Ofcom Try Again for Openreach UK Dark Fibre and Unrestricted PIA

The UK telecoms regulator has today begun consulting on their new Business Connectivity Market Review 2018/19 (BCMR), which among other things is proposing “unrestricted access” to Openreach’s (BT) cable ducts / telegraph poles to boost fibre broadband. It will also try again to impose a Dark Fibre Access (DFA) product.

Ofcom’s review typically focuses upon the market for leased line (Ethernet) style connectivity services, which reflects high-speed point-to-point data links that can be used to connect larger businesses and to supply capacity for both mobile network operators (base stations, masts etc.) and broadband ISPs etc.

The prior 2016 review imposed a number of service quality standards and charge controls upon Openreach (here). On top of that it also required them to offer a regulated Dark Fibre Access (DFA) product, which is despite their earlier 2012 review warning that such a solution could “carry significant risks of worse outcomes, both for consumers and for effective competition, including adding costs and encouraging inefficient entry.”

Advertisement

The originally proposed DFA solution would have allowed ISPs to gain “physical access” to Openreach’s existing fibre optic cables (i.e. enabling them to install their own equipment at either end of the fibre within cable ducts). Several providers expressed a strong interest in using the service (TalkTalk, Three UK, Vodafone and B4RN etc.).

However DFA faced stiff opposition as BT, Virgin Media, Cityfibre and Zayo all warned that it could act to discourage investment in the construction of new fibre optic networks. One of the main bones of contention stemmed from Ofcom’s market definitions, which reflected their plan to make DFA available in all parts of the UK (RoUK) except central London (including the City of London and Docklands).

Suffice to say that none of the major dark fibre builders were pleased with this and BT launched a legal challenge, which ultimately found that the regulator’s market definitions were “incorrect” (here and here). Ofcom was then force to abandon the proposal but promised to try again in the future.

Since then Openreach have launched a kind of virtual (grey) dark fibre solution called OSA Filter Connect but this doesn’t suit everybody, not least since it means having to provide space and power etc. for Openreach’s kit. By comparison some ISPs view DFA as being simpler, especially if it can be made to take fibre at an access chamber rather than having to provide a cabinet for them.

Advertisement

New BCMR Proposals for 2019 Onwards

Ofcom’s current regulation in this market expires in March 2019 and thus they plan to refresh it via this review, before ultimately moving to regulating the business and residential markets through a single review from 2021. The new 2018/19 review broadly proposes a new batch of quality standards and charge controls.

On top of that they will also seek to expand the existing cable duct and pole access (i.e. Physical Infrastructure Access) product by introducing “unrestricted access” (currently PIA primarily only focuses upon the residential and small business market), which means that companies offering high-speed lines for large businesses/mobile/broadband operators will also be able to make use of it.

Just to be clear PIA (aka – Duct and Pole Access) allows their existing poles and underground cable ducts to be used by rivals in order to deploy new ultrafast fibre optic broadband services. Ofcom believes that their change to “can cut the upfront cost of building full-fibre networks by around half.”

The above change was first proposed during the summer as part of the Government’s Future Telecoms Infrastructure Review (related Ofcom plans). As such the biggest news today is that Ofcom has separately also proposed to try DFA again, albeit in a more restrictive fashion.

Advertisement

Ofcom BCMR 2018/19 Statement

In geographic areas where the prospects for competition are low, we are proposing today to maintain charge controls on BT, keeping prices flat, as well as imposing strict quality of service standards. Where there is stronger competition, or prospective competition, we propose lighter regulation than existing rules, to allow this to flourish.

In some areas, even with duct and pole access, there is unlikely to be effective competition in the foreseeable future. So for connections from exchanges where BT faces no competition from rival operators, we are proposing that BT must give competitors physical access to its fibre-optic cables, allowing them to take direct control of the connection.

[The aformentioned] service is often referred to as ‘dark fibre’, because the cables would not be ‘lit’ using BT’s electronic equipment. Instead, they would be ‘lit’ by the competitor installing its own equipment at either end of the optical fibre. We propose that BT should provide this dark fibre access at a price that reflects its costs.

Under the new plan Ofcom will only require BT/OR to offer Dark Fibre at cost in the “inter-exchange connectivity market” for connections from BT Only exchanges (i.e. the connections between BT exchanges in different geographic areas, such as between towns and cities). Crucially they will not be required to offer this in the “access services” market (i.e. connections to end-user business sites, such as office buildings or mobile base stations).

Key BCMR Proposals

We propose finding two separate product markets for contemporary interface (CI) services (e.g. connections over fibre using an Ethernet interface):

• access services, which are the connections to end-user business sites (e.g. office buildings or mobile base stations); and

• inter-exchange connectivity, which are the connections between BT exchanges in different geographic areas (e.g. between towns and cities).

For each of these markets, we propose identifying a single product market covering all bandwidths. In the CI Access services market, we identify separate geographic markets, based on network competition. We propose finding that BT has significant market power (SMP) in CI Access services in each of the geographic markets across the UK, except in the Central London Area (CLA) and the Hull Area.

In the CI Inter-exchange connectivity market, we propose finding that BT has SMP at its exchanges where it faces competition from fewer than two other operators.

We also currently regulate some legacy traditional interface (TI) leased lines which provide low speed services (up to 8 Mbit/s), mainly over copper lines. Volumes of TI leased lines are low and falling as users migrate to modern alternatives. We are therefore proposing to deregulate TI services throughout the UK.

For CI Access services, in areas where BT faces competition from two or more rivals we are not proposing charge controls or quality of service standards.

In areas with no or limited competition (BT Only or BT+1 competitor) in both the CI Access and Inter-exchange connectivity markets, we are proposing to keep prices flat and have strict quality of service standards at all bandwidths. We are also proposing that BT provides access to dark fibre3 at cost in the Inter-exchange connectivity market for connections from BT Only exchanges.

We are not proposing to extend the requirement for dark fibre further in this review, to minimise overlap with areas where we think our unrestricted duct and pole access proposals will be effective in stimulating investment in new networks.

Separately Ofcom has unsurprisingly found that KCOM has Significant Market Power in the wholesale CI Access market for Hull (East Yorkshire), but they plan to deregulate the Hull Area retail market following market entry by other players. “We propose to maintain the existing requirement on KCOM to provide network access on reasonable request and on fair and reasonable charges, terms and conditions,” said the regulator.

An Openreach Spokesperson said:

“Our ducts and poles have been open since 2011 and we’ve launched a number of improvements to make them easier to use, with more due in April. We also support the move to unrestricted access under conditions which continue to encourage investment.”

We share Ofcom’s desire to constantly improve service performance and, having recently delivered our best ever levels of service, we’re committed to continuing that.

We’ll consider the range of proposals in both consultations carefully, whilst continuing to work with Ofcom on developing an effective model that encourages investment.”

The regulator said that today’s consultations (here and here) will close on 18th January 2019 and they then intend to publish their final conclusions during spring 2019. “We will also consult shortly on how we should define geographic areas as either competitive, potentially competitive or non-competitive in our single, holistic residential and business market review in 2021,” said Ofcom.

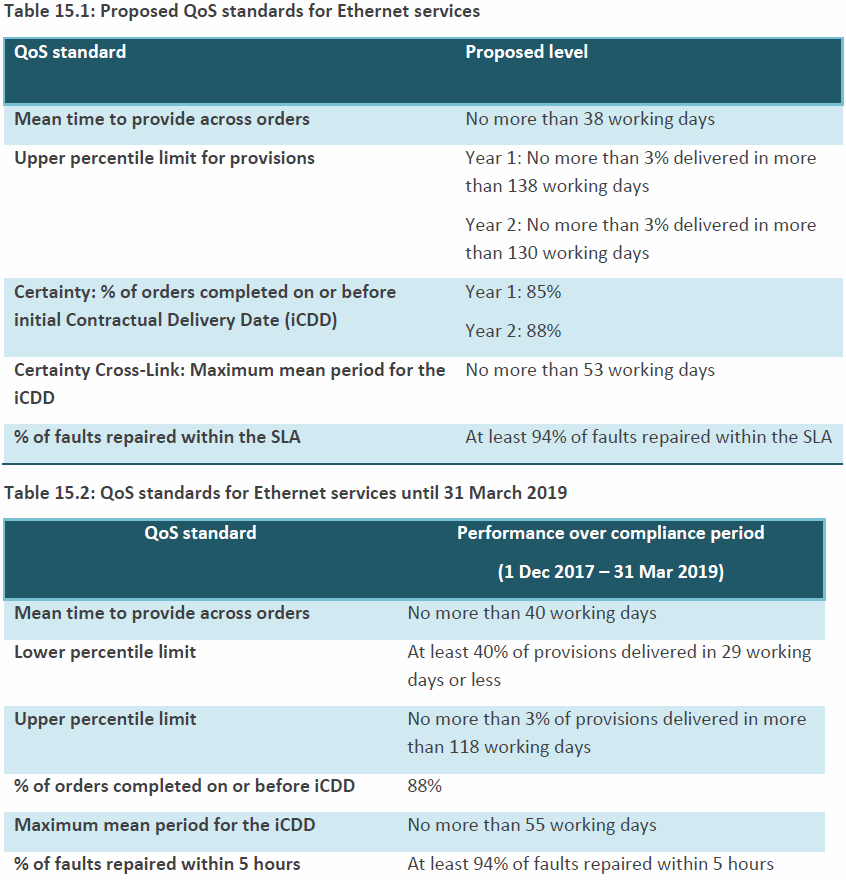

We’ve separately pasted Ofcom’s planned Quality of Service changes for Openreach below (new ones on top).

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Faster On-Board WiFi and Mobile Data Coming to Brittany Ferries

Comments are closed