Opensignal Study Warns Three UK at Risk if Vodafone Merger Fails

Network benchmarking firm Opensignal has published new analysis of the “competitive headwinds” facing Three UK in the mobile market, which finds that the operator’s struggles are “driven by a low subscriber base and high churn resulting from many factors“. But it also warns that the situation could get worse if the proposed merger with Vodafone is rejected.

Just to recap. The proposed mega-merger (here), which has been promoted by both operators as something that would be “great for customers, great for the country and great for competition” (i.e. resulting in a £11bn investment to upgrade the country’s 5G mobile broadband infrastructure), would see Vodafone hold a 51% slice of the business and CK Hutchison (Three UK) retain 49%.

However, opponents of the deal warn that it could result in several negative outcomes, such as the potential for higher prices due to the lessening of competition at both the retail and wholesale (MVNO) level via the reduction in primary network operators from four to three.

Advertisement

The Competition and Markets Authority (CMA), which has yet to approve the deal, have also questioned whether the claimed customer benefits will actually materialise. The authority similarly stated that both operators would in fact “continue to compete with each other, as well as with other mobile operators, in a broadly similar way as today” if the deal didn’t go ahead.

What does Opensignal say?

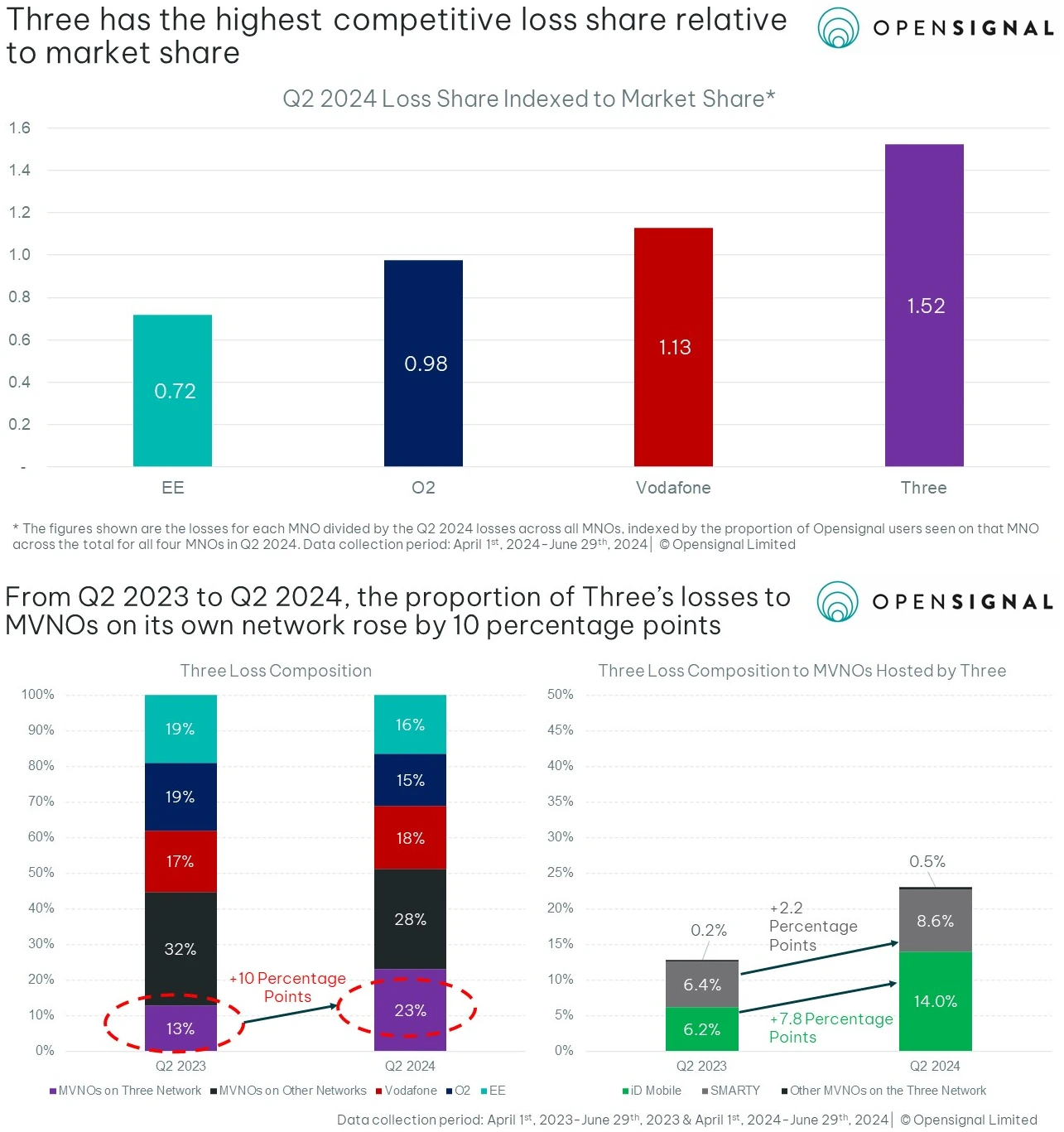

The new analysis from Opensignal leverages data from their Subscriber Analytics solutions to offer insights into the level of competitive churn at Three UK. The data suggests that the operator has been “struggling competitively” (i.e. it has a small subscriber base and high competitive losses relative to its market share), although this much was already obvious from their financial results.

For example, over the last year, Three UK has seen more and more of its losses going to virtual operators (MVNO) on their own network (primarily iD Mobile [Currys] and Smarty – the latter is Three’s own sub-brand).

Advertisement

Opensignal concludes that Three’s struggles are driven by a low subscriber base and high churn resulting from many factors “including the halted expansion of its 5G network and pressure from both its own budget sub-brand and competitively from MVNOs such as iD Mobile“, which compete heavily on price and offer flexible contracts.

“If these issues are not addressed they could lead to an even more precarious financial situation for Three, making it even harder for Three to resume 5G expansion if the merger were not to happen for some reason. This in turn could lead to even more Three customer churn as other providers have more capital to invest in their networks,” said Opensignal.

The reality here is that CK Hutchison would most likely have to find a way of pumping more investment into Three UK, assuming the merger didn’t proceed. On the other hand, it wasn’t long ago that the operator was taking flak for a massive £2bn dividend payout (here), which could be said to put a different spin on things.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« ICUK Launch Broadband One Touch Switching Platform for UK ISPs

Honest Mobile Launches New Family Plan for UK Customers »

I think the churn to other MNOs or MVNOs would be much less, especially to threes mvnos, if they were more competitive on price. I was a three customer and moved to ID mobile, cheaper price, more allowance and rollover. Was happy with the signal, so stayed on the three network.

it is clear that the new boss of three UK has no vision beyond merging with Vodafone. taking away EU roaming was a mistake. the problem with coverage will continue because people no longer want masts built near their homes.

This doesn’t make any sense to me. 3 is in trouble because customers are leaving for *their own* MVNOs ?

Three must be making money from customers on the MVNO, else they wouldn’t have them an an MVNO, right?

So, what they’re actually saying, is customers are price sensitive – and are moving from the “premium” priced 3 brand, to cheaper products on Smarty/IDMobile.

This feels pretty obvious? like if you’re Sim Only, why would you pay more on 3 then move to Smarty etc. and pay less? Smarty also have a much higher amount of advertising vs MVNOs on other platforms with the exception of maybe GiffGaff/Tesco on O2. Though its possible I’m just looking where others advertise.

The narrative spin to push the merge continues. I am not looking forward to Vodafone making a mess of 3.

Can’t see why MVNOs should cause Three any more problems than it does any other network. I wouldn’t suggest this report is biased but this strikes me as the kind of report Three & Vodafone would find very helpful…..

3’s churn to its own MVNO’s probably reflects the fact that 3’s customer experience isn’t at all premium. The web site and web capabilities are shoddy, call centres are the usual unbelievably crap offshore clowns.

Did someone pay Opensignal for this to help push for the merger?

Looks like it. Hope the merger fails

That’s a bit of a slur on an international, independent company (OpenSignal I mean, not Three) don’t you think? Care to walk that back a bit?

Why is it a slur? It’s a reasonable question. Opensignal are far better known for their coverage research, and a report that appears at this time, suggesting poor old 3, who can only afford £2bn dividends won’t be able to survive because their customers are not quite leaving….

Come off it, it is a reasonable assumption that this research was commissioned. If Opensignal want to come here and state that they did it out of the goodness of their heart, and confirm that they have no beneficial commercial relationship with either 3 or Vodafone, then I’m all ears.

BeeTee sounds like an employee low-key threatening me lol.

Three has persued some pretty grim tactics over the last three years. All hopes are pinned on this merger although I think 0% chance it will be approved in its current form.

Would love to be a fly on the wall but so far the new government has shown no love for our industry, personal opinion but I strongly suspect money has changed hands for this article.

Vodafone won’t be a pushover, this potential deal is getting cheaper & cheaper for them.

This article appears to push an agenda rather than being based on facts. The article doesn’t reference Government contracts which Three has replaced Vodafone on through Gamma for example – these contracts surely drive significant revenue for Three and are taking revenue away from Vodafone? Ultimately Three need to offer something different from the other operators. Dropping roaming was not a good move for them (although you can retain roaming on their PAYG plans?) I know a few people who moved from Three SIM Only to PAYG – I assume PAYG is largely ignored for revenue purposes in comparison to SIM only contracts?

this seems like fearmongering to me. three have been around for years, i don’t think they’re suddenly going to collapse if Vodafone doesn’t merge (read: gobble up and destroy). I think these Opensignal folks have been bought and paid for.

I hope this unblocks the merger as a customer of three and Vodafone I want the resulting combined network giving me signal in all areas I need it (which is why I have both at the moment as I need 5g coverage in some areas three is poor in but vodafone is great in etc).

But it mostly overlaps. It is about customer db.

If they can spend 2 billion on dividends, then they can invest in their network, more nonsense from these networks trying to get a merger approved.

I’m one of those who dumped Three for Smarty and wished I had done it years ago. The other half and I were paying over £50 total for unlimited data and calls per month.

With Smarty our total bill is now £28, with no monthly contract and no possibility of running up extortionate bills.

I have lost USA and Australia roaming but eSIMs sort that out for me and I’m still quids in.

I read before that Vodaphone doesn’t have a chance to grow/survive if it can’t merge with three.. and the same with three merging with Vodaphone.

If both are failing, how can they hope to improve things by merging with more failure!?

Been a three customer for over 10 years and have never had any real issue with them. Will be sad if they merge and service goes downhill.

I don’t see why Three “losing” customers to Smarty is even a point worth mentioning. Smarty is 100% owned by Three so although they may be getting less ARPU they are still getting all of it.

It’s just customers are looking around now and realising that in the main the MVNOs offer the same for less money. If it’s your own MVNO; Smarty, Voxi, Giffgaff, it’s still your customer and you are retaining all revenue. Just a different place on an Excel spreadsheet.

If they leave for another MVNO that uses your network (ID) it’s surely still better than leaving completely as you’re still gaining something as opposed to nothing.

Sounds like they are spewing out anything to try to push it through, even if they are puppeting a 3rd party in this case.

Best thing to happen is three go bust defunct then the other 3 networks BT/EE – VM/O2 – VODAFONE can purchase the remaining chunks of spectrum left by the three network which would be no more then also then allow networks to purchase the MVNO’S of the three network that would be more fair then if a merger was to happen then maybe sky or talktalk should do a 50/50 joint venture with Vodafone.

I read the chart showing loss composition to be an improvement for 3 overall. OK so the loss to 3 based MVNOs has increased, but these remain revenue generating. The loss to EE and O2 have decreased as a result (and Vodafone is only up slightly). So looks like a significant reduction in off net losses to me…

I’d love to know their explanation of how two companies merging is “good for competition”, its literally the opposite as you have one less company to compete.

Where does this leave Three and EE with their MBNL partnership and Vodafone/VMO2 with their Cornerstone partnership?

Having Three and Vodafone with access to both of these infrastructure providers would give them an unfair advantage, wouldn’t it?

Seems to that whole comms in this country could do without all the switch/churn malarky, might as well just have 1 network across all freq’s (so providing better coverage for users) as a national utility, could save a fortune in 100s of CxO’s and shareholder payouts, ‘fines’ etc, after all the consumers end up paying either directly or through governmental tax recycling, all the savings would reduce operating costs ‘licencing’ fees etc, even reduce the ofcom overhead attempting to govern the school of all the individual networees/fish etc.

Get rid of the middle men, costs and overheads and just have one national unified mobile network. Wouldn’t that be a good more efficient/less over head idea! You even save all the damned costs of switching and bureaucracy and useless ofcom overview !!

New Zealand model.

A bit like OpenReach set up, where other operators can drink from the same motherlode/umbilical cord.

Like nationalising the network rail and others operate thru it.