UK Full Fibre Growth Stays Strong as Global Broadband Lines Hit 1.27bn

The latest research from Point Topic has found that world fixed broadband lines grew by 1.53% (19.247 million) in Q4 2021 to end the year on a total of 1.274 billion connections, while the quarterly growth rate of “full fibre” (FTTP/B) networks in the UK remained strong at 12.5% (albeit down from 14.8% in Q2 2021).

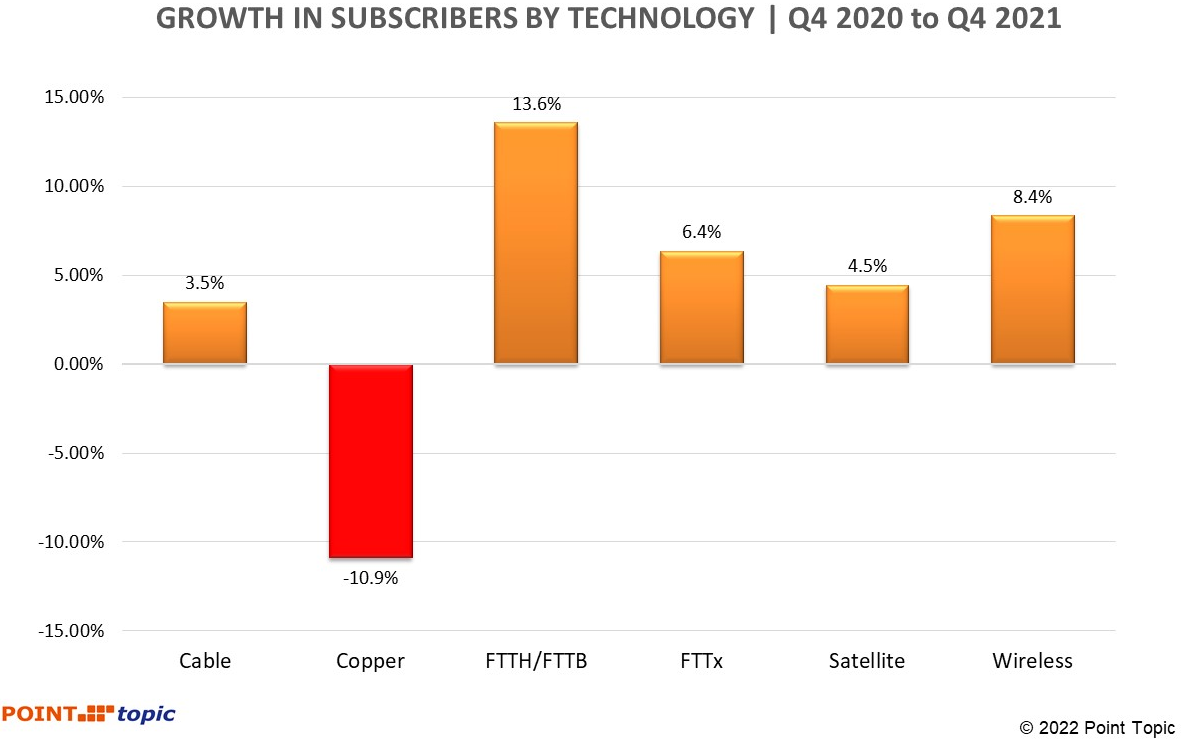

The data shows that both cable (hybrid fibre coax) and copper (ADSL, SDSL) based broadband connections lost market shares as full fibre lines cannibalised their customers. Between Q4 2021 and Q4 2020, the number of copper lines fell by 10.9%, while FTTP/B connections increased by 13.6%. The highest FTTP/B broadband growth rates continued to be found in the UK, France, Italy and Germany etc.

Advertisement

However, back in Q4 2020, the same study reported that quarterly fibre growth in the UK had risen to 28.6% (here), and then it jumped again to a whopping 37.2% in Q1 2021, before suddenly collapsing back to 14.8% in Q2 2021, and it’s since hovered around a similar level for the past few quarters.

All of this is a little odd because the other data that we see – all of it in fact – tends to show that the UK’s full fibre rollout is definitely continuing to ramp-up and has not slowed (Summary of UK Full Fibre Build Progress).

Top markets by fibre growth rates in Q4 2021

(countries with at least 0.5m fibre broadband subscribers)

| Country | FTTH/B/P Growth – Q2 2021 |

| Chile | 15.8% |

| Philippines | 15.6% |

| India | 14.3% |

| United Kingdom | 12.5% |

| Nepal | 8.5% |

| France | 8.1% |

| Pakistan | 7.2% |

| United Arab Emirates | 6.9% |

| Brazil | 6.9% |

| Malaysia | 6.5% |

| Italy | 5.9% |

| Poland | 5.8% |

| Argentina | 5.7% |

| Turkey | 5.5% |

| Germany | 5.4% |

We note that China currently has more than half a billion fixed broadband subscribers – accounting for a major chunk of the global total, having added more than 9.5 million connections in Q4 2021. But East Asia’s share of net additions to fixed broadband subscribers dropped to 52% in Q4 2021, which was mainly due to the 43% decrease in broadband connection adds in China this quarter as that market becomes more mature.

Advertisement

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« G.Network Top 400,000 Full Fibre Premises in London as CEO Exits

Comments are closed