Ofcom – EE Still the Fastest for 4G Mobile Broadband in Major UK Cities

Ofcom’s new Smartphone Cities study has examined the Mobile Broadband performance of 4G network operators O2, EE, Three UK and Vodafone across 7 of the United Kingdom’s major cities (Belfast, Birmingham, Cardiff, Edinburgh, London, Sheffield and Southampton). Overall EE was the fastest.

The results are based on data that was collected by using a Samsung Galaxy S6 Edge+ Smartphone and an uncapped 4G SIM between July and October 2016. The SIMs and handsets used were also enabled for Carrier Aggregation (LTE-Advanced), which is something that’s likely to benefit EE more than most due to their strong level of spectrum ownership in different bands.

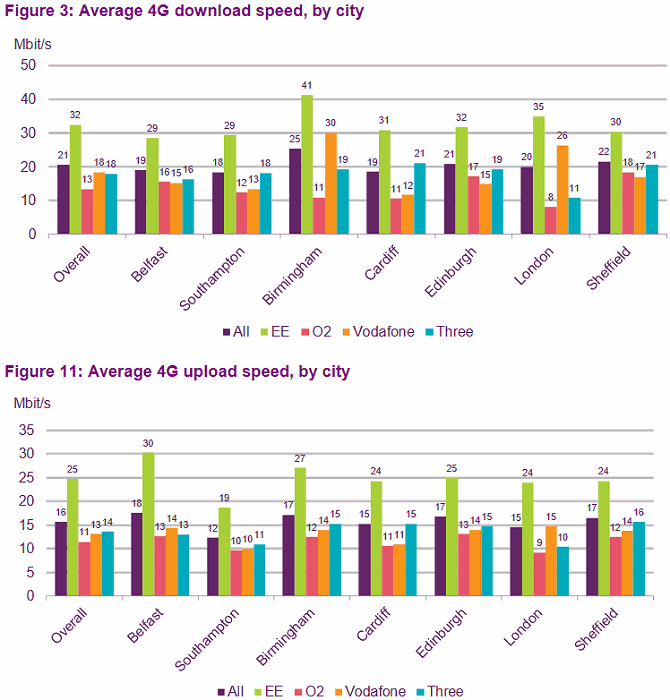

On average 94% of download tests achieved speeds of over 2Mbps, with the results showing an average download speeds of 21Mbps (uploads of 16Mbps) across the seven cities. EE provided the fastest average speed at 32Mbps and were generally well ahead of their rivals for both download and upload performance.

Advertisement

The study also looked at how Mobile speeds fluctuated between peak and off-peak periods, although most operators only seemed to lose around 5-15% of their average download speed between the fastest and slowest times of day.

However the story for latency (server response time in milliseconds) is rather different. Ofcom states that, on average, EE delivered the best response time (33ms) but the results also suggest that the picture was quite varied. This is understandable given the “mobile” nature of 4G networks, where signal quality can vary quite a bit as you move around.

Elsewhere Ofcom found that the vast majority of voice calls were successful throughout the test period, with 99% of calls being completed on Three UK and Vodafone, 98% on EE and 97% on O2. Results for voice call performance tests were consistent across MNOs and cities and ranged from 95% to 100%.

The study certainly provides some useful insight, although like in previous years’ its scope remains fairly limited and of course consumers should always consider the other factors when choosing an operator, such as price, quality of customer service, coverage, contract terms and handset choice etc. Rural areas were not examined in this report.

Advertisement

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Ofcom Reveals its Options for the UK 10Mbps Broadband USO

Comments are closed