Ofcom Push Dark Fibre and Unrestricted Openreach UK Duct Access

Ofcom has today proposed changes under their latest UK Physical Infrastructure (PIR) and Business Connectivity Market Reviews (BCMR), which imposes tougher service quality standards upon Openreach’s (BT) network, introduces a regulated Dark Fibre solution and gives ISPs “unrestricted access” to their cable ducts and poles.

At present only around 7% of UK premises can access a Gigabit speed Fibre-to-the-Premises (FTTP) broadband ISP network (up from 3% a year ago) and the regulator is keen to foster this, while also taking account of the proposals that were made as part of the Government’s Future Telecoms Infrastructure Review (FTIR); this aimed to stimulate the market toward delivering nationwide “full fibre” coverage by 2033.

Suffice to say that the new reviews have both been designed to feed into the aforementioned objective, albeit at the same time as “preserving incentives” for BT Group to invest in doing more fibre. Indeed Openreach recently raised their FTTP ambition from 10 to 15 million premises passed by around 2025 (here) and the regulator needs to be careful about not discouraging such work.

Advertisement

On the flip side Ofcom also recognise that alternative network ISPs, such as Cityfibre, Gigaclear and Hyperoptic (see our Summary of Full Fibre Plans), are having an increasingly big impact upon the market and they want to support those too. As such the regulator has today set out a series of changes that they hope will act to stimulate the wider market and raise standards.

Market Definitions

To understand how competition varies geographically Ofcom have divided the UK into areas based on the number of competing networks. They categorise the areas as:

• BT Only;

• BT+1 competitor; and

• BT+2 or more competitors – high network reach (HNR) areas

Ofcom has also defined two product markets for contemporary interface (CI) services (connections over fibre typically using an Ethernet interface):

• CI Access services, which are the connections to end-user business sites (such as office buildings or mobile base stations); and

• CI Inter-exchange connectivity services, which consists of the connections between BT exchanges in different geographic areas (such as between towns and cities).

Unrestricted Cable Duct & Pole Access (PIA)

Openreach already offers a revised cable duct access solution through their Physical Infrastructure Access (PIA) product, which allows rivals to install their own fibre optic cables through the operator’s existing network. At present this adopts a “mixed usage” model, which means ISPs can deploy local access networks offering both broadband and non-broadband services, provided the primary purpose of the network is the delivery of home broadband.

By comparison today’s move to introduce “unrestricted usage” means that companies offering high-speed lines for large businesses/mobile/broadband operators will also be able to harness PIA, which Ofcom hopes will help to grow the business case for such investments and thus boost the overall reach of fibre infrastructure. Admittedly this may not solve all of the gripes around PIA (here and here) but it is a big change.

Ofcom has also decided to set price regulation on the unrestricted PIA rental services, imposing a level of maximum charges identical to those set out in their 2018 WLA market review for mixed usage PIA. As a side note it’s worth remembering that the PIA product has no usage or geographic scope restrictions, unlike the next change.

Advertisement

The regulator notes that Virgin Media, TalkTalk and CityFibre are among the firms already using Openreach’s ducts and poles to connect thousands of homes and businesses to faster, more reliable broadband (example). Between them, competing providers are using around 12,000 Openreach telegraph poles and 2,500 km of underground duct.

Dark Fibre

Ofcom’s 2016 attempt to introduce a regulated Dark Fibre Access (DFA) product upon Openreach (here), which would have allowed rivals to gain “physical access” to Openreach’s existing fibre optic cables (i.e. enabling them to install their own equipment at either end of the fibre within cable ducts), suffered a spectacular failure after the courts rejected Ofcom’s market definitions (here and here).

The regulator’s plan was to make DFA available in all parts of the UK (RoUK) except central London (including the City of London and Docklands), which didn’t just irritate BT but also other full fibre builders (e.g. Zayo, Cityfibre, Virgin Media etc.) who warned that it could act to discourage investment in the construction of new fibre optic networks.

By comparison today’s new Dark Fibre solution is much more restrictive and will only be available for connections from exchanges where BT faces no competition from rival operators. This reflects the inter-exchange connectivity market, which means the connections between BT exchanges in different geographic areas (e.g. between towns and cities).

Advertisement

Ofcom Statement on Dark Fibre

There are some areas where duct and pole access is unlikely to have a material impact on competition. In the BCMR, we have focused on inter-exchange connectivity routes from the circa 3,700 exchanges where BT faces no competition from rival operators and there are no rival networks within 100m, making network extensions unlikely.

Rival networks are too far from these exchanges to make it economically viable to serve them, even with duct and pole access. This means telecoms providers who purchase wholesale access services from these exchanges have no choice but to use BT as their supplier.

Given the low likelihood of network competition, we are imposing a requirement for dark fibre at cost for inter-exchange circuits that connect to these locations.

In our view this will work for ISPs who are based in Openreach’s exchanges and want to backhaul (capacity supply) between them, but it may not be of much use for alternative network ISPs that are not based in such exchanges (e.g. B4RN). This is all very different from the original DFA product in 2016, although Ofcom has hinted that they may in the future try to extend their Dark Fibre solution again.

New Openreach Quality of Service Standards

As usual Ofcom’s review has included a range of new Quality of Service (QoS) changes, which essentially impose rules about the minimum level of service required for new line installations and repairs etc. The focus here is all about encouraging the operator to get key pieces of work done more quickly.

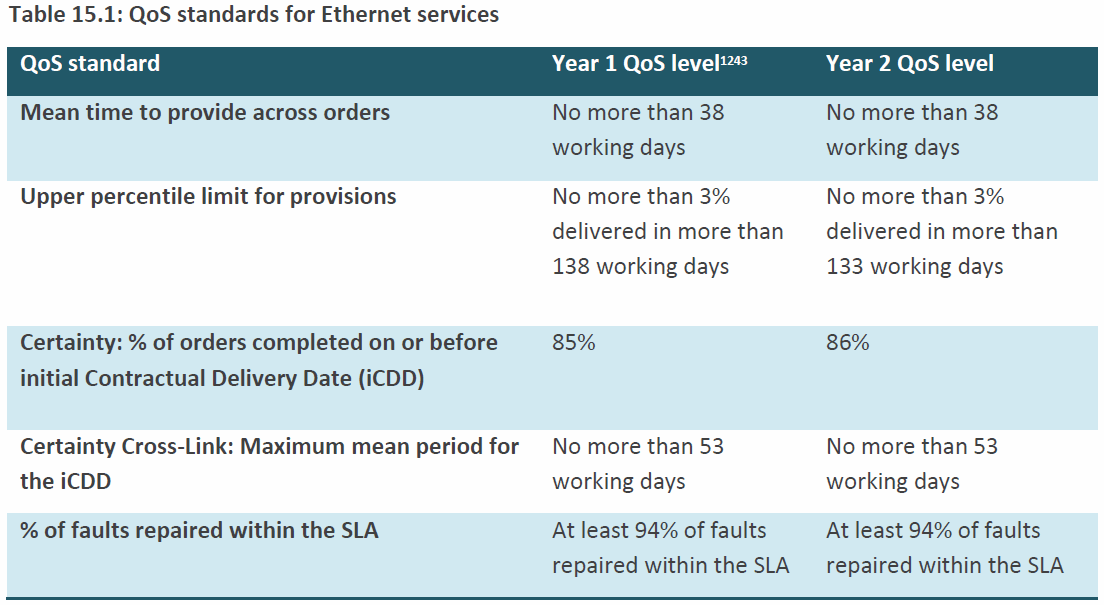

In keeping with that the regulator are imposing QoS standards on Ethernet services in the CI Access services markets in BT Only and BT+1 areas, and in the CI Inter-exchange connectivity market, at BT exchanges where it is the only provider or where there is only one other provider present.

“We have decided to include dark fibre within the scope of the QoS standards in the second year of the market review period (1 April 2020 to 31 March 2021). We are not imposing QoS standards in the Metro Areas or other High Network Reach areas, or on WDM circuits,” said Ofcom.

Overall this represents a gradual continuation of the current QoS standards and it’s worth noting that Openreach already tends to beat these (e.g. looking at certainty cross-link and the 53 working days target, Openreach currently delivers within 44.2 days and 94.6% of faults are repaired within the SLA etc.).

Jonathan Oxley, Ofcom’s Competition Group Director, said:

“The amount of internet data used by people in the UK is expanding by around half every year. So, we’ll need faster, more reliable connections for our homes, offices and mobile networks.

Our measures are designed to support the UK’s digital future by providing investment certainty for continued competitive investment in fibre and 5G networks across the country.”

An Openreach Spokesperson said:

“Last year we delivered our best ever service performance, but we want to keep improving and we share Ofcom’s desire to improve service across the industry.

Our ducts and poles have been open to other companies since 2011, and we recognise that unrestricted access is a natural next step so we had volunteered to get on with that, ahead of Ofcom’s original schedule.

We welcome the greater clarity around Dark Fibre and the timeframe needed to deliver a fully functional product to market.

We’ll consider the range of proposals carefully, and we’ll continue to work with Ofcom on developing an environment that encourages greater investment.”

Separately Ofcom has unsurprisingly found that KCOM has Significant Market Power (SMP) in the wholesale CI Access market for Hull (East Yorkshire), although the changes they propose are fairly minor (mostly centred on extra cost accounting and more information sharing with the regulator).

On the flip side they intend to deregulate the Hull area retail market for CI leased lines and in the wholesale and retail markets for low bandwidth TI leased lines (this is mostly because KCOM now has rivals in these markets). “We consider that these markets are no longer susceptible to ex ante regulation and have therefore removed all remedies in these markets,” said Ofcom.

Otherwise today’s decisions are a draft statement (not final – pending EU approval) and the new regulations will thus cover the period from their final decision, until April 2021. Ofcom said they will aim to implement the new duct and pole access changes 1 month after their final statement, while Dark Fibre will have to be provided from 6 weeks after their final statement.

The final statement itself, subject to any unlikely last minute delays from the European Commission, is expected to be published during June 2019. We should add that in the future Ofcom intends to combine such reviews into a single study and this process will start sooner than you think.

“We intend to consult in December on detailed proposals for a single, holistic residential and business telecoms market review, covering the period 2021 to 2026,” said Ofcom. We can only imagine how much of a headache it will be to report on such a vast review, given that these individual ones can already run to hundreds of pages.

UPDATE 9:37am

Added a comment from Openreach above.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« SpaceX Successfully Launch First 60 LEO Ultrafast Broadband Satellites

Comments are closed