Ofcom’s New 5G Mobile Auction Plan for 700MHz and 3.6-3.8GHz

The UK telecoms regulator has today confirmed that they will proceed to auction of the 700MHz and 3.6-3.8GHz radio spectrum bands in spring 2020 to boost new 5G networks to potentially Gigabit-capable (1000Mbps+) mobile broadband speeds. But in light of last week’s Shared Rural Network deal (here), the coverage obligation is gone.

Ofcom previously intended to impose a coverage obligation on the 700MHz band, which would have required two winning bidders / mobile operators to extend outdoor data coverage (4G / 5G) to at least 90% of the UK’s entire land area within four years of the award in return for discounts, among other things.

However, the new £1bn industry led Shared Rural Network (SRN) will replace the old proposal with the targeted sharing of existing masts and new masts in poorly served areas. The SRN should result in each individual operator reaching 92% geographic coverage by 2025, with licence obligations taking effect in 2026. The collective effect of this will deliver coverage to 95% of the UK.

Advertisement

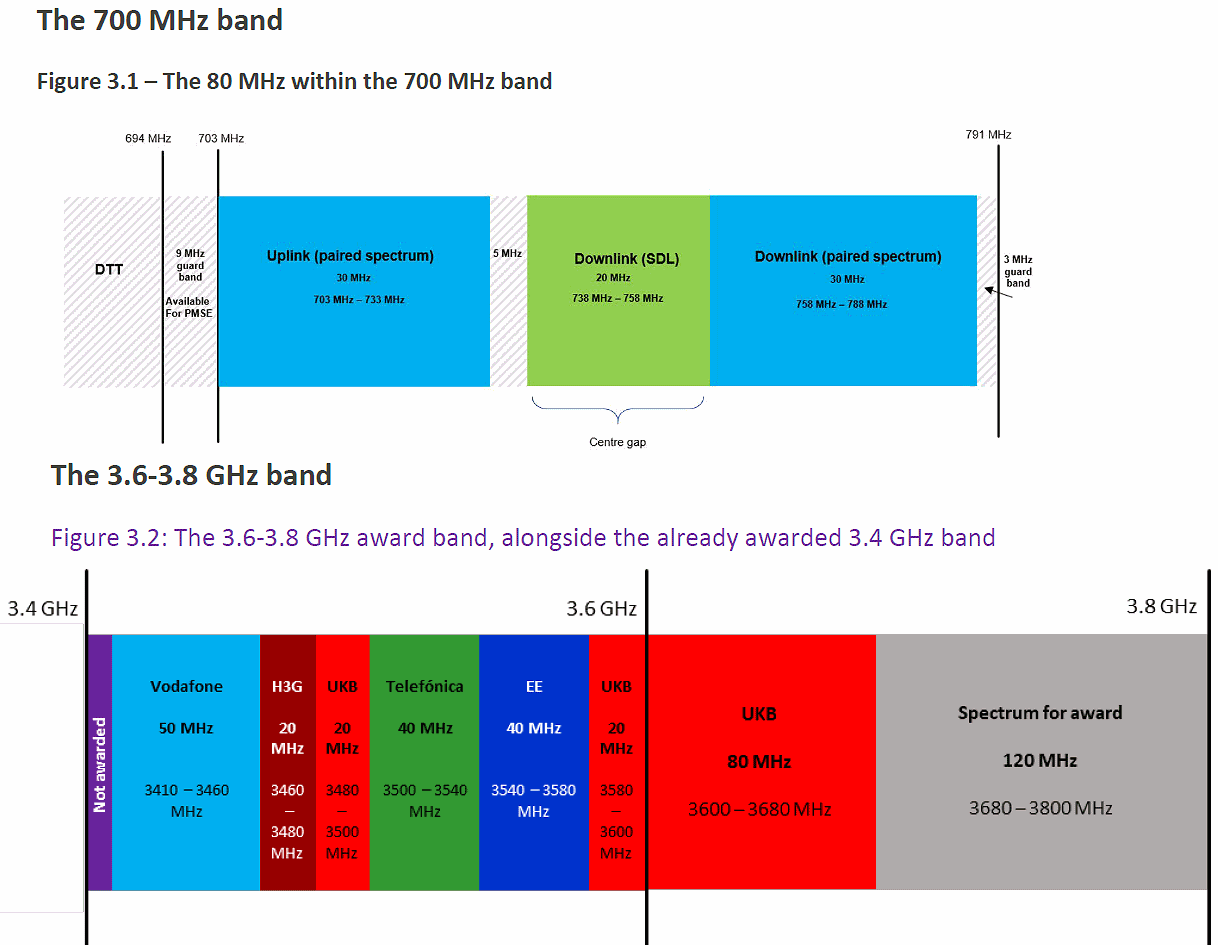

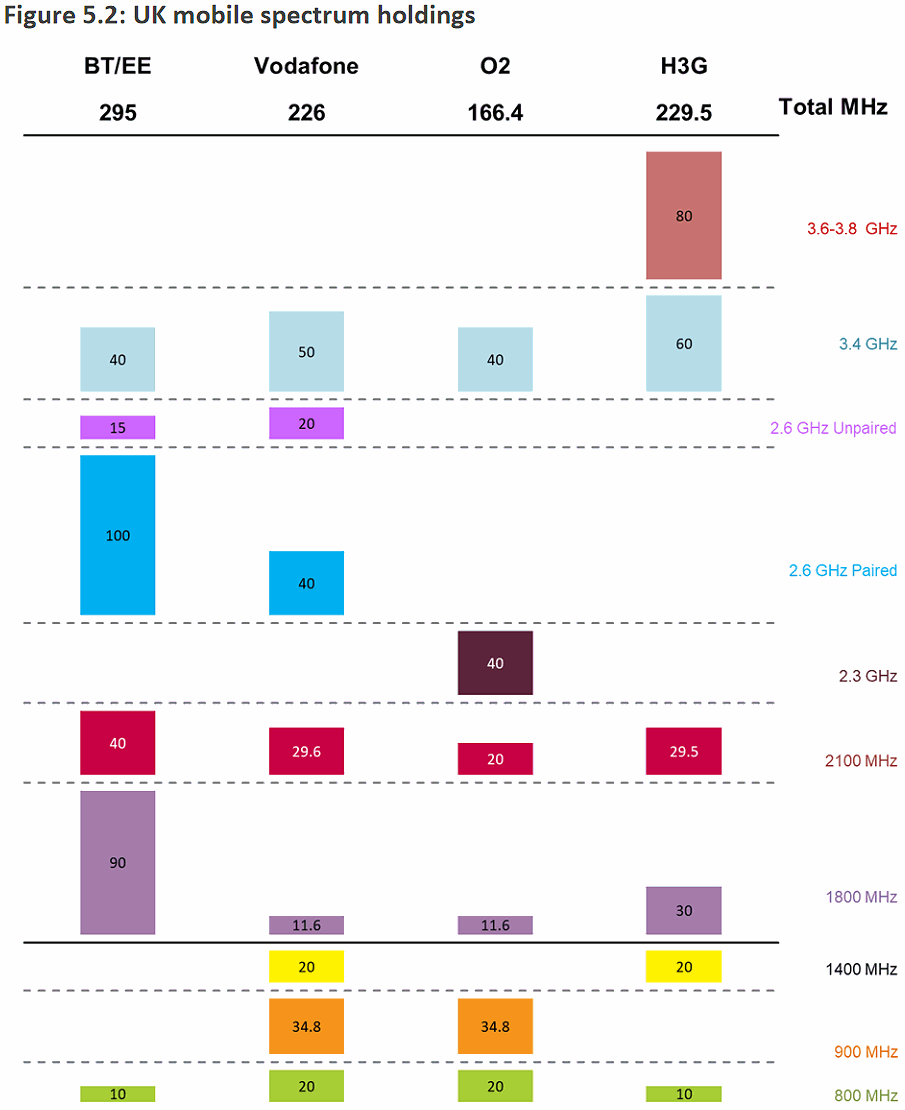

Overall the regulator intends to auction off 80MHz of spectrum frequency in the 700MHz band and 120MHz of spectrum in 3.6-3.8GHz band. As part of this they still plan to impose a 37% cap on the overall spectrum that any one mobile company can hold following the auction.

The cap effectively limits the spectrum that some operators can acquire in the award. In other words, BT (EE) will be limited to acquiring up to 120MHz, while Three UK can only acquire 185MHz, Vodafone may only grab 190MHz and no limits will be imposed upon O2 due to their current holdings.

Obviously the final outcome will ultimately depend upon who bids for what but more spectrum tends to equal better mobile broadband speed and that’s going to be key for 5G.

Advertisement

Philip Marnick, Spectrum Group Director at Ofcom, said:

“We’re pressing ahead with plans to release vital airwaves to improve mobile services for customers. Together with mobile companies’ commitments to improve coverage, this will help more areas get better services, and help the UK maintain its place as a leader in 5G.”

Ofcom’s consultation will be open for responses until 9th December 2019 and they then plan to publish their final decisions in early 2020, before starting the auction in the spring. Meanwhile the auction itself will follow a similar format (aka – simultaneous multiple round ascending) to the regulator’s previous auction of 3.4GHz in 2018 (currently this is the only band being used for 5G).

The planned approach involves two stages:

Principal stage. Companies first bid for airwaves in separate ‘lots’ to determine how much spectrum each company wins.

Assignment stage. Then there is a round of bidding to determine the specific frequencies that winning bidders will be allocated.

Bidding Lots

The spectrum will be made available for bids in the following lots:

A. Six lots of 2×5 MHz (60 MHz in total) in the 700 MHz band with a reserve price in the proposed range of £100m-£240m per lot.

B. Four lots of 5 MHz (20 MHz in total) of 700 MHz downlink-only spectrum, with a proposed reserve price of £1m per lot.

C. 24 lots of 5 MHz (120 MHz in total) of 3.6-3.8 GHz spectrum, with a reserve price in the proposed range of £15m-£25m per lot.

Winners of 3.6-3.8GHz spectrum will have an opportunity within the assignment stage to negotiate their placements within the band among themselves. “This will make it more straightforward for bidders to join together the new spectrum they win with their existing holdings, and potentially reduce the level of ‘fragmentation’ in the wider 3.4-3.8 GHz band,” said Ofcom.

One aim of the above approach is to make it easier for operators to create larger contiguous blocks of spectrum in the same band. For example, Three UK already has a block of 100MHz between 3.4GHz and 3.8GHz, which is ideal for 5G services as it gives them plenty of capacity for ultrafast mobile broadband / data speeds. The other operators will be seeking to replicate that (see below for some context – table of existing spectrum holdings).

Advertisement

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« RootMetrics Benchmarks 5G Mobile Speeds in Birmingham UK

Comments are closed