New BT CEO Reports Ultrafast Broadband Cover of 3.2M UK Premises

BT Group’s new CEO has released his first full year results to the end of March 2019 (Q4 18/19 financial), which finds that Openreach’s FTTP and G.fast based “ultrafast broadband” (100Mbps+) ISP network has grown its coverage to 3.2 million UK premises (up from 2.6m last quarter). Take-up of FTTP is 24.54% and G.fast 1.24%.

The big announcement today, which we’ve covered in a separate article so as not to overflow this one, is that Openreach will now aim to deliver 4 million FTTP premises by March 2021 and 15 million by around 2025 (here). Otherwise there have been several key developments since BT’s last quarterly update in January 2019 and we’ll summarise some of those below.

Over the past few months BT has had an advert banned due to their misleading “UK’s most powerful Wi-Fi” claim (here) and they’ve been sued by property developer Persimmon for allegedly unpaid work (here). Elsewhere Openreach have been able to launch their revised cable duct and pole access product for ISPs, albeit still with some caveats (here).

Advertisement

In better news BT’s consumer ISP division has managed to introduce a new broadband speed guarantee (here) and Openreach have named the next batch of 12 FTTP roll-out locations (here).

Financial Highlights – BT’s Quarterly Change

* BT Group revenue = £5,853m (down from £5,982m)

* BT Group profit after tax = £513m (down from £594m)

* BT Group total net debt = -£11,035m (from -£11,114m)

Meanwhile BT’s assumptions about clawback / gainshare via the government’s Broadband Delivery UK roll-out programme remains unchanged (i.e. public money that can be returned and reinvested by local authorities to help “superfast broadband” coverage to reach around 98% of the UK by the end of 2020).

The operator’s Q2 “life-time view” of their BDUK linked contracts, which predicted that take-up of their FTTC/P network within related areas could eventually reach 61%, suggested that up to around £712m of public investment could eventually be returned for the above purpose.

BT Group’s Capital expenditure

Capital expenditure was £3,963m (2017/18: £3,522m), including network investment of £2,083m, up 21%. This includes £213m grant funding deferral under the Broadband Delivery UK (BDUK) programme, of which £168m relates to the change in base-case assumption for customer take-up announced in Q2. Excluding the effect of the grant funding deferral, capital expenditure was £3,750m.

The remaining increase in network investment reflects increased spend on our Fibre Cities programme, partially offset by lower mobile investment as the Emergency Services Network (ESN) passed the peak deployment phase. Our BDUK Gainshare provision at the end of the year was £639m.

Other capital expenditure components were up 5% with £929m spent on customer driven investments, £747m on systems and IT, and £204m spent on non-network infrastructure.

At this point we should remind readers that BT stopped providing customer figures for their own consumer broadband ISP last year (i.e. covering up for declines), although it’s noted that 72.9% of their retail broadband base now take a “superfast broadband” connection (up from 70.5% last quarter – mostly via FTTC) and this drops to 45.9% for their enterprise base.

Advertisement

Openreach’s Network Coverage

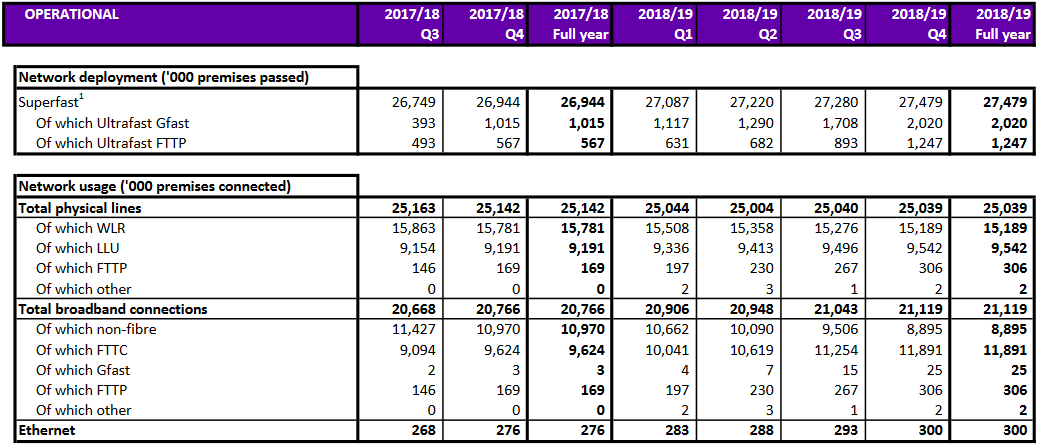

The table below offers a useful breakdown of fixed line network coverage and take-up by technology. Being Openreach the listed totals apply to all ISPs on their national UK network combined (e.g. BT, Sky Broadband, TalkTalk, Vodafone etc.).

Overall their hybrid fibre G.fast ultrafast broadband network now covers 2,020,000 UK premises (up from 1,708,000 last quarter) and Fibre-to-the-Premises (FTTP) covers 1,247,000 premises (up from 893,000). The FTTP rollout is now running at a faster rate (c.20,000 passed per week) than G.fast, which is an interesting reverse as previously G.fast was rolling out at a much quicker pace (the direction of travel is clear).

We note that take-up of FTTP is 24.54% (down from 29.9% last quarter) and G.fast 1.24% (up from 0.88% last quarter). On the surface it might seem like G.fast is struggling for take-up and FTTP is going in reverse but this doesn’t tell the whole story and would be a poor interpretation.

Advertisement

Both technologies are in their early roll-out phase and take-up is a dynamically scaled measurement (dependent upon many factors of consumer choice and awareness), which means that at certain stages of the rollout it may go up or even down depending upon the pace of deployment (i.e. premises passed in any given time-scale), although over time the take-up should only rise as deployments reach maturity (we’re not there yet).

G.fast only started its commercial roll-out a year ago and has made rapid progress, but adoption by ISPs has been limited (e.g. Sky Broadband has yet to offer any ultrafast packages) and those that do offer such products don’t put much or any effort into advertising it (they aren’t even on most commercial comparison sites yet). Likewise it’s fighting in the same areas as Virgin Media.

With time we’d expect the above situation to improve but take-up is something that always takes a lot of time to grow and that’s particularly true while the service is still in the rapid roll-out phase. We’d expect the picture to change once Openreach hit their c5.7million premises target by the end of 2020 but this could be scaled-back again due to the rising focus upon FTTP.

On the flip side FTTP appears to have extremely good take-up and is a more attractive product, but this must be weighed against the fact that it’s slower to deploy (takes more resources to deliver), focuses a lot more on new builds and BDUK areas (better for take-up) and is a much more established and familiar technology.

Likewise Openreach has been deploying FTTP for years and there was a long period pre-Fibre First where they could build take-up, which is now being suppressed by the increasingly rapid pace of their roll-out (we expect that to continue as they deploy ever faster and faster). So for now the message is simple, don’t read too much into the take-up figures while the technologies are in a rapid deployment phase.

As usual our own ISP Listings page has been displaying both ultrafast broadband products for a long time because we don’t force ISPs to pay a commission in order to be shown, like big commercial comparison sites do.

Philip Jansen, CEO of BT Group, said:

“BT delivered solid results for the year, in line with our guidance, with adjusted profit growth in Consumer and Global Services offset by declines in Enterprise and Openreach.

Since joining the company three months ago, it has become clear to me just how fundamental BT’s role is in connecting our society. While we are really well positioned in a very challenging and competitive UK market, we have a lot of work to do to ensure we remain successful and deliver long term sustainable value to our shareholders. We need to invest to improve our customer propositions and competitiveness. We need to invest to stay ahead in our fixed, mobile and core networks, and we need to invest to overhaul our business to ensure that we are using the latest systems and technology to improve our efficiency and become more agile.

Our aim is to deliver the best converged network and be the leader in fixed ultrafast and mobile 5G networks. We are increasingly confident in the environment for investment in the UK. We have already announced the first 16 UK cities for 5G investment. Today we are announcing an increased target to pass 4m premises with ultrafast FTTP technology by 2020/21, up from 3m, and an ambition to pass 15 million premises by the mid-2020s, up from 10 million, if the conditions are right, especially the regulatory and policy enablers.

For 2018/19 the Board has decided to hold the full year dividend unchanged at 15.4p per share. The Board also expects to hold the dividend unchanged in respect of the current financial year given our outlook for earnings and cash flow.”

Jansen’s message is essentially preparing shareholders for the fact that the operator will need to spend big in order to stay competitive, particularly with respect to their independent network arm Openreach (e.g. FTTP) and mobile operator EE (5G rollout is likely to cost more than 4G did, given the requirements for a denser network).

Interestingly today’s results did not include any mention of the previously predicted next round of job losses, which suggests that Jansen is still working to finalise his future strategy. Today’s announcement also included an update on Openreach’s service performance for voice and broadband products in Q4.

Overall Openreach are now offering a service provision first appointment date within 12 days to 99% of customers, an improvement from 92% in Q4 2017/18. The levels of missed appointments, where Openreach was at fault, was maintained at 1.7% over the quarter, a third fewer than last year. Openreach also met all 42 copper and fibre Minimum Service Level (MSL) measures set by Ofcom.

Openreach’s proactive maintenance programme has continued to reduce the number of faults in the UK copper network, delivering a 2% reduction over the full year compared to 2017/18. Fewer network faults combined with improved operational planning has helped increase on time repair performance for voice and broadband products from 81% in Q4 2017/18 to 86% in the same period 2018/19.

In Q4, 100% of the group’s EE and Plusnet service calls and 83% of their BT service calls were answered in the UK and Ireland, as they work towards having all call centres based in the UK and Ireland from 2020.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Openreach Aim for 15 Million UK FTTP Broadband Premises by 2025

Comments are closed