Broadband Delivery UK Boss Expects EU State Aid Clearance This Month

The boss of the government’s Broadband Delivery UK (BDUK) office, which is responsible for managing the country’s national superfast broadband strategy, tenders and related public funding, has said that he expects to resolve Europe’s competition concerns with the process “this month“.

The European Commission’s (EC) concern with the UK allocation of £530m in State Aid for its national superfast broadband deployment, which aims to make related services available to 90% of UK people by March 2015, began in the spring and is currently believed to be holding-up the release of funding for roughly half of the 47 existing Local Broadband Plans (LBP).

Europe is understood to be mulling over several aspects of the process including the inability of smaller ISPs (altnets) to take part, the need for more competitive access to BT’s superfast fibre-based infrastructure (e.g. dark fibre, better unbundling etc.) and most crucially the lack of competition between the two pre-selected bidders.

At present only BT and Fujitsu can take part, yet only BT seems to be an active bidder and Fujitsu has withdrawn from several tenders (often months ahead of the final decision). Crucially state aid rules are designed to prevent member states, such as the UK, from handing out huge public subsidies to individual firms that would risk distorting competition.

Yesterday Dr Robert Sullivan, CEO of BDUK at the government’s Department of Culture, Media and Sport (DCMS), told the Westminster eForum (Broadband Britain Seminar) that “[BDUK] are encouraged that we even have Fujitsu and BT on the framework” because the “investment case for rural broadband networks is incredibly challenging“. This might be true but with tens of smaller ISPs willing to invest many will still wonder why they’ve been so harshly rejected in favour of a purely one-size-fits-all approach.

According to Total Telecom, Sullivan then initially said that he was “confident” of gaining “state aid clearance for the rural broadband projects in the autumn” before later adding that he expected to “get clearance this month” (the autumn period runs from late September to late December). It remains to be seen whether or not this clearance will come with EU caveats.

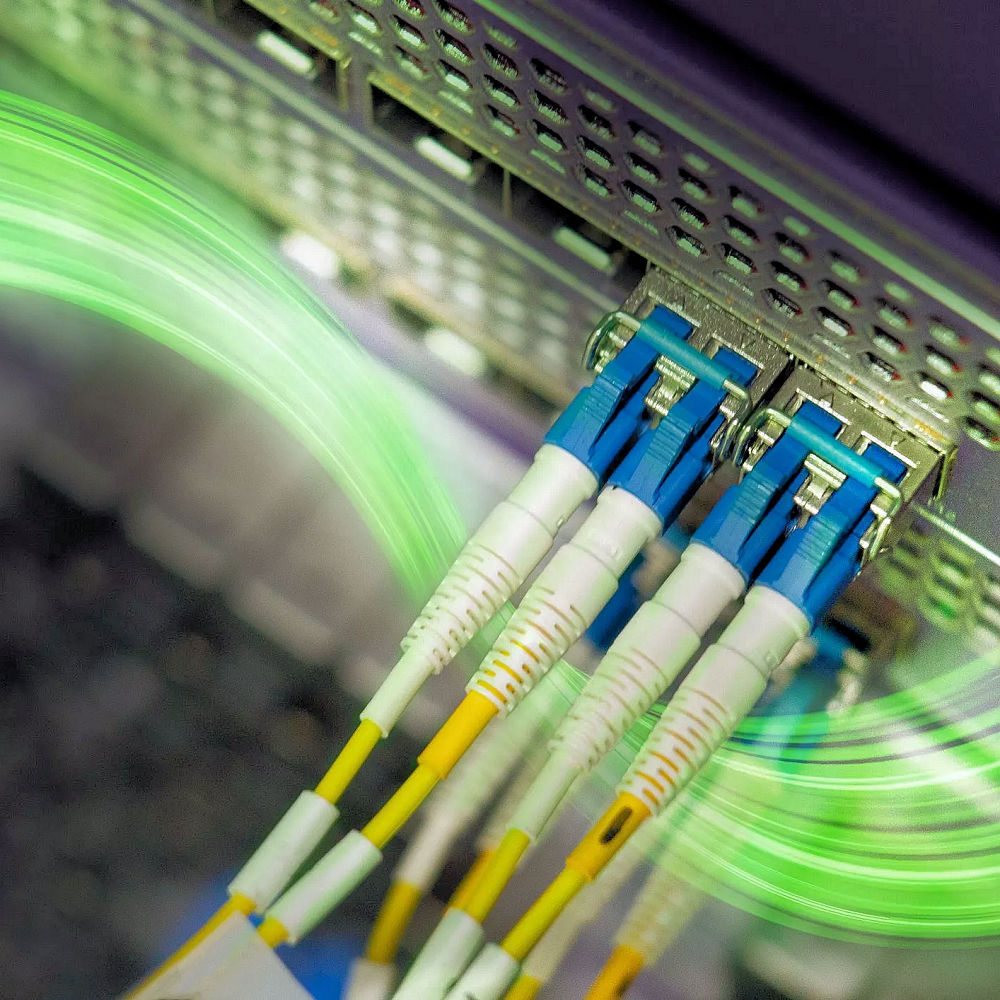

Separately Ian Grant’s Br0kenTeleph0n3 blog noted that Sullivan was also considering a BT proposal for the £150m Urban Broadband Fund (UBF) tenders to be handled under the BDUK framework. The UBF is designed to help roll-out “ultrafast” fibre optic based 80-100Mbps+ (Megabits per second) broadband services in 20 UK cities (here and here), specifically areas where the private sector has failed to improve.

The questionable move could potentially limit the choice of operators to just BT and Fujitsu, which is especially odd since Fujitsu’s own Fibre-to-the-Home (FTTH) network proposal has only ever been costed and targeted towards rural areas. Likewise cities often have a far greater selection of ISPs to choose from, many of which can handle infrastructure development.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook and Linkedin.

« Broadband Provider Zen Internet Wins PC Pro 2012 Best UK ISP Award

Latest UK ISP News

- FTTP (5513)

- BT (3514)

- Politics (2535)

- Openreach (2297)

- Business (2261)

- Building Digital UK (2243)

- FTTC (2043)

- Mobile Broadband (1972)

- Statistics (1788)

- 4G (1663)

- Virgin Media (1619)

- Ofcom Regulation (1460)

- Fibre Optic (1394)

- Wireless Internet (1389)

- FTTH (1381)

Comments are closed