 43 Million UK Adults are “blighted” by Unreliable Broadband

Comments are closed